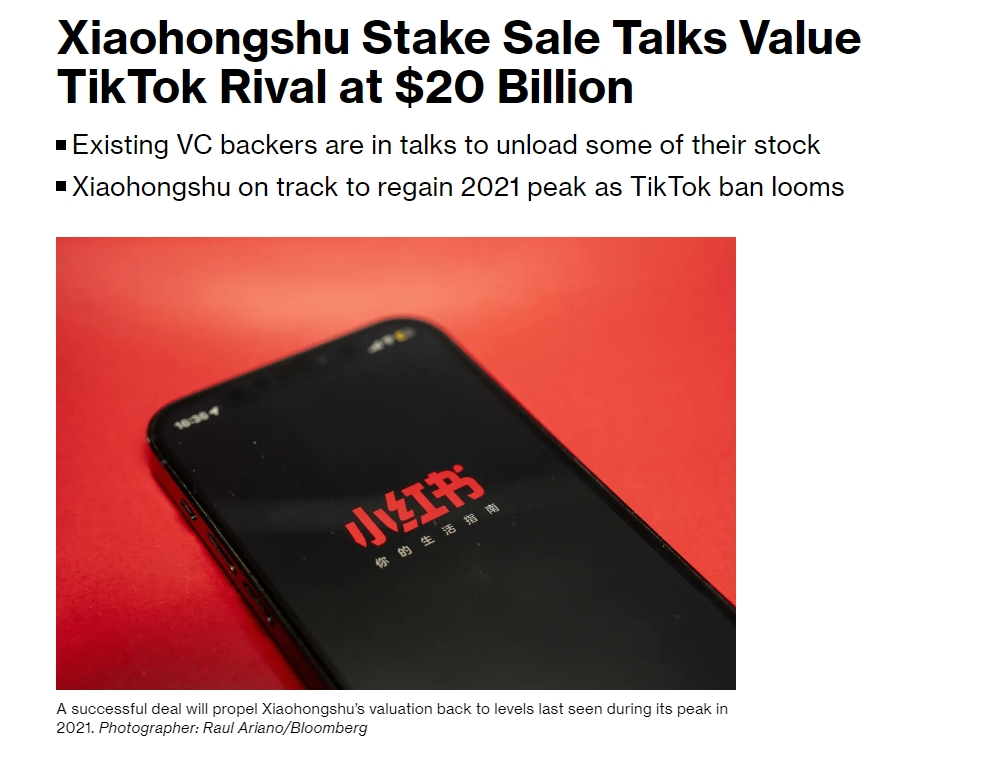

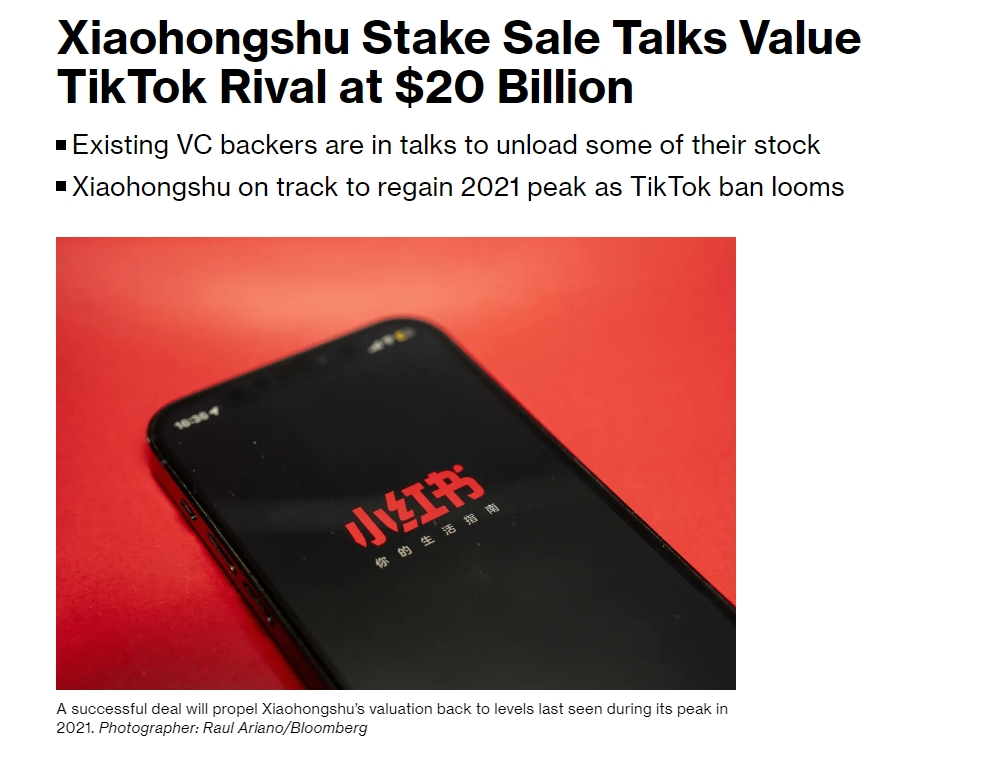

After a long time, the much-awaited Little Red Book may really be listed in Hong Kong!

This 12-year-old Social commerce platform, with its impressive data of 312 million monthly active users, a 400% year-on-year increase in net profit in the first quarter, and the capital action of "restoring the valuation of old stock transfers to US$20 billion.", is becoming a "hot potato" in the eyes of global investors.

For ordinary investors, how to seize this wave of new dividends?This article will break down the listing logic of Xiaohongshu, and attach Xiaobai's 0 threshold account opening strategy to help you seize the opportunity!InvalidParameterValue

Listing rumors add another real weight: capital operation and performance explosion are driven by two-wheel drive

Xiaohongshu has recently intensively released listing signals:

1. Strategic layout in Hong Kong: Establishing a Hong Kong office in 2024 and forming a team familiar with local regulatory rules is regarded as a key move to get close to the capital market;

2. Repair of valuation of old stocks: DST Global, Sequoia China and other institutions took over old stocks at a valuation of US$17 billion to US$20 billion, a premium of more than 40% compared with the trough period in 2023, indicating capital recognition of its profitability;

3. Financial data broke out: revenue in 2023 was US$3.7 billion (year-on-year +85%) and net profit of US$500 million. In 2024, Q1 net profit surged four-fold year-on-year to US$200 million. The dual-engine driving model of advertising and e-commerce has been implemented;

4. User growth moat: Monthly active users exceeded 312 million, and the average daily search volume reached 300 million, accounting for 50% of the total born in 1995, forming a closed-loop ecosystem of "content grass-transaction transformation".InvalidParameterValue

This series of actions is exactly the same as the preparation path taken by former Citigroup executive Yang Ruo when he became CFO in 2021.Although the company still "has no comment" on the listing, the consensus in the capital market is that Xiaohongshu may land in Hong Kong stocks within 2025, becoming another benchmark company for "content + e-commerce" after Quick Hand and Station B.InvalidParameterValue

Analysis of new dividends: Why is the Little Red Book worth betting on?InvalidParameterValue

Referring to the performance of new shares in Hong Kong stocks in recent years, companies with the following characteristics are more likely to receive excess returns:

l Scarcity target: Xiaohongshu is the only super platform that opens up "social + e-commerce + local life", benchmarking Instagram but has stronger monetization capabilities;

l The profit turning point is clear: after turning losses into profits in 2023, the net profit margin of Q1 in 2024 will reach 20%, far exceeding community platforms such as Station B and Zhihu;

l Intensive institutional endorsements: Tencent, Ali, Temasek, Sequoia and other top capital holdings, and pre-listing valuations have been anchored in the primary market;

l Retail sentiment is high: In 2023, the order volume of Double Eleven will increase by 3.8 times year-on-year. The platform's "0 yuan store opening" policy has attracted more than 100,000 small and medium-sized merchants, and the potential retail investor base is huge.InvalidParameterValue

If calculated based on a valuation of US$20 billion, the market value of Xiaohongshu's issuance may be between fast hand (about US$40 billion) and station B (about US$5 billion). Considering its higher profit growth rate, there is considerable room for new premiums.InvalidParameterValue

Opening strategy at 0 threshold: Three steps to seize the lead

For small white investors who have never participated in Hong Kong stocks, they only need three steps to make a layout:

Step 1: Open an account at 0 threshold

Click on the exclusive discount account opening link: p.wealthbr.com/0qBSODM? lan=zh

login account

Open the Wealth Broker App and log in using your account information.

Enter the new share subscription page

In the navigation bar at the bottom of the App, click [Market], and then select [New Share Subscription].

Select new shares

Browse the list of new shares currently available for subscription, click the new shares you are interested in, and enter the details page.

Submit subscription application

Choose the subscription method: Wealth Broker provides cash subscription and financing subscription methods.Financing subscriptions can provide leverage of up to 10 times, depending on the new shares.

Step 2: Prepare enough "ammunition"

l Cash account: Suitable for investors with small funds, and the winning rate depends on the market value of the account;

l Financing account: Leveraging purchase can be used to amplify the probability of winning the contract (interest is required, suitable for those with high risk preferences);

l Strategic suggestions: Give priority to purchasing Group B (large-amount subscriptions), or increase fund utilization through "one-hand financing".InvalidParameterValue

Step 3: Keep an eye on the time window

l IPO period: usually lasts 3-5 days, and subscriptions need to be completed before the deadline;

l Dark trading: You can buy and sell in advance through dark trading the day before listing to capture opportunities for price fluctuations;

l Selling timing: If the increase on the first day reaches psychological expectations, we can sell. We are here to buy new things, not to stock stocks!

Risk warning: Participate rationally and avoid stepping on traps

1. Risk of valuation fluctuations: If the growth rate of advertising revenue falls below 50%(60% in Q1 in 2024), or the e-commerce monetization rate is lower than expected, the stock price may be under pressure;

2. Competition is fierce: Competitive products such as ByteDance "Youshi" and Meituan's "Eating Locally" are accelerating the diversion of users;

3. Geopolitical variables: TikTok's overseas regulatory risks may spill over, and Xiaohongshu's failure to spin off the international version of its business may become a hidden danger.InvalidParameterValue

The listing of Xiaohongshu is not only a reassessment of the value of the "grass planting economy", but also a watershed for China's Internet to shift from traffic competition to efficiency competition.With the increasing convenience of new mechanisms for Hong Kong stocks, ordinary investors can also participate in this wealth feast.Open an account immediately and prepare enough funds. Perhaps the ticket to the next capital myth will be hidden between your clicks!InvalidParameterValue

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.