Last Friday, according to a European Commission statement, artificial intelligence giant Nvidia's acquisition of Israeli startup Run:ai received unconditional approval from the European Union.

What happened?

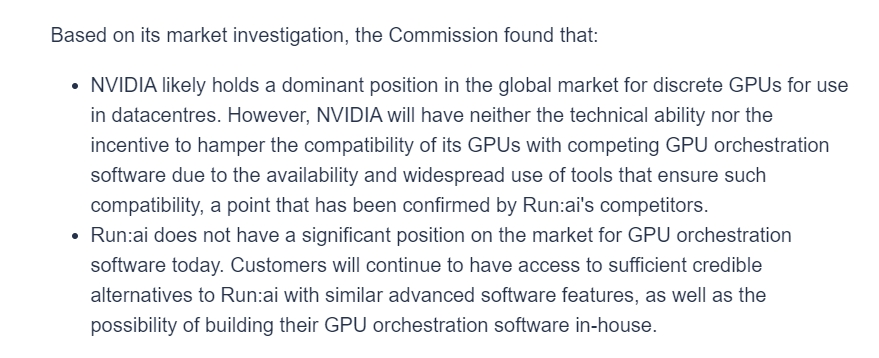

The European Commission said in a statement on Friday that although Nvidia is "a leading producer of critical hardware for artificial intelligence applications used in the EU and beyond," the acquisition does not integrate the artificial intelligence market in the 27 member states.Become any competitive threat.

Teresa Ribera, the EU's new antitrust chief, said,"Our market investigation confirms to us that other software options compatible with NVIDIA hardware will continue to be available on the market."”

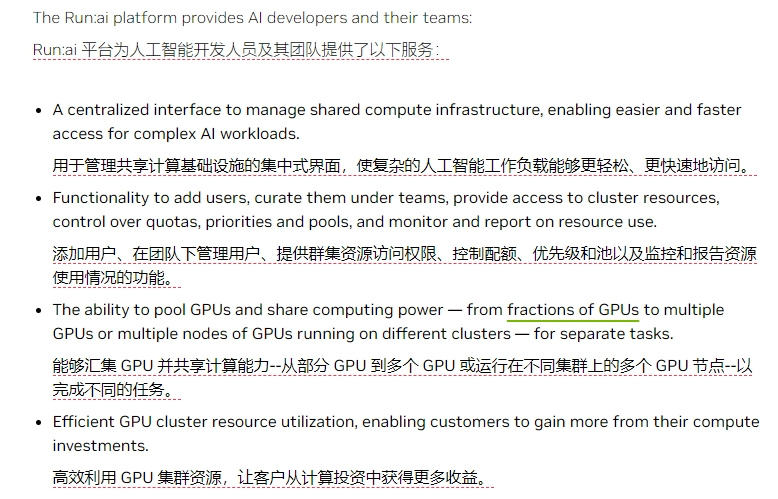

It is understood that Run:ai was founded in 2018 by Omri Geller and Ronen Dar. Its main business is to develop software for processing artificial intelligence computing resources.Run:ai has been a close partner of Nvidia since 2020.

In April this year, after rumors emerged that Nvidia would buy Run:ai for US$700 million, the EU's M & A watchdog took over the investigation following a referral from the Italian competition authority.The last time Nvidia made a big move in Israel was back to the US$7 billion acquisition of Mellanox Technologies Ltd. in 2020.

Why buy?

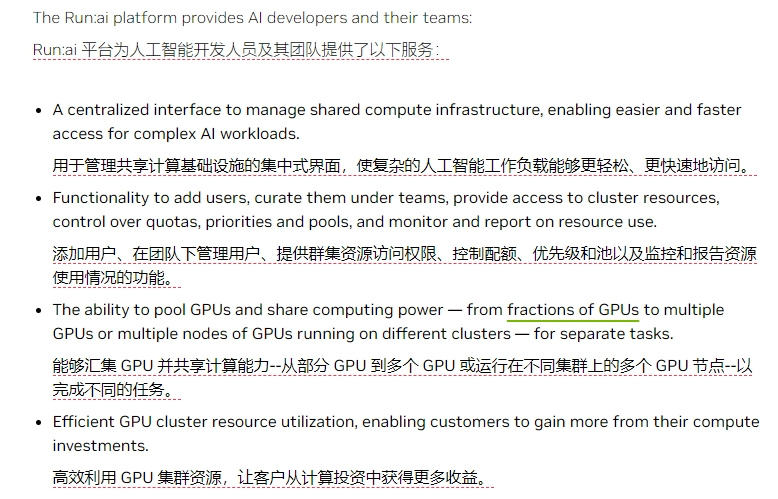

Nvidia acquired Run:ai with the goal of improving customer satisfaction and efficiency.Big technology companies are rapidly investing in young AI start-ups in the hope of gaining early control and benefiting from the AI boom.This can be seen through partnerships between Microsoft and OpenAI, NVIDIA and Inflation AI, and Google and Anthropic.

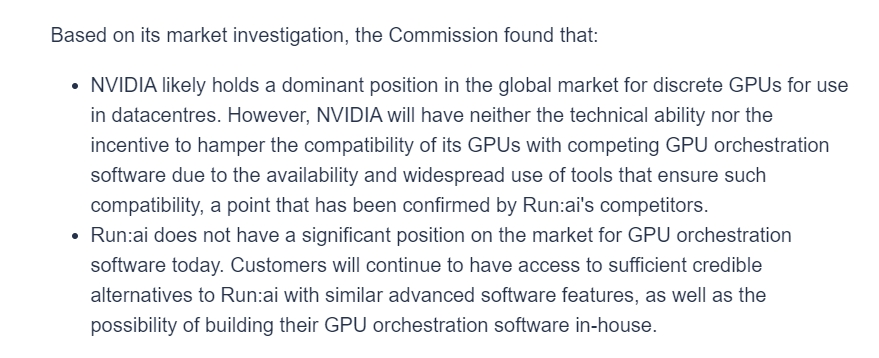

After acquiring Run:ai, Nvidia will provide GPUs for data centers in the future, while Run:ai provides orchestration software in GPUs.These products must be compatible, and there have been concerns that the acquisition could cause companies to deliberately reduce the compatibility of their products with competitors 'products.

The only concern is that the powerful combination of Nvidia and Run:ai could lead to market monopoly, making it more difficult for other independent companies to obtain capital, attract talent, or compete with the advanced technology and influence of larger companies.Especially in the field of artificial intelligence, GPUs may be further monopolized by Nvidia-which is why the EU needs to launch an antitrust investigation.

In response, Nvidia said in its acquisition announcement: "Together with Run:ai, Nvidia will enable customers to access GPU solutions through a single architecture.In addition, Run:ai does not dominate the market for GPU orchestration software because there are many equivalent alternatives on the market or independent manufacturers can build it themselves, which is another important reason why the deal was unconditionally approved by the EU.

AI mergers and acquisitions continue

Regarding Nvidia's acquisition of Run:ai, analysts said that artificial intelligence participants should be excited because it shows that integration in the artificial intelligence market is welcome.

Also in 2024, similar AI track acquisitions include: Google's acquisition of Character.AI, Microsoft's acquisition of Reflection AI, and AMD's acquisition of Silo AI.The above-mentioned acquisitions without exception received the green light from regulators.

It can be observed that after two years of large-scale model arms race, artificial intelligence integration will continue to erupt in 2024.According to Goldman Sachs statistics, the current investment hotspots in the market are still concentrated in the second stage, and the AI infrastructure has not yet been completed.

The world's top Internet giants, such as Amazon, Google, Meta, Microsoft, Oracle, etc., have all announced large-scale AI infrastructure plans this year and next.

Even Nvidia, the chief AI leader, said at the latest earnings call that AI is only at the "early stage" and its future applications will be more extensive and advanced.

Nvidia's long-term vision is that within the next decade, companies will have thousands of "digital employees" to perform complex tasks-such as programmers, circuit designers, marketing project managers, legal assistants, etc.

So, in the face of this wave of artificial intelligence dividends, how should ordinary people participate?

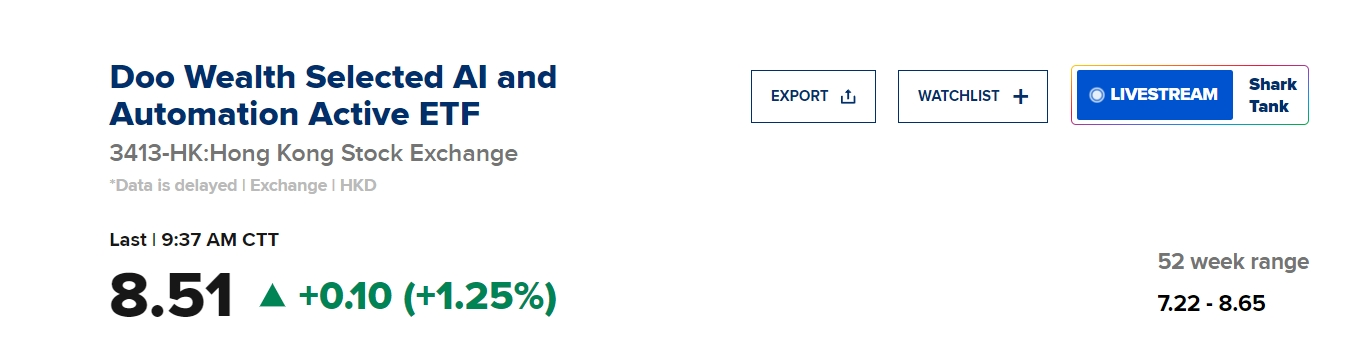

Buying an ETF may be a good choice.

Since the stock price of the artificial intelligence concept is relatively high, taking Nvidia as an example, it costs US$140 to buy a share of Nvidia; the stock prices of Oracle and Google are both above US$150; Microsoft's stock price is around US$400; and Meta's stock price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

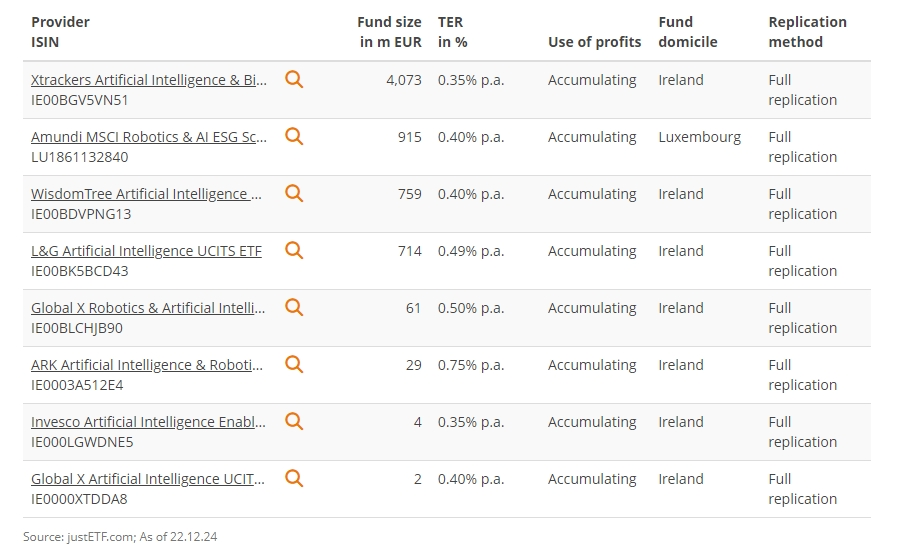

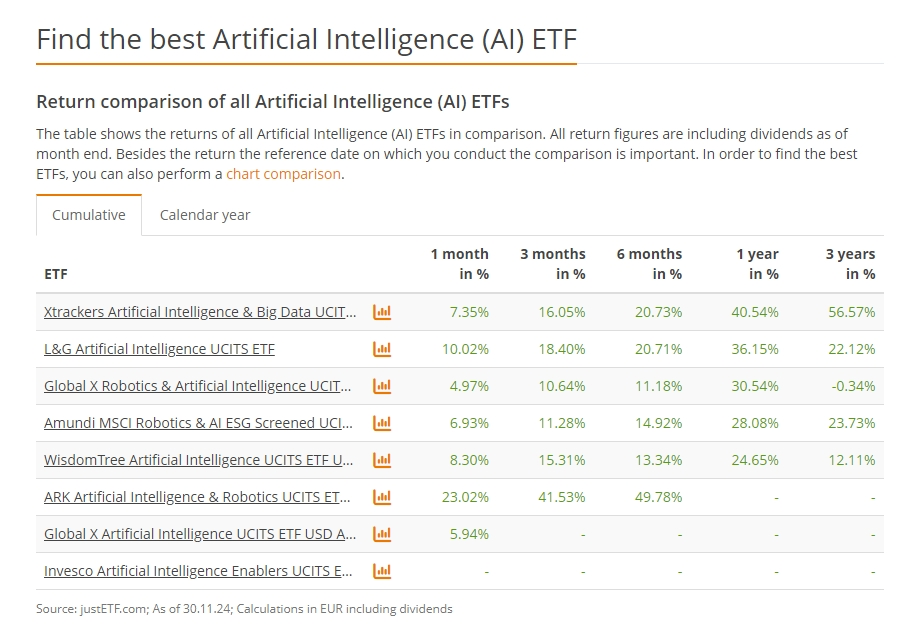

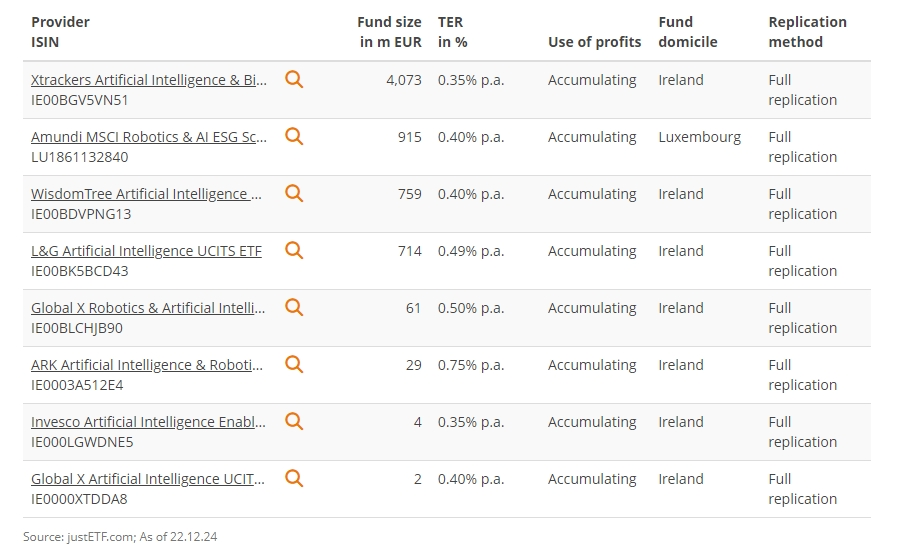

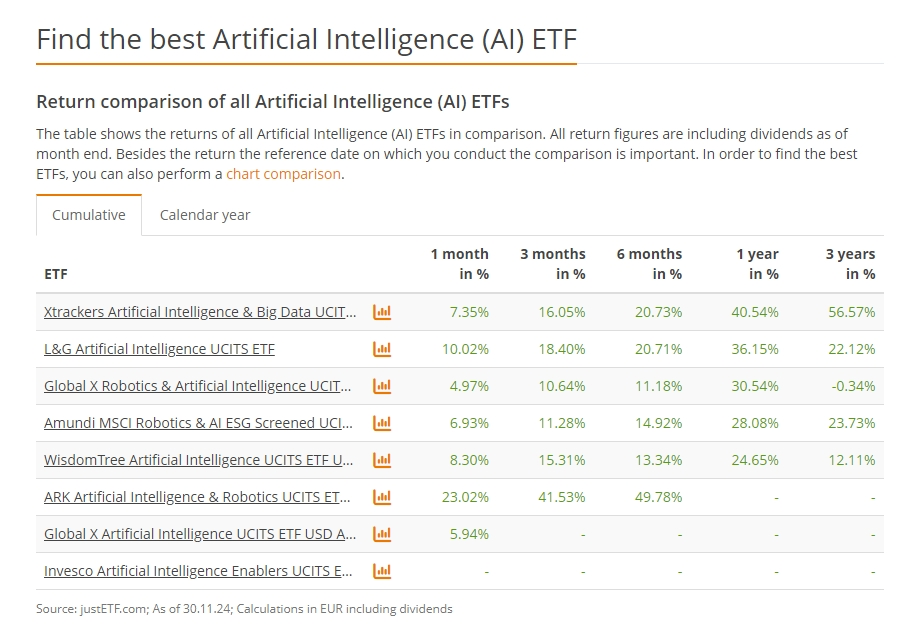

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.