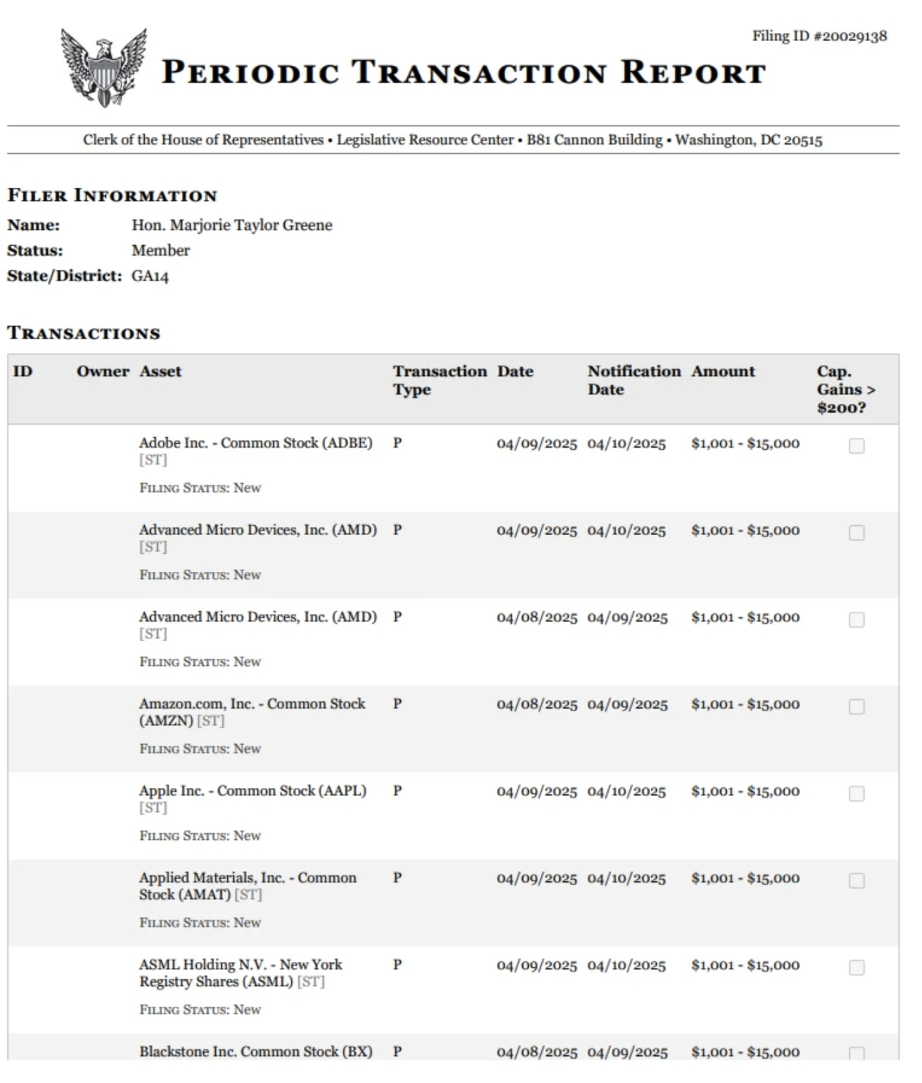

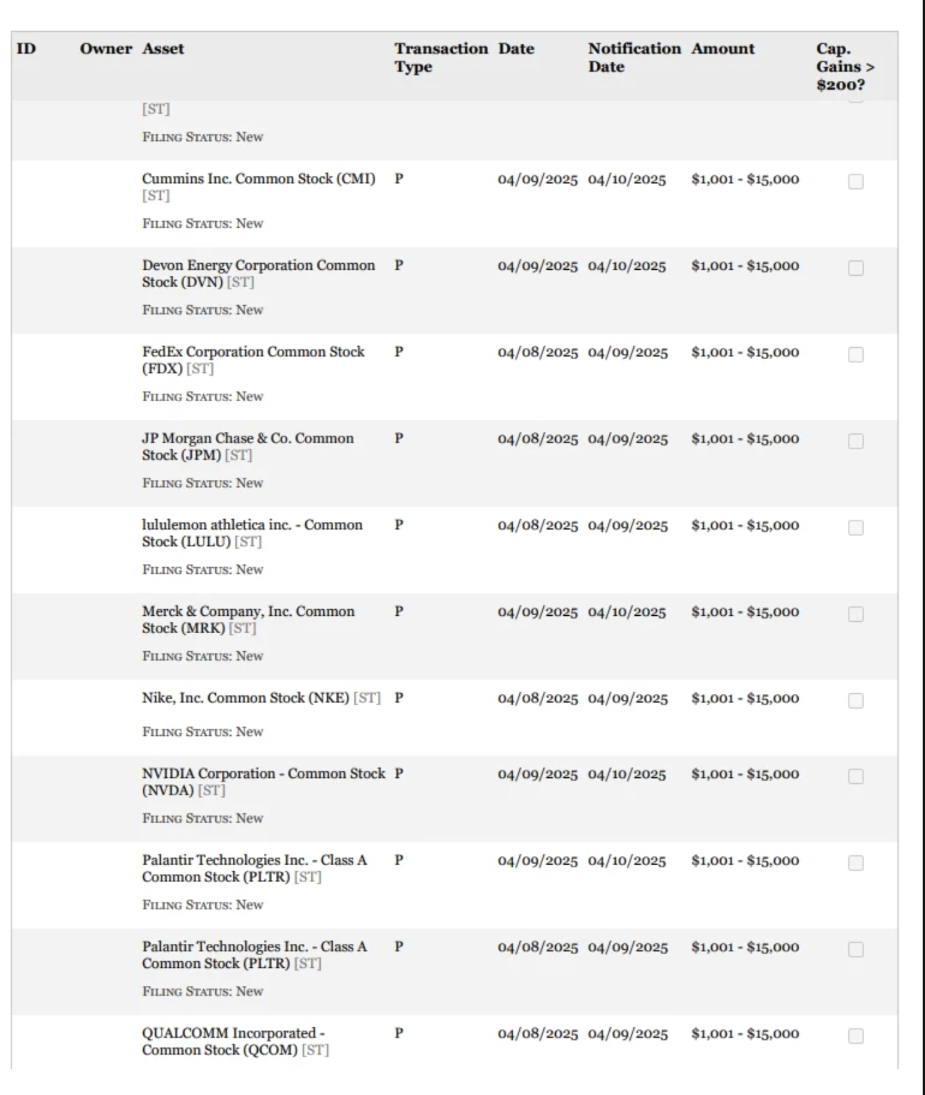

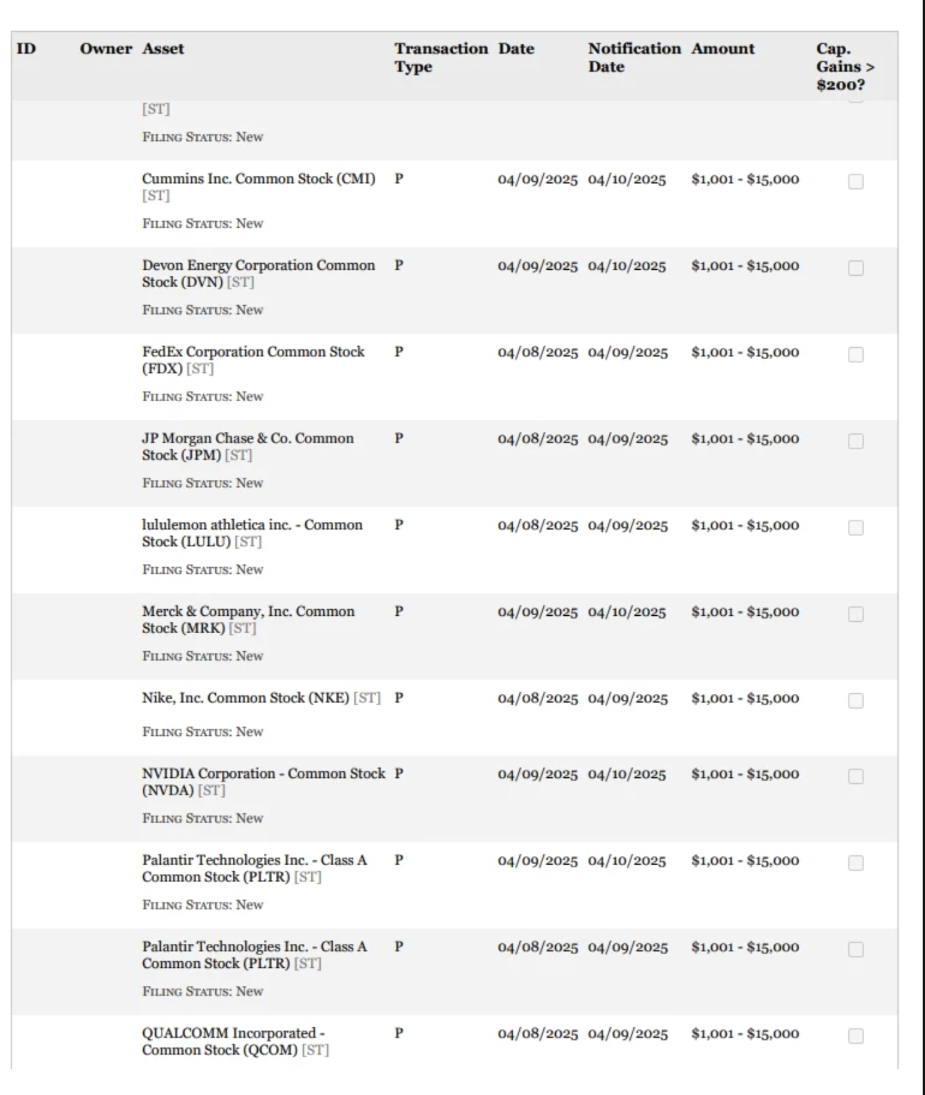

According to congressional disclosures, she made a total of 21 stock purchase transactions between April 8 and 9.

On April 15, according to the U.S. Congressional Trading Report, Republican Representative Marjorie Taylor Greene had accurately purchased Apple, Amazon, Tesla and other technology stocks, and their operating hours highly coincide with market turning points before U.S. President Trump announced the suspension of so-called "reciprocal tariffs" on some countries.

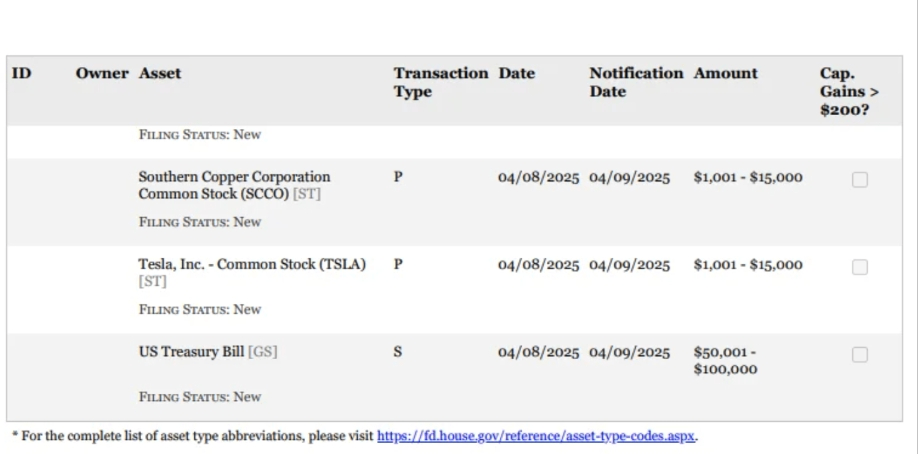

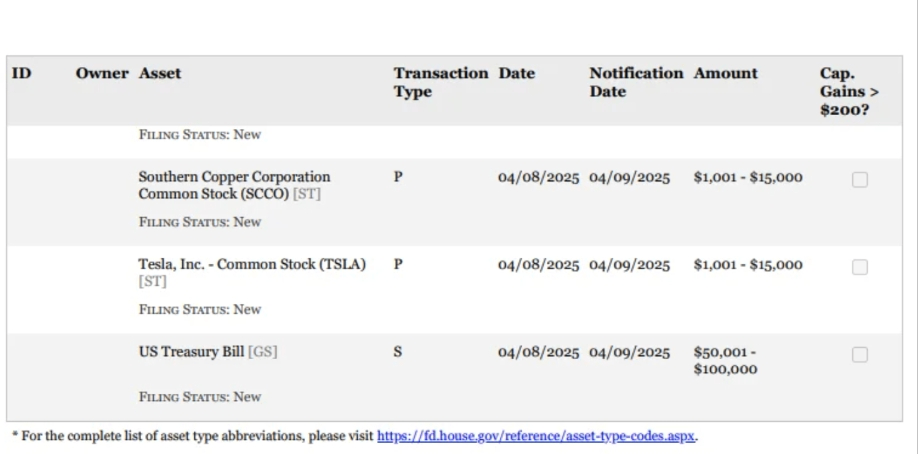

According to U.S. Congressional disclosure documents, she conducted a total of 21 stock purchase transactions between April 8 and 9, with amounts ranging from $21,000 to $315,000, covering technology giants such as Apple, Nvidia, AMD, and Qualcomm., as well as star stocks in the consumer sector such as Tesla and Lulemon.

What is even more intriguing is that she simultaneously sold US$50,000 to US$100,000 worth of US Treasury bonds, echoing subtly the Trump administration's logic of adjusting its tariff policy due to debt pressure.These stocks generally rose sharply after the policy was announced. For example, Apple's market value returned to US$3 trillion due to tariff exemptions. AMD's share price rose by 21% in four days. Palantil Technology once soared by 19%.

It is worth noting that Green is not an isolated example: after Trump took office in December 2024, she has increased her shares at market lows many times, and this operation is just a continuation of her "counter-cyclical investment strategy."

Not only Marjorie, but also US President Trump, who is also a Republican, has also been mired in insider trading recently.Before the U.S. stock market opened on April 9, 2025, U.S. President Trump posted a news message with only 12 words on social media-"Now is a great time to buy!DJT (Trump Media Technology Group Code)"-This seemingly random tweet became the trigger for a dual political and financial storm.

Four hours later, Trump announced the suspension of "reciprocal tariffs" on most countries. U.S. stocks soared in response. The Nasdaq index soared 12.16% in a single day, setting the second-largest single-day gain in history.Data showed that S & P 500 call options surged tenfold before the policy announcement, indicating that some funds were betting in advance on a policy shift. This abnormal trading pattern further supports the market's concerns about information leakage.

Similar incidents occurred one after another, and Democratic lawmakers quickly pointed the finger at potential power rent-seeking.House Leader Hakeem Jeffries publicly called for a complete ban on members of Congress from trading stocks, pointing out that the "Capitol Hill stock gods"'use of information asymmetry to make profits has touched the bottom line of public tolerance.Senator Elizabeth Warren pushed for an independent investigation, calling for a thorough investigation of "who was trading, who made money, who knew what and when."

Although Green argued that transactions were handled with the sole authority of his financial advisers and complied with the CIFI rules, the ambiguity of the definition of "inside information" in U.S. securities law-especially the information time difference between policymakers and market participants-made such incidents often fall into the dilemma of "moral failure and legal difficulty."Scholars who study U.S. government corruption point out that the SEC's past investigation of politicians 'transactions has a success rate of less than 5%, and regulatory loopholes have essentially condoned "legalized" insider operations.