Solana Is Oversold, Price Recovery From $170 May Face Challenge

Solana struggles to recover from $173 amid bearish sentiment. Can it break $183 to reach $201, or will further declines follow?

- Solana’s price has dropped to $173, facing bearish sentiment and struggling to recover after falling from its ATH of $295.

- The RSI entered the oversold zone, indicating potential for a recovery, but Solana has struggled to show sharp rebounds, hindering its comeback.

- Solana faces resistance at $183; failure to breach this level could push it toward $161, while breaking $183 could signal a rally toward $201.

Solana’s price has faced significant challenges in recent months. After reaching its all-time high (ATH) of $295 in mid-January, the altcoin has seen a steady downtrend, now trading around $173.

Despite efforts to bounce back, Solana’s recovery appears difficult due to a combination of market sentiment and investor skepticism.

Solana Is Facing Bearishness On Multiple Fronts

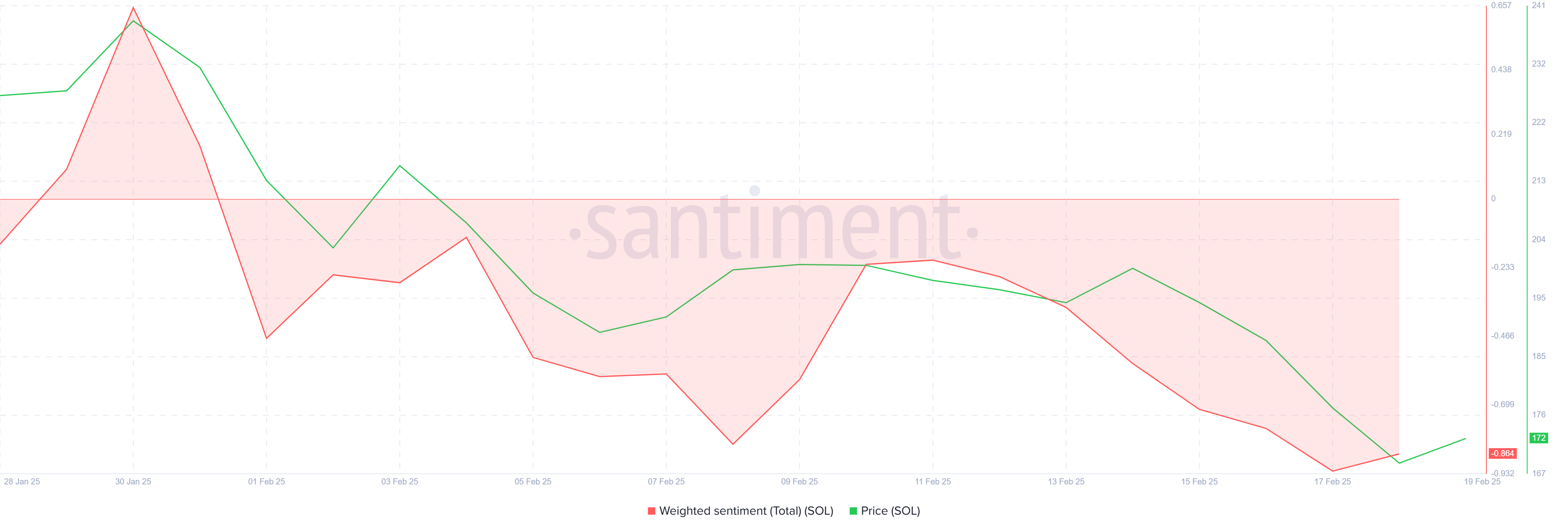

The weighted sentiment surrounding Solana has taken a bearish turn, with many holders expressing a lack of confidence in the token’s recovery. Investor sentiment plays a crucial role in the success of any cryptocurrency, and the prevailing skepticism among Solana holders could prevent further positive momentum. As a result, many investors are holding off on participating in the network, stalling any potential price growth.

This shift in sentiment has a direct impact on Solana’s price movement. If holders remain bearish, it may result in decreased trading activity, further discouraging potential buyers and hampering recovery. With Solana’s price continuing to fluctuate around $170, a major shift in sentiment will be necessary for the altcoin to regain any substantial traction in the market.

In terms of macro momentum, technical indicators such as the Relative Strength Index (RSI) show mixed signals. Recently, the RSI for Solana fell into the oversold zone below 30, a common trigger for reversals in price action.

However, while this typically indicates a potential for recovery, Solana has struggled to exhibit the sharp rebounds typically seen after such dips. This sluggish recovery suggests that the altcoin may face difficulties in making a strong comeback, especially when weighed down by broader market conditions.

SOL Price Faces Resistance

Solana’s price is currently at $173, facing resistance at the $183 level. Given the current bearish sentiment, Solana might struggle to break this resistance and continue its rally. If it fails to breach $183, the altcoin could experience further downward pressure, with the next critical support level at $161.

Failure to hold the $161 support could result in an even steeper decline, bringing Solana’s price closer to the downtrend line and potentially triggering additional losses. Losing this key support could signal prolonged bearish sentiment, extending the losses for SOL holders.

However, should Solana successfully breach $183, it could reclaim upward momentum and push towards $201. This breakout would invalidate the current bearish thesis and help recover some of the recent losses. The ability to secure $183 as support will be pivotal in determining whether Solana can reverse its current downtrend.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.