Is Little Red Book really going to be on the market?How to set a new 0 threshold?

Intelligence interpretation

According to Bloomberg, Xiaohongshu's largest shareholder is negotiating with institutions such as Sequoia Capital, Hillhouse Capital and Tencent to sell shares, with a target valuation of US$20 billion, close to the peak level in 2021.This development was interpreted by the market as a prelude to an IPO, especially after it turned a profit in 2023 (net income of US$500 million, revenue of US$3.7 billion), and improved financial data provided fundamental support for the valuation.This time, Xiao Hongshu was full of confidence.

Since its establishment in 2013, Xiaohongshu has completed 7 rounds of financing, totaling more than US$900 million. Its shareholder lineup includes top institutions such as Tencent, Alibaba, Temasek, and Sequoia China.

Its valuation trajectory is like a roller coaster-it surged to US$20 billion when Temasek led the investment in 2021. In 2023, it fell to US$14 billion due to tight liquidity in the private equity market. Recently, the transfer of old shares has rebounded to the US$17 billion-20 billion range.

Xiao Hongshu tried to go public in the United States, but turned to explore a Hong Kong IPO due to data security review.

It is rumored that in order to be more stable on the road to IPO, Xiaohongshu began to actively seek help from state-owned shareholders.Before "TikTok refugees" poured into Xiaohongshu in large numbers, which brought torrential traffic to Xiaohongshu, Xiaohongshu even negotiated to rent Times Square in Causeway Bay, Hong Kong, covering an area of about 7000 square feet (about 650 square meters), so that it could better serve Hong Kong market.

the new strategy

Looking at the new strategic level alone, it goes without saying that as long as it is listed, Little Red Book is a must-see.

If Xiaohongshu lands in Hong Kong stocks, it is likely to continue the "low issue price and high retail participation" pattern of Chinese stocks in recent years.Its "0 yuan store opening" policy has attracted more than 10 banks and a large number of small and medium-sized businesses to settle in. Although it has not directly opened the closed loop of transactions, it has provided a potential retail investor base for the platform.Referring to cases such as Fast Hand and Station B, Xiaohongshu may anchor the valuation through cornerstone investors and reserve some shares for retail investors to purchase.

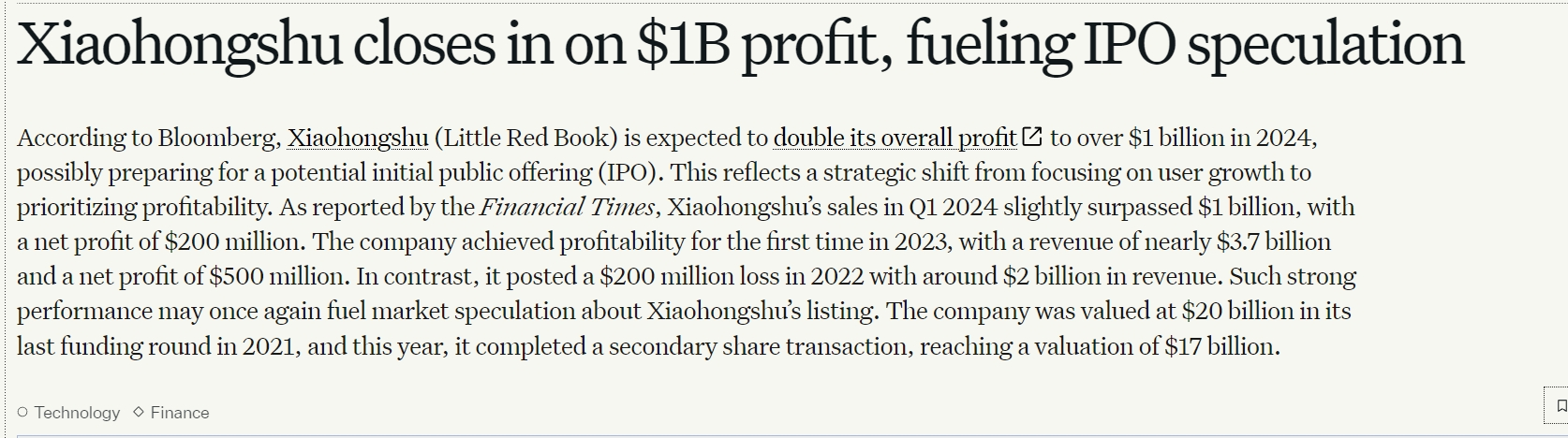

In terms of valuation, analysis said that if Xiaohongshu goes public, Xiaohongshu will achieve revenue of US$3.7 billion in 2023, a year-on-year increase of 85%, and a net profit of US$500 million, turning a deficit into a profit for the first time.Q1 in 2024 will continue to grow at high levels, with revenue of US$1 billion (year-on-year +67%) and net profit of US$200 million (year-on-year +400%). Annual revenue is expected to exceed US$5 billion.This qualitative change in profitability has caused its valuation logic to switch from growth to value. Compared with the average P/E ratio of Hong Kong stock Internet companies (about 20-25 times), the lower limit of the static valuation can be anchored at US$16 billion.

Although advertising revenue still accounts for 60%-70%, e-commerce GMV will increase by 120% year-on-year in 2023, and the order volume of Double Eleven will reach 3.8 times the previous year.Buyers 'e-commerce models (such as Dong Jie and Zhang Xiaohui's live broadcast rooms) have initially become effective. If the proportion of e-commerce revenue increases to more than 30% in 2024, it will significantly improve the market's concerns about its "advertising dependence" and promote PS (market sales ratio) valuation from the current 3.5 times to fast-hand (4.2 times) and Dianduo (5.1 times).

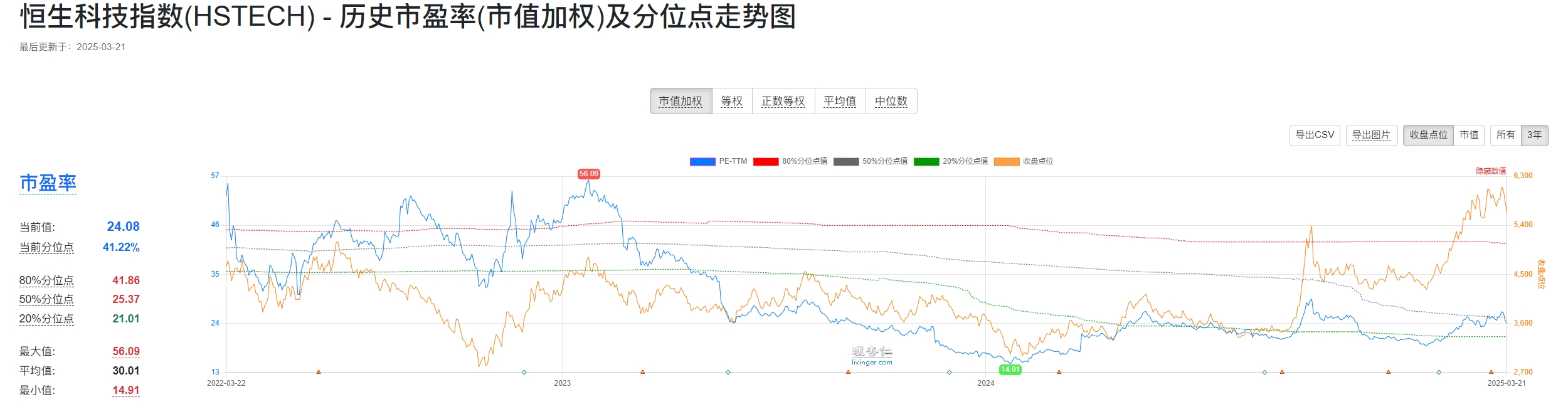

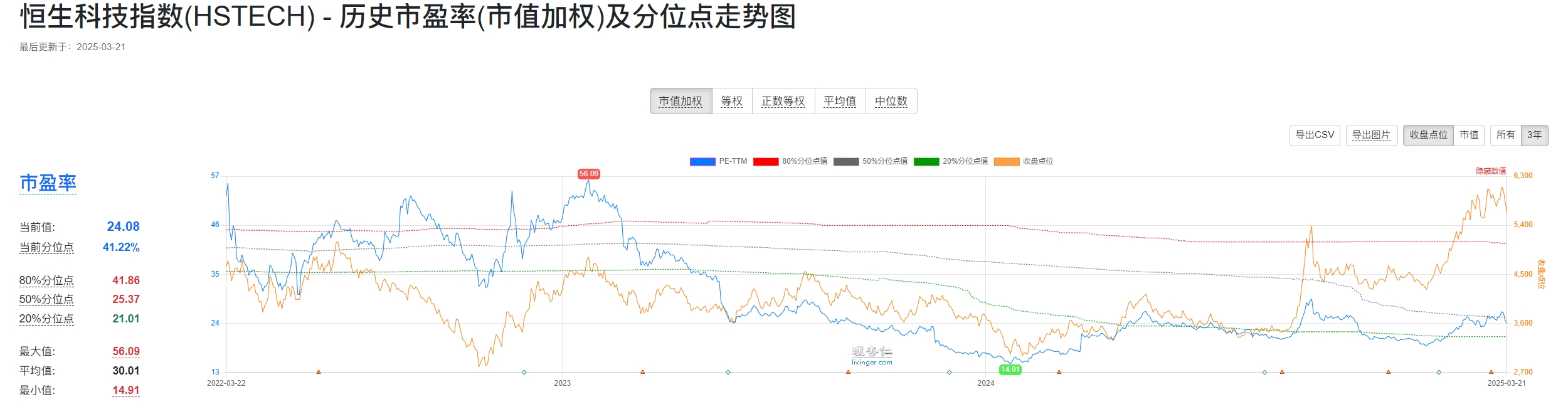

The current P/E ratio of the Hang Seng Technology Index is 40% lower than that of the Nasdaq, and Little Red Book has to bear a "liquidity discount."Referring to the 30% discount of PS (4.1 times) to U.S. stocks (5.8 times) when Hong Kong stocks were listed on Station B, if Xiaohongshu is calculated based on expected revenue of US$5 billion and PS 3.5 times in 2024, the reasonable valuation is approximately US$17.5 billion.

To sum up, the valuation is calculated based on the model and is only for analysis and no investment recommendations.

In an optimistic scenario, assume that revenue in 2024 will reach US$5.5 billion (year-on-year +49%), net profit will be US$1.2 billion, and PS 3.6 times. Combined with international users exceeding 100 million, the proportion of e-commerce will increase to 35%-the valuation will be 20 billion.

Under the neutral scenario, revenue in 2024 will be US$5 billion, net profit will be US$1 billion, and PS will be 3.5 times. The pressure on old shareholders to reduce their holdings will ease, and the sentiment of Hong Kong stocks will pick up-with a valuation of US$18 billion.

Under the pessimistic scenario, the advertising growth rate fell below 50%, the e-commerce monetization rate was below 2%, and the PS dropped to 3.2 times. Coupled with the systemic risk of the stock market, the valuation was at US$16 billion.

How to make new ones?

1. Before subscribing for new shares, you need to open a Wealth Broker account.Wealth Broker provides convenient online account opening service, and users can register through the official website or App.

Click on the exclusive discount account opening link: p.wealthbr.com/0qBSODM? lan=zh

2. New operating procedures for Hong Kong stocks

login account

Open the Wealth Broker App and log in using your account information.

Enter the new share subscription page

In the navigation bar at the bottom of the App, click [Market], and then select [New Share Subscription].

Select new shares

Browse the list of new shares currently available for subscription, click the new shares you are interested in, and enter the details page.

Submit subscription application

Choose the subscription method: Wealth Broker provides cash subscription and financing subscription methods.Financing subscriptions can provide leverage of up to 10 times, depending on the new shares.

Confirm subscription quantity: Enter the subscription number based on your funds.Please note that the number of shares per lot for each new issue may vary and needs to be selected based on specific circumstances.

Submit the application: After confirming that there is no error, click [Confirm Subscription], and the system will prompt you to verify the information again and submit it after confirmation.

3. Deduction time

Ordinary subscription

Subscription funds will be frozen in real time after the application is initiated and will be deducted on the subscription deadline.

Bank financing subscription

Deduction time for principal part: The principal part of bank financing subscriptions is frozen in real time after the subscription application is submitted, and deducted on the subscription deadline date. Bank financing subscriptions are usually one trading day in advance.

Deduction time for partial bank financing: When you submit a subscription, the bank financing amount will be recorded first, and the payment will be uniformly deducted on the winning date.

Bank financing interest must be paid regardless of whether the winning bid is won or not and will be deducted on the date of announcement of the winning bid.If the listing of new shares is postponed or cancelled, the interest-bearing period will increase accordingly.

The subscription fee must be paid regardless of whether the bid is won or not, and will be deducted together with the subscription principal on the subscription deadline.In case of postponement, cancellation of listing, etc. of new shares, subscription handling fees will need to be paid.

Return of funds

Ordinary subscription-after announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

Bank Financing Subscription-After announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

I wish everyone a smooth investment ~

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.