Goldman Sachs Sees $4,000 Gold as Boosts Demand

COMEX Gold futures have surged past $3,300, reaching a historic high, as the worsening trade war dampens global growth prospects, erodes trust in typically safe US assets, and causes turmoil in financ

COMEX Gold futures have surged past $3,300, reaching a historic high, as the worsening trade war dampens global growth prospects, erodes trust in typically safe US assets, and causes turmoil in financial markets.

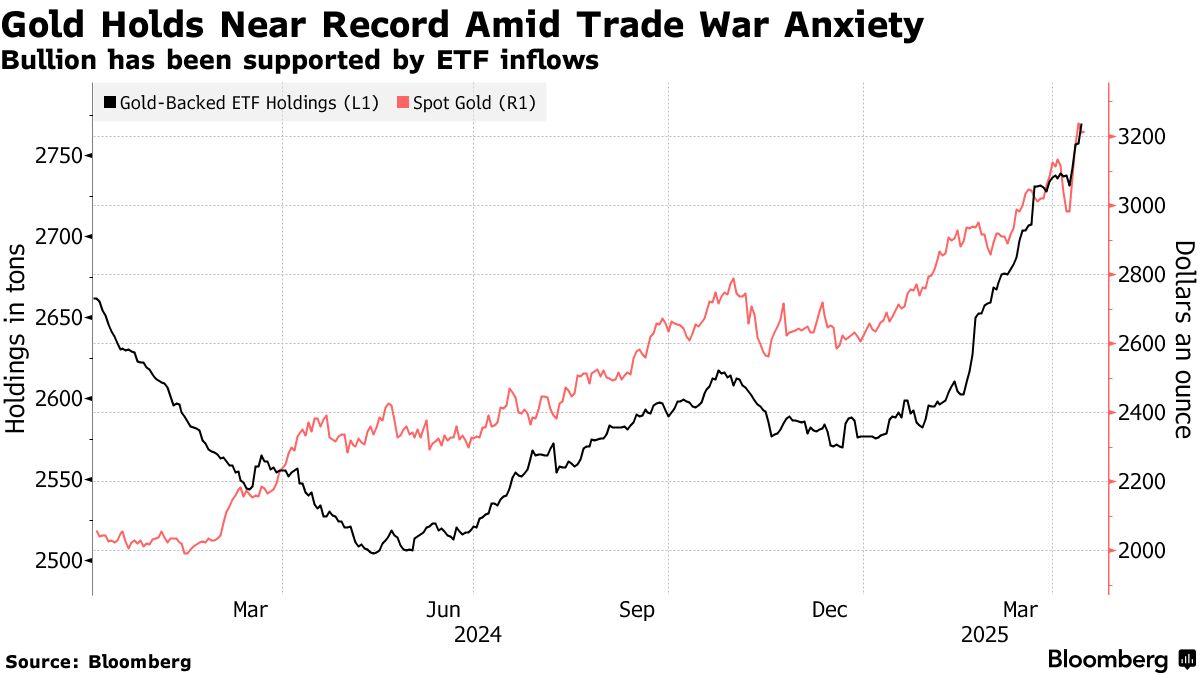

The chart shows that going long on gold has become one of Wall Street's most crowded trades.

With investors increasing their gold ETF holdings and central banks continuing to stockpile gold, large Wall Street investment banks remain optimistic about gold's future outlook. Data shows that gold ETF holdings have been steadily rising since June 2024, in line with the price increase.

Additionally, traders are betting that the Federal Reserve will cut interest rates at least three times this year. Monetary easing policies generally benefit precious metals.

What do analysts think about gold prices?

Goldman Sachs Group Inc. and ubs group ag have issued bullish calls for gold, with stronger-than-expected central bank demand and the metal's role as a hedge against recession and geopolitical risks supporting expectations for even higher prices in 2025.

Lina Thomas and other goldman sachs analysts now expect gold prices to rise to $3,700 per ounce by the end of this year, and to reach $4,000 per ounce by mid-2026. ubs strategist Joni Teves also notes that gold prices could reach $3,500 per ounce by December 2025.

Goldman Sachs analysts state that global central banks may purchase about 80 tons of gold each month this year, up from the previously estimated 70 tons. They also note a surge in inflows to precious metals ETFs, which may reflect investor demand for hedging against recession risks and falling asset prices. Goldman Sachs economists now estimate a 45% chance that the US will fall into a recession this year. If this occurs, gold ETF inflows could accelerate further, pushing gold prices to $3,880 per ounce by the end of the year.

UBS expects strong demand from various market segments such as central banks, long-term asset management firms, macro funds, private wealth, and retail investors, driven by changing global trade and geopolitical dynamics. Teves also states that thinner liquidity conditions—partly due to limited mine supply growth and large amounts of gold tied up in central bank reserves and ETF holdings—could amplify price movements.

"The power struggle between major countries will continue," says Luchen Wang, an analyst at Galaxy Futures Co. in Shanghai. "The attraction of gold as a safe-haven asset means that the likelihood of its price rising in the medium term is greater than the possibility of it falling."

Yuan devaluation, macroeconomic volatility, and rising de-dollarization rhetoric are classic and powerful drivers of gold demand in China, says Justin Lin, a Sydney-based analyst at Global X ETFs. Globally, he adds, "Gold's further rally will likely require a dovish pivot from the Federal Reserve, or clearer signs of a material slowdown in the US economy."

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.