Crypto Market Faces Uncertainty as VCs Split on Future, Says Moonrock Capital CEO

Moonrock Capital CEO Simon Dedic highlights VC uncertainty, a funding freeze, and the potential for an altcoin season in the crypto market.

- Simon Dedic, CEO of Moonrock Capital, warns of growing indecision and fear among VCs about the crypto market's future.

- A sharp decline in VC investments shows a funding freeze, signaling a potential deeper bear market.

- Despite uncertainty, some remain confident in an altcoin season, as the market begins to decouple from Bitcoin.

Simon Dedic, CEO and partner at Moonrock Capital, has expressed concern over the growing indecision and fear among venture capitalists (VC) about the future of the crypto market.

He pointed out that the divide in opinions on future directions has never been more pronounced.

Dedic Warns of Growing Fear and Indecision Among Crypto Investors

In the latest statement, Dedic stressed that the crypto market is currently in an uncertain phase that will eventually be regarded as one of the most defining moments in its history.

According to him, conversations with prominent figures in the space—leading VCs, market makers, top founders, and exchanges—reveal an industry deeply divided on its future direction.

“Never before have I seen such a split in opinions on where things are headed. And never before have insiders and industry professionals been this indecisive and fearful about what comes next,” Dedic wrote.

The CEO noted that a significant number of market participants have already exited or are in the process of leaving. Meanwhile, others are confronting the repercussions of strategic miscalculations, leading to considerable challenges.

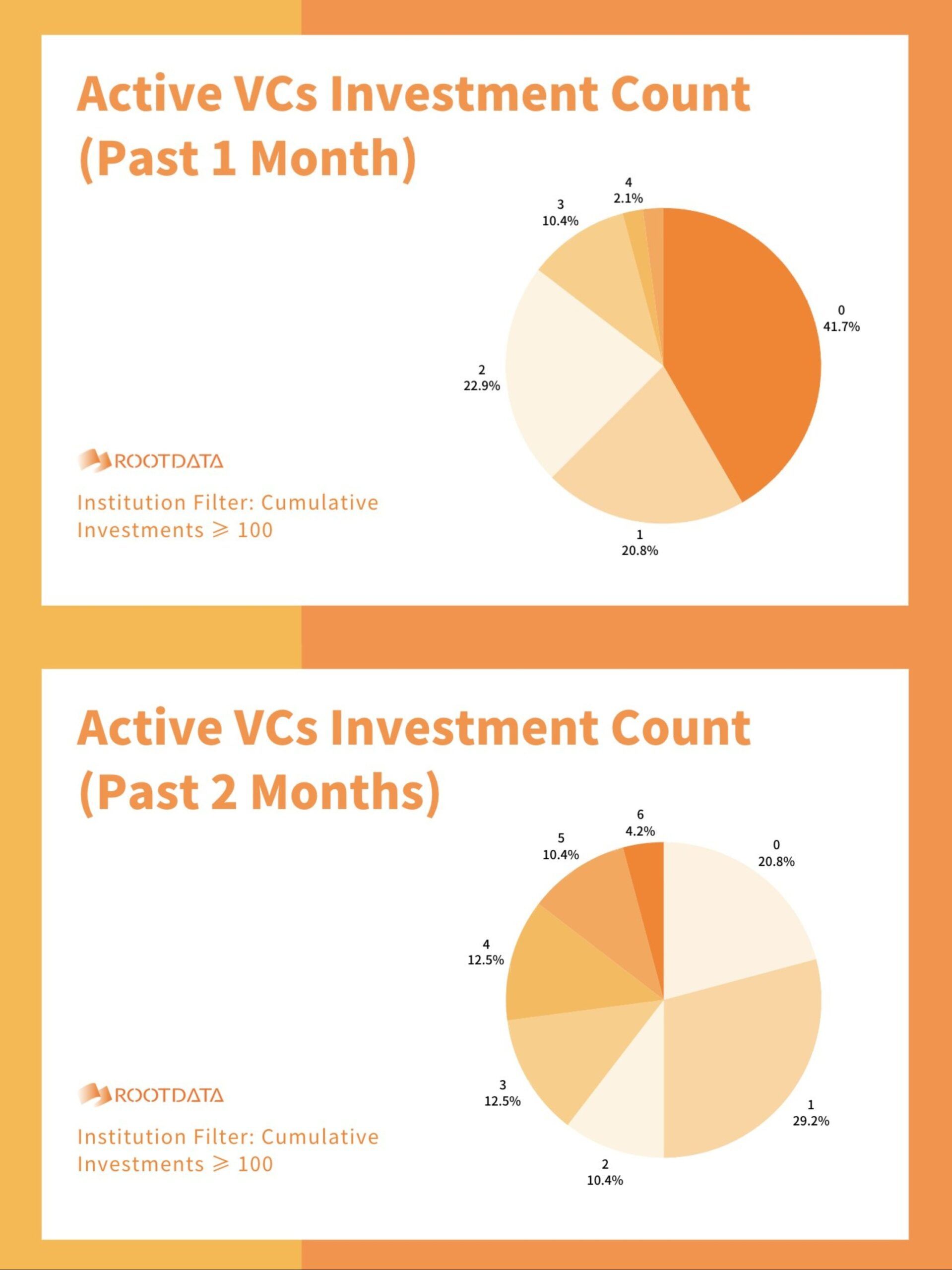

He also observed that the confidence in the crypto market is diminishing among a growing number of individuals. This sense of uncertainty is reflected in the latest observations from RootData. The data shows a clear decline in VC investments in the crypto market over the past month compared to the past two months.

The percentage of VCs making no investments has more than doubled. A similar trend is noticeable among VCs making between 1 and 4 investments.

The analysis also revealed that over half of active VCs have made zero or only one investment. This indicated a cautious and risk-averse approach in the market.

“The funding freeze suggests that we may have entered a deeper bear market phase,” RootData added.

However, not all are abandoning ship. Dedic pointed out that some are staying the course, confident that a fundamentally strong altcoin season is still on the horizon.

“This is the phase that will separate the winners from the losers,” he said.

Industry experts have discussed the distinct nature of the current cycle. The surge in new token releases has caused liquidity fragmentation, which analysts believe is delaying an alt season.

However, analysts also highlight signs of a potential altcoin season, pointing to a possible upcoming decline in Bitcoin (BTC) dominance and the ongoing decoupling of certain altcoins from BTC.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.