PPI and CPI have "deviated" from the future of U.S. inflation.?

The divergence of future core CPI and overall CPI in the United States seems to be recognized by more and more institutions.。

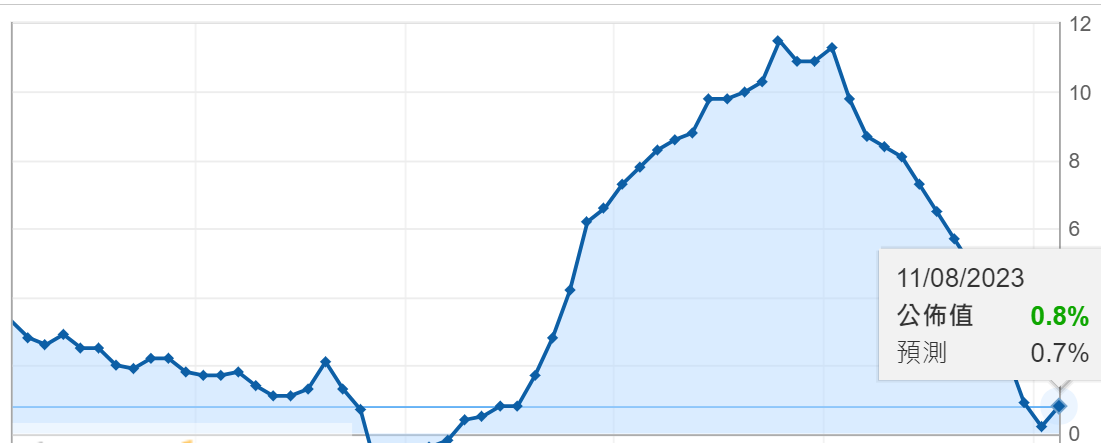

On August 11, local time (last Friday), the United States released the producer price index (PPI) for July.。US July PPI up 0 on year.8%, up 0.3%, both higher than economists had previously predicted。In addition, after excluding food and energy prices, which are more volatile due to seasonal influences, the closely watched core PPI rose by 2% month-on-month and year-on-year, respectively..4% and 0.3%, also exceeded expectations。

PPI data beats expectations after US core CPI hits two-year low

By item, final demand service prices increased by 0.5%, the biggest gain since August 2022。Among them, portfolio management prices rose 7.6%, contribution to PPI up to 40%。Portfolio management prices reflect the price of financial services, such as fund management fees, which are closely related to capital markets, and have been supported by the rise in U.S. stocks since the beginning of the year.。

At a time when the Fed is particularly sensitive to inflation data, such a report clearly doesn't reassure policymakers。After the resumption of interest rate hikes in July, the market is still expecting the Fed to suspend the process in September。However, some Fed officials have been quite tough on monetary policy, including the bank's chairman, Jerome Powell, who has publicly told the media that he will "do whatever it takes to bring inflation down to 2 percent."。

Currently, according to the latest data released on August 10, affected by the rebound in energy prices, the U.S. CPI rebounded slightly in July, with a year-on-year growth rate of 3.2%, 0 more than last month.2 percentage points, but still below market expectations。In addition, the year-on-year growth rate of core CPI in July was up from 4.8% down to 4.7%, a new low since October 2021, which is considered a positive sign。

Logically, the price transmission of the producer ex-factory price index precedes the consumer price index, and under supply-led high inflation, the PPI has a directional effect on the CPI。

However, there are also many statistical differences between PPI and CPI: on the one hand, there are differences in statistical caliber between the two, the most important of which is that the most heavily weighted item in CPI, the owner's equivalent rent, is not within the scope of PPI statistics;。

U.S. core CPI and overall CPI are expected to diverge.

Previously, according to China Merchants Macro forecasts, the subsequent trend of the U.S. core CPI and overall CPI may diverge due to slowing housing inflation and upward energy inflation。Under such circumstances, the U.S. core CPI may move down rapidly, to near 2 percent by the end of this year and early next year.。

This is a fairly optimistic number because the Fed's statutory objectives are twofold: expanding employment and stabilizing prices, and in stabilizing prices, the Fed's inflation target is the 2 percent level.。

The reason given by China Merchants is that due to the forward-looking index of the most heavily weighted housing services in core inflation, the year-on-year growth rate of the U.S. Zillow Rent Index, which began to decline significantly from February this year, housing services are expected to decline rapidly in the third and fourth quarters of this year, driving the U.S. core CPI to cool down.。In addition, according to the latest research from the Dallas Fed, CPI rents in the U.S. will increase from the current 7.7% high, falling back to 5 in the first quarter of next year.The 7% level。

In addition, from the point of view of energy prices, due to high energy prices in the first half of last year, the resulting base effect made energy prices in the first half of this year fell more year-on-year.。However, according to China Merchants, the base effect of energy prices is expected to weaken in the second half of this year, overlaid with a rebound in their prices, theoretically there is a risk that energy inflation will rebound upward on a month-on-month basis.。

In the U.S. CPI basket, the weight of energy prices is 6.9%, the growth of this sub-item will contribute to the growth of the overall CPI。

The divergence of future core CPI and overall CPI in the United States seems to be recognized by more and more institutions.。Today, CICC also said in its report that its judgment on U.S. inflation in the second half of the year was "core CPI slowdown + total CPI bottoming out."。CICC said, with the base effect receded, energy prices stabilized, the United States PPI and CPI inflation are likely to experience a "tail" rise in the fourth quarter of the process。

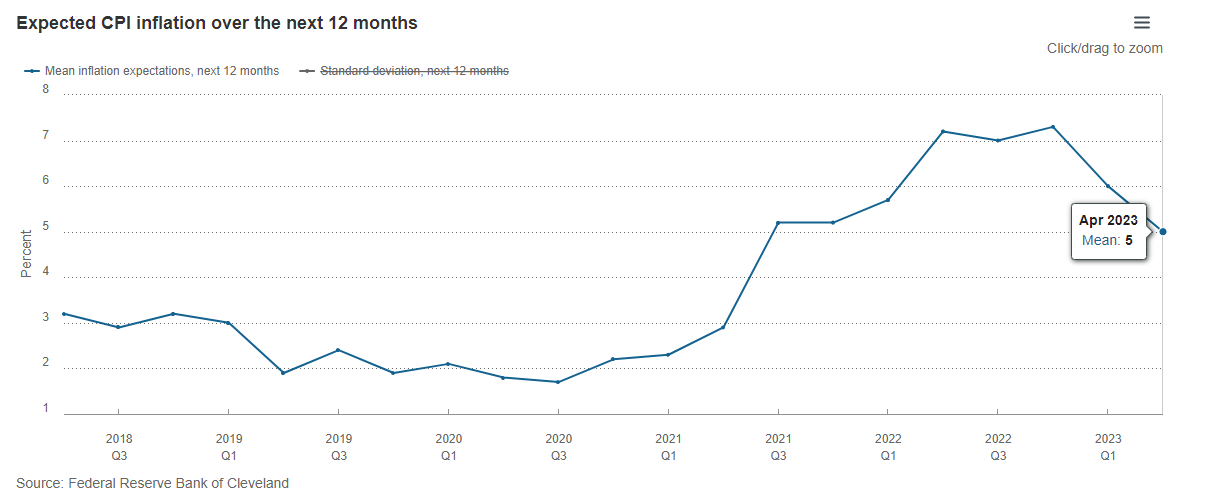

According to a Cleveland Fed survey, U.S. entrepreneurs' inflation expectations for the next 12 months have risen from a high of 7.3% down to 5%, but still higher than the pre-epidemic 2%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.