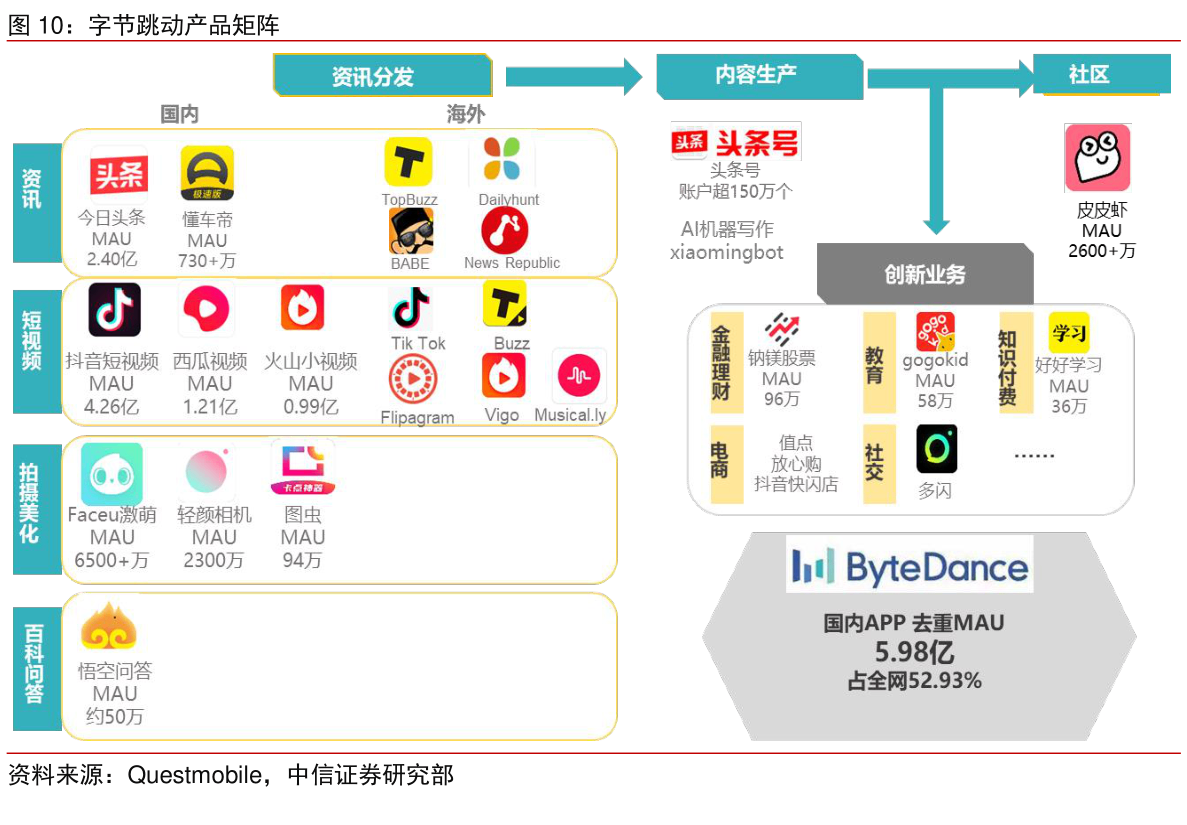

The global Internet industry is witnessing a covert battle for valuation restructuring-ByteDance has surpassed Alibaba (approximately US$308.5 billion) for the first time with its latest valuation of US$315 billion, and has directly surpassed Tencent (approximately US$514.7 billion), becoming the most eye-catching super unicorn in the capital market.

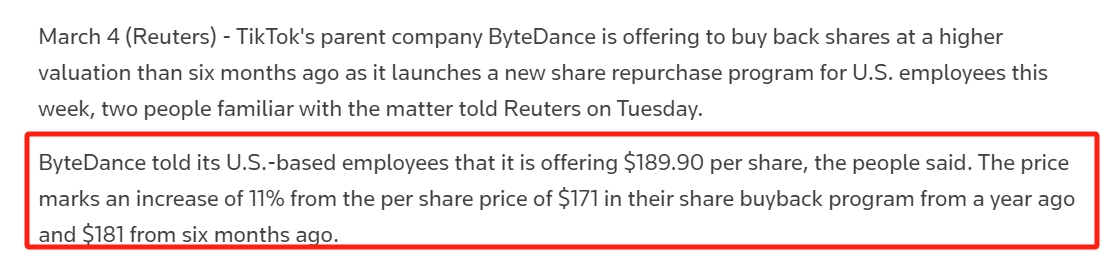

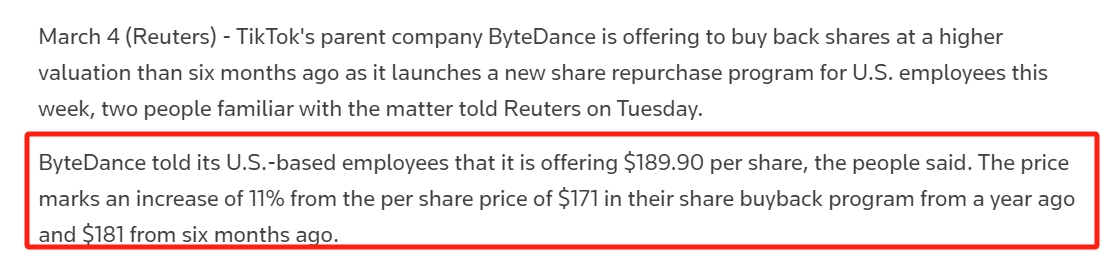

The company, which owns two phenomenal products, Douyin and TikTok, recently released multiple signals to the market through a new round of stock repurchase plan of US$189.9 per share-it is not only a strategic adjustment to the internal shareholding structure, but also It is interpreted by the outside world as a secret prelude to IPO.This two-way rush between valuation jump and business expansion is reshaping the "BAT" pattern of China's Internet.InvalidParameterValue

Valuation transition: A capital narrative from $268 billion to $315 billion

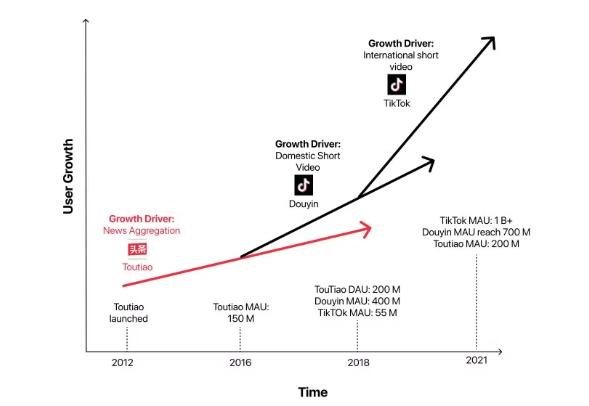

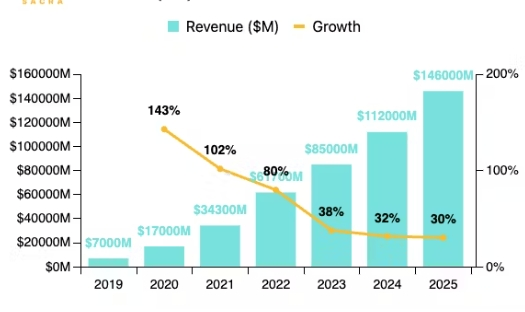

ByteDance's valuation curve can be called a "counter-cyclical sample" of the Internet industry:

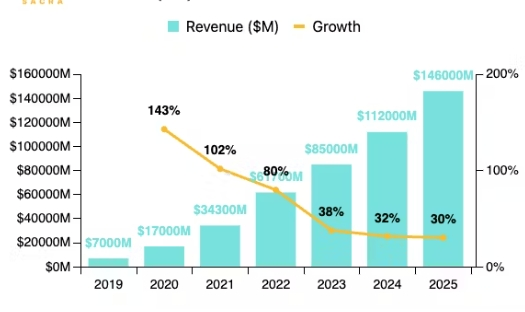

l Rebound at a trough: In 2023, due to TikTok's U.S. policy risks, its valuation once fell to US$268 billion. However, with the resilience of domestic revenue growing by 35% to US$73 billion and international revenue surging by 60% to US$17 billion in 2024, the valuation rebounded by more than 17.5% in 21 months, reaching US$315 billion, surpassing Alibaba to rank second in China's Internet market value.

l Benchmarking giant: Its valuation has reached 61% of Tencent's and 102% of Alibaba's, but its revenue size (estimated at US$110 billion in 2024) is only 65% of Tencent's (HK$712.99 billion) and 1.4 times that of Alibaba, reflecting the market's higher premium to its growth potential.

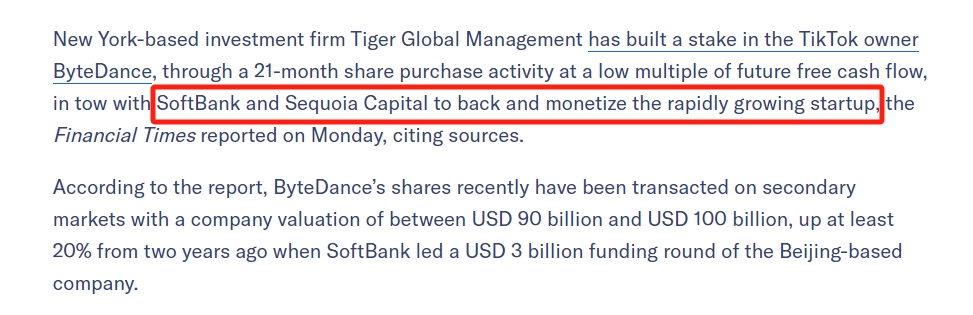

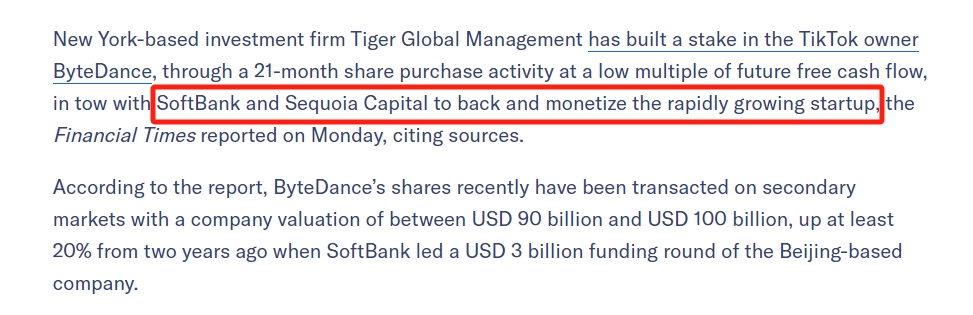

l Capital voting: Sequoia, SoftBank and other institutions continue to increase their prices, while the repurchase price climbed from US$160/share in 2023 to US$189.9/share, an increase of 18.7%, indicating the primary market's recognition of its "non-public listing path."InvalidParameterValue

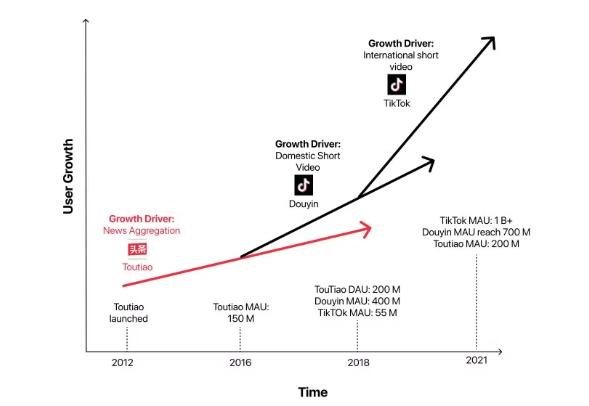

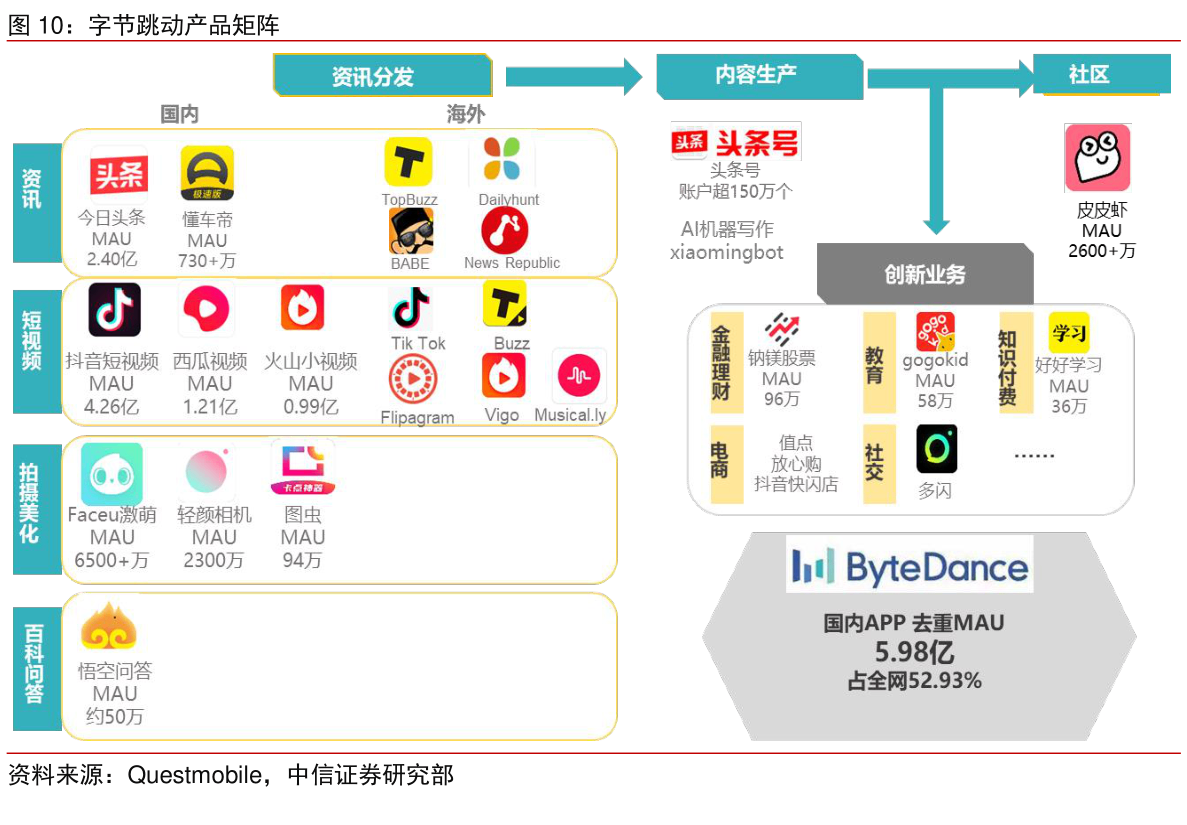

Behind this valuation jump is the "double cycle" support of the ByteDance business landscape: Douyin ranks among the domestic top of Short Video (400 million daily live broadcasts), and TikTok has become a super entry point for the global entertainment economy with a forecast of US$77 billion in live broadcast revenue.InvalidParameterValue

Buyback mystery: Liquidity management or IPO outpost?InvalidParameterValue

Although ByteDance has repeatedly claimed that "there are no IPO plans," the similarity between its capital actions and historical cases has triggered associations:

-

Optimization of equity structure: Stock repurchase has been launched for three consecutive years, with a cumulative scale of more than US$10 billion. It not only provides an exit channel for early investors, but also cleans up the employee option pool and clears up obstacles for future listings.This move is exactly the same as Ali's equity consolidation before its listing in 2014.InvalidParameterValue

2. Valuation stress test: Anchoring a valuation of US$315 billion through old stock trading is equivalent to simulating open market pricing in advance to avoid violent fluctuations during the IPO.This strategy is similar to Meituan's premium trading logic of old stocks before its 2018 Hong Kong stock listing.InvalidParameterValue

3. Strategic deterrent value: High valuations can suppress competitors 'financing capabilities. For example, Tencent has increased its investment in video accounts and e-commerce in response to the threat of ByteDance, and high valuations are itself a barrier to competition.InvalidParameterValue

It is worth noting that Julie Gao, the new CFO of ByteDance, has managed IPOs of Hong Kong stocks such as Meituan and Xiaomi, and her participation is seen as a key signal for potential listing preparations.InvalidParameterValue

Business resilience: The triple engine of advertising, e-commerce and AI

The core logic supporting the valuation of US$315 billion is that ByteDance has built a diversified profit model:

l Advertising moat: Douyin advertising loading rate is only 15%(the industry average is 25%), but with the average user stickiness of 120 minutes per day, the proportion of advertising revenue in 2024 will still exceed 75%, and the monetization ceiling is far from reaching its peak.

l E-commerce surprise attack: Douyin E-commerce's GMV exceeded 500 billion yuan in 2024, and the single-day transaction on Double Eleven was 50 billion yuan. The maturity of the buyer ecosystem (such as Oriental Selection) has gradually allowed it to get rid of its dependence on top anchors.InvalidParameterValue

l AI variables: Investing in AI company MiniMax and self-developed AIGC tools, trying to extend the advantages of algorithms from content recommendations to productivity tools. Its newly released Tongyi Thousand Questions Model has been benchmarked against DeepSeek-R1.InvalidParameterValue

Compared with Alibaba (relying on traditional e-commerce) and Tencent (slowing down game growth), ByteDance's business matrix is more resilient to growth.InvalidParameterValue

Countdown to IPO?The ultimate test of the game between geopolitical risk and valuation

Although the valuation has exceeded US$300 billion, ByteDance's path to listing still faces three variables:

1. TikTok's dilemma in the United States: If the United States forcibly divest TikTok, its valuation may lose 30%; but if operating restrictions are lifted, the US$400 billion valuation cap set by Softbank and other institutions will open up space.InvalidParameterValue

2. Liquidity discount on Hong Kong stocks: The current average P/E ratio of Hong Kong stocks and technology stocks is 40% lower than that of U.S. stocks. If calculated based on the P/P ratio of Hong Kong stocks at Station B, the valuation of the ByteDance listing may shrink to US$250 billion.InvalidParameterValue

3. Regulatory compliance costs: Global data privacy regulations (such as the EU GDPR) and domestic antitrust pressures may squeeze profit margins.

If ByteDance chooses an IPO, the most likely path is to spin off Douyin and list it separately, while retaining TikTok as a private asset to avoid policy risks.Referring to the history of fast-handed Hong Kong stocks 'IPO of 160% on the first day, there is still considerable room for new arbitrage.InvalidParameterValue

Developing new strategies: three major paths for advance layout

Although ByteDance has not yet officially announced its IPO, with reference to its capital operation trajectory and new practices for Hong Kong stocks, investors can check out their slots in advance by:

1. Opening accounts and capital reserves for Hong Kong stock brokers

l Compliance channels: Priority is given to low-threshold compliance brokers, such as Wealth Broker. You can open an account at 0 threshold without passing through Hong Kong, making it convenient to deposit funds in seconds.

Commission discount link: p.wealthbr.com/0qBSODM? lan=zh

l Account type: Cash accounts are suitable for small trials (the winning rate is about 30%), and financing accounts can be leveraged to 10 times to increase the probability of winning.InvalidParameterValue

2. Transfer of old shares and cornerstone investment channels

l Primary market share: Some private equity funds provide ByteDance old shares, with a threshold of about US$1 million, but attention should be paid to liquidity risk (lock-up period is usually 1-2 years).InvalidParameterValue

l Cornerstone anchoring: If Douyin is spun off and listed, you can pay attention to the cornerstone shares released by the underwriters. It usually costs US$5 million to start and enjoys a discount on the issue price.InvalidParameterValue

3. Concept stock linkage and derivative hedging

l Related targets: Lay out ByteDance suppliers in advance (such as advertising agency blue cursor), partners (such as e-commerce service providers have likes), or related concept ETFs.InvalidParameterValue

l Option hedging: If you are worried about market fluctuations, you can purchase corresponding hedging options to reduce the systemic risk of technology stocks.InvalidParameterValue

Recently, if there are new Hong Kong stocks, or if you want to exchange Hong Kong and US stocks to open accounts, you can add WeChat to communicate.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.