Franklin Templeton Files to Create Solana ETF With Staking Capabilities

Franklin Templeton filed for a Solana ETF with staking, aiming to capitalize on shifting SEC sentiment and evolving crypto regulations.

- Franklin Templeton filed for a Solana ETF with staking, expanding on its earlier Solana Trust proposal from this month.

- Previous attempts at staking ETFs were withdrawn, but changing political conditions could favor Franklin Templeton's proposal.

- The SEC's Crypto Task Force recently discussed ETP staking, signaling potential regulatory openness to the concept.

Franklin Templeton filed to create a Solana ETF with staking options today. Earlier this month, it filed for a Solana Trust, and today’s proposal builds on that initial effort.

Presently, any ETF staking activity under this proposal would fall entirely under Franklin Templeton’s proposal. Nevertheless, previous industry efforts to establish a staking ETF in 2024 were withdrawn en masse, but this new attempt is determined.

Will the SEC Approve a Solana ETF?

Since President Trump took office in January, approval for a Solana ETF seems increasingly likely. The SEC has acknowledged a stretch of relevant applications in quick succession, and most Polymarket users think that approval in 2025 is very likely.

However, Franklin Templeton is going one step further, attempting to create a Solana ETF with staking.

“The Sponsor may, from time to time, stake a portion of the Fund’s assets through one or more trusted staking providers, which may include an affiliate of the Sponsor (“Staking Providers”). In consideration for any staking activity in which the Fund may engage, the Fund would receive certain staking rewards of Solana tokens, which may be treated as income,” the SEC filing reads.

To be clear, the “Sponsor” in the brief refers to Franklin Templeton itself, and it would have total control over the staking process and rewards. Although this process is apparently in no way decentralized, it still is a novel proposal in the ETF space.

Franklin Templeton also filed for a Solana Trust in February, and today’s ETF builds on this earlier application. Last year, several issuers attempted to create a staking Ethereum ETF, but all these proposals were withdrawn.

Nonetheless, political conditions are very different in 2025.

First of all, the SEC’s Crypto Task Force consulted industry leaders about ETP staking a week ago. These discussions were more general than a staking ETF specifically, but the Task Force has continued dialogues with other crypto firms.

Additionally, Task Force leader Hester Peirce requested more feedback from the crypto industry earlier today.

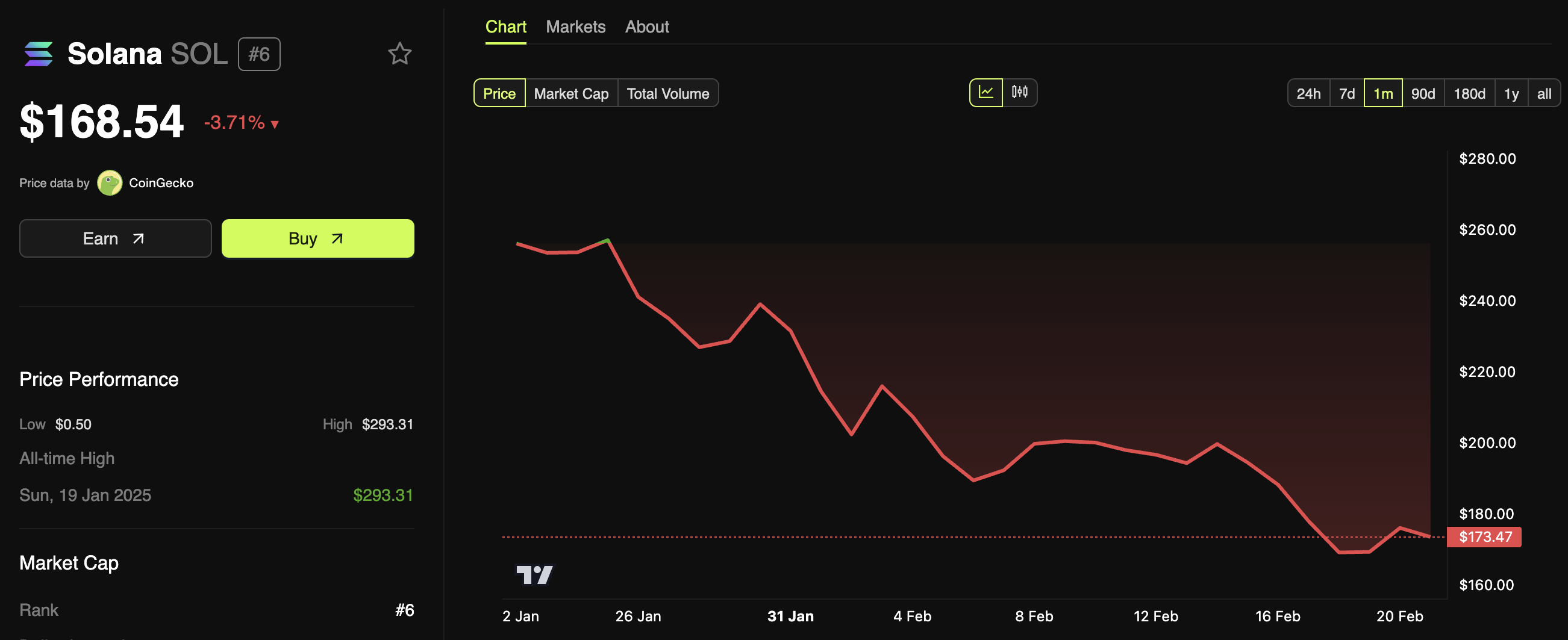

If Franklin Templeton is able to create a Solana staking ETF, it could cause a real boost to the underlying asset. SOL has experienced a difficult month, and there are few immediate signs of a price recovery.

Ultimately, however, there’s no real proof that the Commission will play ball with this request. The Task Force’s recent meeting only concerned ETP staking, and it’s the most bullish signal for Franklin Templeton.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.