连续两次按下暂停键后 澳洲联储仍然保留了继续加息的可能性

暂停加息的决定出乎市场意料,按照此前预期,澳联储原本将在本政策窗口继续加息25个基点。本次意外暂停加息,将在一定程度上打击澳元。

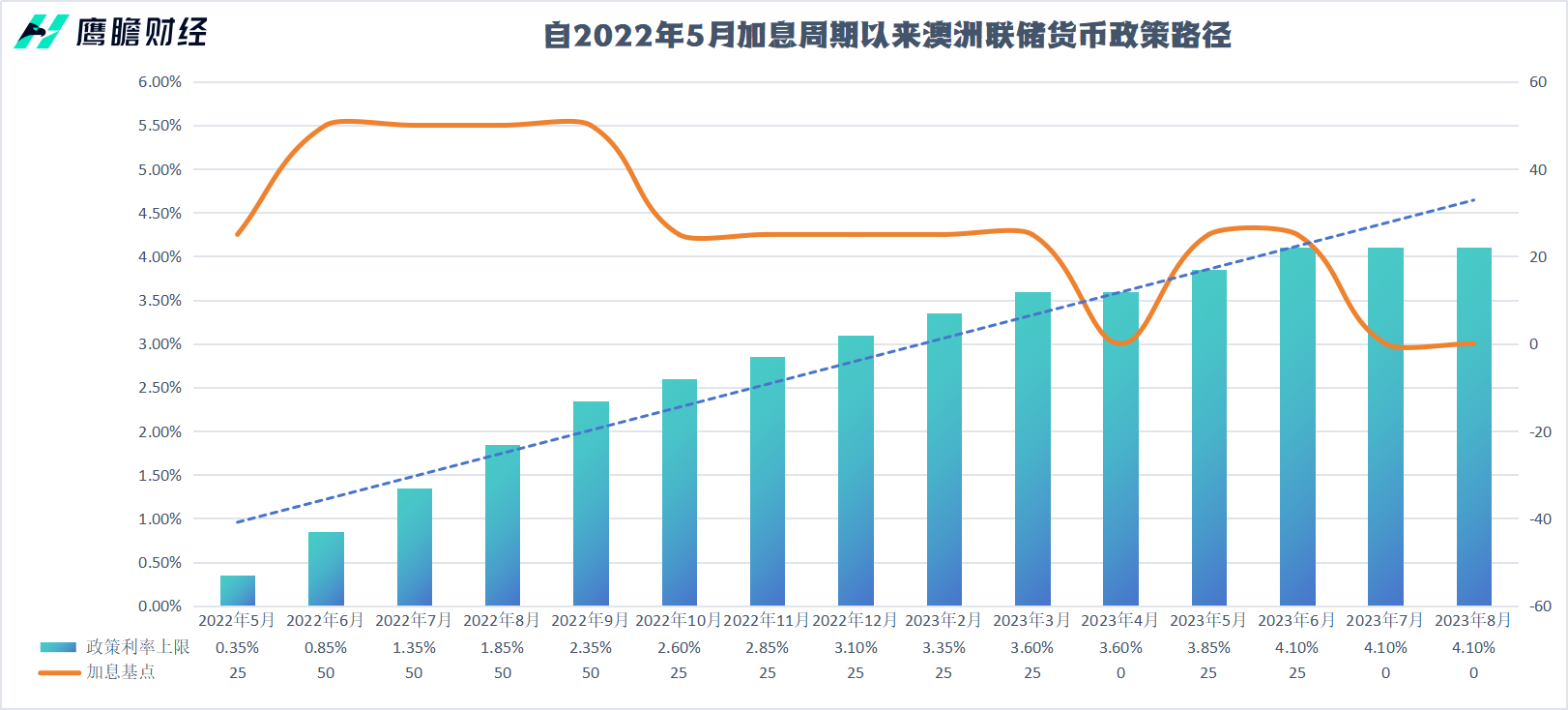

当地时间周二,澳洲联储公布了至8月1日利率决定。根据决定,澳洲联储在8月连续第二次暂停加息,将基准利率维持在4.1%。

澳洲联储主席洛威(Philip Lowe)表示,鉴于经济前景的不确定性,决定本月继续维持利率不变,为评估进一步加息和经济前景提供更多时间。他还指出,虽然澳大利亚的商品价格压力已经有所缓解,但许多服务的物价正在快速上涨,租金通胀也有所上升。根据其预测,澳大利亚通胀压力将继续回落,到2024年达到3.5%左右,到2025年底回到2-3%区间内。

暂停加息决定震惊市场 澳元短线暴跌

暂停加息的决定出乎市场意料,按照此前预期,澳联储原本将在本政策窗口继续加息25个基点。本次意外暂停加息,将在一定程度上打击澳元。果然,决议公布后,澳元兑美元短线跳水,下挫近40点,此外,对利率敏感的三年期国债收益率也快速回落至3.82%。

对于本次决定,澳洲联储在货币政策声明中表示,需要更多时间来评估迄今为止的加息行动以及经济前景——这点和美联储此前强调的,需要观察货币政策的累积效应和滞后效应的观点类似,代表澳美双方央行都正在从货币政策的“操作期”,慢慢转向评估期。

对于通胀水平,澳洲联储表示,澳大利亚的通胀正在下降,但仍处于6%的过高水平。商品价格通胀有所缓解,但许多服务价格却在快速上涨。租金通胀也加剧。我们的核心预测是,CPI通胀将继续下降,到2024年底将降至3.5%左右,并在2025年底回到2%至3%的目标范围内。

根据上周澳洲方面公布数据,第二季度澳大利亚整体通胀放缓幅度大于预期:其CPI指数仍较上年同期上涨6%,虽仍远高于澳洲联储2%的目标,但低于第一季度7%的增幅。此外,加息正起到减缓消费者支出的作用,6月份零售销售出现今年以来最大跌幅。

令人担忧的是,该国的服务通胀仍在上涨,就业市场依旧紧俏,租金压力继续存在。正因如此,有许多分析人士认为,在今日澳洲联储举行的议息会议上,该行仍有很大的加息空间。

该行也显然意识到了这一点,关于劳动力市场,澳洲联储在声明中称,劳动力市场的状况尽管有所缓解,但仍然非常紧张。尽管企业报告劳动力短缺情况有所缓解,但职位空缺和招聘仍然处于非常高的水平。但是,该行强调,由于经济和就业增长预计将低于趋势水平,失业率预计将从目前的3.5%逐渐上升至明年底的4.5%左右。由于劳动力市场紧张和通胀高企,工资增长有所回升。从总体水平来看,只要生产率增长加快,工资增长仍与通胀目标一致。

澳联储对未来收紧货币政策持开放态度

澳洲联储还称,虽然最近的数据与预测期内通胀回到2%至3%的目标范围、产出和就业持续增长的情况一致,但仍存在重大不确定性。

首先,海外的服务价格通胀出乎意料地持续存在,澳大利亚也可能出现同样的情况。其次,在劳动力市场依然紧张的情况下,货币政策运作的滞后性以及企业的定价决策和工资将如何应对经济放缓也存在不确定性。随后,家庭消费前景也是一个持续的不确定性来源。最后,许多家庭的财务状况正遭受痛苦的挤压,而一些家庭则受益于房价上涨、大量储蓄缓冲和更高的利息收入。总体而言,由于生活成本压力和利率上升,消费增长已经大幅放缓。

澳洲联储再次就通胀治理立下“军令状”。该行称,在合理的时间内将通胀恢复到目标水平仍然是委员会的首要任务。高通胀使每个人的生活都变得困难,并损害了经济的运转。它侵蚀了储蓄的价值,损害了家庭预算,使企业更难规划和投资,并加剧了收入不平等。如果高通胀在人们的预期中根深蒂固,那么以后降低通胀的代价将非常高昂,包括更高的利率和更大幅度的失业率上升。

在连续两次暂停加息之后,澳洲联储对于未来的货币政策的收紧仍持开放态度。该行称,委员会可能需要进一步收紧货币政策,以确保通胀在合理的时间内恢复到目标水平,但这将取决于数据和不断变化的风险评估。在做出决定时,委员会将继续密切关注全球经济发展、家庭支出趋势以及通胀和劳动力市场前景。委员会仍然坚定地决心将通胀恢复到目标水平,并将采取必要措施来实现这一目标。

截至发稿,澳元兑美元日内下挫0.93%,报0.6655;澳元兑港币日内下挫0.96%,报5.1884;美元指数则升0.41%,报102.0420。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。