Bank of America analyzed that semiconductors, as a core area that accounts for 50% of the total global chip demand, discussions on its terminal market structure will directly affect corporate strategies and capital flows.

On April 15, Bank of America reiterated that Nvidia and Broadcom were the preferred semiconductor targets in the context of the Trump administration's announcement of exemption from additional tariffs on mobile phones, semiconductors and computers.In addition, Bank of America has also included equipment manufacturers such as Kengteng Electronics, Xinsi Technology, and Fanlin Group in the recommended list.

Although the tariff is only suspended for 1-2 months, the market interprets this as a window period for industrial chain adjustment. According to Bank of America analysis, semiconductors, as a core area accounting for 50% of the total global chip demand, will be discussed on its terminal market structure directly Affect corporate strategy and capital flows.

The Trump administration's tariff policy has always wavered between "coercion and inducement."

On the one hand, subsidies are provided through the Chip and Science Act to attract companies to set up factories in the United States; on the other hand, tariffs of up to 100% are used to force the transfer of the industrial chain.

This move is undoubtedly effective.At present, U.S. semiconductor giants overseas have accelerated their localization in the United States: TSMC's Arizona factory has launched Blackwell artificial intelligence chip production, Nvidia has chosen to move some high-end GPU production to the United States, and Broadcom is also exploring the possibility of acquiring Intel chips.

From the data point of view, the growth momentum of the semiconductor industry is accelerating from consumer electronics to AI infrastructure.IDC data shows that the global semiconductor market is expected to grow by 11% in 2025, with demand for AI-related chips becoming the core driving force, as evidenced by the year-on-year surge of 192% in Nvidia's data center business in the first three quarters.

Under this trend, Bank of America has also included Kengteng Electronics and Synopsis Technology in its recommendation list, highlighting the key role of chip design tool manufacturers in lowering the threshold for AI development.At the same time, the benefit logic of equipment manufacturers such as Fanlin Group and Kelei stems from the capital expenditure cycle driven by the United States 'promotion of the construction of local wafer fabs.

In investing in U.S. stocks, in addition to buying individual stocks directly, what more stable options do we have?

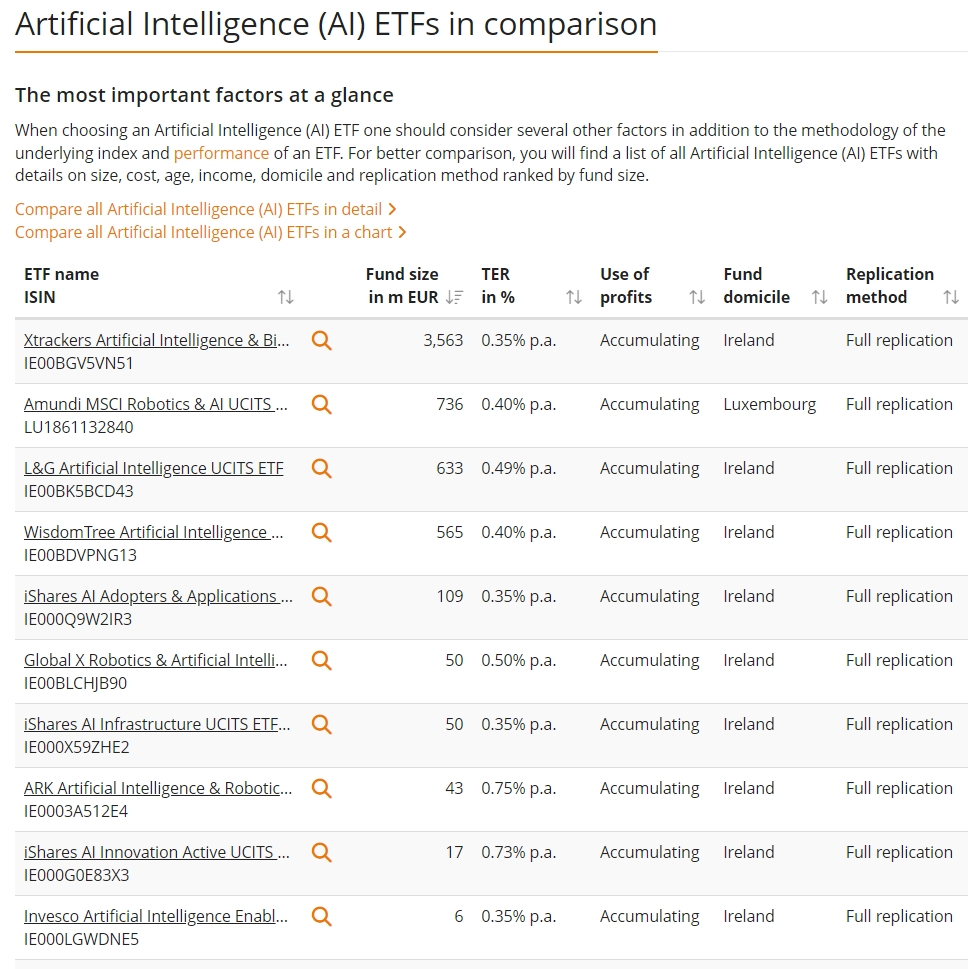

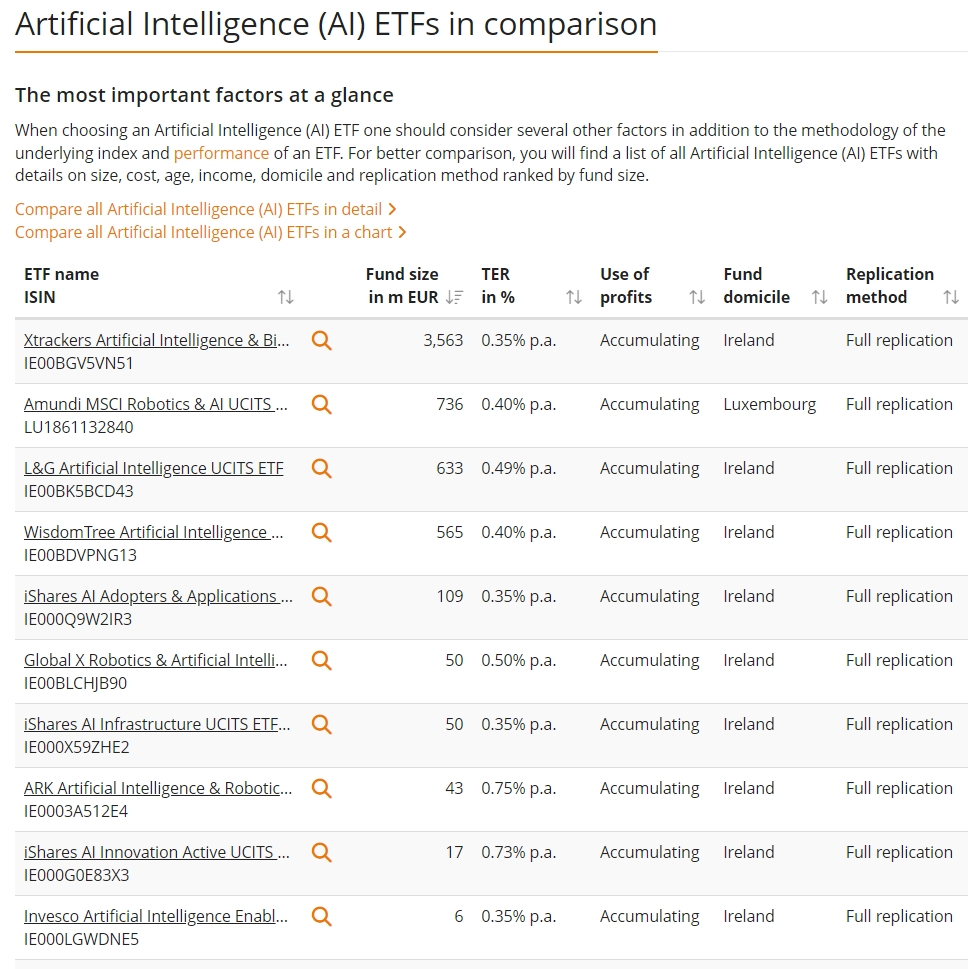

Buying semiconductors, artificial intelligence-related ETFs may be more suitable for ordinary people who do not have time to conduct in-depth research and have small amounts of capital.

Because the stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc., the capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

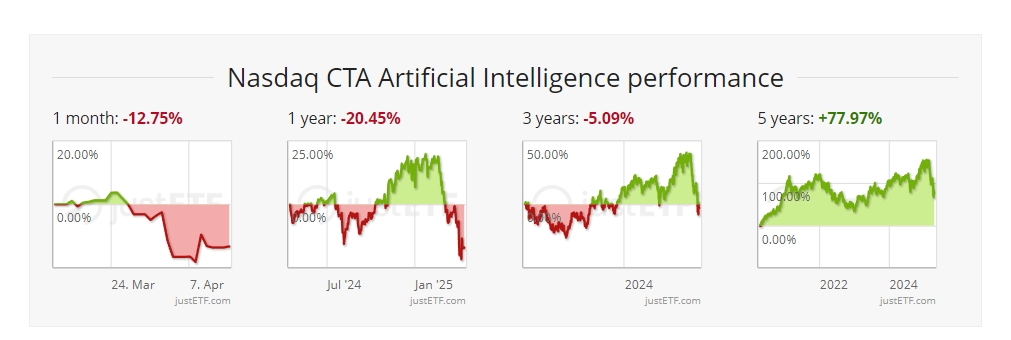

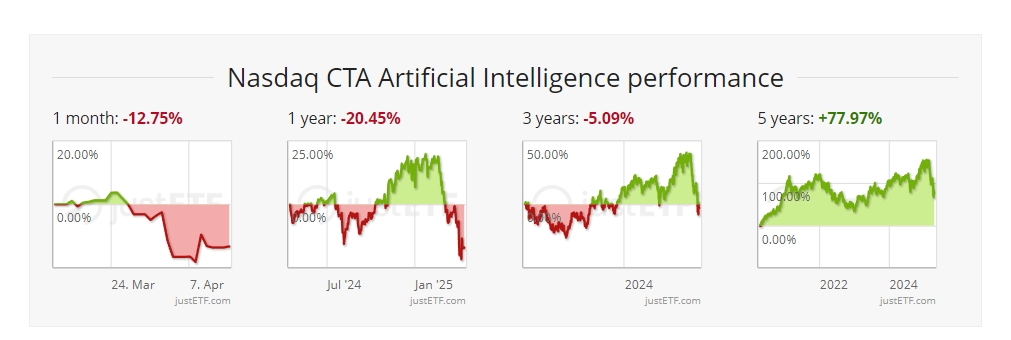

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

I wish everyone a smooth investment ~

![]()