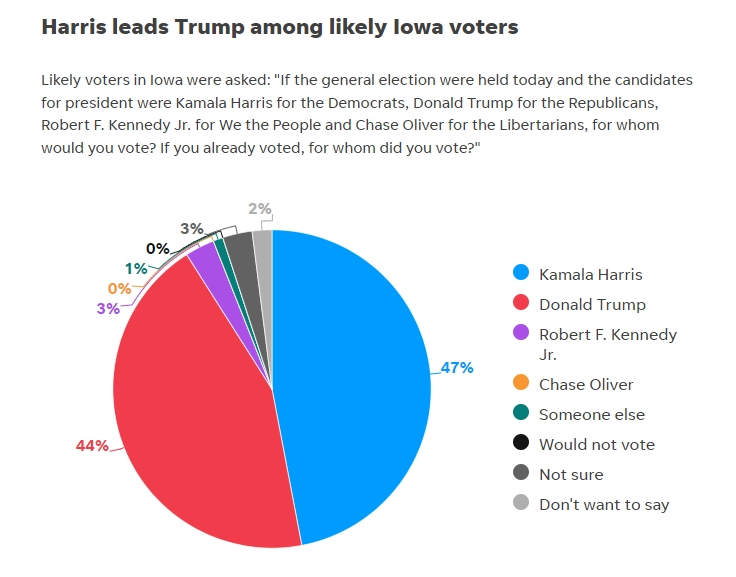

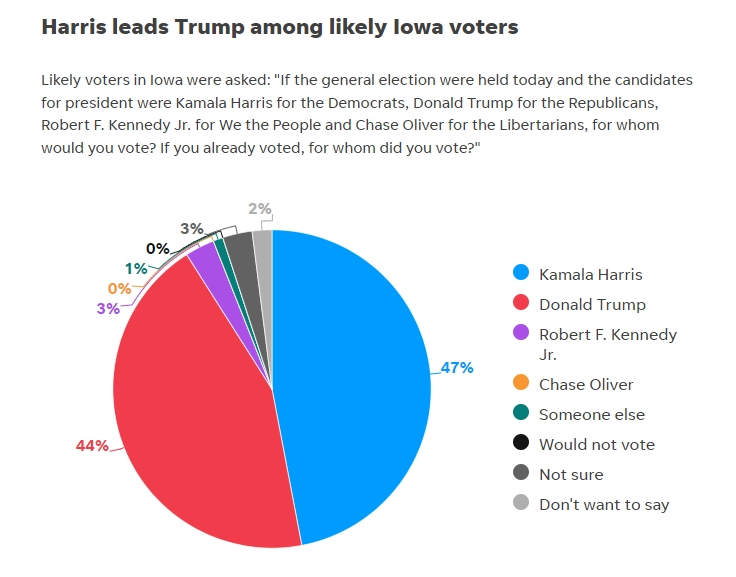

On November 4, the U.S. election is approaching. The U.S. dollar index plunged 0.4% at the opening of Monday due to changes in Iowa polls.In less than two months, the region's election situation reversed from Trump's 4-point lead to Harris's 4-point lead, scaring the recent "Trump Deal" dominated market.

The election in just a swing state can have a huge impact on the huge foreign exchange market. This is the power of the US election.

However, the U.S. election campaign lasted less than a week, while the U.S. president's term lasted for four years.The amplification of short-term volatility may usher in retail investors 'carnival, but from a long-term perspective, the market will eventually calm down.Because of this, whether the election of the US president will bring long-term industry benefits-this topic has begun to enter the horizon.

Especially in the chip industry, judging from the third quarter, whether or not they can carry the AI label is already a criterion for whether chip manufacturers can make profits: companies such as Nvidia, TSMC, and sk Hynix that have deployed AI early have all delivered good results. The third quarterly report, while the results given by lagging behind manufacturers such as Intel and Samsung are not satisfactory.In this situation, even lithography giant Asme has no choice but to lie down-the company's AI-related businesses are very profitable, and it was the downturn in the traditional chip business that caused the company's performance to explode in October.

So, just as chip manufacturers have reached a crossroads and run head-on into the U.S. election, what impact will it have on the chip industry in the next four years?

Let's start with the conclusion. No matter which party is elected, the chip industry will be the focus of the future development of the United States, and this will not change.

In 2022, the U.S. Congress passed the "Chip Act", which stipulates that the United States will provide US$52.7 billion to subsidize the U.S. chip industry. In addition to direct subsidies, the U.S. Congress has approved up to $75 billion in government loan authorizations to support the country's chip manufacturing industry.

The original intention of the U.S. government's move was to promote the return of high-end manufacturing and promote regional economic development, while at the same time building a protective fence for the outflow of cutting-edge technology.Under the Chip Act, eligible manufacturers can not only receive financial support, but also receive an investment tax credit of up to 25%.In terms of research and development, Congress will approve as much as US$200 billion in scientific research funding in the next few years.

It is worth noting that the "Chip Bill" received joint support from both Democrats and Republicans when it was introduced.In other words, the bill itself has a very light partisan color.U.S. policymakers see the bill as a means to expand their future lead. No matter who is elected in the 2024 election, the United States 'determination to develop the chip industry will not change.

On the other hand, what the Democratic Party has been criticized by the market in the past four years is its excessive supervision of the technology industry.During Lina Khan's tenure as chairman of the Federal Trade Commission, she spent most of her time focusing on competition issues in the technology industry. Since existing laws did not adapt well to the situation of the technology industry, the Federal Trade Commission always had to "cross the river by feeling the stones" and make some rulings.For example, the U.S. District Court recently ruled on Google's illegal monopoly case. In extreme circumstances, the company may have to spin off its search business.

But this situation is likely to not last after the election. According to media reports, Lena Khan, known as the "technology butcher", is likely to not return to the Federal Trade Commission.Democratic candidate Harris said during the campaign that she would seek to balance competition and innovation with a "new way forward" strategy that would "encourage innovative technologies such as artificial intelligence and digital assets while protecting our consumers and investors."

Needless to say, Trump, who figured out MAGA's trump card early on, said during the campaign that his administration would "cut costly and burdensome regulations"-which would also benefit the large technology industry.Moreover, Trump is also preparing to impose high tariffs on foreign goods, which will also benefit the return of U.S. manufacturing.

Judging from historical stock prices, U.S. technology stocks rose 177% during the Trump administration, but during the Biden administration, U.S. technology stocks rose "only" 95%.

So, how should we ordinary people grasp the dividends of this wave of chip industry?

From an investment perspective, the stock prices of U.S. technology stocks, especially those related to artificial intelligence, are generally relatively high, and it is more difficult for ordinary investors to participate-take Nvidia as an example, buying a share of Nvidia costs $135; the stock prices of Oracle and Google are both above $150; Microsoft's stock price is around $400; and Meta's stock price is as high as nearly $600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, saving the trouble of selecting.Moreover, for the ETF stock pool, no matter which stock in the basket rises, the ETF will receive the income, which is equivalent to reducing another layer of risk for investors and reducing the pressure brought by sector rotation.

Moreover, ETFs do not face the risk of suspension or delisting.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.For ordinary investors or novice investors, ETFs are undoubtedly the best choice to participate in the artificial intelligence market.