Will Taobao Content E-commerce gain More in 2024?

In 2024, Taobao content e-commerce will strive to achieve a surprisingly goal in user scale, anchors and GMV.

On the afternoon of March 28, 2024, the Taobao Content E-commerce Summit announced its 2023 financial data as well as 2024 business goals.

According to the published data, the scale of Taobao content consumer users grew by 44% year-on-year in 2023; 12,000 live broadcast rooms with monthly transactions exceeding one million; and 8.63 million new content creators and 770,000 new live broadcasting accounts.

In 2024, Taobao content e-commerce aims for even higher growth: a 100% year-on-year increase in user scale, a 100% year-on-year increase in monthly transactions for live broadcasters breaking one million, and an 80% year-on-year increase in GMV.

To achieve this goal, Taobao will utilize funding subsidies of "billions in cash, billions in flow", as well as high-quality human resources, and other auxiliary investments to keep promoting the integration of content and live streaming, enhance the penetration of platform content e-commerce, and focus on launching blockbuster products through normalized marketing.

Cheng Daofang, General Manager of the Taobao Content E-commerce Business Unit of Taotian Group, stated, "In 2024, Taobao's content and e-commerce will shift from addition to multiplication, unleashing a new round of content e-commerce dividends."

Literally, content e-commerce refers to the dissemination of high-quality content through live streaming, short videos, and other means in this fragmented Internet information era, triggering the purchasing interest of audience groups. It focuses on users, integrates big data from various platforms, categorizes people in a labeled form, and delivers content based on user interests.

There are significant differences between traditional e-commerce and content e-commerce.

Traditional e-commerce is more passive, only when users intend to buy related products could have the opportunity to enter the shopping list. In comparison, content e-commerce is more proactive, creating an "atmosphere" with soft articles, evaluations, and other product-related content to establish consumers' shopping logic. It dedicate to turn virtual scenes into reality, as long as the content is high-quality, there is no need to worry about users' consumption.

Overall, the emphasis on content has brought revolutionary impacts on advertising, consumer behavior, value assessment standards, and e-commerce ecology. More and more consumers tend to find products in live streams and posts, leading to a seismic shift in e-commerce rules, with the core being the alignment of content value with personalized demands.

In addition, since Taobao Group gained the highest priority within Alibaba's various businesses, Alibaba has increased its investment in Taobao Live, and the pressure of live e-commerce has followed suit.

In December last year, Taobao's Content E-commerce Business Unit was officially established, merging Taobao Live and Guangguang for the first time, connecting live streaming, short videos, and graphic content businesses. The full-chain process of "pre-streaming seeding, explosive transactions during streaming, and sustained operation after streaming" has brought greater opportunities for platform merchants in terms of traffic, conversion, retention, and repurchase.

In 2024, Taobao will further promote the integration of live streaming and browsing. It is understood that Taobao has currently shifted its core focus back to the products themselves, reducing the types of content on the homepage, and instead focusing on building personal IPs as the starting point, stimulating click-through rates on product links through high-quality content and highly attractive personalities.

In terms of investment, according to Cheng Daofang, more than 40 billion yuan will be allocated for influencer cultivation, 30 billion yuan for store ecosystem construction, what's more, Taobao will also pay attention to the growth of intraindustrial live streaming ecology.

Regarding consumer decision-making, Taobao's in-app seeding has the most optimal and shortest conversion path, and brands and merchants are exploring various attempts based on live streaming in forms such as graphics, short videos, and short dramas.

In KOL development, Taobao has established a new live e-commerce company, offering a six-month "fully managed service" for new anchorpersons, with several hundred to a thousand Taobao customer service representatives joining the team.

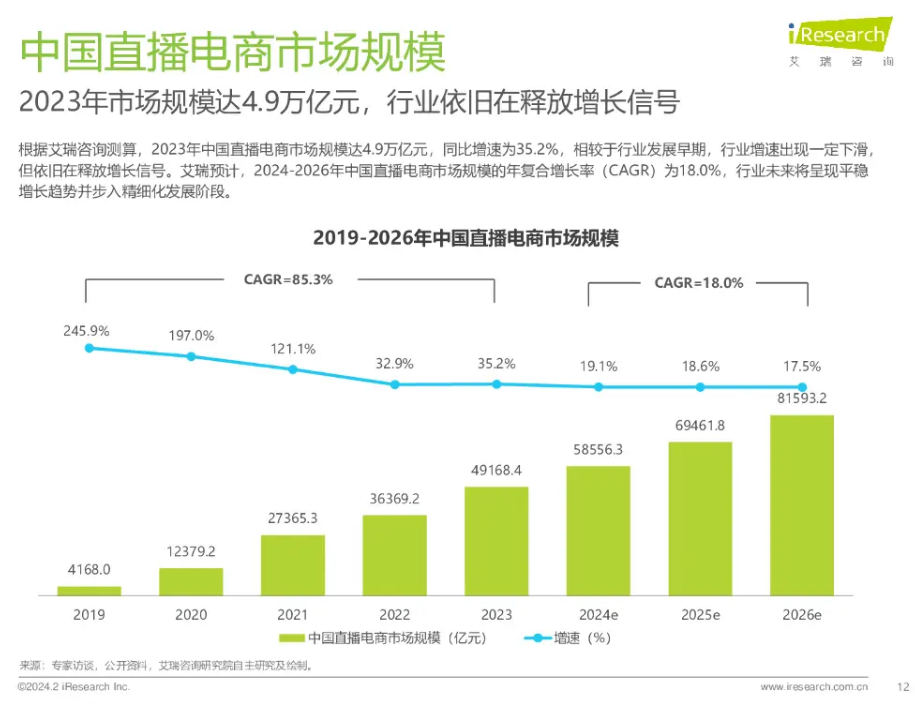

According to the 2023 China Livestreaming E-commerce Industry Research Report by iResearch Consulting, China's livestreaming e-commerce continues growing steadily, with a transaction volume of 4.9 trillion yuan in 2023, a staggering 35% increase. In 2024, as content e-commerce enters the second half, industry competition will become even more intense. Various ecosystem partners such as brand merchants, influencers, and MCNs will place greater emphasis on sustainable long-term development in addition to chasing short-term gains and explosive growth.

Taobao has unveiled its new goal, demonstrating its confidence and determination in the rapid growth of content e-commerce and its firm commitment to investment. In 2024, Taobao will join hands with ecosystem partners including influencers, celebrities, institutions, brands, and merchants to share the new dividends from the coming doubled growth.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.