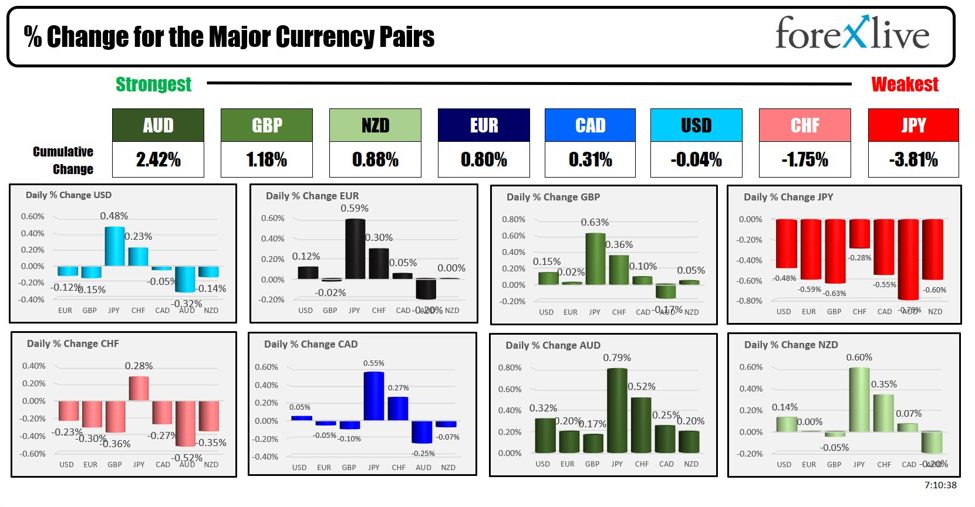

随着 NA 会议开始 , 澳元最强 , 日元最弱.

随着北美会议的开始 , 澳元最强 , 日元最弱.这种组合扭转了澳元 (或纽元) 最弱和日元更熟悉的主题.

随着北美会议的开始 , 澳元最强 , 日元最弱.这种组合扭转了更熟悉的主题 , 澳元 (或纽元) 最弱 , 日元最强.不出所料 , 盘前美股出现反弹 , 有助于反转.纳斯达克在盘前期货交易中上涨了 200 点 ( 目前 ).这扭转了昨天的 - 160 点跌幅.尽管如此 , 美国主要指数本周仍在下跌。.

美元兑日元的平仓和所谓的 “套利交易 ” , 即一些投资者以低利率借入日元投资于美元资产 ( 或其他国家的资产 ) 以获得更好的回报 , 一直是资金流出的借口一些资产 , 进入其他资产.话虽如此 ,日经 225 指数本周经历了 2021 年以来最糟糕的一天.比特币、石油、白银、铜甚至黄金本周下跌.所以可能会有美元的抛售和美国股票的清算 , 但它似乎正在变成现金.这个故事将如何展开.

当然 , 当你有像我们本周这样的举动时 , 尤其是像 Magnificent 7 这样的资产 , 找到 “原因 ” 总是很有趣的 ( 我.e.套利交易平仓) , 但它可能只是 “获利了结 ” , 是的 , 暂时停在现金或货币市场.美联储下周开会,随着 2024 年上半年 2% 左右的增长 , 可能很难削减.因此 , 停车一段时间并购买蘸酱可能是一个不错的主意.

顺便说一句 , 日本央行下周确实会开会 , 市场认为利率上升 10 个基点的可能性为 65%.美联储也开会 , 市场关注的焦点是央行在 9 月份开始降息.

今天的数据可能有助于美联储做出这一决定 , 因为受青睐的通胀指标 (核心 PCE) 将于美国东部时间上午 8 : 30 发布.美国东部时间上午 10 点 , PCE 数据以及密歇根大学消费者信心指数 ( 最终 ) 将突出显示今天发布的经济数据.:

- PCE price index MoM: Forecast 0.1% versus 0.0% last month. YoY estimate 2.5% versus 2.6% last month.

- Core PCE Price Index m/m: Forecast 0.2% versus 0.1% last month. Estimate 2.5% versus 2.6% last month

- Personal Income m/m: Estimate 0.4% versus 0.5% last month

- Personal Spending m/m: Estimate 0.3% versus 0.2% last month

- Revised UoM Consumer Sentiment: Estimate 66.0 versus 68.2 last month and 66.0 preliminary

- Revised current conditions: Preliminary 64.1. Last month 65.9

- Revised expectations: Preliminary 67.2. Last month 69.6

- 1 year inflation expectations. Preliminary 2.9% versus 3.0% last month

- 5 year inflation expectations. Preliminary 2.9% versus 3.0% last month

北美会议开始时其他市场的快照显示 :

- Crude oil is trading down $0.37 at $77.91. Although lower today, at this time yesterday, the price was even lower at $76.36. The price is down -0.80% for the week

- Gold is trading up $7.80 or 0.33% at $2373. At this time yesterday, the price was trading at $2371.44. For the week the price of gold is down -1.07%.

- Silver is trading down eight cents or -0.32% at $27.73. At this time yesterday, the price is trading at $27.57. For the week the price of silver has tumbled -5.02% which comes after 8-5.10% decline last week.

- Bitcoin trading higher at $67,298 (well there is some buying in bitcoin today) . At this time yesterday, the price was trading at $64,208

- Ethereum is trading higher as well as $3246. At this time yesterday, the price was trading at $3174.03

在盘前 , 主要指数的快照交易走高.

- Dow Industrial Average futures are implying a gain of 287.93 points. Yesterday, the Dow Industrial Average rebounded with a gain of 81.20 points or 0.20% to 39935.08.

- S&P futures are implying a gain of 47.78 points erasing the declines from yesterday. Yesterday, the S&P index closed lower by -27.89 points or -0.51% at 5399.23. The S&P is on pace for back-to-back weeks of 2% declines.

- Nasdaq futures are implying a gain of 223 points . Yesterday, the index closed lower by -160.69 points or -0.93% at 17181.72. Coming into today (with the gains, it may not play out), the NASDAQ was on pace for back-to-back weeks of -3% declines (at the close yesterday the index was down -3.08% after falling -3.68% last week). It hasn't done that since September 2022.

- Yesterday, the Russell 2000 index rose by 27.60 points or 1.26% at 2222.98.

欧洲股票指数大多走高.本周指数也喜忧参半 :

- German DAX, +0.49%. The index is up 1.19% this week.

- France CAC, +0.91%. The index is down -0.56% this week.

- UK FTSE 100, +0.85%. The index is up 1.22%.

- Spain's Ibex, -0.07%. The index is up 0.44% this week.

- Italy's FTSE MIB, +0.25% (delayed 10 minutes). The index is down -1.01 percent this week

亚太市场的股票收盘下跌 :.

- Japan's Nikkei 225, -0.53%. For the week the Nikkei fell -5.98% it's worse decline since April 15 week when it tumbled -6.21%.

- China's Shanghai Composite Index, +0.14%. For the week it fell -3.06%.

- Hong Kong's Hang Seng index, +0.10%. For the week it fell -2.28%.

- Australia S&P/ASX index, +0.76%. For the week the index fell -0.60%.

纵观美债市场 , 收益率涨跌不一 :

- 2-year yield 4.434%, -0.8 basis points. At this time yesterday, the yield was at 4.366%. 2-year yield are currently down -7.8 basis points this week

- 5-year yield 4.132%, -1.2 base points. At this time yesterday, the yield was at 4.088%. Currently the 5-year yield is down -3.6 basis points this week.

- 10-year yield 4.240%, -1.5 basis points. At this time yesterday, the yield was at 4.225%. Currently, the 10 year yield is unchanged this week

- 30-year yield 4.481%, -1.9 basis points. At this time yesterday, the yield was at 4.495%. Currently, the 30-year yield is up 3.4 basis points.

看看国债收益率曲线 ,

- The 2-10 year spread is at -19.6 basis points. At this time yesterday, the spread was at -14.4 basis points. Currently, the spread is up 8.0 basis points this week

- The 2-30 year spread is +4.5 basis points. At this time yesterday, the spread was 12.6 basis points. Currently, the spread is up 11.0 basis points this week

在欧洲债券市场 , 基准 10 年期收益率较低 :

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。