The news of Xiaohongshu's IPO is becoming more and more true.

In February 2025, Xiaohongshu rented a 7000-square-foot office space in Times Square, Causeway Bay, Hong Kong for HK$280,000 per month, living next to Internet giants such as Alibaba and ByteDance.

The significance of Times Square in Causeway Bay to the capital market is self-evident-Causeway Bay is the core financial and commercial area of Hong Kong. Its landmark attributes and capital aggregation effect provide a dual springboard for Little Red Book to connect mainland and overseas markets.

In January this year, Bloomberg reported that Xiaohongshu's major shareholders were negotiating to reduce their shares, and existing shareholders such as Tencent, Sequoia China, and Hillhouse were interested in taking over.

The report mentioned that Xiaohongshu is valued at at least US$20 billion (over 145 billion yuan).As Xiao Hongshu's big move is made in Hong Kong, it is more likely that the company will form a local team in Hong Kong in advance to improve the compliance structure and facilitate future IPOs.

Let's first briefly introduce Xiaohongshu.Then pull the moat for everyone to understand.

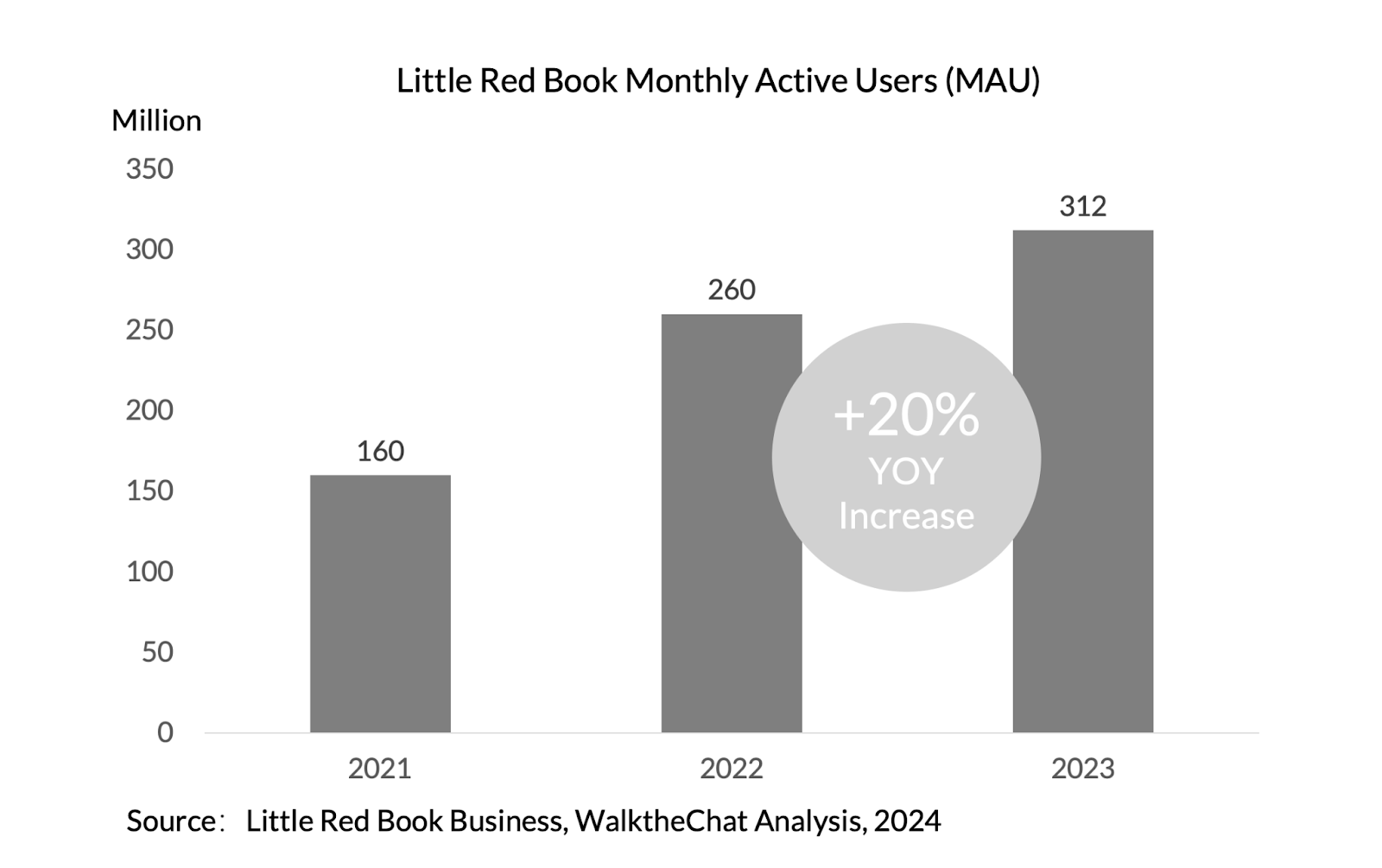

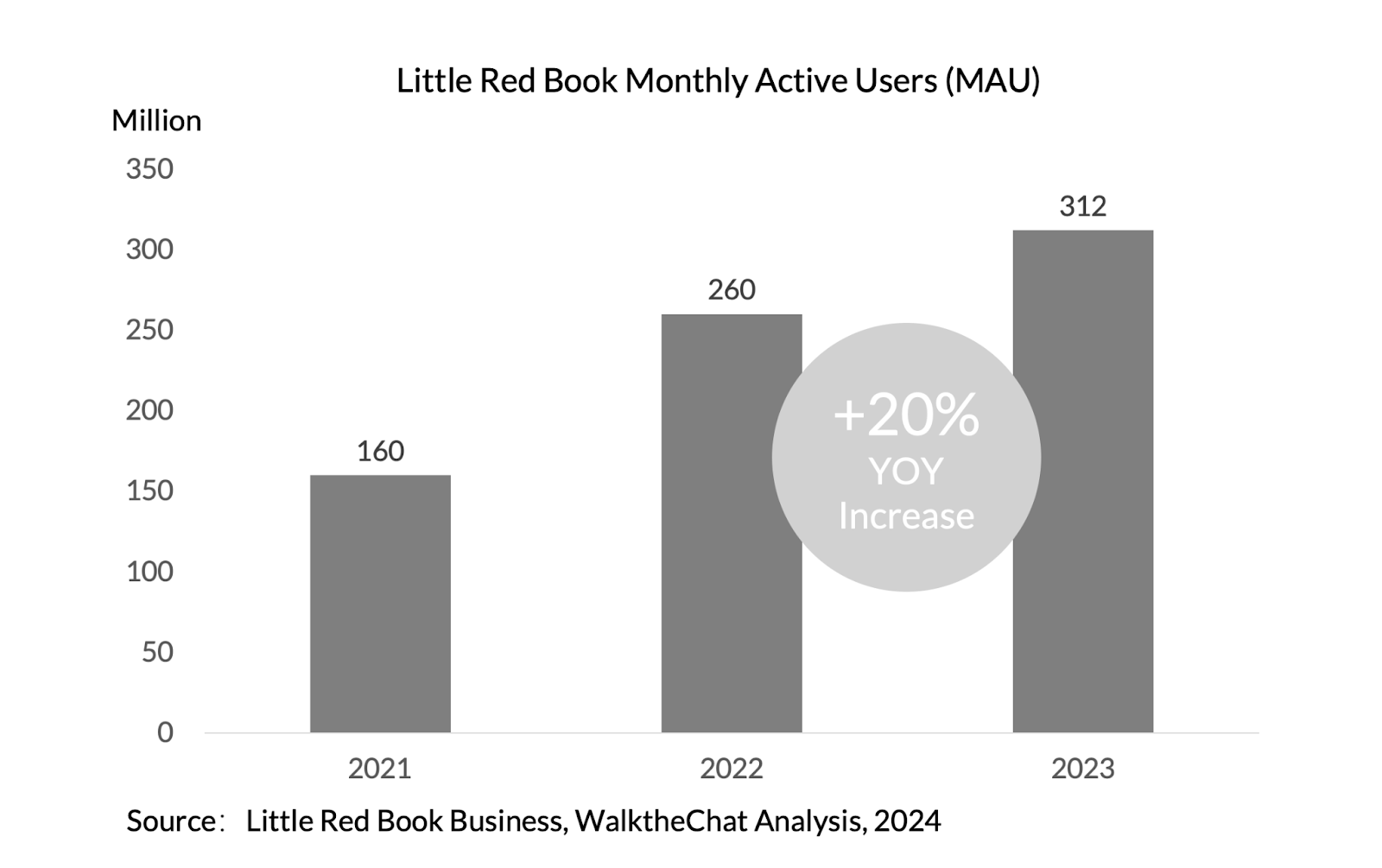

Born in 2013, Xiaohongshu originally started as a PDF manual of overseas shopping strategies, but has now evolved into a "lifestyle super community" with a monthly life of more than 312 million yuan.

The average daily production of notes by platform users exceeds 30 million, and the content covers more than 300 sub-areas such as beauty, travel, and home furnishing. Among them, users born in the 1990s account for 70%, forming a "grass planting economy" with young women as the core. ecology.

What is particularly noteworthy is that its average daily search volume has exceeded 600 million in the fourth quarter of 2024, surpassing WeChat search and approaching half of Baidu's search volume, becoming the third largest search portal on the Chinese Internet.

How terrifying is Xiaohongshu's ability to attract money?

In addition to the Douyin and Fast Hand led Short Video track and the solid shelf e-commerce of Taobao and Jingdong, Xiaohongshu has opened up a third path with the "community + search" model.

Data shows that 88% of search behaviors on the platform are initiated by users, 42% of new users use search functions on the first day, and 70% of monthly users rely on search to complete consumption decisions.This high-intent traffic makes its advertising click-through rate 30% higher than the industry average, and advertising revenue will contribute more than 80% of revenue in 2023.

According to statistics from QuestMobile, the average monthly usage time of Xiaohongbook users is 21.22 hours, surpassing Station B and ranking at the forefront of the content platform, confirming the dual stickiness of "deep planting of grass" and "instant conversion".

This "search is consumer decision-making" feature allows Xiaohongshu to build a unique moat in the collaboration between advertising and e-commerce.

Let's take a look at Xiao Hongshu's financial situation.

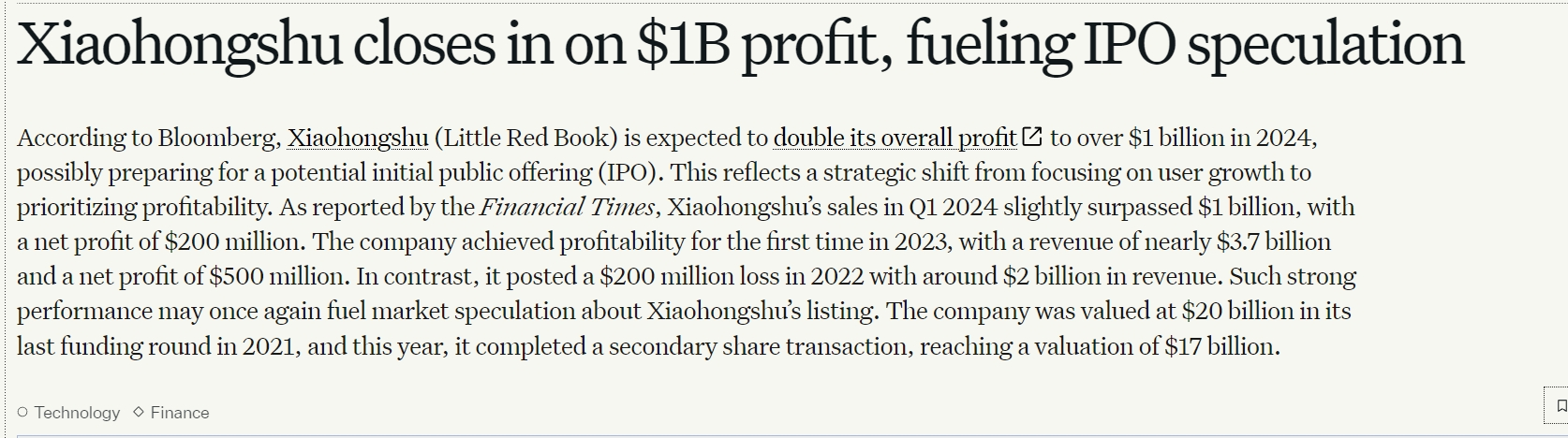

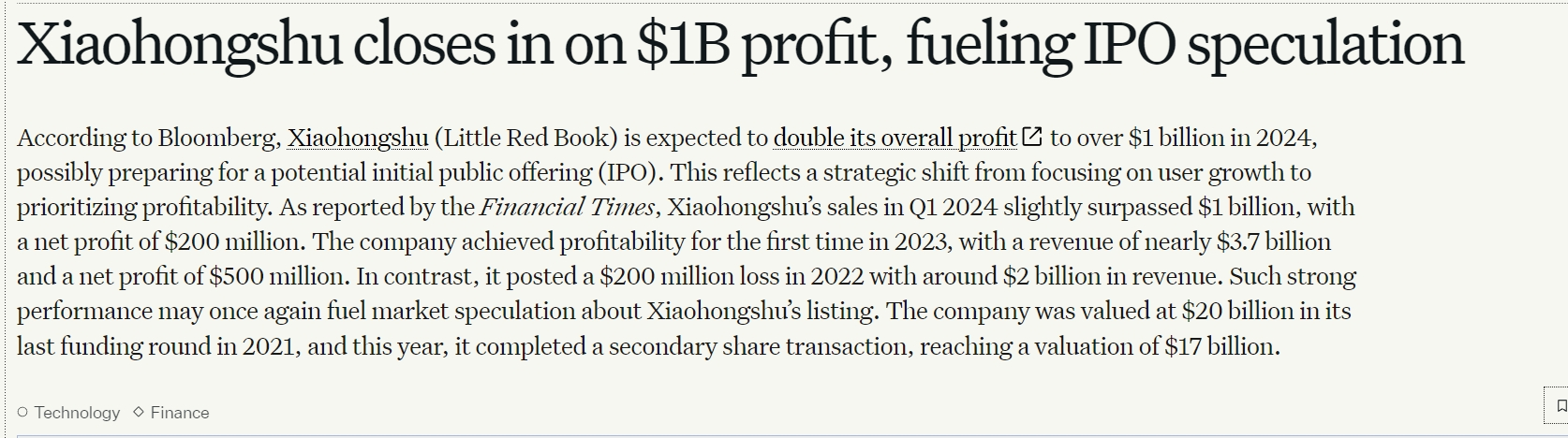

Judging from the path of the IPO, Xiaohongshu's financial explosion will occur in 2023.

That year, Xiaohongshu surged 85% year-on-year to US$3.7 billion, and its net profit reversed from a loss of US$200 million in 2022 to a profit of US$500 million, achieving full-year profit for the first time.What has helped turn losses into profits is the dual driving force of the increase in advertising unit prices and the monetization rate of e-commerce-the number of platform brand advertisers has increased by 40%, and the proportion of e-commerce commission revenue has climbed from 12% in 2022 to 23%.

By the first quarter of 2024, its single-quarter revenue has exceeded US$1 billion, and its net profit has reached US$200 million, and its profitability continues to strengthen.It is worth noting that Xiaohongshu has positioned 2024 as the "Year of Efficiency", reorganized the algorithm department and launched the "AIPS Crowd Asset Model", trying to further reduce marketing losses through data closed-loop.

As an Internet company founded in 2013, Xiaohongshu has experienced at least 7 rounds of financing. Although Xiaohongshu did not respond to this rumor, listing in Hong Kong has always been Xiaohongshu's goal.

Since the introduction of former Citi executive Yang Ruo as CFO in 2021, rumors of Xiaohongshu's listing have periodically disrupted the market.

In July 2024, its E+ round financing valuation reached US$17 billion, while the valuation was pushed up to US$20 billion during shareholder reduction negotiations in early 2025, a surge of nearly 70% from three years ago.The continued increase in investment institutions DST Global, Sequoia China, Hillhouse Capital, etc., as well as the ecological synergy between Alibaba and Tencent, have provided endorsement for its valuation.

Prior to this, Xiao Hongshu's recruitment information in Hong Kong had already flowed out, including customer development, marketing management, channel management and other positions.It is worth mentioning that Xiaohongshu not only opens up global business development positions, but also prefers cross-border business MT in local campus recruitment in 2025.

It was not until this time that Xiao Hongshu settled in Hong Kong that everyone suddenly realized that Xiao Hongshu, who had been honing her sword for ten years, might really be getting closer and closer to the IPO.

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.

Exclusive discount link to open an account: p.wealthbr.com/0qBSODM? lan=zh