Tortoise and Hare in Payments

According to a recent ACI report, while countries like India and China have embraced real-time payment systems and process billions of transactions a day, the U.S. is far behind.

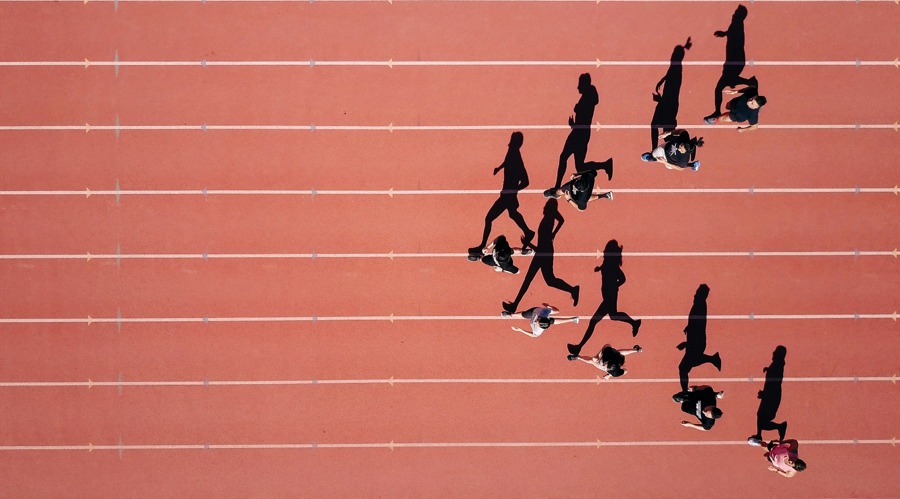

For decades, the United States has been an undisputed financial superpower, a towering giant standing unshaken on the global economic stage. However, in the realm of payments, once-leading innovator in finance, the U.S., is increasingly resembling a slow and steady tortoise, lagging behind a group of agile hares.

According to a recent ACI report, while countries like India and China have embraced real-time payment systems, processing billions of transactions daily, the United States lags far behind. In 2023, only 1.5% of U.S. payment transactions occurred in real-time, a negligible figure compared to the global average.

The report emphasizes five key drivers for fostering a thriving ecosystem for real-time payments:

- Collaboration: Successful markets see strong collaboration among financial institutions, payment service providers, central banks, and even governments, creating a unified front to establish and operate a robust system.

- Merchant Incentives: Just getting consumers on board isn't enough. It's crucial to attract merchants to accept real-time payments. India's practice of waiving merchant fees and issuing QR codes for easy adoption is a case in point.

- Open and Inclusive Ecosystem: The report underscores the increasingly important role of fintech firms and smaller banks in driving real-time payments. The U.S. financial sector needs to adopt a more open and collaborative attitude, working with these players to expand coverage and transaction volumes.

- Continued User-Friendly Applications: Real-time payments thrive when there's a range of easy-to-use applications seamlessly integrated into daily life. Examples like paying utility bills, transportation costs, subscription services, or even groceries with a QR code scan or a tap on a mobile app. The U.S. needs to encourage similar innovations to drive adoption beyond niche markets.

- Cross-Border Ambitions: The future of payments is global, with instant cross-border fund transfers being a game-changer. Countries like India are leading the way with their UPI system facilitating instant payments across multiple nations. The U.S., with its vast international network, can leverage this trend by collaborating with major trading partners to achieve interoperable real-time payment systems.

Therefore, the sluggish adoption, especially considering the inherent advantages the U.S. possesses, raises eyebrows. Strong banking systems, widespread internet access, and a tech-savvy population—all the factors needed for realizing the real-time payment revolution seem to be in place. So, what's hindering the U.S.'s progress?

—Part of the reason lies in legacy systems.

The current payment infrastructure is an outdated relic, taking days to settle transactions, a snail's pace compared to the real-time world we live in now. This slowness creates friction—a frustration for consumers and businesses forced to wait for funds.

Additionally, the adaptability of the U.S. financial sector is slow. Unlike some international counterparts, banks aren't prepared to face the potential of real-time payments. Fear of disrupting existing revenue streams, coupled with the cost of implementing new infrastructure, breeds a sense of inertia.

However, a shift is underway. The FedNow real-time payment service launched by the Federal Reserve in 2023 marks a turning point. Though adoption rates are still low, FedNow represents a crucial step toward a more efficient payment system. Hopefully, this new infrastructure will stimulate innovation and incentivize banks to eventually join in.

Yet, they have convincing reasons to do so.

Real-time payments offer various benefits. For consumers, it means faster access to funds, increased convenience (such as seamlessly splitting restaurant bills), and potentially lower transaction costs. On the other hand, businesses can benefit from faster settlements, improved cash flow management, and tapping into new customer bases reliant on instant access to funds.

Furthermore, real-time payments have the potential to reshape entire industries. The gig economy relies on instant transfers to thrive, enabling workers to immediately receive their service fees. Similarly, real-time payments could fundamentally change how we pay bills, eliminating late fees and simplifying financial management.

The potential impact isn't limited to domestic affairs. As the global economy becomes increasingly interconnected, the ability to send and receive funds cross-border in real-time becomes crucial. Here, if the U.S. doesn't modernize its payment infrastructure, it risks falling behind.

The good news is, there's been some progress in the U.S. payment landscape.

The slow but steady growth of real-time transactions in the U.S. indicates an increasing awareness of the benefits these systems offer. Additionally, businesses are increasingly demanding faster and more efficient payment solutions. This pressure, coupled with the ongoing development of FedNow, could be the catalyst needed to achieve real transformation.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.