Energy, Tech, and Financials: Top Sectors to Rebound After Tariff Tension

According to strategists at 22V Research, once the turbulence caused by tariffs eases, three sectors are expected to rebound the strongest: energy, financials, and technology stocks.Based on 22V's cal

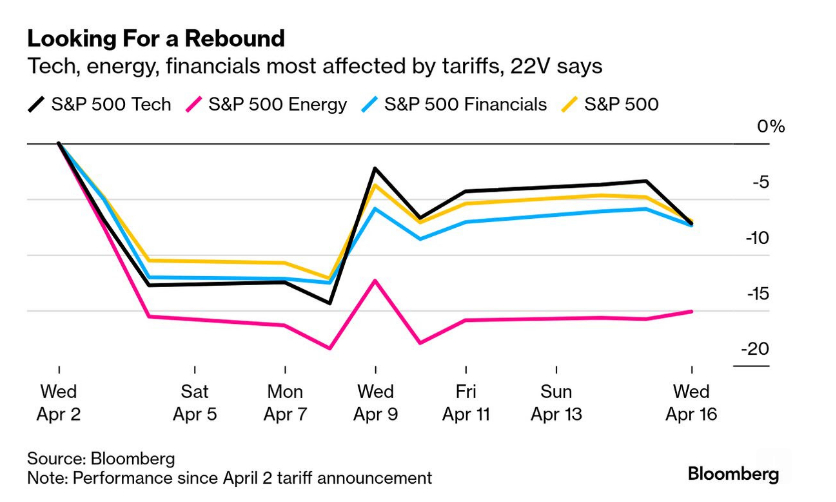

According to strategists at 22V Research, once the turbulence caused by tariffs eases, three sectors are expected to rebound the strongest: energy, financials, and technology stocks.

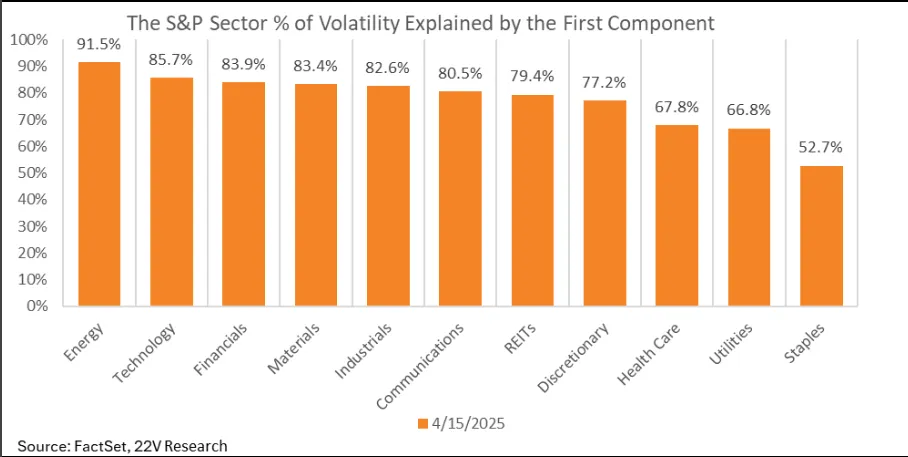

Based on 22V's calculations, the decline in these sectors has been most closely linked to tariff-related news in April. For example, in the energy sector, tariffs explain over 90% of the fluctuations in the past month. During this period, the energy sector dropped by 16%.

22V Research speculates that once tariff tensions ease, these sectors will experience a strong rebound, as the more compressed the spring, the stronger the bounce.

Kevin Brocks, Director at 22V Research, stated, Once tariff concerns subside, the energy sector will become one of the major beneficiaries, as an improvement in the global economic outlook could stimulate more demand for oil. Similarly, stronger consumer spending could boost credit card usage and loan activity, benefiting financial companies. Meanwhile, as tariff clarity improves, demand for electronics and gadgets will support the technology sector.

22V's outlook is supported by actual market data. According to bank of america, energy ETFs saw an inflow of $129 million last week, making it one of the highest inflows in the sector's ETFs.

Goldman Sachs' trading desk also showed that hedge funds bought U.S. financial stocks in the highest quantities in four months last week.

Dennis Debusschere, president of 22V and one of the strategists behind the volatility research, has a solid track record. In March 2020, he predicted that U.S. stocks could quickly recover their losses if fiscal stimulus took hold, and that is exactly what happened.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.