In Gold We Trust? Time to Rewrite the Dollar

Every U.S. bill and coin bears the phrase "In God We Trust," but after recent market moves, perhaps it should read: "In GOLD, We Trust."As of publication, COMEX gold futures surged 2%, breaking past t

Every U.S. bill and coin bears the phrase "In God We Trust," but after recent market moves, perhaps it should read: "In GOLD, We Trust."

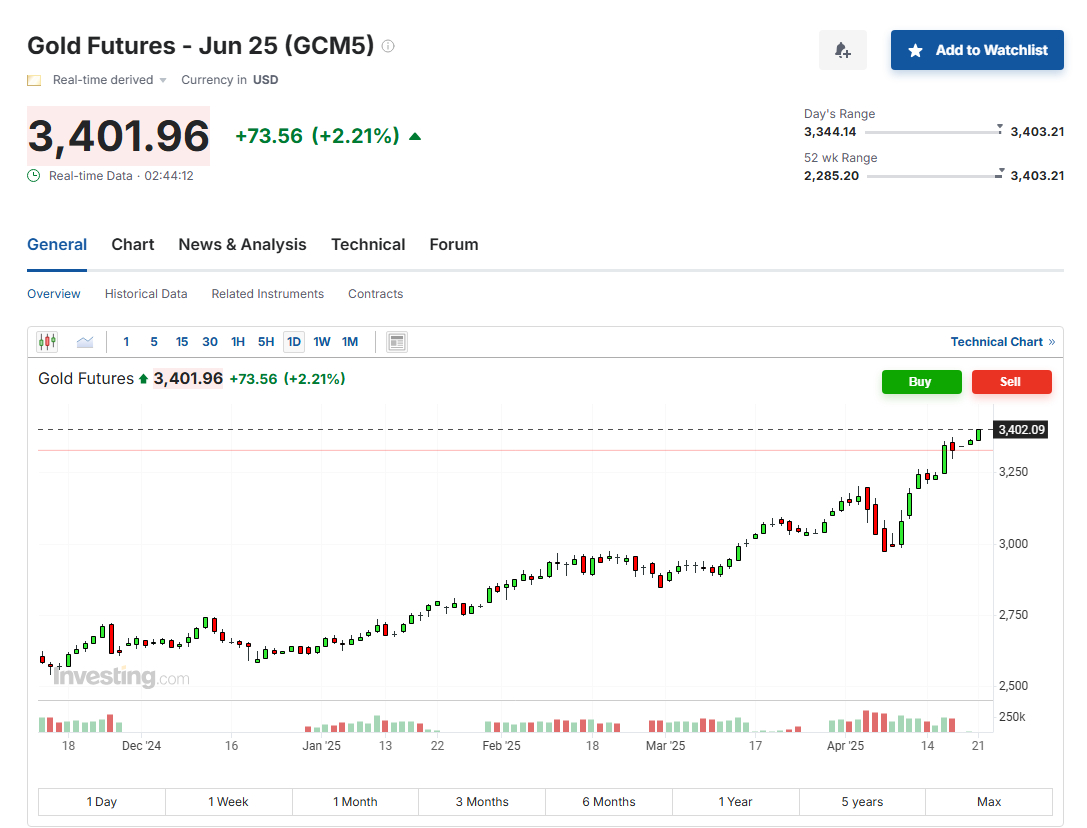

As of publication, COMEX gold futures surged 2%, breaking past the $3,400 mark.

What Triggered the Spike? Trump's Golden Words

In the Asian trading hours on Monday, gold made a dramatic jump—directly fueled by a provocative statement from Donald Trump:"He who has the gold makes the rules." That one line sparked global investor fears about international order and the credibility of U.S. financial leadership.

Tensions are already high due to Trump's ongoing public clashes with Federal Reserve Chair Jerome Powell. Trump is reportedly exploring ways to fire Powell prematurely—something that would undermine the long-standing independence of the Fed. French Finance Minister Eric Lombard issued a stark warning: removing Powell could "endanger the dollar's credibility and destabilize the U.S. economy."

Investors Vote With Their Wallets: A Triple Sell-Off

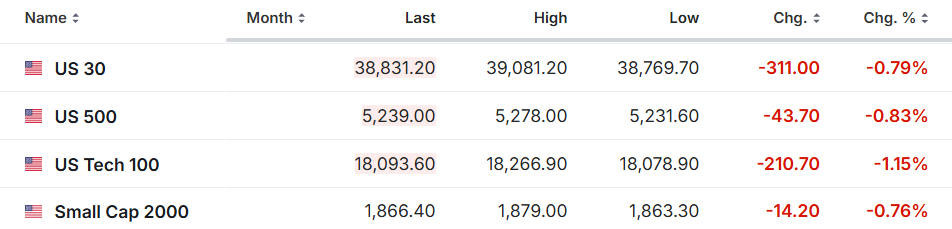

Trust in the U.S. is fading fast. Investors have launched a full-blown exodus from American assets—dumping stocks, bonds, and the dollar all at once.

The U.S. Dollar Index has plunged to around 98.4, a level not seen since March 2022.

"Investor behavior has shifted," said former Fed senior economist Steven Kamin. "Usually during crises, they buy dollars. This time, they're selling. It suggests growing skepticism about U.S. Treasuries and dollar-based assets."

Ludovic Subran, Chief Economist at Allianz, warned:"Tariffs are just the tip of the iceberg. If the dollar depreciates 30%, are U.S. returns still positive? Everyone is doing the math."

Allianz's Multi-Asset cio Ingo Mainert revealed that over the past month, the firm has been rotating heavily out of U.S. assets and into European holdings. Multiple clients have called to discuss slashing their U.S. exposure.

As the Dollar Falls, Gold Gets Fed

With America's status as the world's financial anchor under threat, where can investors go? There's no alternative fiat strong enough—so they're going back to basics: gold.

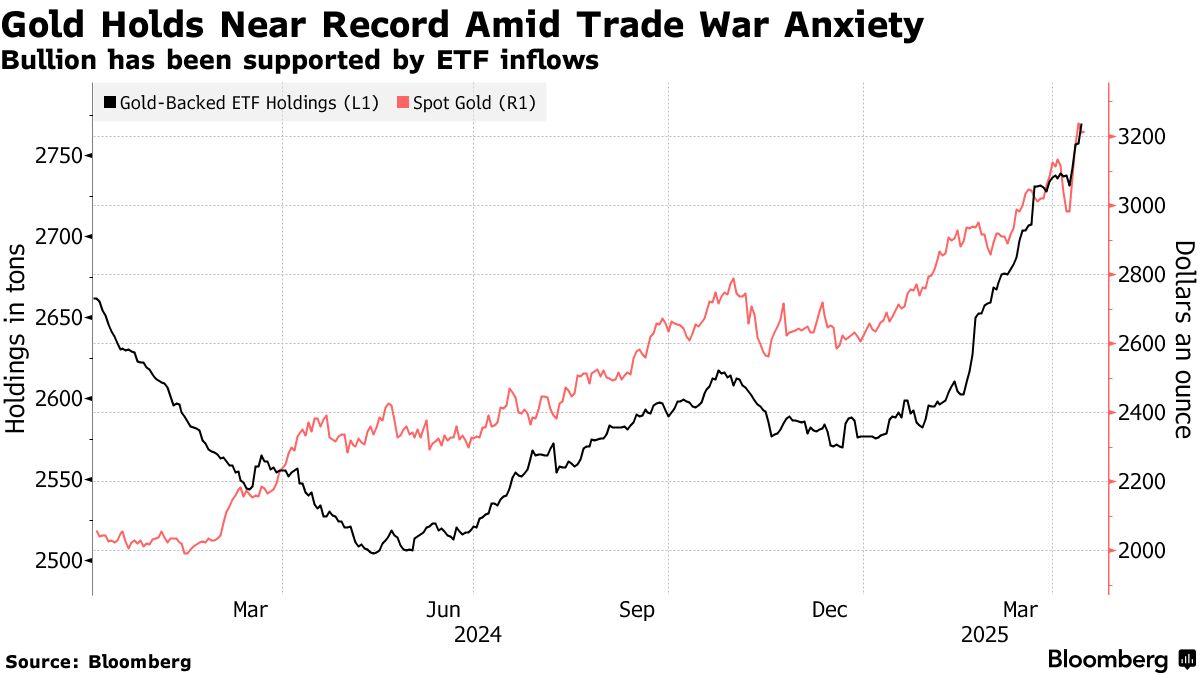

The chart shows that going long on gold has become one of Wall Street's most crowded trades.

With investors increasing their gold ETF holdings and central banks continuing to stockpile gold, large Wall Street investment banks remain optimistic about gold's future outlook. Data shows that gold ETF holdings have been steadily rising since June 2024, in line with the price increase.

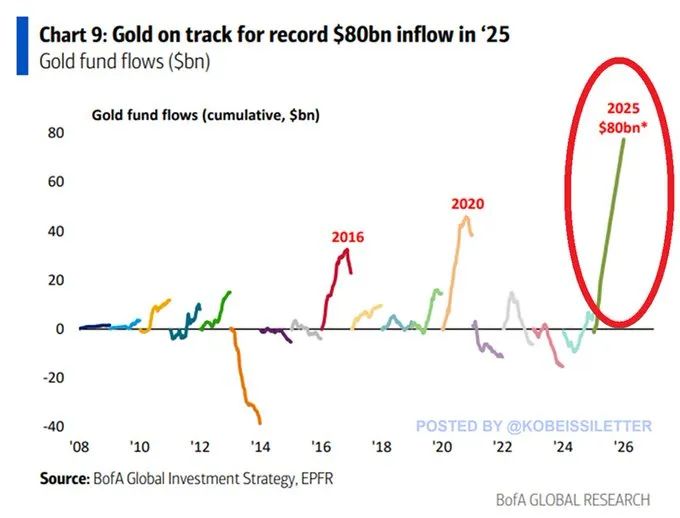

So far in 2025, gold-tracking funds have seen record net inflows of $80 billion, more than double the total for all of 2020.

Wall Street's Gold Targets: $4,000 in Sight

Both goldman sachs and ubs have issued bullish forecasts for gold, citing stronger-than-expected central bank demand and widespread investor buying as a hedge against recession and geopolitical turmoil.

Goldman Sachs analysts, led by Lina Thomas, forecast gold will hit $3,700/oz by end-2025 and $4,000/oz by mid-2026. They estimate global central banks are currently buying 80 tons per month, exceeding their previous estimate of 70 tons/month.

They also expect that if the U.S. enters recession—currently a 45% probability—then inflows to gold ETFs will accelerate, possibly pushing prices to $3,880/oz by year-end.

UBS strategist Joni Teves projects gold to reach $3,500/oz by the end of 2025. His bullish outlook stems from robust demand across the board: central banks, long-term asset managers, hedge funds, and individual investors.

Teves also pointed out a key risk factor: declining market liquidity in the gold sector, due in part to limited mining supply and hoarding by central banks and ETFs. This could amplify price volatility

Chinese financial players are also bullish. Gao Ruidong, Chief Economist at Everbright Securities, said this gold revaluation wave reflects global economic imbalances shaking the existing monetary system. He sees a global need to restructure the financial order, and during such times, emerging markets are turning to gold as a "supra-sovereign" safe asset.

But Is the Gold Bull Unstoppable?

Not everyone is cheering. Some experts warn the current rally might be overheated. After all, in just four months, gold has gained as much as it did in all of last year.

Ken Fisher, founder of global investment firm Fisher Investments, warned that gold's safe-haven and inflation-hedge powers may be overstated. During the 2008 financial crisis, gold didn't hold up as well as expected. In the 2020 COVID panic, gold briefly crashed when funds sold it to cover equity margin calls.

Jiang Zhenlong, assistant researcher at the Chinese Academy of Social Sciences' Institute of International Finance, believes it's still too early to declare the collapse of U.S. dollar credibility. As long as U.S. economic data doesn't surprise to the downside and the debt ceiling drama gets resolved, the U.S. economy could continue supporting the dollar system.

For now, Jiang suggests, the mass dumping of dollar assets may be more of a short-term emotional reaction to Trump's tariff policies than a long-term shift.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.