XTB adds automated ETF investment scheme for UK clients

Poland-based multi-asset broker and trading platform XTB launches a new automated service for its UK clients。

Automatically invest in ETFs with XTB

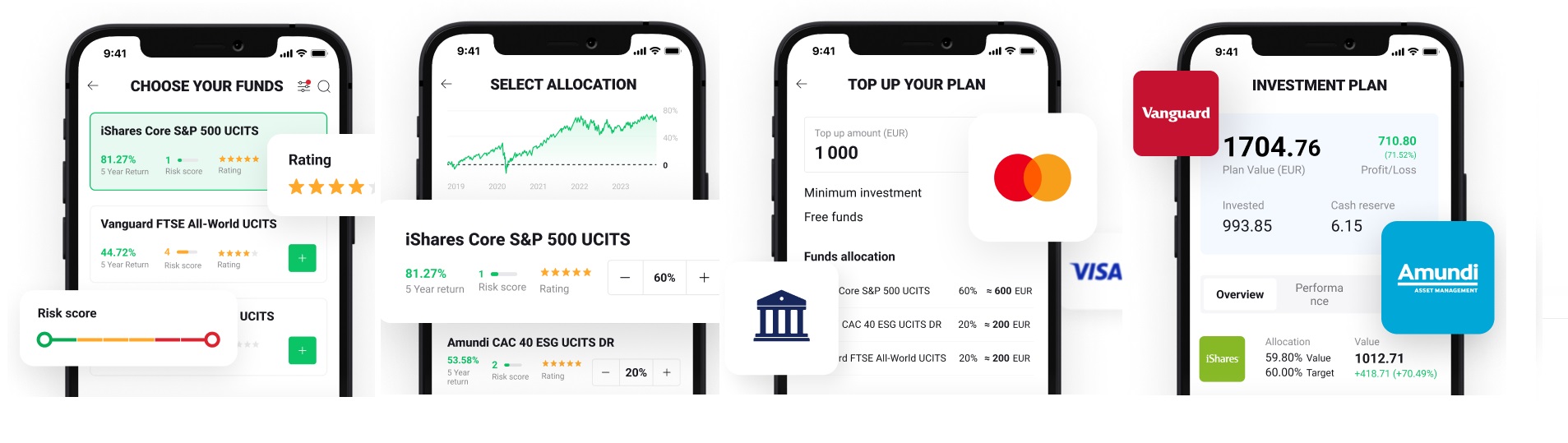

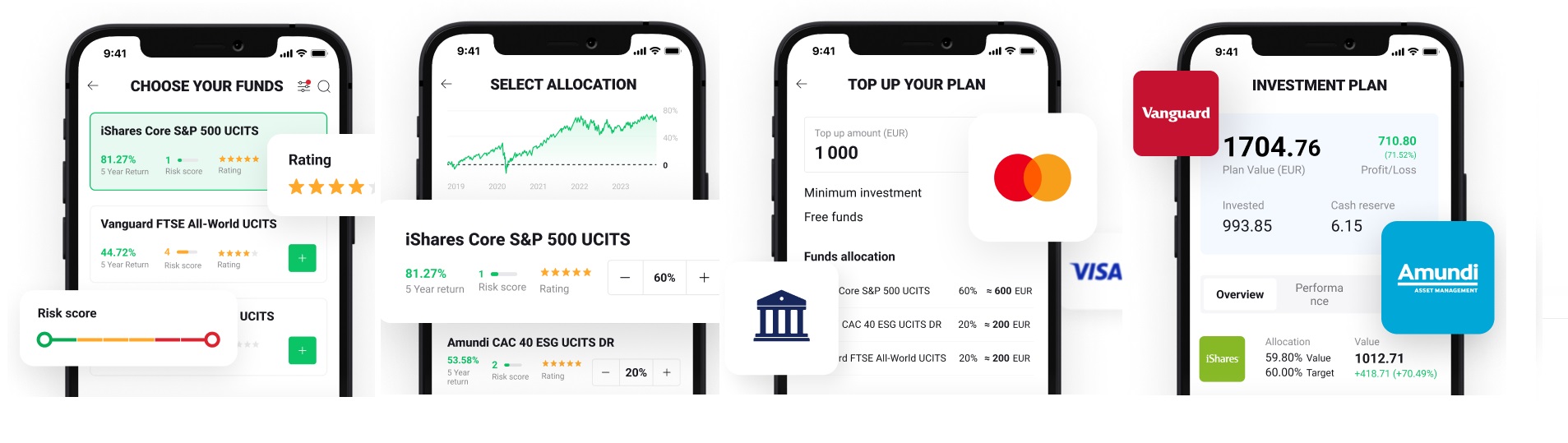

The XTB investment scheme allows UK clients to save and invest regularly through a range of ETF-based strategies。

With this service, UK investors can now set up regular payments or contributions to their existing portfolios.。Or, for more confident investors, they can build a new portfolio from scratch and top up with a predefined asset allocation plan。

XTB's investment plans allow users to create customized portfolios with more than 350 ETFs, which are primarily aimed at long-term savers or those looking to build a portfolio for retirement.。

What is ETF?

An ETF or exchange-traded fund is an open-end fund, similar to a mutual fund, but unlike a mutual fund, an ETF is listed and traded on a stock exchange, just like shares of a limited company。

ETFs typically track a stock index, a sector, an industry, or a country, but can also capture price movements of commodities and bonds, and even specific investment themes and factors such as growth, value, stock income, low volatility, etc.。

Typically, an ETF is a passive investment vehicle that holds a basket of stocks, shares, or other instruments that can track and capture the return on the underlying investment。

For example, the iShares Core FTSE 100 UCITS ETF (ISF LN) is designed to track the performance of an index made up of the UK's 100 largest companies.。

To do so, it holds a basket of UK stocks with varying weights across 11 sectors。Its largest holdings are in the largest FTSE 100 stocks such as Shell, AstraZeneca, HSBC and Unilever.。

Unlike stocks in investment trusts or other closed-end funds, the value of an ETF unit depends primarily on changes in the value of the underlying investment, rather than on the supply and demand of the ETF unit itself.。

Small account commission-free investment

As long as your monthly investment does not exceed 100,000 euros, XTB's investment plan is commission-free, and if your monthly investment exceeds 100,000 euros, you will pay 0.2% commission, but the minimum bill fee is 10.00 pounds。

Please note that if you buy or sell a foreign ETF, that is, an ETF that is not denominated in sterling, your trade will be charged 0.50% foreign exchange conversion fee。

The ability to make regular contributions to one (or more) scheduled savings and investment plans is a very powerful tool。Long-term savings allow investors to reinvest dividends to benefit from the compound interest effect, while also being resilient to short-term market fluctuations.。

Now that this can be done with XTB, and with very low or no transaction fees, this is another positive factor for retail investors。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.