The first independent spin-off of the ByteDance system is here.

Understand the last round of financing before the launch of the listing Sequoia China led the investment

The well-known car-savvy emperor has been revealed that it will start the final round of financing before listing at a valuation of US$3 billion (approximately RMB 21.7 billion). Sequoia China will lead the investment, followed by old shareholders KKR and Transatlantic Capital, with a goal of raising US$700 million to US$800 million.

Let's first give a brief introduction to the car emperor, and then look forward to the prospects of Byte's listing.

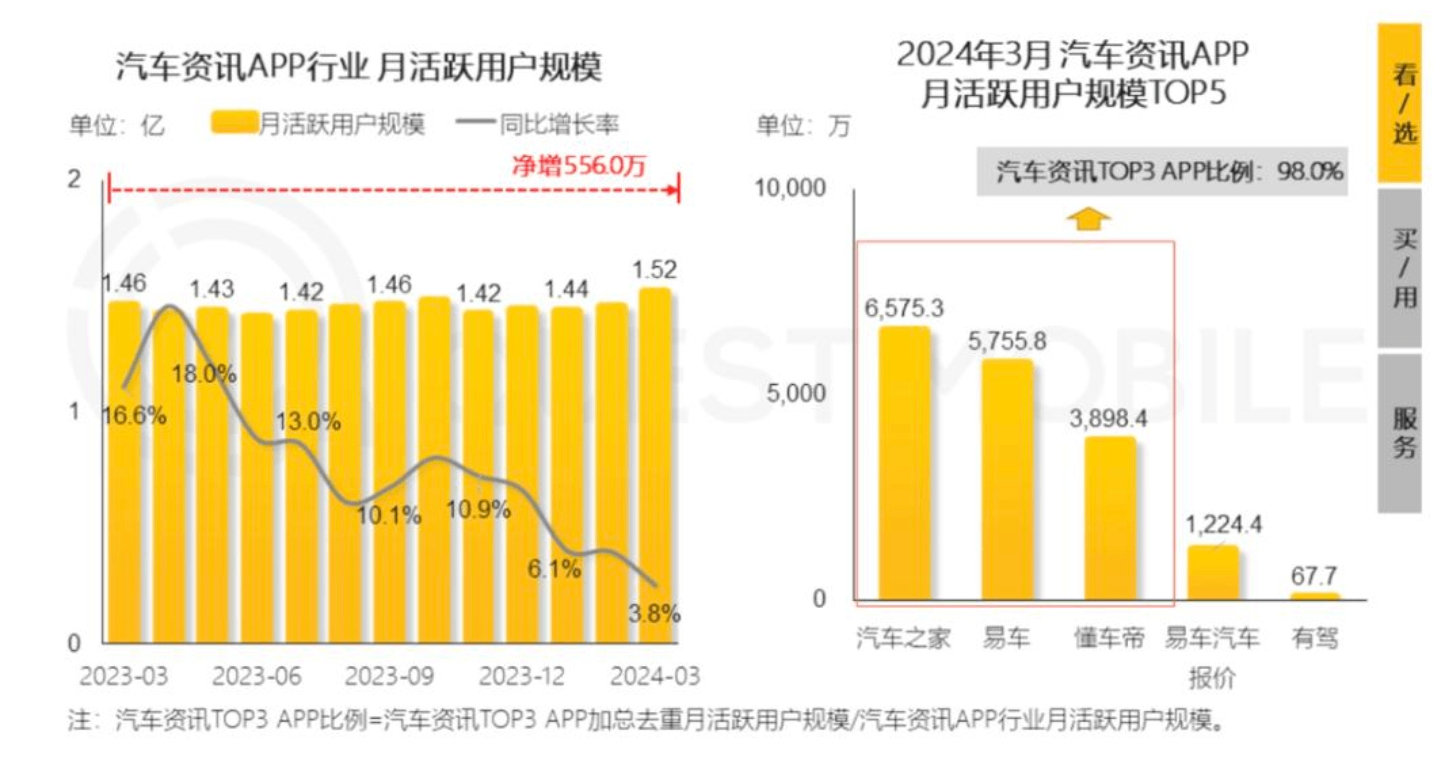

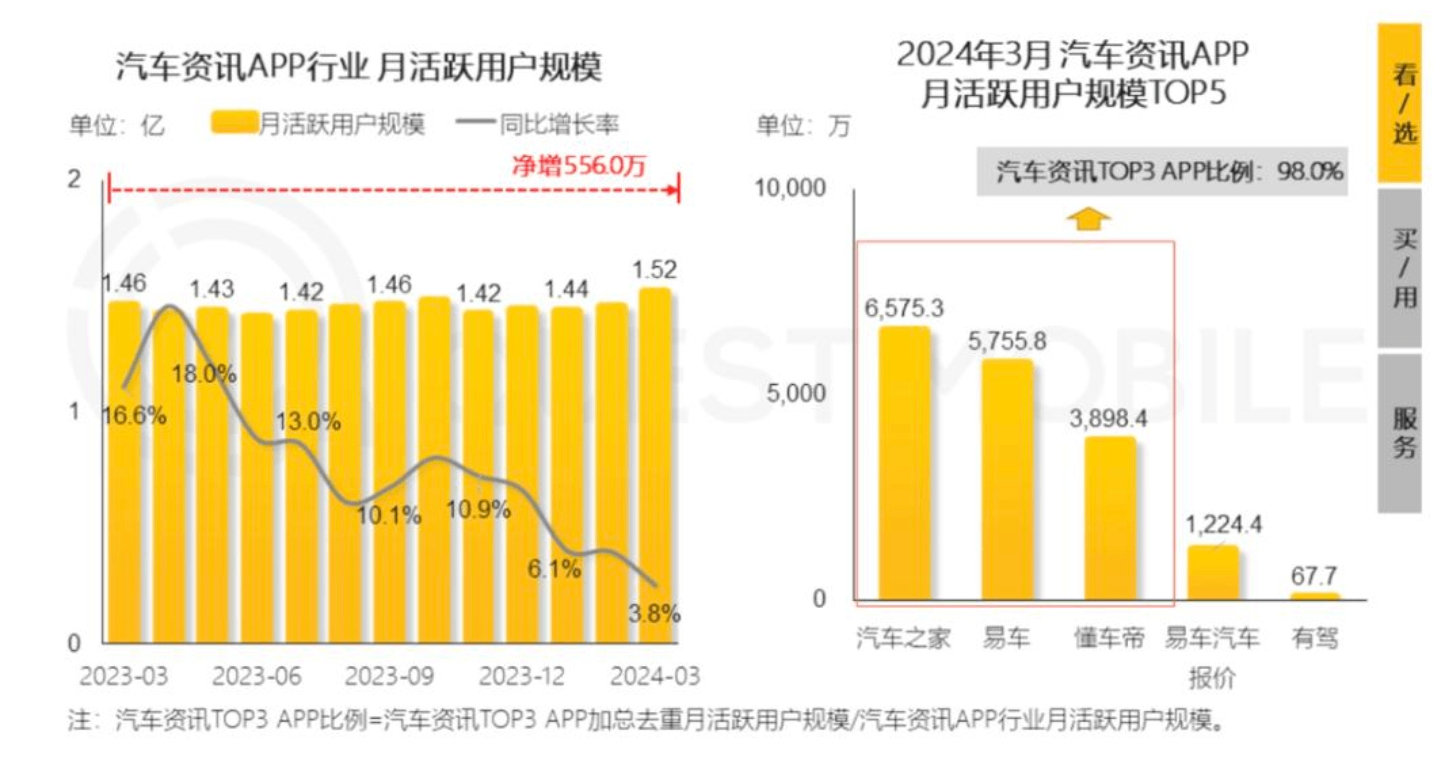

From the perspective of business fundamentals, the rise of Understanding Car Emperor can be called a typical case of byte's "traffic irrigation + content ecology" model.Relying on the super-traffic portal of Douyin, Today's Headlines, and Watermelon videos, its car content has exceeded 5.6 billion daily views, and its daily active users have reached 310 million, covering more than 6.34 million creators. It has quickly entered the first echelon in the industry and has become a direct competition with established platforms. Car Home forms direct competition.

Although the market value of Auto Home has dropped from a peak of HK$90 billion to approximately RMB 24.8 billion in the Hong Kong stock market, its 2023 revenue of 7.18 billion yuan and net profit of 1.88 billion yuan still provides a benchmark for understanding the profit prospects of Car Emperor.

However, Car-Understanding Emperor's ambitions go beyond the information platform. In recent years, his expansion into offline transactions and aftermarket services-such as the second-hand car business covering 350 cities, opening an 8000-square-meter car mall, and launching car maintenance services-attempts to build a "content-transaction-service" closed loop. Although this asset model can enhance user stickiness, it also faces fierce competition from car companies 'direct sales channels and "cat tiger and dog" car maintenance chains.

Why is byte split at this time?

Why did Byte choose to split up at this time?The author believes that there are two main reasons.

First, since 2021, the Group has continued to optimize its business structure and tilt resources towards core sectors such as Douyin and TikTok. Non-core businesses such as education and games have either been shrunk or divested.

Although understanding the car emperor is not a first-level department, its commercialization path is clear and its cash flow is relatively stable. The spin-off and listing can not only reduce the pressure on the parent's funds, but also retain the vitality of the team through equity incentives.

Second, the increase in the number of old shareholders Sequoia and KKR implies that Byte is trying to provide an exit channel for early investors through a "partial listing" approach against the background of the overall IPO being blocked. This "gift package" operation not only maintains Capital relations, but also avoids the risk of valuation discounts due to the rush to overall listing.

In a word, Byte is using it to understand the car emperor to stabilize investor confidence.

However, understanding that the road to the listing of the car emperor is not smooth-its business model still relies heavily on advertising and clue services, and homogeneous competition with the car home may lead to increased income but not increased profits; the 2023 winter test triggered collective doubts by car companies, exposing the inherent contradiction between the credibility and business neutrality of third-party evaluations.

In addition, user complaints about information leakage, price opacity and other issues, as well as the trend of OEMs building their own direct sales channels, all pose challenges to their long-term growth.

Byte launches a US$315 billion repurchase sword index listing?

Interestingly, while Byte is preparing to go public, it is also actively carrying out share repurchase.

There are three benefits to stock buybacks, all of which are closely related to listing.

First, share repurchase can reduce the company's outstanding share capital and increase financial indicators such as earnings per share (EPS), thereby improving the company's market value and image to a certain extent.This is similar to the company's goal of striving to enhance its own value and attractiveness before listing. It is both to show investors the company's good development prospects and attract more investors 'attention and participation.

Second, the repurchase behavior conveys to the market the company's management's confidence in the company's future development, believing that the company's stock is undervalued, which will help enhance the confidence of existing investors.Enhancing investor confidence is also an important goal for companies planning to go public, as it will help gain better market recognition and higher issue prices when going public.

Third, by buying back shares, companies can adjust their equity structure, prevent excessive dilution of equity, and even enhance management's control to a certain extent.This is similar to the company's reasonable planning and optimization of the equity structure before listing, which is to ensure the company's stable development in the capital market and maximize the interests of shareholders.

According to byte news, the company has recently launched a stock repurchase of US$315 billion, which is further higher than the US$300 billion in November 2024. If we understand that the car emperor can successfully go public at a valuation of 21.7 billion, it may add a new fulcrum for the group's overall valuation.

What is even more interesting is that the capital narrative of ByteDance is taking a subtle turn.In addition to understanding the car emperor, the group plans to invest more than 150 billion yuan in artificial intelligence in 2025, focusing on natural language processing and computer vision, and trying to build a second curve in fields such as generative AI and autonomous driving.

--At a time when major Internet companies are "giving AI or giving me death", all-out efforts to enter AI may be another round of capital narrative of the impact of bytes on listings.

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.

Exclusive discount link to open an account: p.wealthbr.com/0qBSODM? lan=zh