Given that the Fed will not fight market interest rates, it is likely that the Fed will still maintain its planned four interest rate cuts next year.

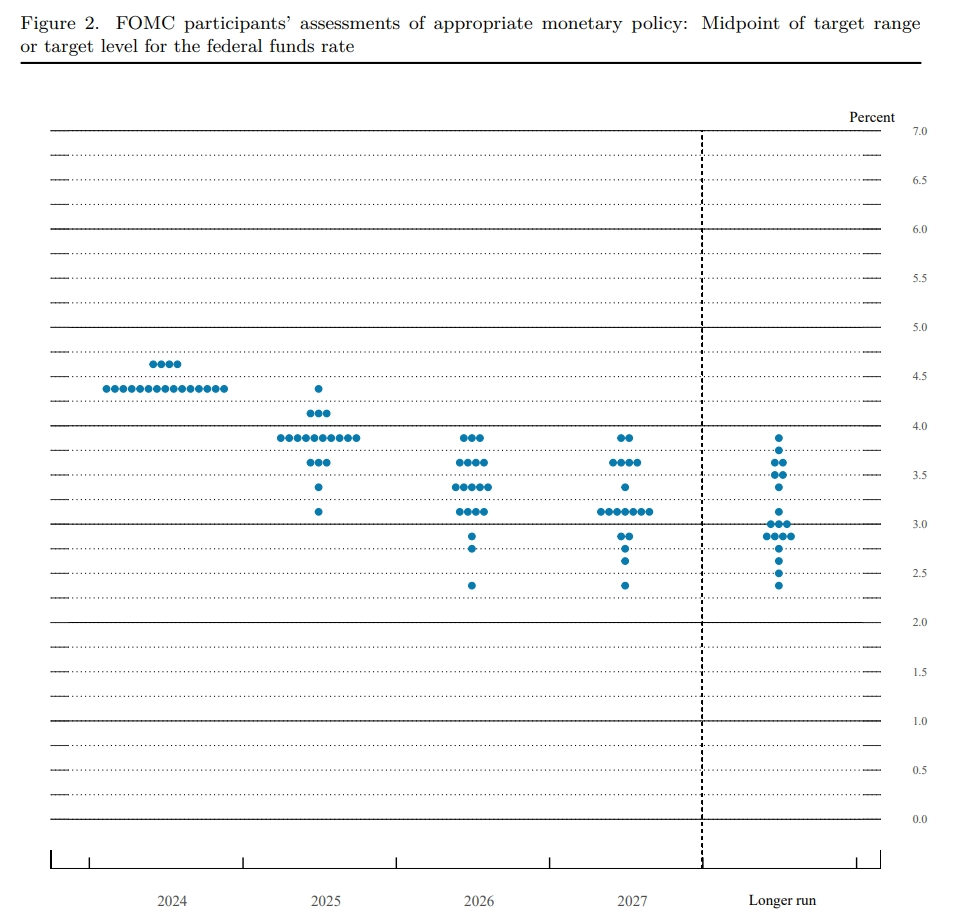

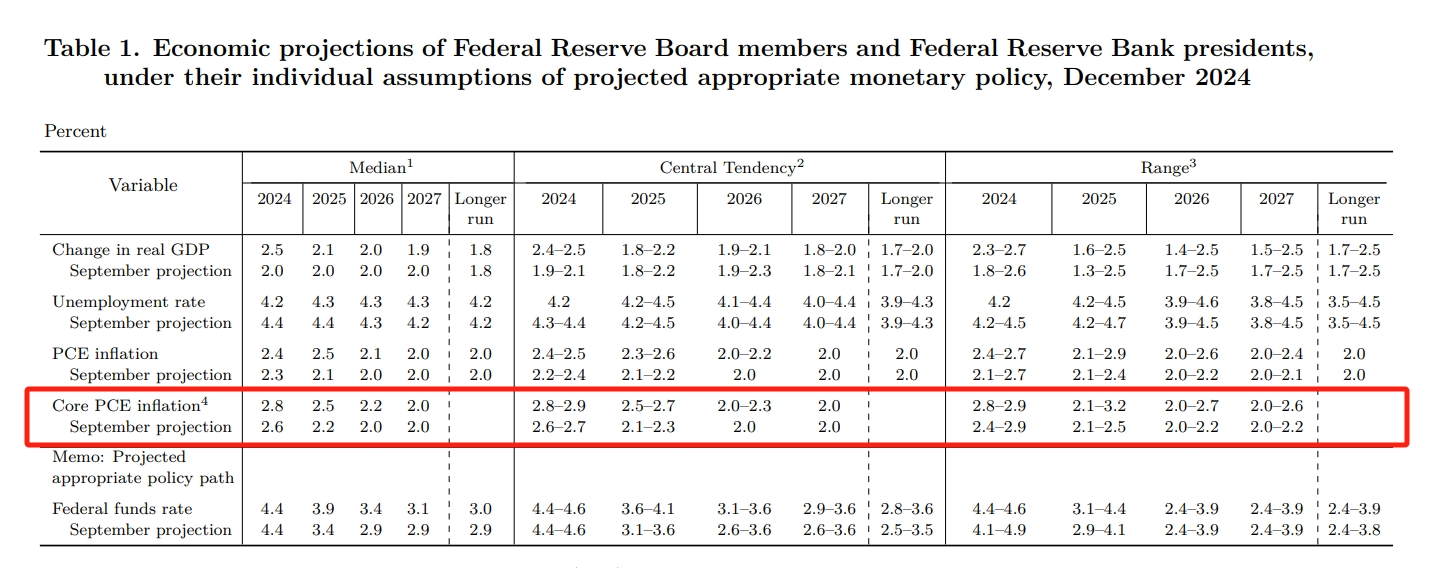

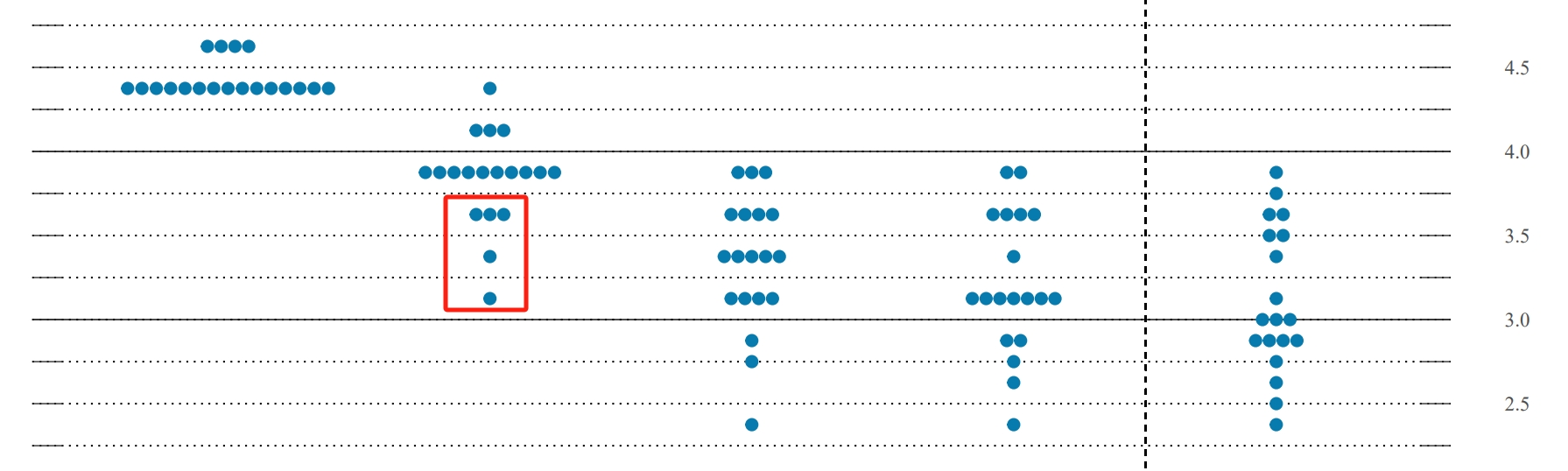

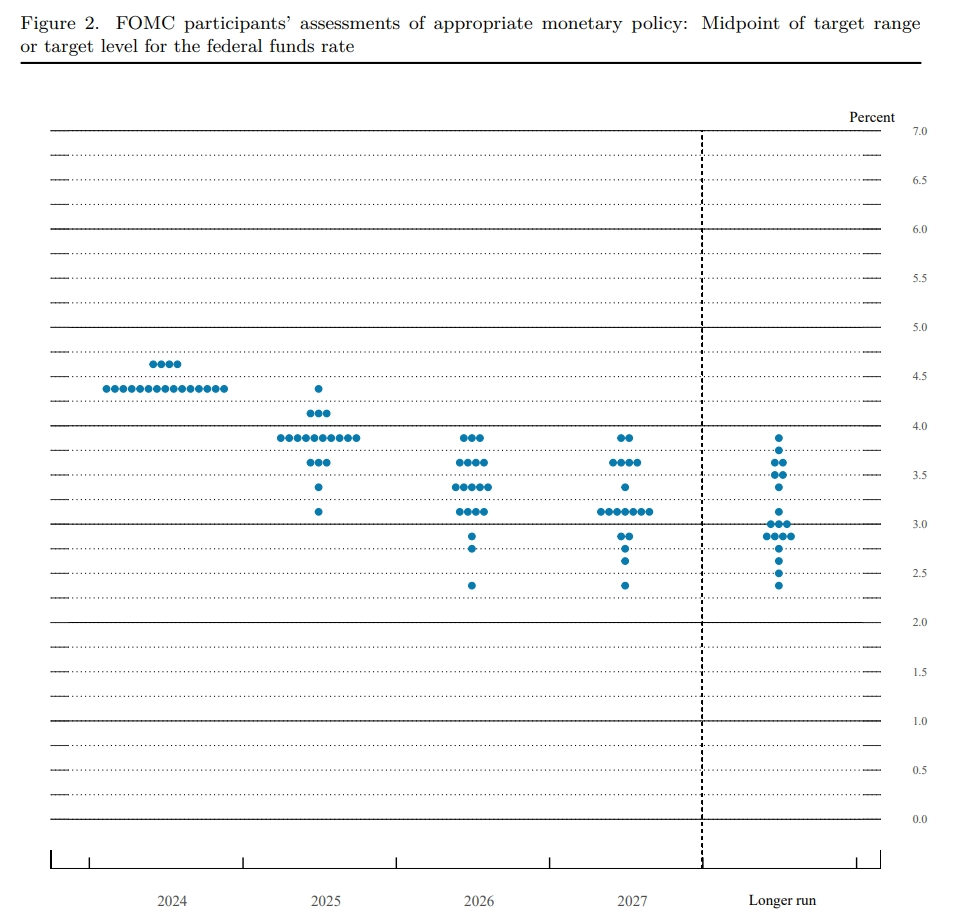

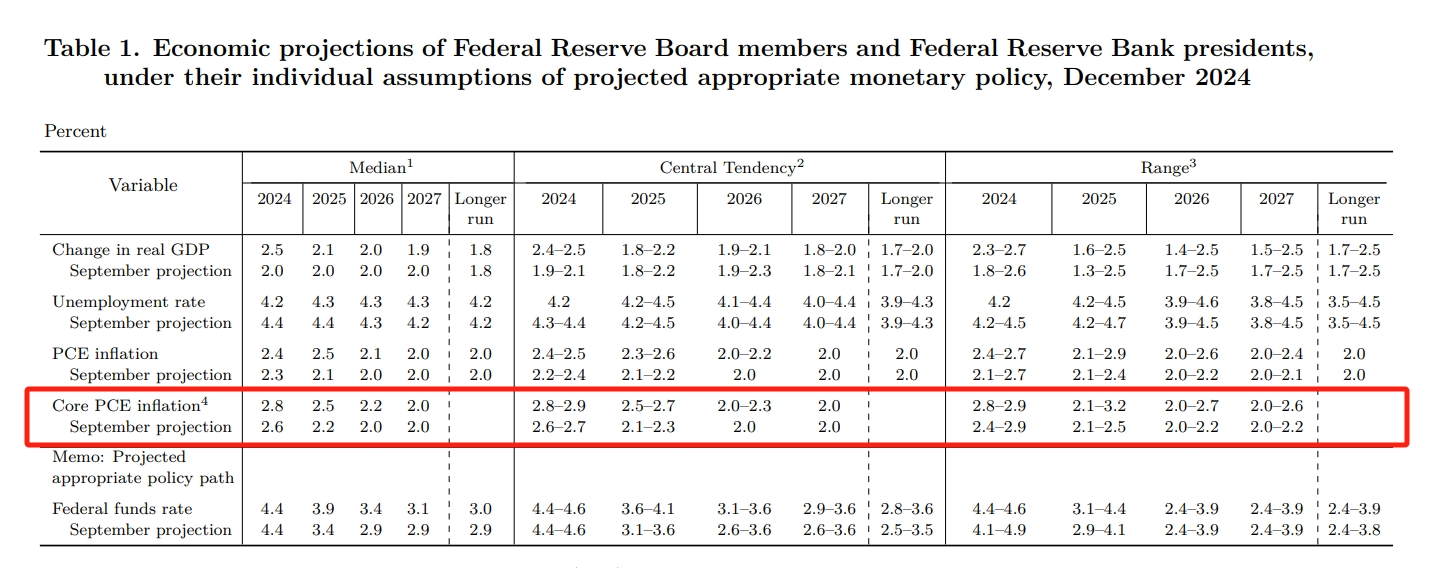

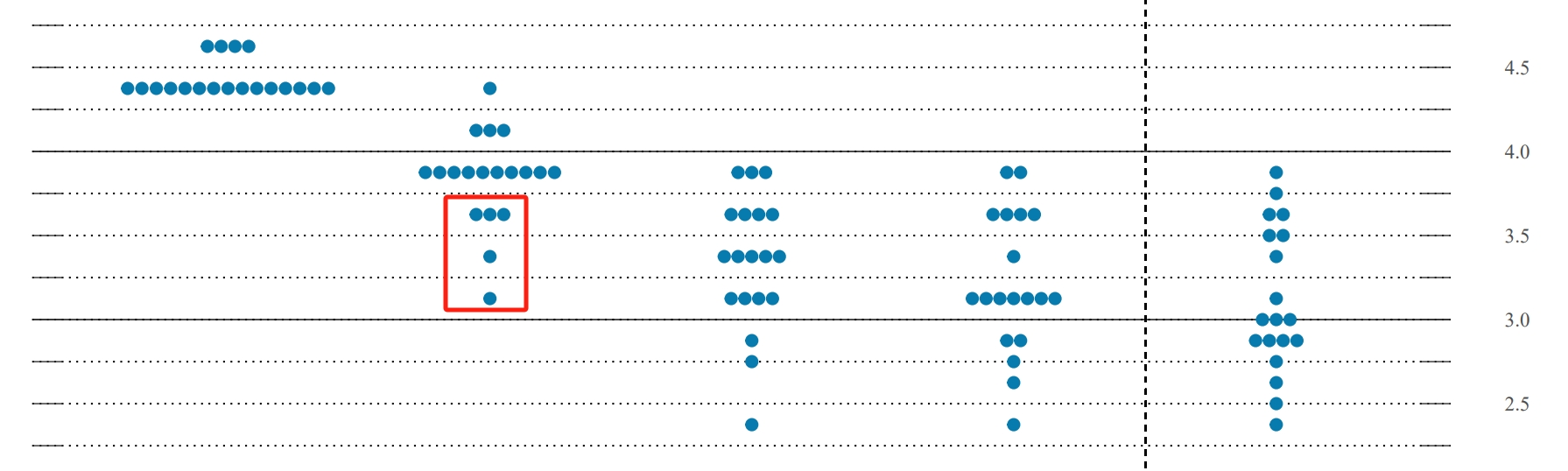

Recently, the Federal Reserve released a dot-matrix chart of the economy for December. Most voting committees predict that the Federal Reserve will only cut interest rates twice next year, rather than the four times previously predicted by the market.Affected by the news, U.S. stocks fell sharply overnight, and the Nasdaq index fell 3%.

But as the stock market recovered, a different voice appeared on Wall Street again.Louis Navellier, founder and chief investment officer of Navellier & Associates, which manages more than $1 billion, firmly believes that the Federal Reserve will have to cut interest rates four times next year as global interest rates collapse.

Specifically, the European Central Bank will cut key interest rates four to five times in 2025 until rates fall to 2% to 1.75%.The crisis in Germany and France is intensifying, increasing the risk of economic downturn.In South America, Brazil has been actively working to support its currency, the real, but Brazil's budget deficit is as high as 10%, and its local currency's credibility has been tested.Analysts say Brazil seems to be following Argentina's example and may soon have to devalue its currency.

Different from the past, the driving force for this round of interest rate cuts comes from non-American countries. The decline in global interest rates will trigger capital inflows into U.S. bonds, which in turn will lead to a decline in U.S. bond yields.Navil predicts that given that the Fed will not fight market interest rates, the Fed will likely maintain its planned four interest rate cuts next year.

Generally speaking, interest rate cuts will make it easier for companies to borrow, household consumption more prosperous, the market economy more active, and the stock market will also be boosted.

Investing in the medium term usually has the following characteristics:

1. Focus on capital stability: Platforms are needed to ensure the safety of investment principal.

2. Stable returns: In the medium term, investors tend to choose assets with less volatility to diversify investment risks.

3. Transparency: Platform compliance and operational transparency are particularly important.

In this regard, Wealth Broker's multi-asset management functions and global layout provide reliable security for medium-term investors.

Wealth Broker platform compliance and security

Global compliance system Wealth Broker has established a complete global compliance framework with the dual regulatory qualifications of Australia ASIC and New Zealand FSPR.The platform strictly complies with the financial regulatory requirements of various countries to ensure the safety of user assets.

Risk Management Mechanism Wealth Broker has established a strong risk management system through cooperation with well-known asset management institutions such as Morgan Stanley and Fosun Fortune.The platform's products have been strictly reviewed to ensure that they meet the stable needs of medium-term investors.

Transparent fee structure Wealth Broker provides clear and transparent fee descriptions, allowing users to understand transaction and management costs in advance and avoid hidden charges.

Wealth Broker's medium-term investment highlights

Multi-asset selection: Medium-term investors can invest in low-volatility products such as stocks, bonds, and funds through Wealth Broker, or they can choose hybrid funds with steady growth for asset allocation.

AI consulting services: Wealth Broker's AI consulting function provides scientific asset allocation suggestions based on medium-term investors 'risk appetite and investment goals to help users maximize profits.

Market analysis tools: The platform provides users with detailed market analysis reports and medium-term investment suggestions to help investors better understand market dynamics and formulate suitable investment strategies.