Tradu Launches New Cryptocurrency Exchange

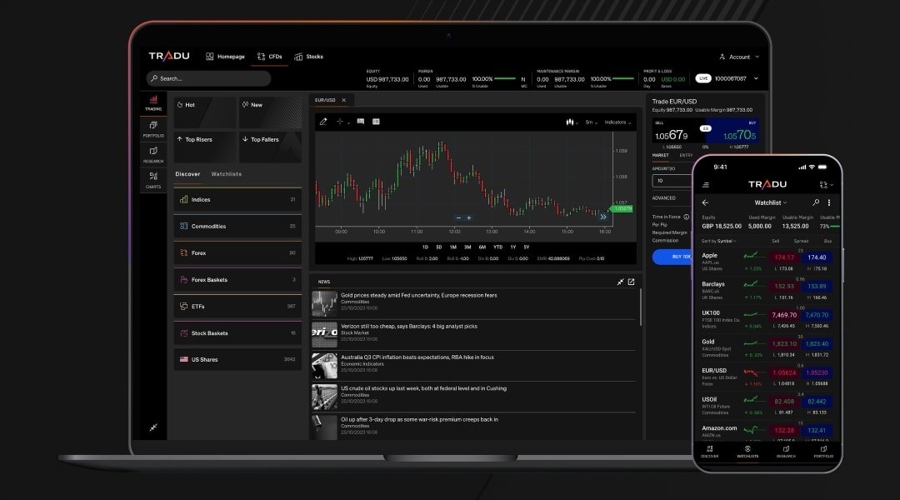

Tradu, a multi-asset trading platform, announced the launch of a new cryptocurrency exchange designed to meet the needs of active traders and investors for low, transparent fees.

Tradu announces the launch of a new cryptocurrency exchange aimed at meeting the needs of active traders and investors seeking low fees and transparency. The platform is part of Stratos Group International, LLC, a subsidiary of Jefferies Financial Group Inc. (NYSE: JEF), offering over 40 currency options, including popular choices like Bitcoin and Ethereum.

Low Fees and Transparent Pricing

A key selling point of Tradu is its transparency and cost-effectiveness in the cryptocurrency trading arena, claiming to save users up to 95% in fees compared to other exchanges and providing a straightforward fee structure visible to users before placing orders. Tradu charges a 0.1% commission and offers instant rebates for larger trading volumes.

In addition to the commission-based model, Tradu also provides customers with the option to trade without commissions, where fees are included in the spreads.

Brendan Callan, CEO of Tradu, commented, "At Tradu, we are true supporters of cryptocurrencies. It's a massive market garnering attention from significant investors, and as a true multi-asset trading platform, it's important for us to provide access to both traditional assets and new digital assets for our clients. We're bringing institutional-level pricing and infrastructure to the retail cryptocurrency market, offering traders direct costs and tight, transparent spreads, allowing active traders and investors to maximize their returns."

Partnership with dxFeed for Market Data Access

Previously, global financial data solutions company dxFeed launched the Infrastructure as a Service (IaaS) project for Tradu, allowing dxFeed to become the manager of key infrastructure and data provision, enabling Tradu to focus on core business objectives.

dxFeed's IaaS capabilities aim to address the technical challenges of providing market data, offering seamless access to data from major global exchanges. Through scalable, low-latency infrastructure, dxFeed ensures integrated market data delivery to clients in Asia, the Americas, and Europe, catering to rapid reconfigurations to meet performance demands.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.