TSMC Forecasts Record Q2 Revenue as Trump Tariff Spurs Chip Buying Frenzy, AI Outshines Smartphone Slump

As AI buzz takes a backseat to Trump's aggressive tariff push, tsmc stepped into the spotlight with a strong Q1 report—and an even stronger outlook for Q2. Despite rising fears that sweeping tariffs c

As AI buzz takes a backseat to Trump's aggressive tariff push, tsmc stepped into the spotlight with a strong Q1 report—and an even stronger outlook for Q2. Despite rising fears that sweeping tariffs could shake up the global chip supply chain, TSMC is projecting record revenue next quarter. The company's message to those worried about the fallout: "Not so fast."

The chip foundry reported Q1 revenue of $25.53 billion, up 35% year-over-year in USD terms (42% in local currency), and down 5% quarter-over-quarter—right in line with the company's guidance range of $25–25.8 billion. Net income came in at $10.97 billion, up 53% YoY.

Gross margin held firm at 58.8%, down slightly from Q4 but up significantly from the prior year, thanks to strong contributions from iPhones and AI-related demand.

AI Chips Dominate as 5nm Outshines 3nm

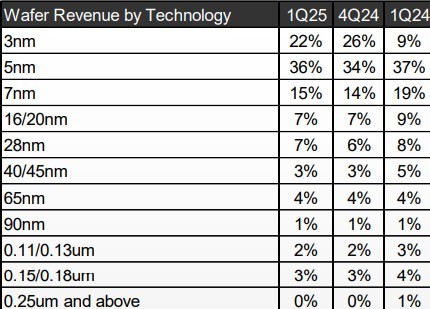

While revenue from 3nm chips dipped to 22% of total revenue—due to post-holiday seasonality and limited lift from Apple's AI features—5nm demand is heating up. That node contributed 36% of total revenue, up two points from Q4, driven by Nvidia's Blackwell (B200) chips and growing interest in ASICs like Broadcom's custom silicon.

7nm remained stable, contributing 15%. Combined, the advanced nodes (3/5/7nm) still accounted for a strong 73% of total revenue—though slightly down from last quarter.

HPC Chips Fuel Growth, Smartphones Slump

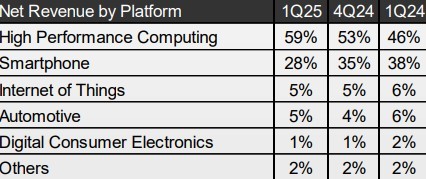

High-performance computing (HPC), which includes AI and data center chips, made up 59% of revenue this quarter, up 6 percentage points. That's a powerful indicator of sustained AI demand.

In contrast, smartphone chip revenue fell to 28%, down 7 points from Q4 and 10 points from last year—a steep decline even for the typically soft Q1. With apple under tariff pressure and facing softer iPhone sales, this trend may linger.

IoT and automotive chip contributions both hovered around 5%, with auto up 1 point from the previous quarter.

North America Booms—But Also Brings Risk

Geographically, North America now accounts for 77% of TSMC's revenue—up 2 points QoQ. China dropped to 7%, continuing its decline. While the U.S. remains TSMC's largest and fastest-growing market, this overexposure could become a major vulnerability if Trump's 25% tariff threat becomes reality.

Given TSMC's still-limited U.S. production capacity, most of its U.S.-bound products could soon face tariffs, making its reliance on America a double-edged sword.

Q2 Outlook: Through the Roof

Here's where it gets even more bullish. TSMC expects Q2 revenue of $28.4–29.2 billion, implying 38% YoY growth and a strong 13% QoQ jump. Gross margin is projected to remain in the 57–59% range.

Analysts believe the surge is being driven by a rush of orders from major tech companies looking to front-load inventory before tariffs go live—likely pushing TSMC to a record-breaking quarter.

AI remains the key engine. The company reaffirmed that AI-related revenue will double this year and is boosting its CoWoS advanced packaging capacity to meet demand.

Despite political headwinds, TSMC reaffirmed its full-year growth forecast of mid 20%, and maintained capex guidance at $38–42 billion. It's also speeding up construction of its second Arizona fab as part of its U.S. expansion.

This was a strong quarter by any standard—but it's the outlook that really turns heads. The company's optimism for Q2 and the full year reflects not just AI strength, but also the possibility that some form of deal or workaround on tariffs may already be in motion behind the scenes.

Still, with 35%+ growth in the first half, and full-year guidance holding at ~25%, it suggests potential turbulence in the second half as the post-tariff reality sets in.

Either way, TSMC just made a very clear statement: they're ready for whatever comes next.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.