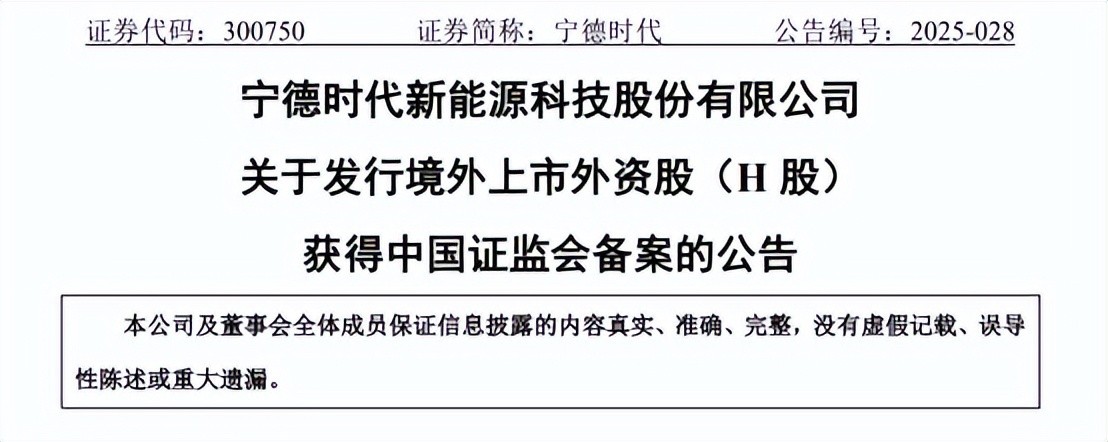

1. Issuance plan and foreign capital rush to raise funds

1. Countdown to Hong Kong stock listings

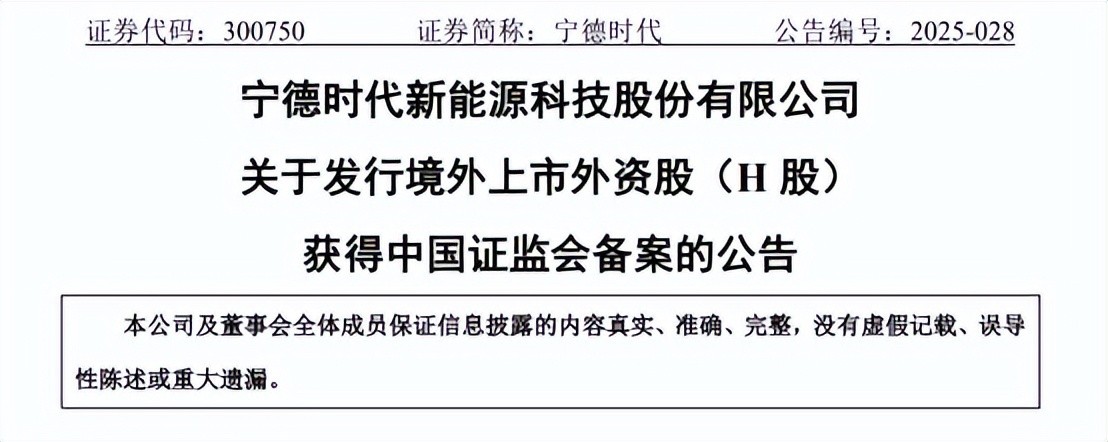

Ningde Times has been approved by China Securities Regulatory Commission and plans to issue no more than 220 million H shares, which is expected to become the largest IPO of Hong Kong stocks in 2025.The China Securities Regulatory Commission requires the issuance to be completed within 12 months. Time is tight and investors need to make arrangements in advance.InvalidParameterValue

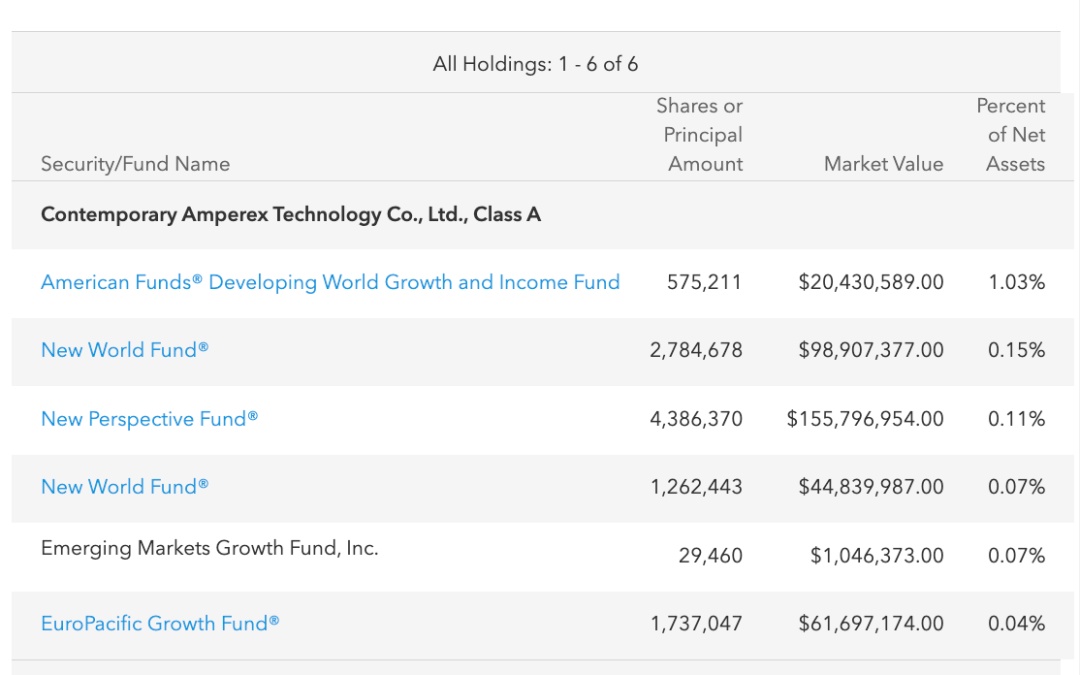

2. Foreign investment is rushing for cornerstone share

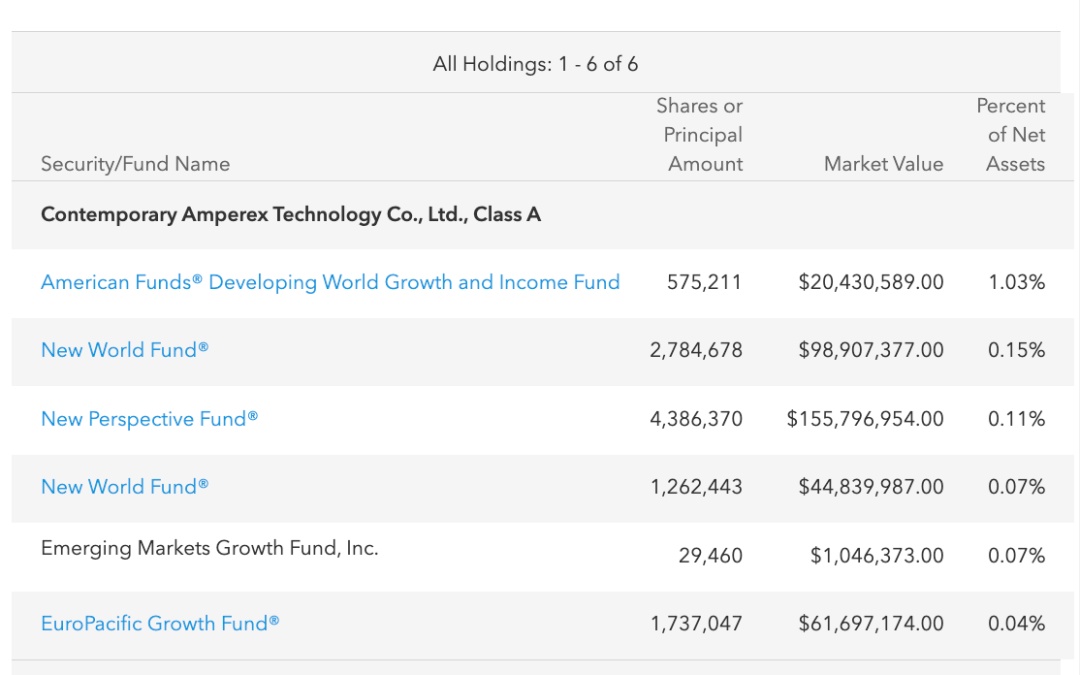

l Sovereign funds and long-term capital: Norway sovereign funds, capital groups, etc. have already held heavy positions in Ningde Era, of which the six funds under Capital Group have a total position of approximately 2.8 billion yuan.

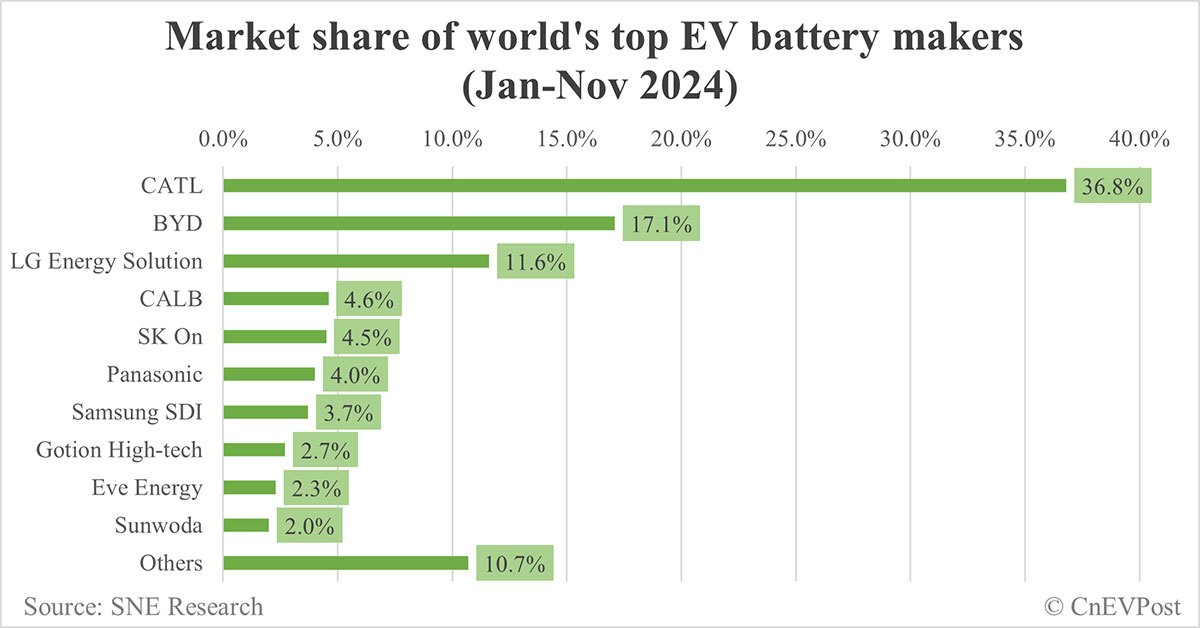

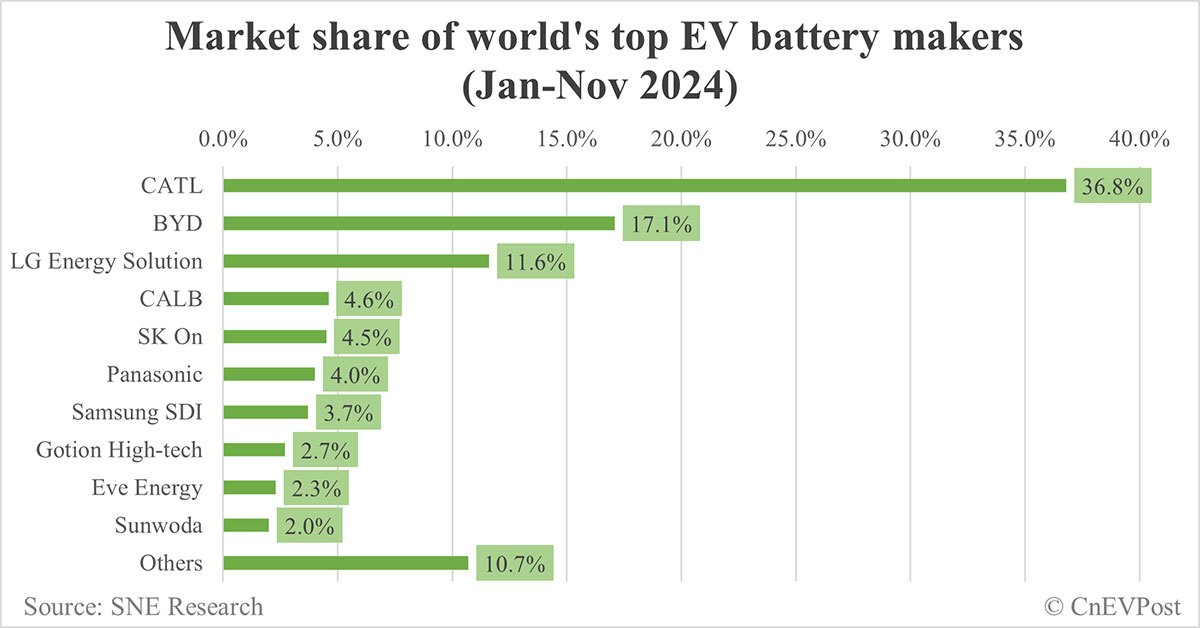

l The logic of foreign investment adds: the global power battery market share is 36.8%(2024 data), combined with the high growth of the energy storage business (market share of 36.5%), foreign investment is betting on the leading position in the new energy industry chain.

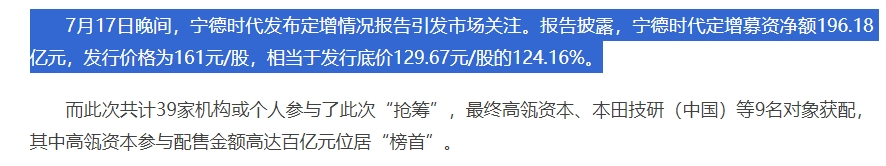

l Historical fixed increase cases: During the fixed increase in 2020, Hillhouse Capital, Honda and other institutions entered the market at a high price of 161 yuan/share, demonstrating capital's recognition of technical barriers and cost control capabilities.InvalidParameterValue

2. New strategies and fund allocation suggestions

1. Capital scale stratification strategy

l Small amount of funds (≤ HK$10,000): Increase leverage by 10 times to reduce the entry threshold by Internet brokers (such as Wealth Broker) that support "one-hand financing".

l Medium capital (HK$20,000 - 50,000): Adopt a "tail strategy" to balance the winning rate and financing costs to avoid high interest consumption in Group B.InvalidParameterValue

l Large amounts of funds (≥ 60,000 Hong Kong dollars): Divided financing is divided into Group B, and decentralized subscriptions increase the probability of winning the bid. The current Hong Kong dollar offered rate (HIBOR) is as low as 3%-4%, giving a significant advantage in financing costs.InvalidParameterValue

2. Valuation margin of safety and catalytic factors

l A-share benchmarking: The current dynamic P/E ratio of Ningde A-shares is only 21.95 times, far below the industry average. The issuance of H-shares may further open up space.

l Technological breakthroughs: The solid-state battery pilot test line has been launched and CTC 2.0 technology is about to be mass produced, which is expected to become a catalyst for post-market valuation.InvalidParameterValue

3. Risk warning and hedging advice

1. Core risk points

l Competition in the industry has intensified: BYD blade batteries and Tesla's self-developed batteries threaten market share, and the trend of self-research by car companies may weaken customer stickiness.InvalidParameterValue

l Geopolitical risk: Trade barriers in Europe and the United States (such as the U.S. IRA bill) may delay the release of overseas production capacity.InvalidParameterValue

l Volatility of lithium prices: If lithium carbonate prices rebound sharply, it may squeeze profit margins (the 15% increase in Ningde's net profit in 2024 has partially benefited from the decline in lithium prices).InvalidParameterValue

2. hedging strategy

l Option hedging: Reduce the systemic risk of technology stocks by buying corresponding hedging options.InvalidParameterValue

l Linkage of related targets: Configure ETFs in relevant industries to disperse the risk of fluctuations in individual stocks.InvalidParameterValue

4. How to participate in the new competition?InvalidParameterValue

login account

Open the Wealth Broker App and log in using your account information.

Click on the exclusive discount account opening link: p.wealthbr.com/0qBSODM? lan=zh

Enter the new share subscription page

In the navigation bar at the bottom of the App, click [Market], and then select [New Share Subscription].

Select new shares

Browse the list of new shares currently available for subscription, click the new shares you are interested in, and enter the details page.

Submit subscription application

Choose the subscription method: Wealth Broker provides cash subscription and financing subscription methods.Financing subscriptions can provide leverage of up to 10 times, depending on the new shares.

Confirm subscription quantity: Enter the subscription number based on your funds.Please note that the number of shares per lot for each new issue may vary and needs to be selected based on specific circumstances.

Submit the application: After confirming that there is no error, click [Confirm Subscription], and the system will prompt you to verify the information again and submit it after confirmation.

deduction time

Ordinary subscription

Subscription funds will be frozen in real time after the application is initiated and will be deducted on the subscription deadline.

Bank financing subscription

Deduction time for principal part: The principal part of bank financing subscriptions is frozen in real time after the subscription application is submitted, and deducted on the subscription deadline date. Bank financing subscriptions are usually one trading day in advance.

Deduction time for partial bank financing: When you submit a subscription, the bank financing amount will be recorded first, and the payment will be uniformly deducted on the winning date.

Bank financing interest must be paid regardless of whether the winning bid is won or not and will be deducted on the date of announcement of the winning bid.If the listing of new shares is postponed or cancelled, the interest-bearing period will increase accordingly.

The subscription fee must be paid regardless of whether the bid is won or not, and will be deducted together with the subscription principal on the subscription deadline.In case of postponement, cancellation of listing, etc. of new shares, subscription handling fees will need to be paid.

Return of funds

Ordinary subscription-after announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

Bank Financing Subscription-After announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

I wish everyone a smooth investment ~

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.

Account opening details are shown as followsˇ