净利率、税前/税后净利是什么?

一间公司的获利能力是投资人的关注重点,若获利不断成长,股价容易上升。本文介绍净利率、税前净利、税后净利之间的关系,以及在选股时该注意的3件事。

一家企业的获利能力是长期投资人关注的重点因素之一,获利能力强的企业,其股价容易随其发展而不断上涨;同时,盈利喜人的企业也会将股息股利回馈给股东。

净利&净利率

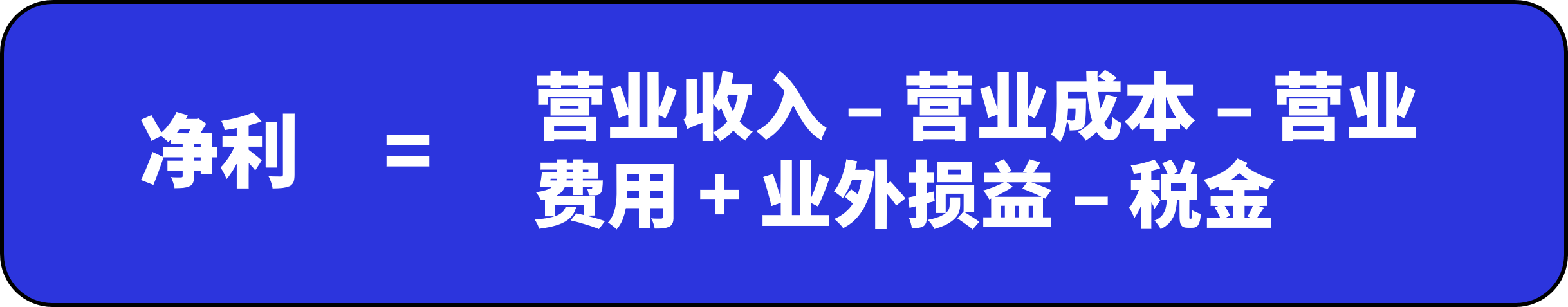

净利(Net Income)又称为盈余、纯益,一般指的是税后净利,用来衡量一家企业实际赚了多少钱。将企业的营业收入扣掉各种支出费用,如营业成本、营业费用、业外损益及所得税等等,最后所剩的利润就是企业真正的获利成果。

净利率(Profit Margin)通常指的是税后净利率,是由税后净利占营业收入的百分比结果,也就是每赚进1元的收入中,有多少是企业真的赚到钱的比例,其计算公式如下:

税前净利&税前净利率

税前净利(Pre-Tax Income)指的是一家企业获得的营业收入,扣掉成本费用、营业费用,再加上本业以外的损益,就能得到税前净利的结果。

从计算公式来看,这项指标可以用来检视企业”本业外损益“的情况,能够避免买到本业赚钱,但受到业外亏钱影响的企业。

税前净利率(Pre-Tax Income Margin)指的是税前净利占总营业收入的百分比,用来衡量一家公司每元收入中,税前的净利占比。

检视企业财报时,若发现税前净利率大于营业利益率的话,就代表公司有业外收入,可能来自于出售土地、厂房、设备、汇兑损益、或业外转投资的收入等。相反,如果税前净利率小于营业利益率的话,表示公司业外有出现亏损的情况。

税后净利&税后净利率

税后净利(Net Income)是衡量一家公司最终获利表现的一项指标,能反映出公司实际赚了多少钱。

税后净利率(Net Profit Margin)指的是税后净利占总营业收入的百分比,显示出一家公司每元营收中,税后的净利占比。

净利率高低的含义

一家企业的净利率越高,代表获利能力越强;反之,越低代表获利能力越差。不过,有时候企业的净利率高低,是受到业外损益的影响,拉高或降低了净利率的表现。

而业外损益可分为两种:经常性和非经常性,经常性损益指的是会一直发生,像是利息收入;非经常性损益指的是一次性损益,例如出售土地、厂房、设备或汇兑损益。

所以,实际上高净利率的企业有可能并不是因为本业赚钱能力很强,甚至本业还有可能出现亏损。若出现这种情况,该企业就不会是一个好的投资目标。一家企业若要维持长期的成长性,本业获利能够持续提升才是长久之计。如果能再加上业外也能持续赚钱,那就会相当可观。

毛利率、营业利益率、税前/税后净利之间的关系

从损益表组成结构来看,一家公司将产品或服务出售后所获得收入,称为营业收入(Revenue)。

首先,营业收入需要扣掉在制造产品或提供服务时所需要的费用,包含原物料成本、人工成本、制造成本等,这些费用称为营业成本(Cost of Goods Sold, COGS)。

接着,再扣掉制造产品过程中所需的间接费用,这些费用包含销售、管理以及研发等与营运相关的费用,称为营业费用。

销售费用(Selling and distribution expenses):员工薪资、水电费、瓦斯费、门市租金及广告费等。

管理费用(Administrative expenses):各部门开支及服务费用等。

研发费用(Research and Development Expenses):投入研究新产品、新技术、新制程、新专利、改进生产技术及制程等。

扣掉以上两种成本费用后剩余的部分称为营业利益,也代表着公司本业获利的情况。将公司本业以外的损益考虑进去后,就能知道在本业以外的损益情况,也就是税前净利。

最后,扣掉营业所得税后就能知道公司在出售一项产品或服务后,到底实际有多少前能赚进口袋中。

小结

净利率一般指的是税后净利,用来衡量一间企业实际赚了多少钱。税前净利与税前净利率是用还衡量一家公司本业以外的损益情况,透过这项指标能够避免买到本业赚钱,但受到业外亏钱影响的企业。税后净利与税后净利率衡量一家公司最终获利表现的一项指标,能反映出公司实际赚了多少钱。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。