In the Ningde era, we can prepare for the new era.

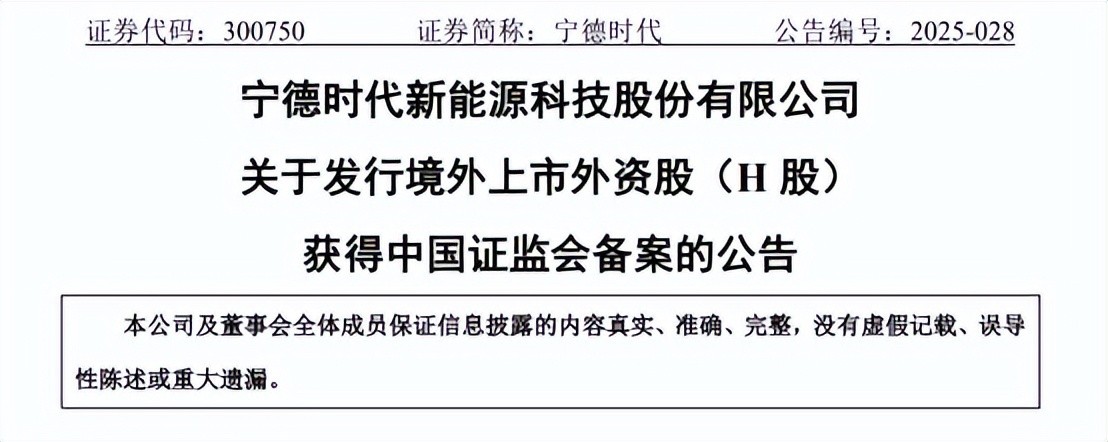

Late at night on March 25, big news came.According to the announcement issued by Ning Wang, the company has officially obtained the "Notice for Filing Overseas Issuance and Listing" issued by the China Securities Regulatory Commission, and plans to issue no more than 220 million H shares and list them on the main board of the Hong Kong Stock Exchange.This filing took only 25 days from acceptance to approval, setting one of the fastest records for overseas issuance filings by Chinese companies in recent years.

The speed with which the CSRC issued the letter this time highlights the support of China's capital market for the new energy industry.Since the 2024 Central Economic Work Conference proposed "promoting high-quality development of the entire new energy industry chain", the China Securities Regulatory Commission has clearly stated its support for qualified enterprises to optimize their capital structure through overseas listings.This time, the efficiency of the supervisory level is indeed strong.

Now the pressure is on Ningde, because the China Securities Regulatory Commission has clearly required that the Ningde era complete the issuance within 12 months, otherwise the materials need to be updated, which is to highlight the word "fast".Therefore, in the Ningde era, all students can really prepare for the challenge.

company profile

Ning Wang is not allowed to introduce too much-it has been the world's largest leading company in installed power batteries for eight consecutive years (market share in 2024 is 37.9%). Therefore, Ning Wang's listing in Hong Kong stocks is not only in line with the national strategic orientation, but also benefits from the optimization of the regulatory approval process.

financial position

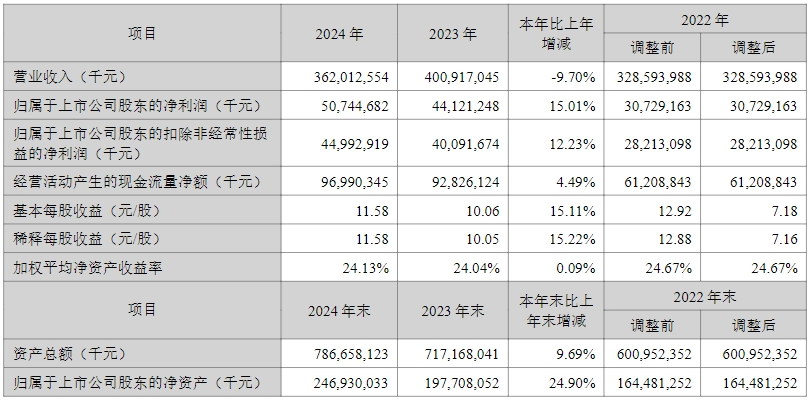

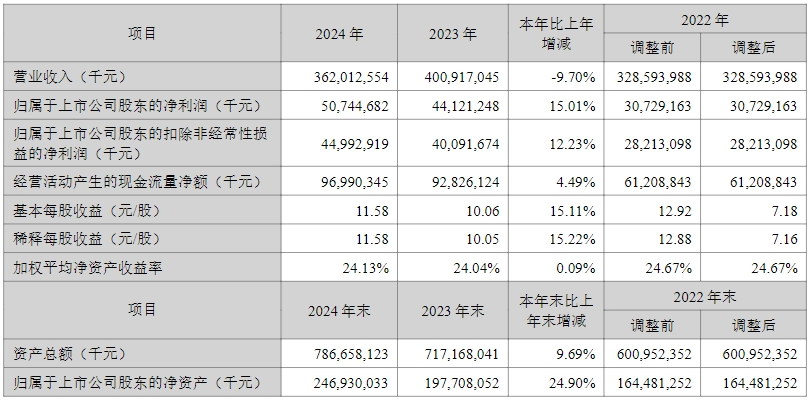

According to the latest 2024 annual report, the company's operating income fell 9.7% year-on-year to 362 billion yuan, but net profit attributable to the parent increased by 15% to 50.7 billion yuan against the trend.

This scissors difference of "volume reduction and profit increase" is due not only to the cost-side improvement brought by the downward trend in lithium carbonate prices, but also to the volume of high-margin sectors such as the energy storage business (market share of 36.5% in 2024).However, the decline in revenue has also exposed the pressure of periodic overcapacity in the power battery industry. According to statistics from SNE Research, the global power battery capacity utilization rate has dropped to 65% in 2024, and leading companies have begun to shift from scale expansion to technology premium competition.

Therefore, some people say that the Ningde era chose to list in Hong Kong stocks at this time, which can not only use the international capital market to replenish ammunition, but also optimize the shareholder structure by introducing overseas strategic investors to reserve food and fodder for the research and development of the next generation of solid-state batteries and sodium-ion batteries.

It seems reasonable.

Purpose of raising-start talking about the three stages of Ningde's "great voyage"

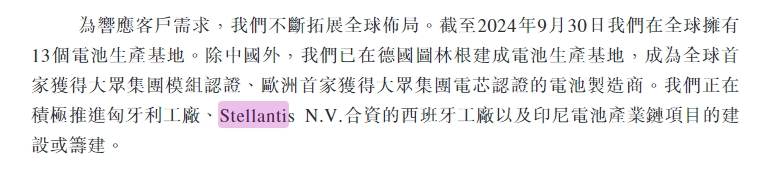

According to the prospectus, the funds raised will be mainly used for the Hungarian factory, the Spanish factory jointly invested with Stellantis, and the construction of Indonesian battery industry chain projects-in fact, anchoring the "sailing strategy."

Ningde's "Great Navigation" era can be mainly divided into two stages.

The first stage, 2017-2023: This stage is mainly from product export to product localization.In the initial stage, it mainly exported power batteries, entered the European market through technological advantages, and successfully tied to traditional car companies such as BMW, Volkswagen, and Daimler.The key breakthrough at this stage is to break through the market monopoly of Japanese and Korean companies, such as becoming BMW's core supplier in 2018, and gradually increase the battery supply share of European car companies from less than 10% to 27.5% in 2023.

Later, with the tightening of the EU carbon tariff policy, Ningde Times launched localized production in Europe in 2021, building the first overseas factory (14GWh) in Thuringia, Germany, and then invested US$7.34 billion in Debrecen, Hungary to build a super factory (100GWh) to build a "4-hour supply chain circle".

The second stage, after 2024: This stage is mainly about innovation in technical licensing and joint venture model-in order to circumvent the restrictions imposed by the U.S. Inflation Reduction Act (IRA) on "physical list" companies, Ningde Times launched RS (License & Royalty Service) technology licensing model, which provides patent licensing and technical support to Ford, Tesla, General Motors and other car companies, and charges service fees.For example, using this model in cooperation with Ford to build the Michigan plant (35GWh), Ningde Times can obtain a technology premium without direct investment.

This model is also called "technological poverty alleviation" by domestic netizens.The advantage of technological poverty alleviation lies in that it deepens the binding of international automobile companies through the "big joint venture" strategy and achieves dual export of "technology + capital", which effectively reduces geopolitical risks and rapidly expands overseas market share.

If Ningde Times is successfully listed on the Hong Kong Stock Exchange this time, the company's great voyage era will enter a new three stage-capital internationalization and Hong Kong stock listing.Because the listing of Hong Kong stocks can not only provide Ningde with low-cost financing channels, but also build a global shareholder network by introducing cornerstone investors such as Middle Eastern sovereign funds and European pension funds.

If Ningde Times is successfully listed on the Hong Kong Stock Exchange this time, the company's great voyage era will enter a new three stage-capital internationalization and Hong Kong stock listing.Because the listing of Hong Kong stocks can not only provide Ningde with low-cost financing channels, but also build a global shareholder network by introducing cornerstone investors such as Middle Eastern sovereign funds and European pension funds.

Data shows that as of September 2024, Ningde's US dollar and euro reserves were only US$10.593 billion, making it difficult to support tens of billions of euros of overseas investment plans.

Develop new strategies and valuations

For investors with different capital sizes, strategic choices need to be tailored.

For small amounts of funds below HK$10,000, it is recommended to participate through Internet brokers (such as Wealth Broker) that support "one-hand financing", use 10 times leverage to cover the entry threshold, and gain the opportunity to win the lottery at the lowest cost;

2-5 For medium-sized funds of HK$10,000, the "A-tail strategy" can be adopted to avoid the high interest consumption of Group B and strive for a higher winning rate;

6-10 For large amounts of funds of more than 10,000 Hong Kong dollars, the optimal solution is to finance in Group B through separate accounts, and improve fund efficiency through decentralized subscription in multiple accounts. If the operation is divided into 3 households based on a principal of 100,000, and combined with the financing leverage of securities firms, at least 3 B units can be covered. The probability of winning the bid will increase exponentially.

Of particular concern is that the current Hong Kong dollar interbank offered rate (HIBOR) is at a low level, and the financing cost is about 3%-4%, which is significantly lower than the historical average.

From a valuation perspective, the dynamic P/E ratio of Ningde A-shares is only 22 times, which is significantly lower than the industry average, and the discount on H-share issuance will open a margin of safety.

On the technical side, the company's solid-state battery pilot line has been implemented, and CTC 2.0 technology is about to be mass-produced. These innovative breakthroughs are expected to form a valuation catalyst after listing.

Risk Warning

Fluctuations in global lithium prices may affect profit margins, trade barriers in Europe and the United States may delay the release of overseas production capacity, and the trend of car companies to independently develop batteries may weaken customer stickiness.It is recommended to adopt a "core + satellite" strategy, taking into account cornerstone anchored subscriptions and dark market and initial volatility arbitrage.For medium-and long-term investors, they can pay attention to the passive capital inflows brought by the inclusion of the MSCI index and the explosive potential of the energy storage business under the goal of carbon neutrality.

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.

Exclusive account opening discount link:

If Ningde Times is successfully listed on the Hong Kong Stock Exchange this time, the company's great voyage era will enter a new three stage-capital internationalization and Hong Kong stock listing.Because the listing of Hong Kong stocks can not only provide Ningde with low-cost financing channels, but also build a global shareholder network by introducing cornerstone investors such as Middle Eastern sovereign funds and European pension funds.

If Ningde Times is successfully listed on the Hong Kong Stock Exchange this time, the company's great voyage era will enter a new three stage-capital internationalization and Hong Kong stock listing.Because the listing of Hong Kong stocks can not only provide Ningde with low-cost financing channels, but also build a global shareholder network by introducing cornerstone investors such as Middle Eastern sovereign funds and European pension funds.