什么是市场周期?如何应对市场周期?

揭开市场周期的秘密,学习如何以战略思维应对不同阶段。通过我们的专业建议,实现收益最大化。

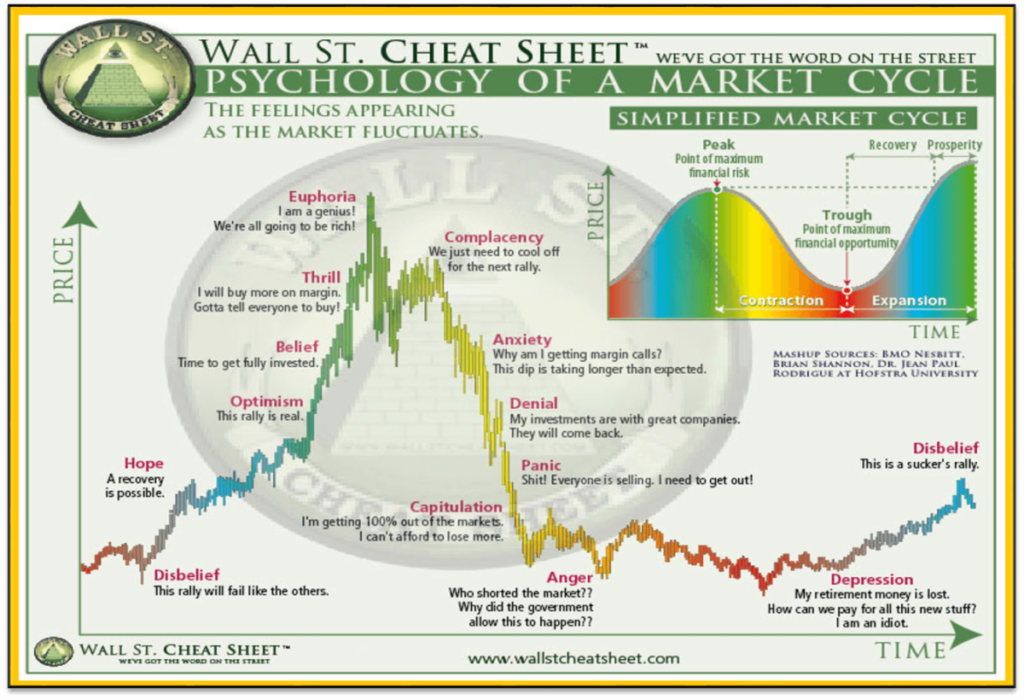

市场是一个不断变化的实体,理解市场周期的心理对于投资者和交易者至关重要。通过识别影响市场行为的心理因素,投资者可以更好地预测市场动向,做出更明智的决策。

在本文中,我们将深入探讨市场周期的心理,并探索市场的不同阶段以及它们是如何受到心理因素的影响的。

市场周期的不同阶段

以下是《华尔街备忘单》中的市场周期心理学图示:

1.繁荣阶段 - 乐观与信心

市场的繁荣阶段以快速增长和投资者的乐观情绪为特征。在这一阶段,投资者更容易承担更大的风险,并参与投机行为,因为他们相信市场将持续上涨。然而,这种乐观情绪可能导致资产的过度估值,从而引发市场崩盘。

2.泡沫阶段 - 激动与狂热

市场的泡沫阶段以非理性的过度兴奋和资产的高估为特点。在这一阶段,投资者因害怕错过而愿意为未被基本面支持的资产支付高价。这一阶段通常会伴随市场崩盘,因为投资者意识到资产价格并不可持续。

3.崩盘阶段 - 焦虑、否认与恐慌

市场的崩盘阶段以迅速下跌和投资者的恐慌情绪为特征。在这一阶段,投资者更倾向于亏损出售资产,因为他们认为市场将继续下跌。这种恐慌情绪会加剧下跌,导致更多投资者出售资产,形成自我实现的预言。

4.熊市阶段

熊市阶段以长期下跌和投资者的悲观情绪为特征。在这一阶段,投资者更可能采取观望态度,因为他们相信市场将继续下跌。然而,这一阶段也可能为精明的投资者提供机会,因为资产可能被低估,从而带来有吸引力的买入机会。

5.复苏阶段

市场的复苏阶段以逐步增长和投资者的乐观情绪为特征。在这一阶段,投资者更愿意承担风险,并参与投机行为,因为他们相信市场将继续上涨。然而,需要注意的是,复苏阶段可能是脆弱的,如果条件发生变化,市场崩盘可能会再次出现。

6.牛市阶段

牛市阶段以长期增长和投资者的乐观情绪为特征。在这一阶段,投资者更可能采取买入持有策略,因为他们相信市场将持续上涨。然而,需要注意的是,牛市阶段可能会被熊市所取代,因为市场条件和投资者情绪会发生变化。

7.高估阶段

市场的高估阶段以非理性的过度兴奋和资产的高估为特点。在这一阶段,投资者因害怕错过而愿意为未被基本面支持的资产支付高价。这一阶段通常会伴随市场崩盘,因为投资者意识到资产价格的不可持续性。

8.调整阶段

市场的调整阶段以下跌和投资者的谨慎情绪为特征。在这一阶段,投资者更可能采取观望态度,因为他们相信市场将继续下跌。然而,这一阶段也可能为精明的投资者提供机会,因为资产可能被低估,从而带来有吸引力的买入机会。

情绪在市场周期中的关键作用

情绪在市场周期中起着至关重要的作用。恐惧和贪婪是影响市场行为的两大主要情绪。恐惧可能导致投资者在市场下跌时恐慌性抛售,引发市场崩溃;而贪婪则可能导致投资者在市场繁荣时过度投资,形成泡沫。

应对市场周期的策略

为了在不断变化的市场周期中取得成功,投资者可以采取以下策略:

- 长期视角:关注基本面,避免被短期市场波动所干扰。

- 多元化投资:通过分散投资组合,降低单一资产或市场的风险。

- 风险管理:设定明确的止损点,避免因市场波动而遭受重大损失。

- 持续学习:不断学习市场知识,提高对市场动态的理解和预测能力。

结论

市场周期的心理学是一个动态且复杂的领域,理解其背后的心理因素对于投资者至关重要。

通过采取长期视角、多元化投资、风险管理和持续学习,投资者可以更好地应对市场周期的挑战,实现财务目标。

市场周期的每个阶段都提供了不同的投资机会和风险,理解这些阶段的心理特征,可以帮助投资者做出更明智的投资决策。

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。