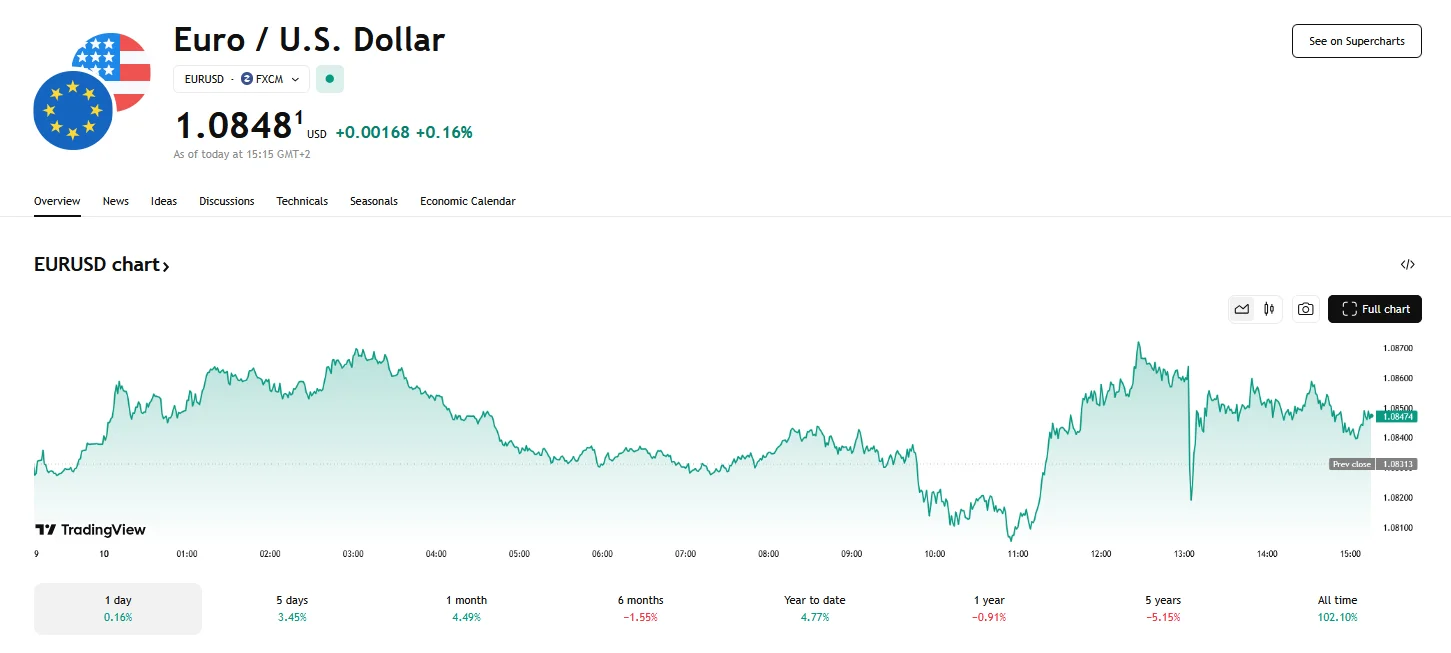

Euro Anchored at $1.08 as U.S. Dollar’s Downward Trend Persists Euro Anchored at $1.08 as U.S. Dollar's Downward Trend Persists

Key momentsThe euro has solidified its position at around $1.08, a level of stability not seen since November.The euro’s strengthening is attributed to significant policy actions within the Eurozone.

Key moments

- The euro has solidified its position at around $1.08, a level of stability not seen since November.

- The euro’s strengthening is attributed to significant policy actions within the Eurozone. Key factors include Germany’s planned fiscal reforms, the European Central Bank’s measured interest rate cut, and increased defense spending across Europe.

- Negative momentum from weak U.S. economic data and tariff fears have resulted in a weakening U.S. dollar.

Euro Gains Ground Amid Global Economic Uncertainties

The euro has found a stable footing around the $1.08 mark, a level it hasn’t consistently maintained since the early days of November. This consolidation comes on the heels of a significant upward movement, spurred by a confluence of economic and political factors within the Eurozone.

A primary catalyst for the euro’s strength was the announcement of substantial fiscal policy changes in Germany. The nation’s key political factions revealed plans to overhaul existing debt restrictions and establish a considerable infrastructure fund. Simultaneously, European leaders reached an agreement to boost defense expenditures, reinforcing the region’s security and industrial base. These decisions injected renewed confidence into the euro.

Additionally, the European Central Bank (ECB) implemented a widely anticipated reduction in interest rates, signaling a move towards a less restrictive stance. While the ECB’s action was broadly expected, its acknowledgment of a shifting policy landscape has fueled speculation about potential future rate adjustments.

Conversely, the U.S. dollar has faced considerable selling pressure, influenced by a combination of economic data and policy decisions. Recent U.S. economic reports, including figures from the Bureau of Labor Statistics, have fallen short of market expectations, raising concerns about the strength of the U.S. economy. Specifically, the reported increase in nonfarm payrolls stood at 151,000 in February, a figure lower than the anticipated 160,000. The unemployment rate saw a slight uptick to 4.1%. Additionally, the situation surrounding Trump’s tariff policy on imports from Canada, Mexico, and China has contributed to anxieties about potential economic headwinds.

The euro’s stability around the $1.08 level reflects a balance between the positive momentum generated by Eurozone policy changes and the ongoing uncertainties surrounding the global economic outlook.

However, the euro’s continued strength is not without potential challenges. The successful implementation of Germany’s proposed fiscal reforms hinges on political negotiations, which are expected to be complex. While initial market reactions have been positive, any significant setbacks in these negotiations could undermine investor confidence. Furthermore, the U.S. economic data, while currently showing signs of weakness, could shift in the coming months.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.