什么是相对强度指数(RSI)?

相对强弱指数(RSI)是一种工具,可以帮助投资者根据最近的价格变化来评估资产的价格是低于还是高于其实际价值,它可以帮助投资者决定是否购买或出售资产。

相对强弱指数(Relative Strength Index, RSI)是一种基于资产近期价格变化的工具,旨在帮助投资者预测未来价格的可能走势。

RSI的定义

投资者可以通过相对强弱指数可以有效预测股票价格的涨跌。RSI由分析师James Welles Wilder, Jr.于1978年创立,衡量资产价格近期变化的速度和幅度。这一指标帮助交易者判断股票是否被高估(交易价格高于其实际价值)或低估(交易价格低于其实际价值)。被低估的股票可能会面临价格上涨,而被高估的股票则可能会出现价格下跌。尽管RSI是一个有用的工具,但它并不完美,最好与其他指标结合使用。

示例分析: 假设一家鞋店以50美元的价格销售最新款式的鞋子。随着该款式越来越受欢迎,店铺每天将价格上涨5美元。两周后,鞋子的价格达到了120美元。如果该鞋子的实际价值仅为50美元(例如,根据其他商店的定价),那么你可能会认为该鞋子在这家零售店的价格被高估。在这种情况下,你可能会犹豫是否购买,因为你预测这家店未来可能会降低价格。尽管你没有复杂的图表作为参考,但你的思考过程与交易者使用相对强弱指数的逻辑是相似的:跟踪近期价格变化以预测未来走势,从而做出投资决策。

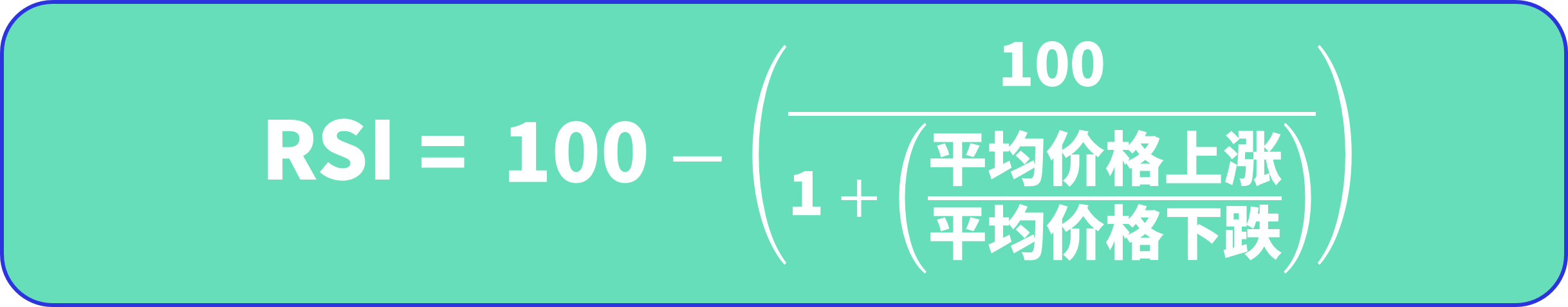

RSI的计算方法

相对强弱指数的计算相对复杂,通常基于14天内的平均价格涨幅和平均价格跌幅。其基本公式为:

由于RSI计算需要两周的数据,因此手动计算较为繁琐,在线RSI计算器可以简化这一过程。

RSI的意义

相对强弱指数通过分析资产的历史表现来预测未来走势。RSI值的范围为0到100,常见的规则是RSI值超过70表示资产被高估,未来可能下跌;而RSI值低于30则表示资产可能被低估,未来可能上涨。RSI值为50通常被视为中性,意味着资产未被高估或低估。

需要注意的是,30和70只是一般指示。若某资产的RSI值经常超过70(长时间被高估),可以将80作为参考值。某些资产在RSI指标下可能长期被高估或低估,而没有价格修正的发生。

如何解读RSI图表

相对强弱指数通常以图表形式呈现,通常与股票的价格走势图一同显示。将RSI图表与价格趋势进行比较,可以为投资者提供比单独使用RSI更丰富的信息。RSI图表的纵轴显示RSI值的变化范围,通常为0到100,而横轴显示相关时间段(一般为14天)。

RSI是否是一个可靠的指标?

相对强弱指数(Relative Strength Index, RSI)在股票市场中具有一定的参考价值,但由于股票价格的波动受多种因素影响,仅依靠RSI进行预测并不总是可靠。RSI主要基于资产的近期价格历史,但历史数据并不能可靠地预测未来。只有当RSI数值与资产价格的长期趋势一致时,它的有效性才会增强。然而,识别价格可能反转的确切时机,往往是困难的。此外,资产可能会长时间处于被高估或被低估的状态,而价格却没有相应变化。

将RSI与其他技术指标结合使用,可以提高预测的准确性。例如,移动平均收敛散度指标(MACD)使用不同的指数移动平均(EMA)来衡量近期价格之间的关系,以帮助识别趋势变化和动量。这种结合能更全面地反映市场动态。

RSI被低估与被高估的定义

-

被低估(Oversold):被低估的资产交易价格低于基于其他价值指标的预期价格。通常,这可能意味着未来价格会有所上涨。相对强弱指数值为30或以下通常被视为资产被低估。然而,不同分析师对被低估的定义可能有所不同。

-

被高估(Overbought):被高估意味着资产价格相较于其他价值指标或历史价格过高。相对强弱指数值为70或以上通常表示资产被高估,这可能预示着价格可能会回调。同样,不同分析师对这一概念的看法可能存在差异,价格未必会立即下跌。

RSI的常见形态

背离现象(Divergence) 背离现象指资产价格与技术指标(如RSI)之间的运动方向相反。当投资者发现背离时,这通常意味着资产价格的趋势将很快减缓或改变方向。正背离可能预示着价格上涨,而负背离则暗示价格可能下跌。但需要注意的是,背离并不总是出现在价格反转时。

RSI的摆动拒绝(Swing Rejections) 当RSI值从被低估或被高估区域向中性状态移动时,市场趋势可能会发生拒绝,尤其是在股票整体处于上升趋势时。这种情况下,RSI可能会再次回落并突破之前的最高点。具备足够观察能力的投资者能够把握这种即将发生的摆动拒绝,从而可能实现盈利。

相对强弱指数在分析资产价格波动时具有一定的指导意义,但投资者应结合其他技术指标进行综合分析,以提高决策的准确性和有效性。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。