The US can really manage inflation successfully while avoiding a recession?

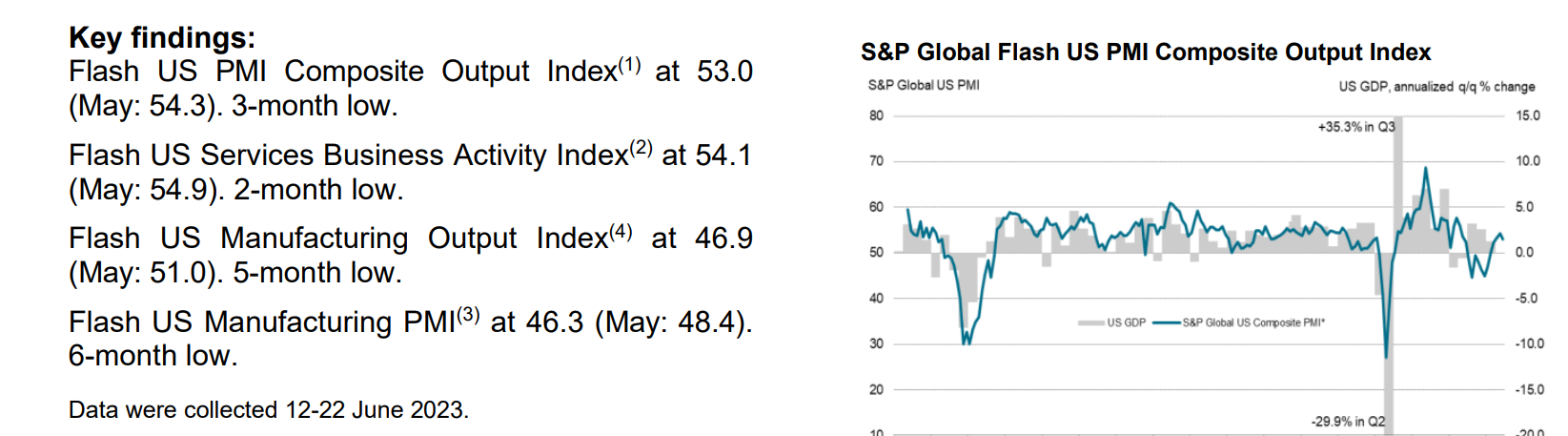

Although the manufacturing data is not satisfactory, but driven by the services PMI data, the U.S. Markit composite PMI in June still recorded 53.0, which fell short of expectations and previous values and hit a three-month low, but remained above the boom-bust line for the fifth consecutive month, indicating that U.S. business activity remains expansionary overall.。

On June 23, the initial value of the U.S. Markit manufacturing PMI for June was 46.3, less than the expected 48.5, after returning to above the 50-year-old line in April, again below the line, the lowest so far this year;.1, slowing for the first time this year, base and previous values 54.9 flat, slightly better than expected 54。

Services PMI slows for first time this year Wage upward pressure remains

Although the manufacturing data is not satisfactory, but driven by the services PMI data, the U.S. Markit composite PMI in June still recorded 53.0, which fell short of expectations and previous values and hit a three-month low, but remained above the boom-bust line for the fifth consecutive month, indicating that U.S. business activity remains expansionary overall.。

Specifically, the U.S. manufacturing new orders index hit a six-month low in June, but the performance of the services sector was relatively solid, resulting in the composite PMI's new orders, while declining, remaining at 53.5, above the boom-bust line; in terms of price indices, the service sector price index climbed in June to its highest level since January this year, but factory input costs fell to their lowest level in three years, indicating that inflation may be shifting from manufacturing to services; in terms of employment, although companies have increased their headcount, the margin has slowed.。

In response, Chris Williamson, chief business economist at Standard & Poor's Global Market Intelligence, said the overall pace of expansion in U.S. business activity remained strong in June, matching GDP growth of 1.7% pace in line, bringing second-quarter growth to around 2%。

For the apparent decline in manufacturing data, he analyzed that while improved supply conditions have helped boost manufacturing production in previous months, the growing decline in new orders means that factories are facing a situation where there is no work to do.。He also said that the situation is better in the service sector (relative to manufacturing), where demand has proven to be elastic。Separately, the Fed's recent pause in rate hikes has also helped boost business optimism in the year ahead。

Labor data and inflation are closely related and are now one of the Fed's high concerns。Commenting on the data, Williamson noted that the tight labor market remains a concern because "upward pressure on wages remains the main driver of higher costs in the services sector."。However, overall sales price inflation in U.S. goods and services has fallen to its lowest level since late 2020, according to the data, suggesting the Fed is winning the battle against inflation.。

Fed hawks in charge of U.S. labor, housing market hot

For now, the Fed's inflation governance has been effective。According to the latest U.S. CPI report released last week, core CPI, excluding volatile food and energy, rose 5.3%, lower than the previous value of 5.5%, and the lowest since November 2021, but slightly higher than expected 5.2%; core CPI rose 0.4%, in line with expectations and previous values。Overall CPI rose 4% year-on-year in May, falling for 11 consecutive months, the smallest year-on-year gain since March 2021 and well below the peak reached in June last year..1%。

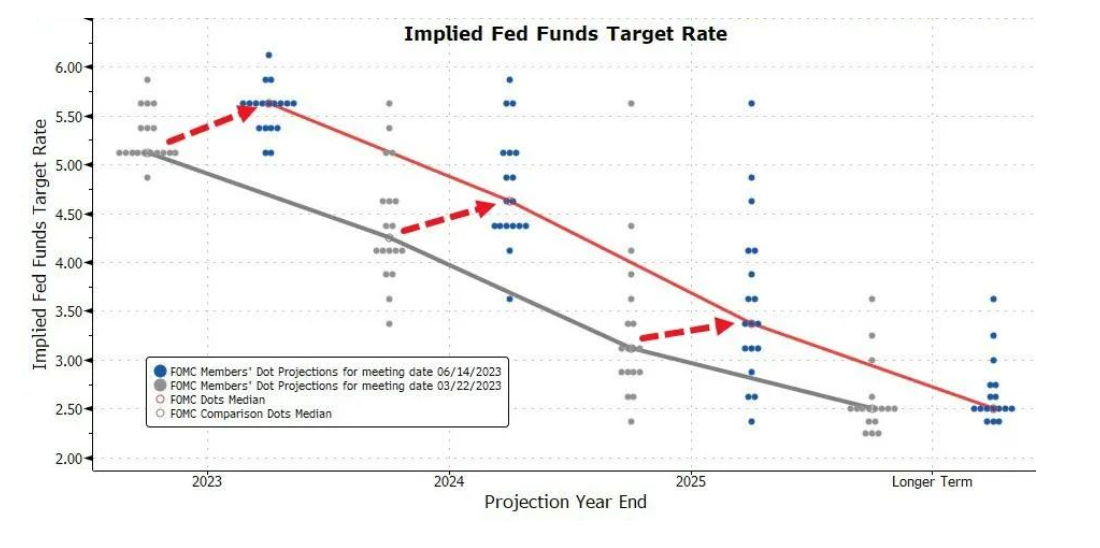

In mid-June, after a 15-month cycle of rate hikes, the Fed finally hit the pause button to keep the policy rate ceiling at 5.25%。In response, Fed Chairman Jerome Powell (Jerome Powell) said that after easing the pace of rate hikes, the Fed can include more data and information in its decision-making, and can wait for the economy to absorb and reflect the full effects of the credit crunch caused by monetary policy and banking events.。

However, according to the dot plot released by the Fed along with the economic outlook after the resolution was announced, the bank's median interest rate forecast for the end of the year went from 5.1% jump to 5.625%, which means that the Fed will raise interest rates at least twice in the next four meetings of the year, a total of 50 basis points, a fairly hawkish view.。

In addition, according to the dot-plot vote, 12 of the 18 policymakers expect interest rates to reach 5.5% -5.75% or higher, and three of them even hope that the terminal rate has reached 5.Continue to raise interest rates on the basis of 625%。In a press conference after the resolution was announced, Powell said that, as shown in the SEP dot plot, the FOMC Committee agreed on the need to reduce inflation to the 2% target level and would do whatever it takes to do so (Whatever it takes)。

Last week, Powell reiterated the need for a rate hike in the current scenario while attending hearings before the U.S. House Financial Services Committee and the Senate Banking Committee。He said the U.S. is far from meeting its inflation target and will vote for two more rate hikes during the year if the economy performs as expected。He also revealed that the vast majority of the committee believes there is still a little bit of room for interest rates to rise。

Although Powell mainly talked about banking regulatory reform at the hearing, the outside world is more concerned about the Fed's "top leader" revealed the monetary policy level of information。In the only discussion of the issue, Powell said that compared with 2022, the magnitude of the rate hike is no longer so important, the future may be in accordance with the "more moderate magnitude to continue to raise interest rates."。

He also stressed that the Fed has never used the word "pause" (pause) to describe the decision to raise interest rates, 16 of the 18 FOMC officials believe that the year to continue to raise interest rates is appropriate, and the vast majority of people are expected to raise interest rates twice this year.。

Regarding the labor market, he pointed out that even if the economy slows down, there is still a very serious shortage of labor supply, but the supply balance is gradually improving, the current very strong labor market to keep the U.S. economy strong, people's concerns about the economy is mainly inflation.。In particular, he pointed out that the Fed is facing an unusual situation: with the unemployment rate fell to a multi-decade low, the central bank's task of maximizing employment "over" completed, but the inflation target "far from being achieved," so the current policy focus is still resolutely fighting inflation.。

According to the U.S. non-farm payrolls data released this month for May, the number of new non-farm payrolls in the U.S. for the month was as high as 33.90,000, well ahead of expectations and above the (revised) previous value of 29.40,000 people。In addition, non-farm data for March-April this year were revised upward, with a cumulative range of 9.30,000, the job market is pretty strong。US May labor force participation rate at 62.6%, the labor force grew slightly by 130,000, and the supply side is still in a continuous repair phase.。

At present, the Fed's "crux" of the inflation problem is that, without destroying the historical level of labor enthusiasm, through the regulation of policy interest rates, to lower the high level of inflation, in principle, as far as possible to avoid recession.。

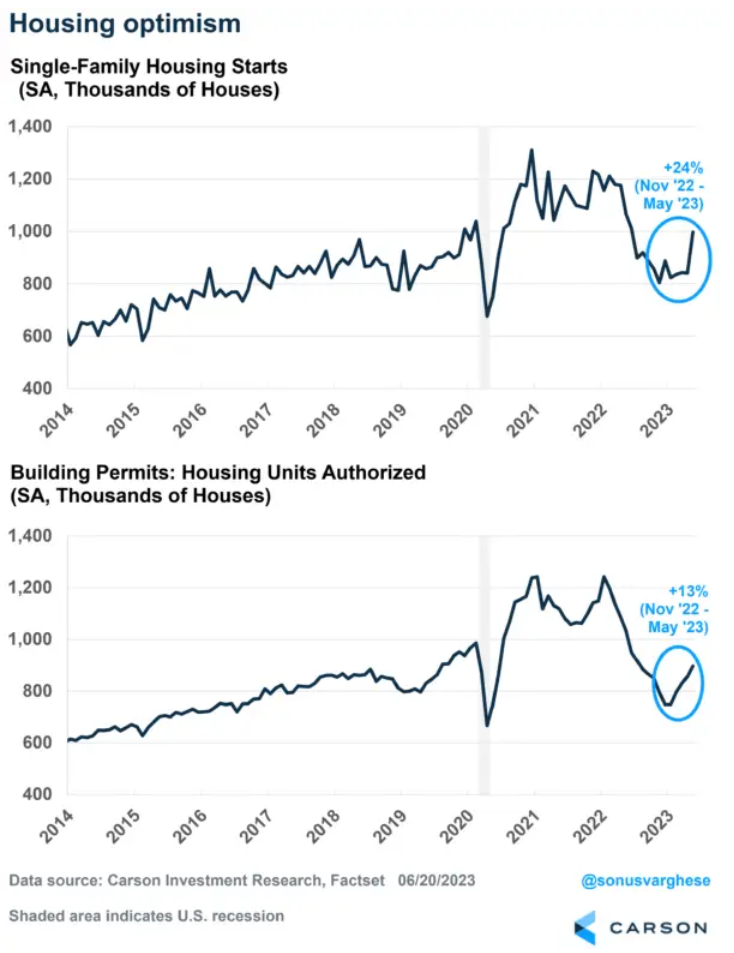

In addition to the strength of the job market, the U.S. real estate market has also been bright recently.。On Tuesday, the total number of new housing starts in the U.S. surged 21 on an annualized basis in May..7%, recorded 1.63 million, the largest percentage increase in 30 years。According to another data released on the same day, the total number of construction permits in the United States in May also exceeded expectations by 149..10,000, higher than the previous value of 141.70,000。

Based on historical experience, weak real estate data tends to signal the beginning of a recession, and this time the real estate data shines, effectively refuting that expectation。In response, Sonu Varghese, global macro strategist at Carson Group (Carson Group), said that historically, the real estate market will bottom before the end of the recession, and then usually lead the economy out of trouble。Home builders' sentiment, perhaps the best leading indicator of property activity, has been soaring since late last year, and they feel significantly better about the outlook for demand。

He also noted that the current dynamics are similar to those seen in the early days of the economic expansion: "What is clear is that 7% mortgage rates have not deterred new home buyers.。After all, if someone wants to buy a house, they will buy a house. "。

Goldman Sachs: The economy is not entirely clear but the outlook is not as cloudy as it used to be

For now, under the strong pressure of the Fed's monetary policy for nearly a year, positive signals from the U.S. economy are springing up like mushrooms: the Fed has slowed the pace of interest rate hikes, the real estate market has bottomed out, consumption is gradually picking up, the labor market is still hot, the banking crisis has not expanded into serious systemic risks, and the debt ceiling problem has been resolved before the deadline.。

Under such circumstances, many economists have also lowered their expectations of a recession in the United States.。

In early June, according to the results of a survey released by Goldman Sachs, the bank had lowered the probability of a recession in the next 12 months from 35% to 25%, while other forecasters pushed the start date of a recession further to the end of the year, and some even believed that the United States might avoid a recession altogether.。

In response, Goldman Sachs chief economist Jan Hatzius (Jan Hatzius) said that the U.S. economy is not completely clear, but the outlook is not as cloudy as in the past.。He also said that while we are in an below-trend growth environment, positive growth seems more likely。

Yesterday, U.S. Treasury Secretary Janet Yellen also spoke out publicly, saying that the risk of a recession in the United States is diminishing.。She said: "If there is (a recession), I expect the likelihood has gone down.。Because labor markets are resilient, inflation is falling.。I wouldn't say there's no risk of a recession because the Fed is tightening monetary policy.。"

Despite the bullishness, but known as the bellwether of the recession - U.S. long-term and short-term Treasury yields upside down in the recent record high.。Data show that the difference between the U.S. 10-year Treasury yield and the 2-year Treasury yield reached 97 basis points in early trading on Tuesday, the largest inversion of the yield curve in more than 40 years.。

Historical data show that the last two long inversions between that yield were followed by recessions: the yield curve inversion that occurred in 2006-2007, which later became a prelude to the Great Financial Recession of 2008-2009.。In addition, before the market crash of 2001-2003, investors had seen the yield curve inverted in 2000.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.