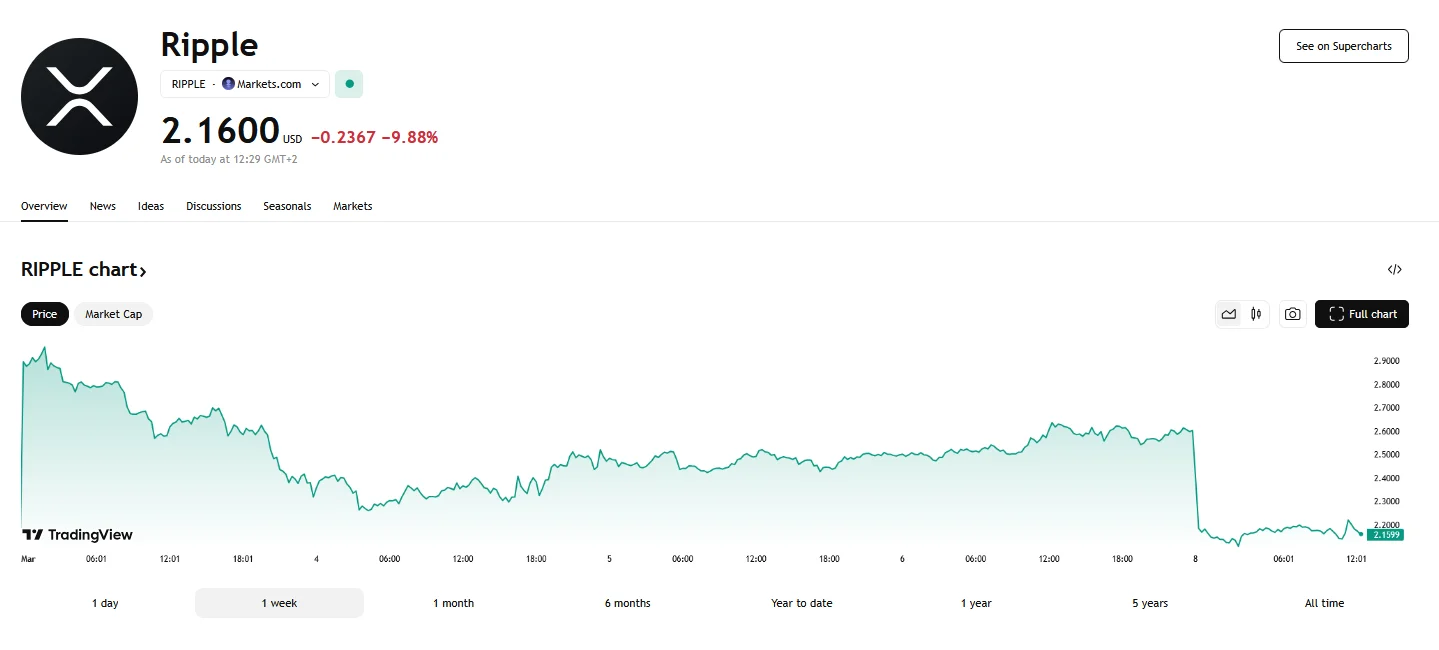

XRP Plummets 7% to Under $2.20 Amid $730M Outflow XRP Plummets 7% to Under $2.20 Amid $730M Outflow

Key momentsXRP experienced a sharp decline, with its value falling by 7% and dipping below the $2.20 mark. Market anxieties, compounded by wider crypto market downturns and global economic uncertainti

Key moments

- XRP experienced a sharp decline, with its value falling by 7% and dipping below the $2.20 mark. Market anxieties, compounded by wider crypto market downturns and global economic uncertainties, contributed to the significant price reduction.

- During Monday’s trading session, XRP’s price reached a low of $2.0887.

- A substantial $730 million outflow from XRP’s payment volume signals a decline in user engagement and confidence.

XRP’s Network Data Raises Red Flags

A significant downturn struck the XRP market, with its value plummeting by 7% as it fell below the $2.20 mark, a stark contrast to its recent highs. This decline wasn’t merely a minor fluctuation; it represented a substantial shift in investor sentiment, underscored by a massive $730 million outflow of XRP from its transactional volume. Furthermore, the cryptocurrency’s price descended to $2.0887 earlier today.

The broader crypto landscape also experienced a downturn, contributing to XRP’s woes. However, specific on-chain metrics painted a troubling picture for XRP, with declines in payment activity, active accounts, and overall transaction volume. These indicators suggested a diminishing interest in the Ripple ecosystem, potentially signaling reduced adoption and waning user engagement.

Prior to this slump, XRP had seen a period of notable growth, reaching over $3. However, this surge proved short-lived, as the token succumbed to market pressures. Despite the current bearish trend, some analysts remain optimistic about XRP’s long-term potential. They suggest that if XRP can maintain support above the $2 threshold, it might invalidate bearish patterns and even trigger a rally toward $5.

A deeper analysis of the market revealed a confluence of factors contributing to XRP’s decline. The crypto fear and greed index, a measure of investor sentiment, hit a multi-year low, indicating “extreme fear” among traders. This fear was exacerbated by global economic uncertainties, including ongoing tariff wars and a lack of significant announcements from key regulatory bodies.

The substantial $730 million XRP outflow further compounded the token’s problems. This reduction in payment volume signaled a serious lack of confidence among investors and users, raising concerns about the fundamental health of the XRP network. Historically, robust network activity has been a crucial driver of cryptocurrency price rallies. The current decline, therefore, represented a significant red flag.

Technical indicators also painted a bearish picture, with the emergence of a “death cross” pattern signaling potential further downward pressure. This pattern, combined with the lack of sustained upward momentum, suggested that XRP faced significant challenges in regaining its previous highs.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.