Asset Tokenization Changes Traditional Investment Models

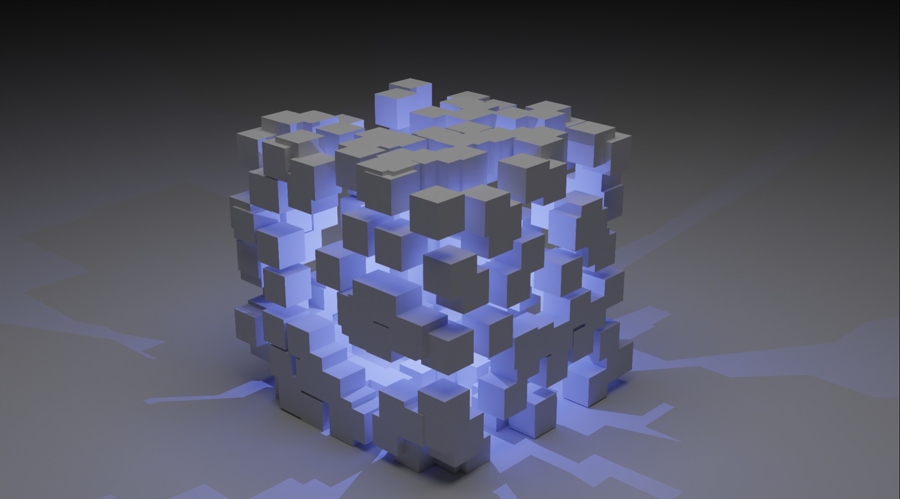

Tokenization involves converting physical or financial assets into digital tokens on the blockchain。In banking, this means representing assets such as real estate, stocks or commodities as programmable tokens。

Tokenization involves converting physical or financial assets into digital tokens on the blockchain。In banking, this means representing assets such as real estate, stocks or commodities as programmable tokens。Each token is backed by an underlying asset and becomes a digital representation that can be transacted securely and transparently on a blockchain platform.。

Asset tokenization triggers dramatic changes in the industry

Breaking down traditional barriers

One of the main effects of tokenized assets in the banking industry is to provide new opportunities for a wider range of investors.。Traditionally, high-value assets have tended to pose a barrier to entry for individual investors。Tokenization enables partial ownership, enabling investors to buy and trade portions of valuable assets, thereby democratizing previously exclusive investment opportunities。

Enhance liquidity

Traditional investment models often face the challenge of illiquidity, especially in real estate and private equity.。Tokenization allows assets to be traded around the clock in secondary markets, thereby introducing liquidity to those markets。Investors can buy or sell tokens at any time, creating a more dynamic and liquid investment environment。

BENEFITS FOR BANKS AND INVESTORS

For banks, adopting tokenized assets can improve operational efficiency。The use of blockchain technology simplifies the entire investment process from issue to settlement。Smart contracts are automatically executed contracts where the terms of the agreement are written directly into the code, which automates many processes, reducing administrative overhead and the risk of error.。

In addition, tokenization increases the transparency of banking operations by providing real-time visibility of asset ownership and transfers。Every transaction is recorded on the blockchain, creating an immutable and auditable ledger。This transparency reduces the risk of fraud and enhances investor trust in the financial system。

Overcoming challenges and regulatory environment

As with any innovation, the adoption of tokenized assets in the banking sector poses regulatory challenges。Regulators are actively adapting the framework to ensure investor protection, market integrity and compliance。Clear and comprehensive regulatory guidelines are essential to promote the responsible development of tokenized assets within the banking industry.。

While blockchain technology inherently provides security through decentralized and cryptographic protocols, the industry must remain vigilant against potential vulnerabilities.。Strong cybersecurity measures and ongoing advances in blockchain security protocols are essential to maintaining trust in the tokenized asset ecosystem.。

Turn on a new dimension of asset ownership

Partial ownership as a norm

Tokenized assets bring about a paradigm shift, making partial ownership the norm rather than the exception。This shift not only democratizes access rights, but also meets the changing preferences of investors seeking to diversify their portfolios without the burden of full ownership.。Banking institutions, as managers of this shift, are well placed to facilitate a seamless transition to an era of shared ownership。

New asset classes and investment strategies

As tokenization expands, it brings a whole new asset class。Digital representation of real-world assets opens the way for unique investment strategies, such as investing in tokenized intellectual property or renewable energy projects。The integration of traditional financial expertise and technological innovation enables banking institutions to open up new investment opportunities。

Strategic Cooperation and Industry Synergy

The future of tokenized assets in the banking sector lies in promoting a cooperative ecosystem。Banking institutions are increasingly partnering with fintech startups and blockchain platforms to leverage collective expertise.。These collaborations not only drive innovation in tokenization processes, but also ensure seamless integration of banking services with emerging technologies。

In addition, tokenized assets provide an opportunity for banking institutions to advocate for sustainable and impactful investments.。By tokenizing assets in line with environmental, social and governance (ESG) principles, banking institutions contribute to the global shift to responsible finance。This alignment with social values not only attracts socially conscious investors, but also makes banks major players in sustainable financial practices.。

Opening up new areas of banking services

The emergence of tokenized assets has not only changed the investment model, but also opened the door to innovative banking services.。As financial institutions enter the space, they find themselves at the forefront of pioneering solutions that go beyond traditional banking services。

Tokenized assets as collateral

One promising avenue is to use tokenized assets as collateral for loans and other financial products。Banking institutions can simplify the mortgage process by using the transparency and security of blockchain。This not only reduces operational complexity, but also speeds up the lending process, providing borrowers with novel and efficient financing options。

Opportunity to generate revenue

Tokenized assets open new avenues for revenue generation。Through the Decentralized Finance (DeFi) platform, banking institutions can provide customers with the opportunity to participate in liquidity pools, pegs and other decentralized financial instruments.。This diversification of investment options is in line with the changing preferences of modern investors, who seek more dynamic financial strategies.。

结论

The combination of tokenized assets and banking marks a significant departure from traditional investment models, opening up new possibilities for investors and financial institutions.。

As technology matures and regulatory frameworks evolve, tokenized assets are expected to become the cornerstone of the future financial landscape, providing efficiency, accessibility and liquidity that traditional investment channels once could not achieve.。And as banking institutions continue to embrace the transformative potential of blockchain technology and tokenization, they will be in the vanguard of shaping an era in which asset ownership transcends traditional boundaries.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.