Weilai Q1 loss and then expand gross profit and delivery volume are down! Li Bin finally let go: the whole department cut prices by 30,000 yuan!

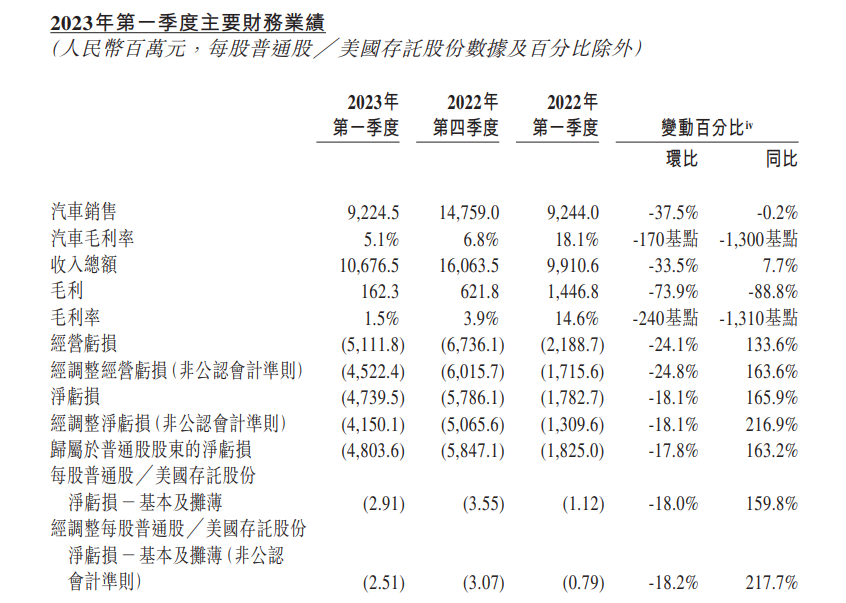

On the evening of June 9, Weilai released its first-quarter results for 2023.。Performance data show that NIO's total revenue in the first quarter of 2023 was 106.76.5 billion yuan, down 0.2%; gross profit of 1.62.3 billion yuan, down 88.8%; net loss of 47.39.5 billion yuan, up 165% year-on-year.9%。On June 12, Weilai announced a $30,000 cut in the starting price of all models.。

On the evening of June 9, the new energy forces "Wei Xiao Li" in the first quarter of 2023, although late but to。Performance data show that NIO's total revenue in the first quarter of 2023 was 106.76.5 billion yuan (RMB, the same below), down 0.2%, down 33.5%; of which automobile sales revenue was 92.24.5 billion yuan, down 0.2%, down 37.5%。This was mainly due to lower average selling prices due to lower deliveries and higher deliveries of ET5 and 75kWh standard battery packs.。Other sales revenue increased in the same period and month-on-month, mainly due to the increase in accessories sales, maintenance services, automotive financial services, used car sales and energy solutions brought about by the increase in ownership.。

The data also show that the gross profit of NIO 2023Q1 is 1.62.3 billion yuan, down 88.8%, down 73.9%。Automotive gross margin declined due to changes in product mix and increased battery unit costs, resulting in a first quarter gross margin of only 1.5%, compared to 14.6%, 3 in the previous quarter.9%。Automotive gross margins also declined on a year-over-year basis; in terms of net profit, Weilai's net loss in the first quarter was 47.39.5 billion yuan, compared with 1.7 billion yuan in the same period last year..82.7 billion yuan。Adjusted net loss (non-GAAP) was 41.50.1 billion yuan, compared with 1.3 billion yuan in the same period last year..09.6 billion yuan。

This quarter, Weilai continued to increase revenue without increasing profits.。Although the net loss recorded narrowed month-on-month, it still more than doubled year-on-year。At the same time, gross margins also declined on a year-over-year basis, to just 1 in the first quarter..5%, automotive gross margin is only 5.1%。Regarding the decline in gross profit on vehicles, the company explained that it was due to changes in product mix on the one hand and increased discounts offered for the previous generation ES8, ES6 and EC6 models on the other.。

Continued losses and declining gross margins, coupled with a decrease in deliveries from the previous quarter, make it easy to worry about whether NIO will be able to meet its previously stated goal of breaking even in the fourth quarter of this year.。On the post-performance conference call, Li Bin, founder, chairman and CEO of Weilai, said that from the current situation, it will definitely be pushed back, but Weilai hopes that this postponement can be controlled within a year.。Weilai CFO Feng Wei followed up with a boost: "With the delivery of the 2nd generation platform products, our product prices will improve in the second and third quarters, the average selling price and gross margin will pick up, we expect the third quarter gross margin can return to double-digit levels, in the fourth quarter more than 15%。"

Regarding whether there is a short-term financing plan, Li Bin said: "The delivery in the first and second quarters of this year is indeed a little less than in the fourth quarter of last year, which also affects the cash flow of operations, but we believe that with the recovery of delivery in the third quarter, the cash flow of operations will definitely improve, and our current cash can support the company's business development in the visible future.。"

As at 31 March 2023, the Group's cash and cash equivalents, restricted cash, short-term investments and long-term term deposits amounted to $37.8 billion.。By comparison, cash flow at the end of last quarter was about $45.5 billion.。

Li Bin said that the company's financing channels are smooth, Li Bin also revealed that the company has been taking relevant actions to deal with the continued losses: "This year, we have also taken some measures, such as some fixed asset investment, we have postponed, including some research and development projects, but also postponed, as well as our global market entry, in Europe, this year we will also focus on several countries that have entered.。And as he said, both NIO's R & D and internal administrative costs showed signs of slowing down in the first quarter.。R & D expenses (non-GAAP) are 27.11.6 billion yuan, up 79% year-on-year.1%, down 23.7%。Selling, general and administrative expenses (non-GAAP) are 22.39.3 billion yuan, up 24.3%, down 31.2%。

The number of deliveries is getting ugly, and Weilai finally announced a price cut, which Li Bin can't hold on to.?

In terms of vehicle deliveries, vehicle deliveries in the first quarter amounted to 31,041 vehicles (including 10,430 high-end smart electric SUVs and 20,611 high-end smart electric cars), an increase of 20% year-on-year..5%, a decrease of 22.5%。

This result is only slightly better than Xiaopeng in the middle of "Wei Xiaoli."。The ideal delivery volume is up year-on-year, while Xiaopeng is down year-on-year.。Extending to April and May, Weilai's deliveries are already on the red light.。The delivery volume of Weilai in May hit a new low for the year, not only in the "Weili," but also in a number of new energy vehicle companies is a rare occurrence of the same, ring-on-ring decline of the brand.。Since 2023, NIO's car delivery data has fallen month by month.。A total of 43,854 vehicles were delivered in January-May, just 17 short of its target of annual sales of 250,000 vehicles..54%。

For the decline in delivery data, Weilai said that as the company pushed its models to the second-generation technology platform NT2.0 platform switch, a number of products are in the replacement period, can deliver only NIO ET5 and ES7 products。

Looking at the fewer and fewer delivery figures, Weilai felt that things were going badly and rushed to launch the new ES6 at the end of May.。This is equipped with the second generation technology platform NT2.ES6 of 0 was launched in China on May 24 and delivery began the next day。In the earnings report, Weilai gave second-quarter delivery guidance of 23,000 to 25,000 units, slightly higher than market expectations, and with the delivery figures so grim, it seems that Weilai is trying to bet on ES6.。

Judging from the post-performance call, Weilai seems to be quite satisfied with ES6 at the moment。Li Bin said that the ES6 has reached the expected situation of the lock order, the test drive conversion rate is the highest test drive conversion rate in the history of all models of the company.。He said: "ES6 in June is certainly a climbing process, our current goal is to achieve the production and delivery of 10,000 vehicles in July, we are still confident to achieve the goal.。"

However, after the launch of ES6, some users thought the price was too high.。It is reported that ES6's Nappa leather, seat massage / ventilation / heating, queen seat and other comfort configurations need to be optional. In contrast, these configurations are standard on the ideal L7 Air model。

Although ES6 has been listed, but whether it will become a burst is still unknown.。In the face of a record number of deliveries, Li Bin, who had previously set a Flag saying "never cut prices," finally let go and announced a price cut.。

On June 12, Weilai announced a $30,000 cut in the starting price of all models.。Specifically, the rights and interests of the first owner of a new car are adjusted to a 6-year or 150,000-kilometer warranty for the entire vehicle, 6-year free car networking, and lifetime free road rescue.。At the same time, free power exchange service will no longer be used as a basic car rights, users can choose a single payment for power exchange, NIO will then launch a flexible charge and exchange service package。For users who have already picked up their cars, the rights and interests of the first car owner, including a lifetime free power exchange, remain unchanged. When repurchasing a new car, users can choose to transfer the rights and interests of the original car to the new car, or choose to give up their rights and interests in the car to offset the purchase price of 30,000-50,000 yuan.。

This price cut is also a precursor.。Earlier in the phone conference, on whether the price will be reduced in exchange for sales, Li Bin said that the entire market price changes are very large, but certainly will not use the reduction of the way to do the corresponding price adjustment。He added: "Of course, we are also considering a lot of flexible measures, for example, for those who do not need to switch services, we have a better approach, we are also conducting various aspects of the study."。"

"Wei Xiao Li" pricing overlap, fight or increasingly fierce

In Weilai's planning, a stepped price layout will be formed。At present, the "Weilai" brand in the sale of models are priced at more than 300,000 yuan, the second brand "Alps," the price will be down to 20-30 million yuan.。Although the third brand "Firefly" focuses on the European market, it will also be sold domestically and is expected to sell for between 100,000 and 200,000 yuan.。The two sub-brands are expected to be in mass production in 2024.。Such as sub-brand cars listed, Weilai's car series will cover the price range of 10-65 million yuan.。

In terms of ideals, there are also three price steps, namely, the ideal L5 and L6 for medium-sized cars of 200,000-300,000 yuan, the ideal L7 and L8 for medium-sized cars of 300,000-400,000 yuan, and the ideal L9 for full-size cars of 400,000-500,000 yuan.。Founder Li Xiang said at the beginning of the year that there would be no models under $200,000。

And Xiaopeng, the current model is basically 150,000-300,000 yuan。In a quarterly call, founder He Xiaopeng has revealed that there will be a small amount of layout below 200,000 and above 300,000, but the core is still between 200,000 and 300,000 yuan.。

As you can see, the price coverage of the "Wei Xiaoli" three families is relatively wide.。For Weilai, the future of 300,000 yuan or more of the ideal model will be the main rival, 300,000 yuan or less Xiaopeng will compete with it.。

All along, the models launched by NIO are mainly high-end models。At present, Weilai has ranked first in China's high-end pure electric vehicle market of more than 400,000 yuan for 12 consecutive quarters.。It is precisely because of the high price of its models that Weilai has been able to watch the fire from the shore in the "price war" of electric vehicles this year.。But once the Weilai into the low and medium price range of models, is bound to also face the pricing of this life and death barrier, which will be a big test for the Weilai。Although Weilai's "Alps" and "Firefly" are planned to be launched in Europe first, car companies are now "going to sea," so whether in China or outside China, Weilai's competition will only be big or not.。The future of the advantages of the geometry, it is difficult to say。

Q1 performance is not ideal, a number of major banks cut the target price of Weilai H shares

Citi released a research report saying that, given the huge pricing and profit pressures in the industry, the gross margin forecast for NIO from this year to the following year was reduced from 17.1%, 22.9% and 23.1%, respectively, down to 7.1%, 9.1% and 9.4%。At the same time, this year's net loss forecast from 4.9 billion yuan, down revised to a net loss of 12.5 billion yuan, next year and the following year's net profit forecast from 1.4 billion yuan and 3.3 billion yuan, respectively, to a net loss of 5.9 billion yuan and 3 billion yuan.。H-share target price from 102.HK $7 down to 88.4 Hong Kong dollars。Maintain a "buy" rating。

Furui reports that Weilai's first-quarter results are again worse than expected, with gross margins down 1.7 percentage points to 5.1%, net loss widened to approximately RMB4.8 billion。Q2 delivery guidance is 2.30,000 to 2.50,000 units, meaning an increase of 19% to 26% from the previous year, in line with expectations.。

The bank believes that while the delivery of the Group's new ES6 and the upcoming mass-market brand Alps may help it, the high fixed costs associated with channel development and BaaS will continue to hinder the Group's move to profitability.。The bank noted that the group lacks models that can achieve economies of scale and that high sticky fixed costs will hamper profitability until deliveries pick up, adjusting its earnings per share forecast for 2023 and 2024 to a loss of 7.RMB 2 and loss 6.Rmb1 to reflect weaker margin outlook。The bank maintains the Group's "hold" rating, with an H-share target price of 53..HK $39 to 52.HK $74。

Bank of America Securities released a research report that Weilai's first-quarter results fell short of expectations, the company's sales forecast for the next two years down 21% and 24% to reflect the latest product release channels and market competition, while lowering its gross margin and sales forecast, the expected net loss will be expanded.。The bank lowered its target price on NIO's H-shares from HK $93 to HK $85, reiterating its "buy" rating.。

Although the first quarter results were weaker than expected, but affected by news such as price cuts, today's Weilai-SW rose nearly 5% to close at 63.HK $15。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.