The Fed pressed the pause button as scheduled, but the three major U.S. stock indexes dived collectively during the session.?

On June 14, local time, the Federal Reserve announced its June interest rate decision as scheduled, in line with market expectations。After a 15-month cycle of rate hikes, the Fed finally hit the pause button。

On June 14, local time, the Federal Reserve announced its June interest rate decision as scheduled, in line with market expectations。After a 15-month cycle of rate hikes, the Fed finally hit the pause button。Since March 2022, the Fed has raised interest rates 10 times in a row, with a cumulative margin of a staggering 500 basis points, and the benchmark interest rate has climbed rapidly from zero to the current 5-5.25%, which has had a strong impact on asset pricing across all asset classes。

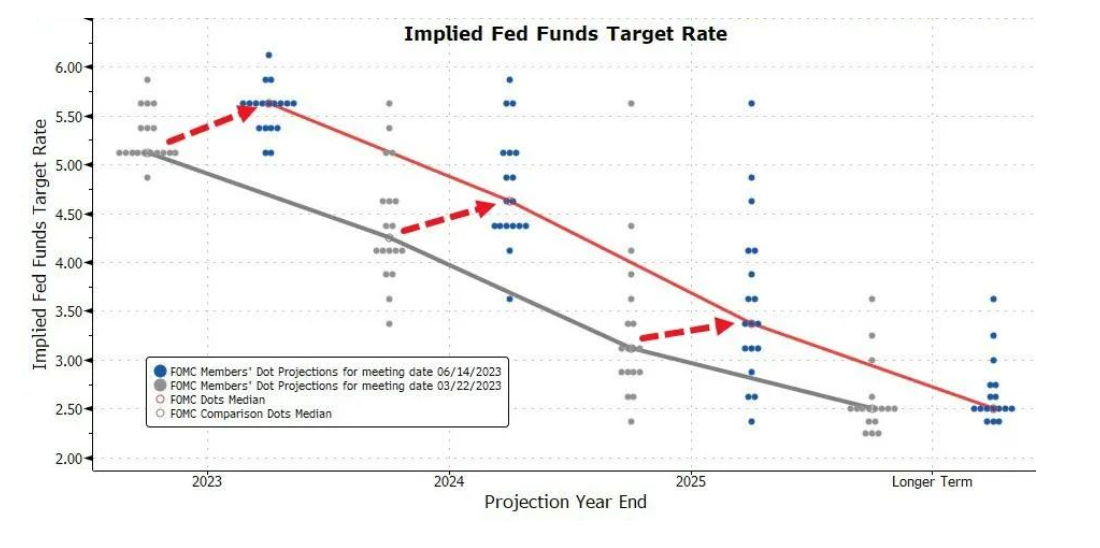

Dot chart: there will be two more rate hikes during the year

In this statement, the Fed continued to reiterate the additional language of last May's statement, that is, the FOMC "remains highly concerned about inflation risks," only one statement has changed significantly, that is, "to determine the extent to which additional policy tightening should be appropriate," modified to "determine the extent of further tightening is appropriate," implying that the Fed's rate hike has not yet ended.。

Last week, Australia and Canada, which had already announced a moratorium on interest rate hikes earlier than the United States, restarted the pace of interest rate hikes, showing the twists and turns of the road to inflation governance, while the United States chose to stay put at this policy meeting, marking the country's inflation governance has also entered a new stage - from the operational period to the assessment period.。In the future, the Fed needs to closely observe the lag and cumulative effects of monetary policy and rely on data to make camera decisions。

While the pause in rate hikes appears to be a dovish move, the Fed has given a hawkish view in the dot plot released along with this one, signaling that this skip in rate hikes is only a pause, not a permanent end.。According to the May CPI data freshly released during the meeting, although the overall CPI fell more than expected to 4%, but due to the negative effect of the high base, this data appears slightly "distorted."。In addition, the core CPI, which excludes energy and food, which are subject to seasonal fluctuations, rose instead of falling in this data and remained at 5.3% high, even higher than market expectations of 5.2%。

The reason for this is that sequential increases in used car prices and rents have contributed significantly to core CPI growth, and supporting these two sub-items is the recent strong employment in the United States.。

According to the dot plot released by the Fed this time, the median of the Fed's interest rate forecasts for the end of the year went from 5.1% jump to 5.625%, shocked the market。It is reported that the Fed will hold four more interest rate meetings during the year, in July, September, November and December, according to the current interest rate ceiling 5..25% to calculate, the Fed will need to raise interest rates at least twice in the next four meetings, by 50 basis points

In addition, among the 18 policymakers voting on the dot plot, interest rates are expected to reach 5.5% -5.75% or more of the commissioners reached 12, and three of them even hoped to reach 5..Continue to raise interest rates on a 625% basis to curb inflationary pressures。The results of this dot plot show that most policymakers agree that further policy tightening is needed to combat repeated inflation.。Not only that, they may see terminal rates much higher than the market expects。Separately, the forecast also shows that at least 12 officials want to time the rate cut to 2024, rather than the end of the year previously predicted by the market.。

It stands to reason that the Fed's suspension of rate hikes as scheduled helped boost market confidence, but the bank's hawkish caliber directly spooked the day's U.S. stock market。After the Fed announced its interest rate decision, the three major U.S. stock indexes dived collectively during the session and recovered somewhat after half an hour.。Dow down 1 at one point.25%, closing decline narrowed to 0.68%; Nasdaq down 0 in 10 minutes.93%, close to close red; S & P 500 down 0.71%, close slightly up 0.08%。

At yesterday's meeting, Fed officials also updated their economic forecasts, lowering expectations of the risk of a U.S. recession.。Specifically, the economic forecast puts the median U.S. GDP growth forecast for the full year 2023 from 0 in March..4% to 1%; to increase the U.S. personal consumption expenditure price index (PCE) in 2023 from 3.2% up to 3.3%; the average U.S. unemployment rate in the fourth quarter of 2023 from 4.5% down to 4.1%。

Powell: Whatever it takes to fight inflation

After the announcement of the resolution, at a press conference, Federal Reserve Chairman Jerome Powell (Jerome Powell) responded to a series of concerns about the interest rate decision, the entire conference lasted 1 hour and 50 minutes.。

At the outset, Powell explained why a pause in rate hikes at this time would not be self-defeating against the backdrop of the current housing market recovery and financial conditions beginning to ease。He said that 15 months ago, the Fed's top issue was how to raise interest rates quickly, and in December, after raising interest rates by 75 basis points in a row, the bank reduced the rate hike to 50 basis points and will further reduce it to 25 basis points at three meetings this year.。

He noted that the main problem facing the Fed right now as terminal rates approach is determining how much interest rates still need to be raised。The Fed should moderate its rate hikes, and this meeting's pause reflects that process。The pace of rate hikes and the terminal rate are separate variables, and the pace of slowdown is independent of the level of the terminal rate。

Regarding this pause, Powell also said that after easing the pace of rate hikes, the Fed can include more data and information in its decision-making and can wait for the economy to absorb and reflect the full effects of the credit crunch caused by monetary policy and banking events.。If you look at the pace of rate hikes separately from the terminal rate, he thinks it makes sense to pause。

Regarding monetary policy in July, he said that the FOMC Committee insisted on a one-session discussion and did not make any decisions on the future monetary stance at this meeting, especially at the July meeting.。He also revealed that the Fed will broadcast live the July meeting。

As for the upward shift in the dot plot, Powell explained: "First of all, the data is higher than expected, but if you compare it with the SEP in March, the forecast does not deviate too much: GDP growth is up, the unemployment rate is down, inflation is up, which means more policy tightening is needed.。The terminal interest rate predicted by the dot plot is fairly consistent with the interest rate expectations for market trading prior to the March banking event, which means we are back to March。"

Powell then focused on the explanation of the level of inflation。He said that over the past two and a half years, the financial sector and the Federal Reserve have repeatedly predicted downward inflation, and the results have been wrong。Core PCE inflation rates haven't made much headway in the past six months and still hover at 4.5% above the level, there is no real significance to the downside。So today's Fed policy decision both slows the pace of rate hikes and signals a stance to continue raising rates during the year。

He noted, "I think it's still the same narrative about where de-inflation comes from.。On the commodity inflation side, the supply side has improved but not yet returned to its original level; on the housing inflation side, new rental prices are lower and the downward shift in data is only a matter of events。Most of the downward shift in inflation this year and next will come from this sub-item, but the rate of de-inflation may be slower than expected; finally, core services inflation accounts for more than half of core PCE, and signs of deflation are not yet evident.。Labor costs are the biggest cost of this sub-item, and there are some indicators that the labor market is cooling, but we need this to continue。In short, although inflation has entered a downward channel, the process of de-inflation is blocked and long.。"

He also went on to reaffirm the Fed's determination to fight inflation.。He said that, as shown in the SEP dot plot, the FOMC Committee agreed on the need to reduce inflation to the 2% target level and would do whatever it takes to do so (Whatever it takes)。This is our plan。Price stability is for the benefit of today's workers, families and businesses, benefits generations, is the cornerstone of the economy, and is our top priority.。

In the end, he directly "killed" the market bet that the Fed opened the interest rate cut window this year.。He said: "As we all know, not one person on the committee voted to cut interest rates this year, and I don't think it's likely to be appropriate to do so this year.。Inflation hasn't really come down, there hasn't been much of a response to the current rate hike and we have to keep working。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.