澳洲联储11月重启加息进程:OCR上调至4.35% 为12年以来最高水平

根据澳洲联储预计,到2024年底,CPI指数将达到3.5%左右,并在2025年底进一步回落至2%至3%目标区间的顶部。

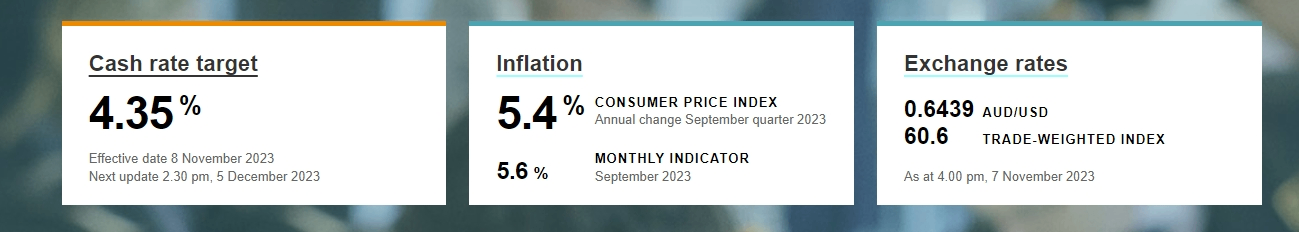

11月7日,澳洲联储发布利率决议,在连续四次保持按兵不动后,重启加息,将官方现金利率(OCR)从4.10%上调至4.35%,创下2011年11月以来的最高水平。另外,该行还将外汇结算余额支付的利率提高25个基点至4.25%,作为货币政策的补充收紧措施。

三季度通胀抬头明显 澳洲联储加息并不意外

根据10月底公布数据,澳大利亚在第三季度的通胀率抬头明显。三季度实际通胀率录得5.4%,超出预期的5.1%。其中受到油价飙升的影响,澳大利亚在当季的交通成本大涨7.2%,房租上涨2.2%,电费上涨4.2%,这些物价的增长也共同促使澳洲的月度通胀连续第三月反弹,通胀抬头态势明显。

从劳动力市场来看,澳大利亚劳动力需求的紧张态势也并没有得到缓解。根据公布数据,澳洲的失业率仍维持在年内的最低点3.6%,这代表劳动力成本还有继续上升的可能性。于是,在数据公布后,澳洲联储在11月重启加息的可能性从5%直接飙升至50%,劳动力市场对通胀的影响程度可见一斑。

市场对澳洲联储的本次加息行动并不感到意外。根据媒体对39位经济学家的一项调查,在这些经济学家中有将近90%的人在利率决议公布之前就曾成功预测加息。澳洲联储主席布洛克在议息声明中表示:“是否需要进一步收紧货币政策以确保通胀在合理的时间范围内回归目标,将取决于数据和对风险的不断评估。”布洛克这一言论直接导致澳大利亚3年期国债收益率应声下跌1个基点至4.26%,澳元兑美元短线走低近50点。

澳洲联储:预计通胀数据2025年底回落至目标区间

在议息声明中,澳洲联储对未来的CPI指数的路径做出了预测。澳洲联储表示,虽然澳大利亚的通货膨胀已经过了顶峰,但读数仍然过高,而且比几个月前的预期更加持久。最新的CPI通胀数据显示,虽然商品价格通胀进一步放缓,但许多服务价格仍在继续快速上涨。尽管根据此前预测,CPI指数将继续下降,但进展似乎慢于先前的预期。目前,根据澳洲联储预计,到2024年底,CPI指数将达到3.5%左右,并在2025年底进一步回落至2%至3%目标区间的顶部。

对于通货膨胀,澳洲联储称,高通胀正在给人们的实际收入带来压力,家庭消费增长疲软,住宅投资也是如此。鉴于经济增长预计将低于趋势水平,就业增长预计将慢于劳动力增长,失业率预计将逐渐上升至4.5%左右,这一增幅比之前的预测更为温和。虽然过去一年工资增长有所回升,但只要生产率增长加快,工资增长仍符合通胀目标。澳洲联储继续称,在合理的时间内将通胀恢复到目标水平仍然是委员会的首要任务。

值得注意的是,澳洲联储在声明的最后一段对措辞进行了调整,从“可能需要进一步收紧货币政策”软化为“是否需要进一步收紧货币政策”。分析师称,这听起来像是希望尽可能长时间按兵不动,澳洲联储可能会在未来几周内派出发言人传递这一信息。

加拿大皇家银行:一次鸽派的加息

机构方面,房地产研究机构CoreLogic研究总监Tim Lawless认为,澳洲联储决定将官方现金利率上调至4.35%,这清楚地表明,如果通胀率超过2%-3%的目标区间,澳洲联储愿意提高利率。Tim Lawless还称,持续紧张的劳动力市场状况以及零售支出数量和价值的回升可能是支持加息举措的额外因素。

盛宝市场称,澳洲联储的声明未能证实一些市场参与者预期的鹰派立场。市场策略师Charu Chanana在一份报告中写道,在澳洲联储宣布加息25个基点后,澳元的反应是典型的“买消息,卖事实”。在过去几周里,加息预期不断升温,使澳元成为G10货币中涨幅最大的货币之一。但市场的定价不仅是今天加息,还包括在本轮周期内再次加息。澳洲联储的声明未能证实这种鹰派立场,而是采用了依赖数据的方法来评估进一步紧缩的需求。

加拿大皇家银行资本市场利率策略师Rob Thompson则认为,澳洲联储在本次的加息行为是一次“鸽派加息”。他表示,澳洲联储在本次加息后并不会立即采取后续行动:“市场可能会认为本次加息行动标志着澳洲联储重新打开了加息大门,但其实他们的本意却是尽可能地少干预市场,继续加息的障碍实际上非常高。”

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。