数字支付爆发式增长!2027将占全球总交易额一半?

电子支付正在加速取代现金和银行卡,成为全球增长最快的支付方式。

买东西用扫描二维码的方式,或者使用电子钱包就能付款,这就是电子支付。电子支付把互联网,金融机构,以及每个人的终端设备有效地联合起来,形成了一个新型的支付体系。

正是由于电子支付不需要物理货币的交换,所以其具备了许多传统支付方式所不具备的优势,例如便捷性和支付速度。只要拥有手机等终端,用户可以随时随地完成支付,这可以大大地提升交易效率。

另外,相比较于现金,数字支付通常有更严格的安全措施,每笔交易记录都可以被电子化地保存和追踪,这也成为了电子支付在后疫情时代大放异彩的原因。正因如此,自2018年以来,数字钱包的使用率增长了四倍,而现金的使用率则下降了近一半,不少人甚至喊出了“现金已死”的口号。

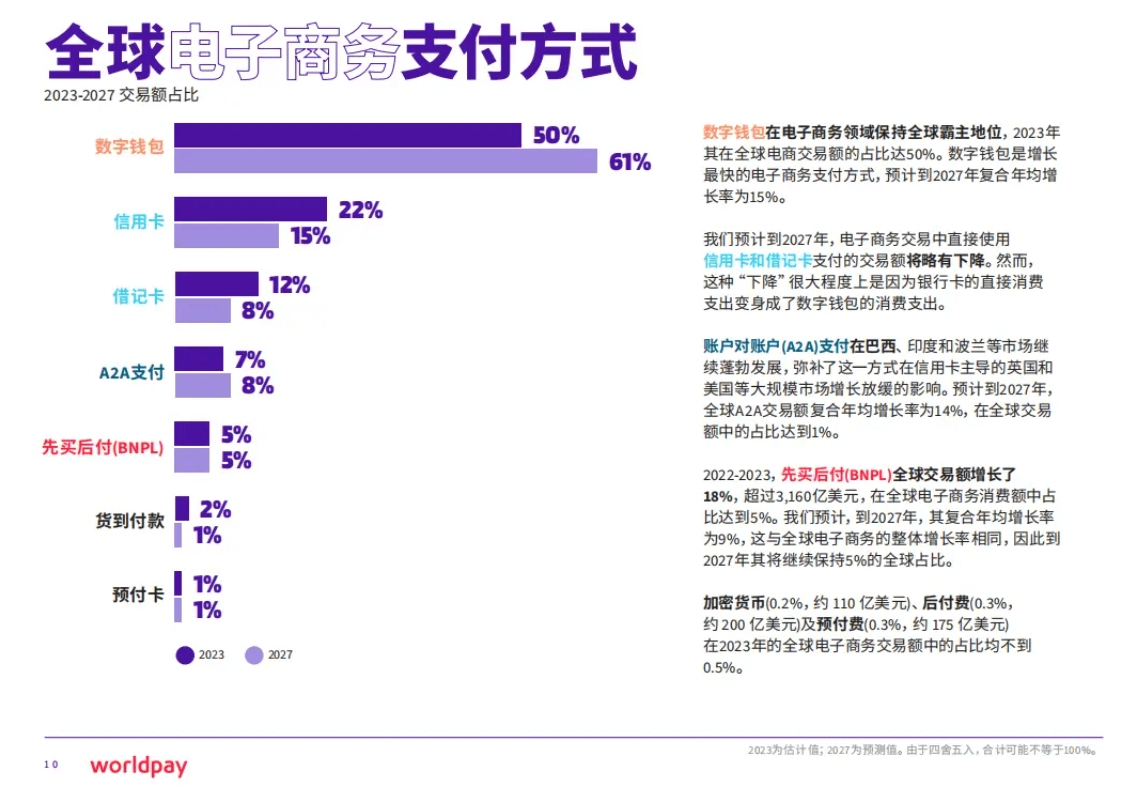

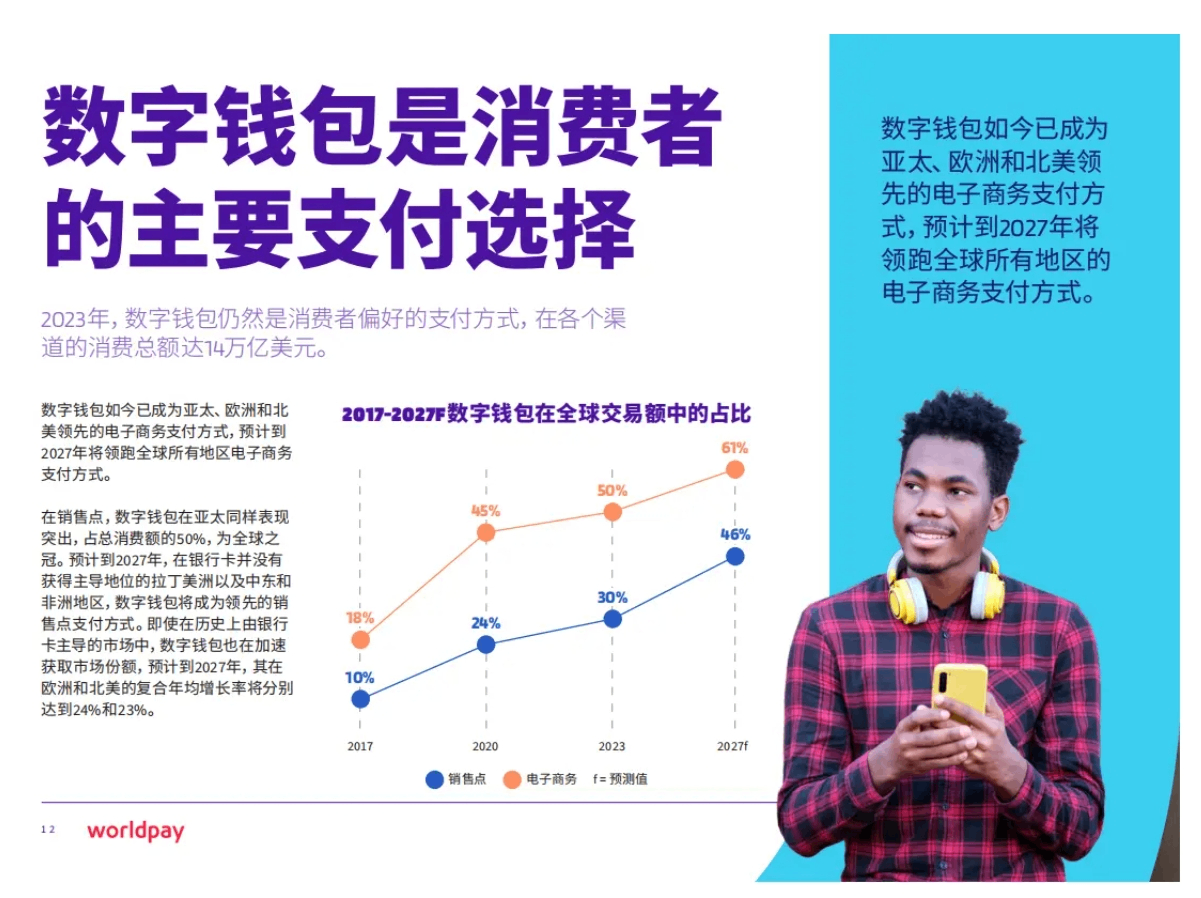

目前,电子支付的发展更是有愈演愈烈之势,预计未来将取代更多支付方式。根据Worldpay最新公布的全球支付报告,截至2024年,数字钱包在全球电子商务中的消费比例,已经占到了50%,总消费额超过3.1万亿美元。

即使是在线下销售点,数字钱包的消费额也能占到30%,总消费额超过10.8万亿美元。目前,电子支付正在加速取代现金和银行卡,成为全球增长最快的支付方式。

Worldpay预计,到2027年,全球将有一半的交易采用电子支付的形式,支付总额超过25万亿美元,这个夸张的数值已经和全球最大经济体美国的全年GDP接近。

秉持着“打不过就加入”的精神,各界巨擘都纷纷开始部署自己的电子支付解决方案,在各自领域打响了抢夺支付习惯的“抢滩登陆战”。首先是和线上支付最密切相关的电商平台,在近几年,拉丁美洲的美客多、美国的亚马逊、日本的乐天,以及新加坡的虾皮,都推出了自己的电子支付解决方案。

其次,一些传统支付方式起家的银行,如丹麦银行、土耳其银行、阿根廷银行,也推出了自己的数字钱包,向新支付手段靠拢。甚至,一些超级应用,如微信和支付宝,也在抢占数字钱包市场。

总部位于美国的Paypal是全球最具有影响力的数字钱包之一,光靠转账收益,每年的营收都能保持在200亿美元以上,去年更是达到了300亿美元,未来很有可能会保持在这一水平。这么大的蛋糕,很难让传统银行们不心动。

那么,普通人该如何把握后疫情时代的电子支付红利呢?第一种,可以购买和电子支付相关的股票;

第二种,可以购买跟踪IPAY指数的被动型基金,该指数的标的为行动支付指数(Prime Mobile Payments Index),主要跟踪信用卡网络,支付基础设施,软件服务等大型通信公司的股价;

第三种,还可以购买和Doo Wealth类似的主动投资型基金,该指数主要跟踪苹果、甲骨文、亚马逊、VISA等大型电子支付公司的股价,分享未来的发展红利。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。