3 Understated Signs Suggest Cardano (ADA) Price Risks Falling Below $0.70

Cardano (ADA) faces risks of dropping to $0.69 amid falling volume and bearish signals. Could ADA rebound, or is a deeper correction likely?

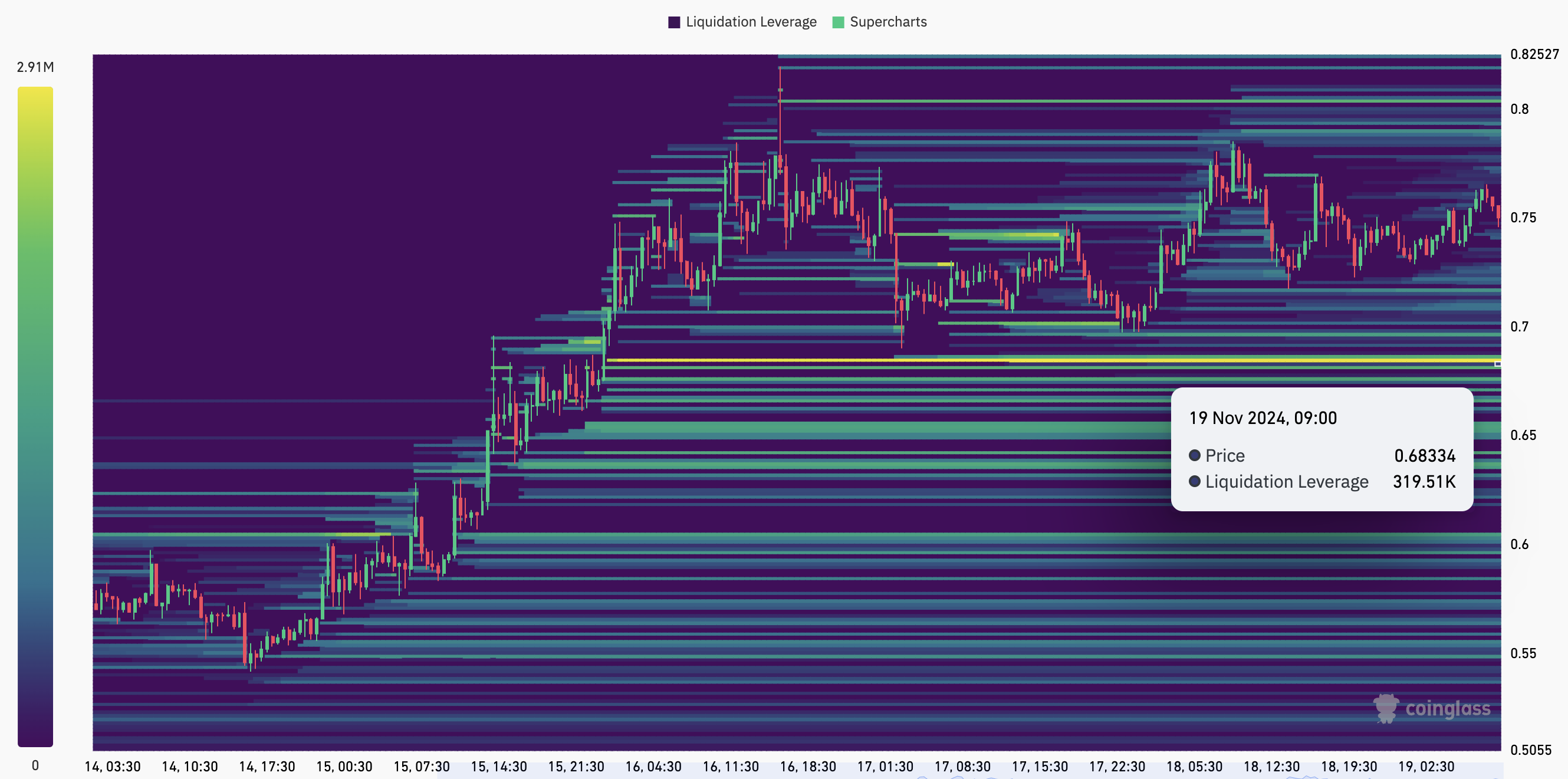

- Cardano (ADA) faces bearish pressure, with the liquidation heatmap highlighting a potential drop to $0.69 due to concentrated liquidity.

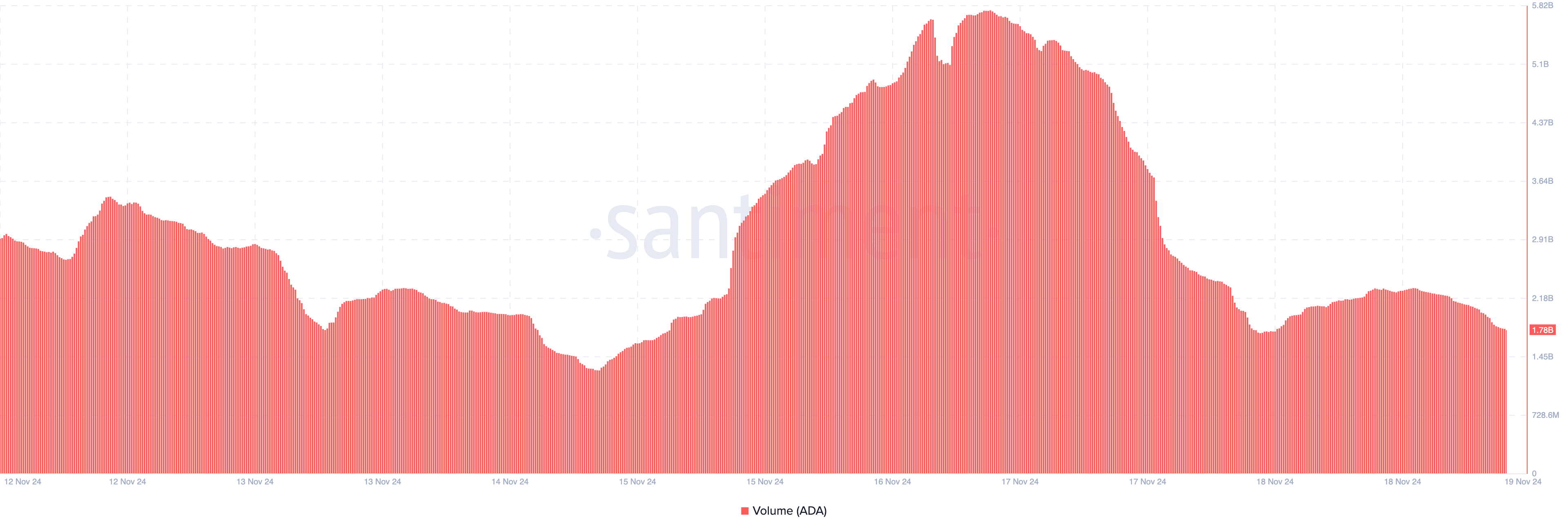

- Trading volume has plummeted from $6B to $1.78B, signaling reduced investor interest and increasing chances of further price declines.

- Bollinger Bands suggest heightened volatility; ADA could fall to $0.63 if selling pressure persists, or rebound to $0.82 with renewed buying.

Recently, Cardano (ADA) attempted to reach $0.80 but fell short, with its price now at $0.75. This decline has sparked concerns about its short-term prospects.

These concerns might be valid, especially as this on-chain analysis suggests that ADA could slip lower than it has in recent times.

Cardano Liquidity Concentration Goes Lower

According to Coinglass, the liquidation heatmap is one key indicator suggesting that ADA’s price could decrease. For context, the heatmap pinpoints price levels where large-scale liquidations might occur.

The indicator also identifies price levels with a high concentration of liquidity. When liquidity is concentrated in a specific area, it often signals that the price is likely to move toward that region. On the liquidation heatmap, this is represented by a color shift from purple to yellow, indicating higher liquidity.

Further, the one-week liquidation heatmap for Cardano reveals that the concentration has shifted to $0.69. Based on this observation, ADA’s price could potentially drop from $0.75 to $0.69 in the short term, aligning with the prevailing market conditions.

Another indicator supporting the potential decline in Cardano’s price is the drop in trading volume. On November 16, Cardano’s volume was nearly $6 billion. However, according to on-chain data from Santiment, it has since dropped significantly to $1.78 billion.

Trading volume measures investor interest by measuring the total value of tokens exchanged within a specific timeframe. Rising volume indicates heightened interest and activity, often leading to an upward price surge. Conversely, a decline in volume suggests waning interest. If reversed, this could have averted another Cardano price decrease.

Therefore, the notable drop in Cardano’s volume, combined with its recent price decline, signals reduced demand and increases the likelihood of further price depreciation in the short term.

ADA Price Prediction: $0.63 Could Be Next

On the daily chart, BeInCrypto observed that the Bollinger Bands (BB) has expanded. The BB is a technical indicator that measures the volatility around a cryptocurrency. Depending on the buying or selling pressure in the market, an expanded BB could cause a quick drop or hike in price.

Further, the BB also shows if an asset is overbought or oversold. When the upper band of the BB touches an asset’s price, it is overbought. On the other hand, if the lower band hits the value, it means that the token is oversold.

For Cardano’s price, the upper band touching the price suggests that the altcoin could face a drawdown below $0.68. If selling pressure rises, ADA could drop to $0.63.

However, if Cardano’s volume increases with a resurgence in buying pressure, this might change. This could also happen if investors decide to HODL instead of liquidating their assets. In that scenario, the value could jump to $0.82.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.