Xiaomi Q1: "Recovery+Innovation" Bring New Highs

According to the latest report, Xiaomi's net profit and revenue in 2024Q1 both exceeded market expectations, mainly due to the growth in sales of smartphones, IoT, and lifestyle consumer products.

On May 23, Xiaomi Group announced its financial report for the three months ended March 31, 2024.

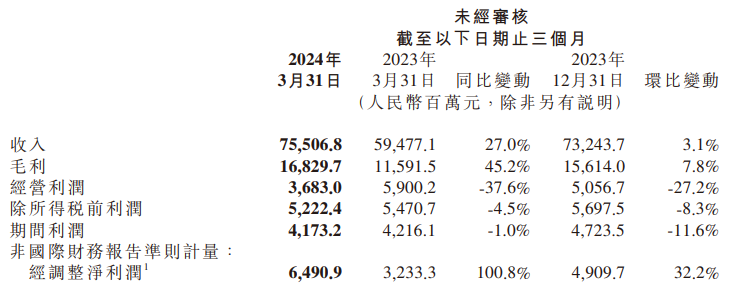

According to the report, Xiaomi Group recorded revenue of 75.51 billion yuan in Q1 2024, a year-on-year increase of 27%; gross profit of 16.83 billion yuan, a year-on-year increase of 45.2%; and adjusted net profit of 6.49 billion yuan, a substantial year-on-year increase of 100.8%. Basic earnings per share were 0.17 yuan, and diluted earnings per share were 0.16 yuan.

In the first quarter, Xiaomi's net profit and revenue both exceeded market expectations, mainly due to the growth in sales of smartphones, IoT, and lifestyle consumer products.

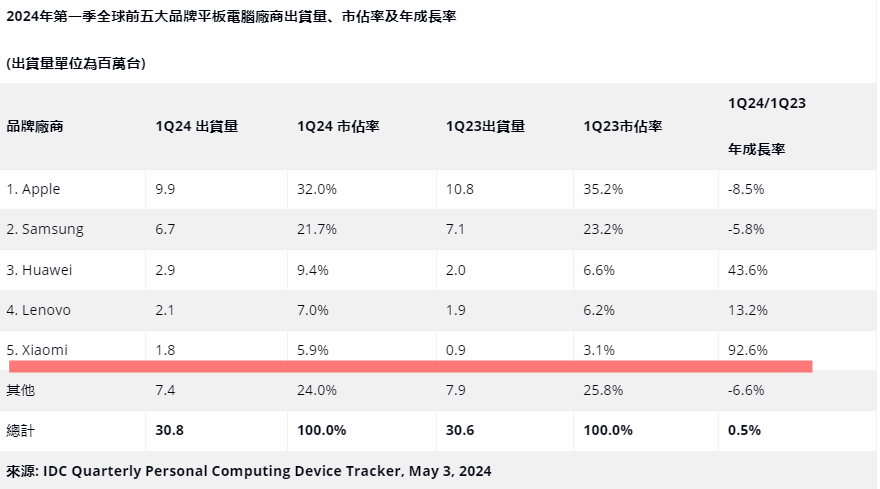

Specifically, Xiaomi's smartphone business revenue was 46.48 billion yuan, a year-on-year increase of 32.9%; IoT and lifestyle consumer products revenue was 20.37 billion yuan, a year-on-year increase of 21.0%; internet service revenue was 8.05 billion yuan, a year-on-year increase of 14.5%; and other business revenue remained stable at around 0.6 billion yuan year-on-year.

Xiaomi Smartphone Is Back

During the period, Xiaomi's core smartphone business continued to recover, achieving year-on-year growth for three consecutive quarters, with a gross profit margin of 14.8% (compared to 11.2% in the same period last year). Xiaomi attributed this to improvements in product structure and a decrease in the cost of core components.

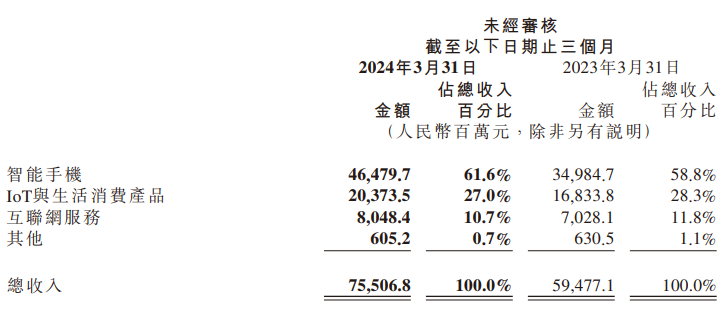

According to Canalys, Xiaomi's global smartphone shipments in Q1 2024 reached 40.6 million units, achieving a year-on-year increase of 33.7%, far exceeding the global market average growth rate of 9.8%. Additionally, Xiaomi ranked in the top three in terms of shipment volume for 15 consecutive quarters, holding a 13.8% market share.

However, due to the increased revenue proportion from overseas markets with lower average selling prices (ASP), Xiaomi's smartphone ASP for this quarter slightly decreased by 0.6% year-on-year, from 1,151.6 yuan to 1,144.7 yuan.

Data shows that Xiaomi's high-end strategy has achieved significant results. In the first quarter, shipments of high-end smartphones accounted for 21.7% of the total, and the market share in the 5,000-6,000 yuan price range in mainland China reached 10.1%, with offline shipments holding a market share of 9.0%. Xiaomi plans to continue promoting its new retail strategy.

At the earnings conference, Xiaomi Group President William Lu stated: "2024 is the year of Xiaomi's ecosystem upgrade, with a goal to expand the number of stores in the mainland China market to 20,000 within three years, optimize store location choices, and increase store area."

In overseas markets, Xiaomi seized the growth opportunities in emerging markets, with faster growth in the shipment volume of mid-to-low-end products in less developed regions. In the Middle East, shipments surged by 96% year-on-year, with a market share increase of 7.1% to 20.9%. Xiaomi maintained the third position in Latin America, Southeast Asia, and Africa, with market shares of 15.3%, 16.5%, and 10.6%, respectively.

Living With MIJIA IoT

Data shows that in Q1, the gross profit margin of Xiaomi's IoT and lifestyle consumer products business reached 19.9%, a year-on-year increase of 4.1%, setting a new historical high.

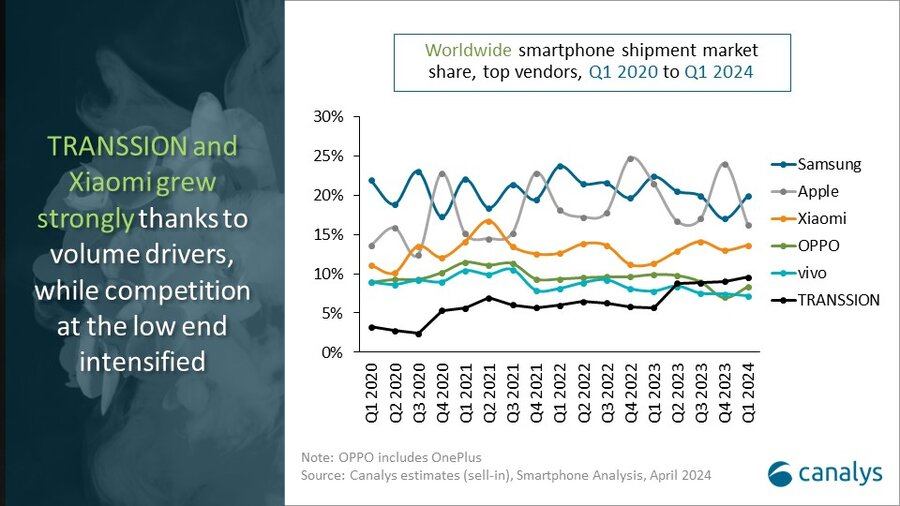

This record was mainly driven by increased revenue and gross profit margins from tablets, smart home appliances, and wearable products. According to IDC, Xiaomi's global tablet shipments in this quarter surged by 92.6% year-on-year, ranking fifth globally and third in mainland China, driving a 70.5% year-on-year increase in tablet revenue.

Regarding the 46.0% year-on-year growth in smart home appliances, Xiaomi Group CFO Alain Lam attributed it primarily to increased shipments of air conditioners (up 63% year-on-year), refrigerators (up 52% year-on-year), and washing machines (up 47% year-on-year) in mainland China. Revenue from smart TVs and laptops remained relatively stable.

By the end of the reporting period, MIJIA AIoT platform had connected over 786 million IoT devices (excluding smartphones, tablets, and laptops), a year-on-year increase of 27.2%. The number of users with more than five devices connected to the AIoT platform exceeded 15.2 million, a year-on-year increase of 24.2%. In March, the monthly active users of MIJIA APP increased by 14.0% year-on-year, exceeding 89.1 million.

In the wearables segment, data showed that Xiaomi's global shipment of TWS earphones surpassed Samsung for the first time, ranking second globally and first in mainland China with a year-on-year increase of 70%.

Speaking of the internet services business, Xiaomi's gross profit margin reached 74.2% this quarter, with global and mainland China monthly active users reaching new highs. In March, global monthly active users exceeded 658 million, a year-on-year increase of 10.6%, while mainland China monthly active users exceeded 160 million, a year-on-year increase of 9.7%. In the same month, the global monthly active users of smart TVs exceeded 676 million, a year-on-year increase of 11.6%.

Growth in advertising revenue also contributed to the internet services business, with revenue reaching 8 billion yuan, a year-on-year increase of 14.5%. Overseas business grew steadily, with revenue increasing by 39% year-on-year, reaching a record high and accounting for 31.2% of the overall service revenue.

SU7 Needs Higher Capacity

In March, Xiaomi's first smart electric vehicle series, Xiaomi SU7, was launched, receiving widespread market attention.

The series is positioned as a "C-class high-performance, ecosystem technology sedan" and aims to enhance user experience by integrating a smart ecosystem. The Xiaomi SU7, Xiaomi SU7 Pro, and Xiaomi SU7 Max models are priced at 215,900 yuan, 245,900 yuan, and 299,900 yuan, respectively.

As of April 30, the cumulative number of locked orders for the Xiaomi SU7 series reached 88,063 units; as of May 15, the series had delivered over 10,000 new cars; and the goal is to achieve over 10,000 monthly deliveries by June.

In terms of Xiaomi Pilot, Xiaomi insists on full-stack self-research technology, with the team size exceeding 1,000 people, and plans to expand to 1,500 by the end of this year and 2,000 the following year. At the end of May, Xiaomi will open urban "Navigate on Autopilot" (NOA) in 10 cities in mainland China and fully spread it in August.

Regarding Intelligent Cockpits, the series integrates Xiaomi HyperOS for seamless cross-platform connectivity between the car system and smartphones, and connectivity between the car system and MIJIA smart devices. It also features the AI assistant "Xiao Ai", offering a full-range voice interaction experience from five sound zones. The center console also supports multi-device expansion, enriching the smart ecosystem.

In terms of the sales service network, Xiaomi plans to establish 219 sales stores covering 46 cities and 143 service centers covering 86 cities by the end of 2024, essentially covering all provinces, autonomous regions, and municipalities in mainland China.

William Lu stated that due to consumers receiving deliveries earlier than the lock order time shown in the app, the factory's production capacity is ramping up quickly. The company plans to start double-shift production in June, but did not disclose the specific delivery time for the new models due to internal confidentiality policies.

"In recent years, Xiaomi has been continuously improving the overall design of the company, breaking down the 'full ecosystem of people, cars, and homes' into six strategies: high-end, industry-leading capabilities, AI, OS, chips, and new retail, which have contributed to the current performance," said William Lu.

In the field of AI LLMs, Xiaomi stated that the company will not venture into general LLMs but will continue to focus on lightweight deployment of end-side LLMs. Through the combination of "end-cloud" (AI LLMs + Xiaomi HyperOS), Xiaomi aims to meet users' multi-scenario needs and achieve cost reduction and efficiency improvement.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.