About two-thirds of companies believe that a trade war poses a "very significant" risk to the global economy in the next two years.

Tariff issues have shrouded global trade since November last year, and a new trade war is about to start as incoming President Donald Trump promises new tariff measures.

From now on, the direction of global trade will largely depend on the leaders of the world's largest economies: the timing, size and duration of tariffs, as well as which countries and products will be targeted, and potential retaliation.Outstanding is US$24 trillion in global merchandise trade.

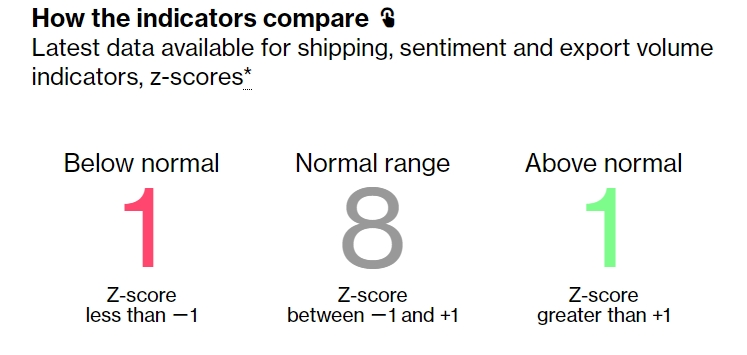

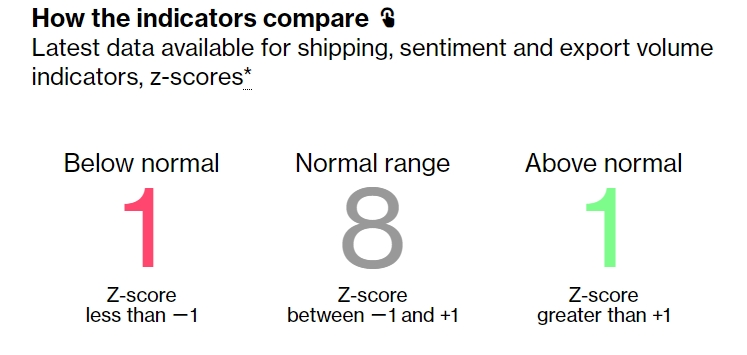

Bloomberg's trade tracker shows that of the 10 key international trade indicators, two are at "below-normal" levels, seven are at "normal" levels, and one is at "above normal" levels, unchanged from last month.The tracker was created during Trump's first administration to measure the impact of his trade war.

The inauguration ceremony on January 20 is about a month away, and the company is preparing for what comes next.According to FedEx Corp. According to U.S. inventory data, some companies are importing goods in advance, while factories in China are considering new production centers and customers.According to a survey by the Oxford Economics Institute, about two-thirds of companies believe that a trade war poses a "very significant" risk to the global economy over the next two years.

In some industries, companies like chemicals and plastics maker LyondellBasell Industries NV have seen orders drop due to inventory overcrowding and uncertainty.

"Investors should be prepared for the early announcement of tariffs by the new government," Ronald Temple, chief market strategist at Lazard, said in a December report."The trend of swinging away from globalization, multilateralism and relative geopolitical stability may be underestimated.”

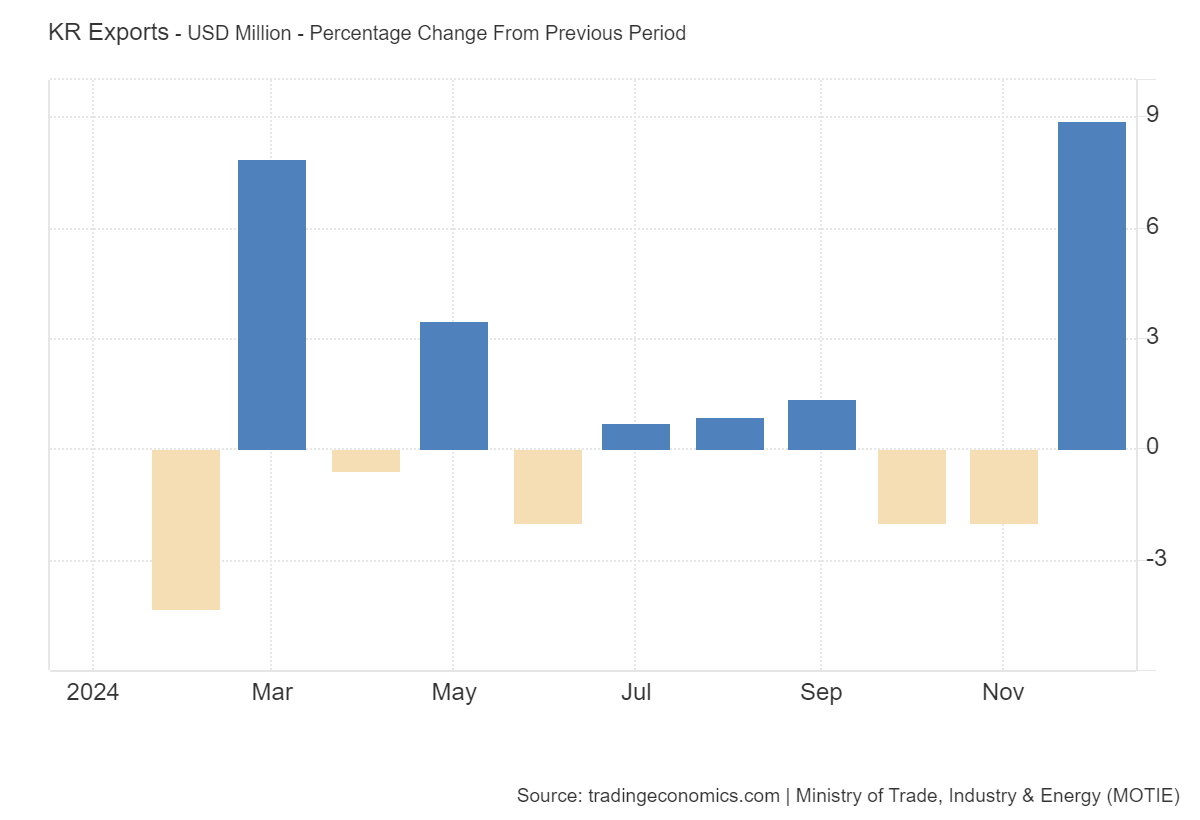

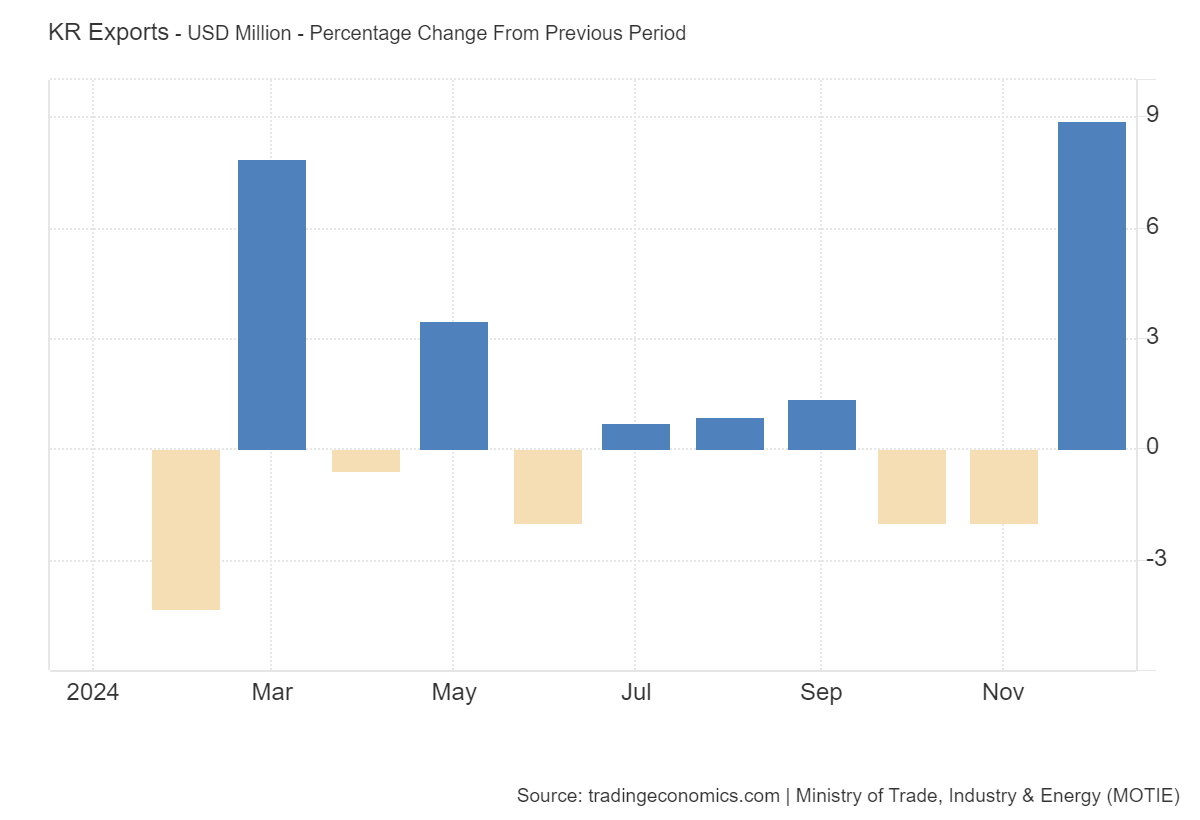

Currently, most factories seem to be in a wait-and-see state, waiting for clear policy directions.Global manufacturing, as measured by JPMorgan's PMI index, was on the verge of slight expansion or contraction at the end of the year.South Korea's initial exports, seen as a bellwether of global demand because of its diversified exports, were little changed in December.

During fourth-quarter earnings conference calls, executives were asked by analysts about tariffs, but often said they were ready."Everyone is talking about tariffs, but when will they be implemented and how comprehensive will they be?This is a question of billions of dollars,"said Inga Fechner, global trade economist at ING Group.

In fact, companies have been fighting protectionism and dissatisfaction for nearly a decade.In order to adapt, they set up factories outside China and readjusted cargo transportation routes.In the trade war, although Trump's tariff stick is extremely powerful, the adaptability of companies cannot be underestimated.

A trade war is a disaster for some companies and an opportunity for others.Take Top Glove Corp Bhd of Malaysia as an example, one of the world's largest manufacturers of disposable medical gloves.The company's U.S. sales surged 120% month-on-month in the fourth quarter as customers moved away from sanctioned China suppliers.

Companies in Vietnam and Mexico have also benefited from the loss of orders from China. Currently, the proportion of U.S. imports from China has dropped from 22% in 2017 to about 14%.