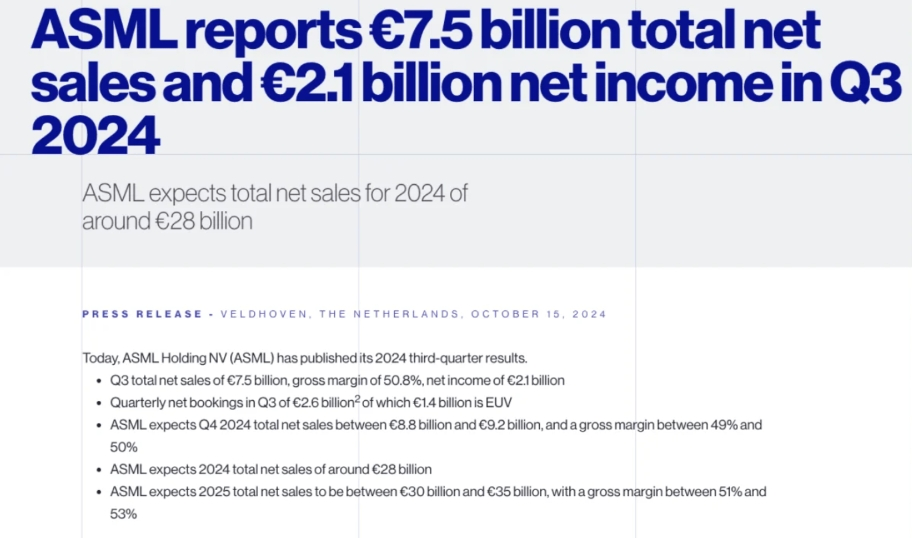

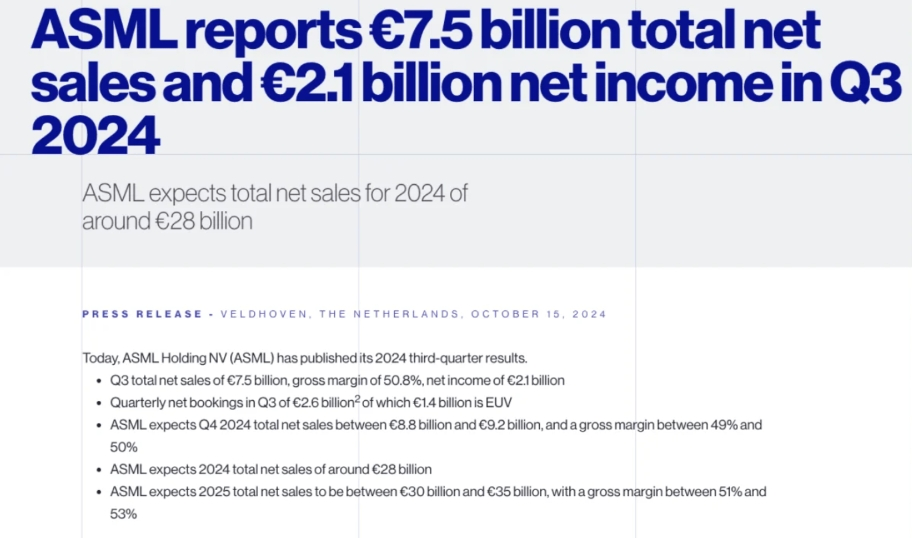

Last week, Asmail and TSMC announced their third-quarter results respectively.As the top core force in the world's chips, the report cards handed over by two similar track players actually show a scene of ice and fire--

Asmai's orders in the third quarter were only 2.6 billion euros, nearly half of the market expectation of 5.4 billion euros.After the results, the ADR of Asmai U.S. stocks once fell more than 17%, and finally closed down 16.26% at US$730.43.The company's share price on the Amsterdam stock market closed down 16%, the largest one-day decline since 1998, and was temporarily suspended during the session;

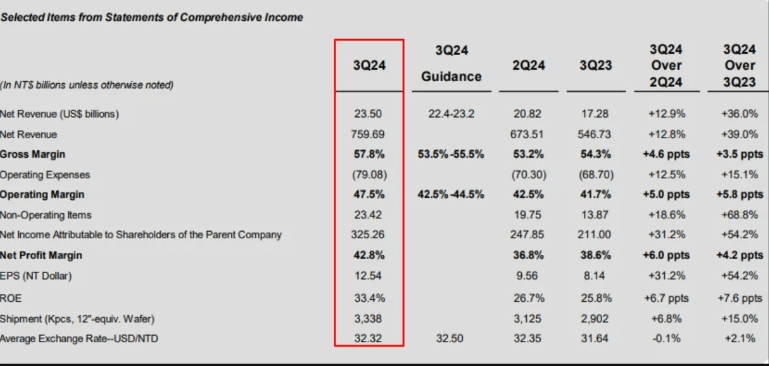

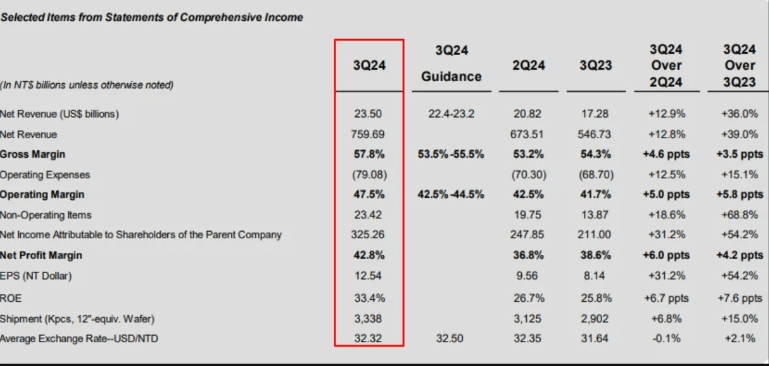

Global chip foundry giant TSMC's third-quarter results comprehensively exceeded expectations. Net revenue during the reporting period reached NT$759.69 billion, a year-on-year increase of 39%, exceeding the forecast of NT$751.06 billion; net profit was NT$325.3 billion, exceeding market expectations of NT$299.3 billion, a year-on-year increase of 54%.

They are both top performers in the chip industry, why is the performance difference so huge?

Artificial intelligence's demand for high-end chips has entered a stage where there is insufficient stamina?

Actually, it's not.From a macro perspective, the demand level of the entire chip industry is still in a weak recovery stage, but the demand for chips related to artificial intelligence is still at a blowout level.

For example, Asmai's financial report shows that demand for chips in areas of the chip industry that are not related to artificial intelligence, such as electrical vehicles, industrial fields, Internet of Things equipment, and a wide range of consumer electronics, has declined sharply.The decline in chip demand in traditional industries was the main culprit dragging down Asmail's performance in the third quarter; however, on the other hand, the demand for AI chips related to artificial intelligence infrastructure, especially all types of AI chips focusing on B-side data centers, is still very hot.

TSMC's financial report also showed that in the third quarter, the proportion of revenue generated by advanced process chips related to artificial intelligence had reached 69% of overall chip revenue, 2 percentage points higher than the second quarter.In TSMC's chip narrative, 7-nanometer and more advanced technologies are counted as advanced processes, and the more advanced the chip, the higher the price.For example, TSMC's 2-nanometer chips are priced 33% higher than 3-nanometer chips.It can be said that TSMC's third-quarter performance exceeded expectations, which was also due to the surge in demand for high-end chips by artificial intelligence.

The trend of U.S. stocks last week also well confirmed the market's judgment. The stock prices of companies related to semiconductor equipment, such as Asmai, Kelley, and Ram Research, all experienced a sharp drop; while the stock prices of chip companies closely related to artificial intelligence, including TSMC, Nvidia and Broadcom, experienced a sharp rise.

At least for now, the market has not completely eaten up the dividends of artificial intelligence.

According to Goldman Sachs 'latest estimates, the current investment hotspots are still concentrated in the AI infrastructure stage.The world's top Internet giants, such as Amazon, Google, Meta, Microsoft, Oracle, etc., will all pay for large-scale AI infrastructure.

Goldman Sachs estimates that their capital expenditures will reach $215 billion in 2024 and $250 billion in 2025, respectively, and a large portion of this will be AI-related.In other words, the next year and a half to two years will still be the era of large-scale AI infrastructure.

Unfortunately, those related to the concept of artificial intelligence are mainly large technology stocks. The stock prices of technology stocks are generally relatively high, and it is more difficult for ordinary investors to participate in the market.

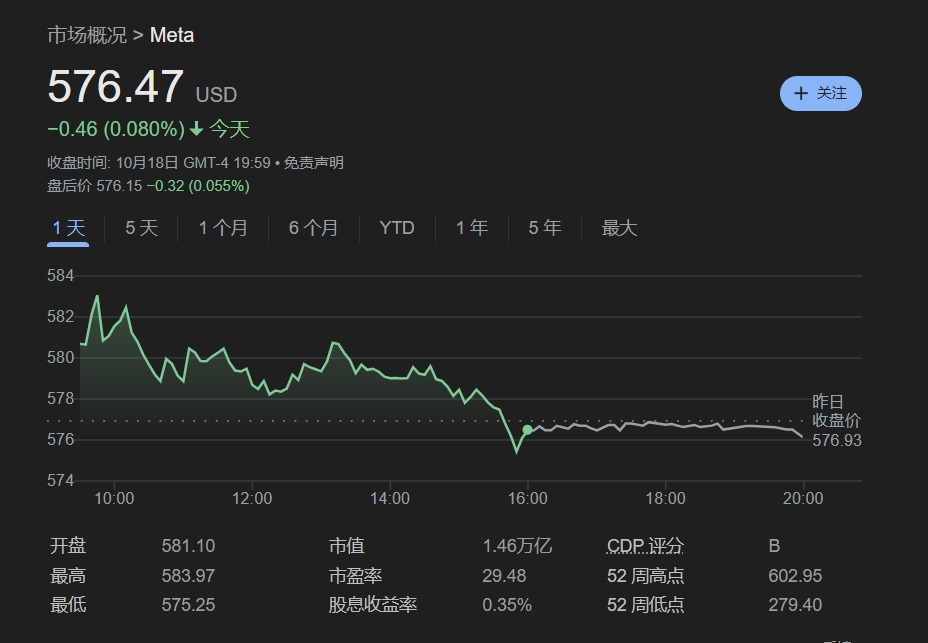

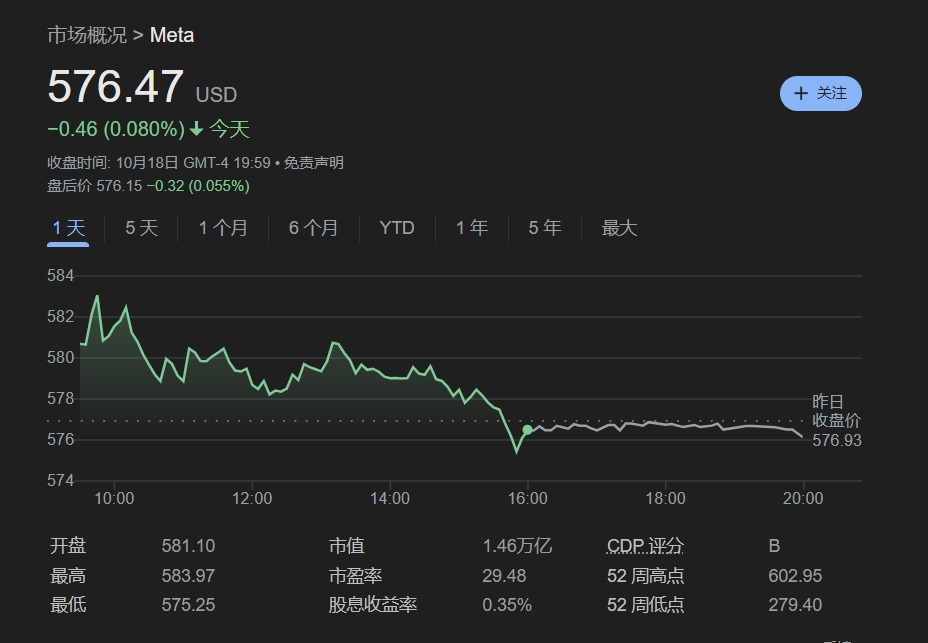

Take Nvidia as an example. Buying a share of Nvidia costs US$135; Oracle and Google share prices are both above US$150; Microsoft's share price is around US$400; and Meta's share price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, saving the trouble of selecting.Moreover, for the ETF stock pool, no matter which stock in the basket rises, the ETF will receive the income, which is equivalent to reducing another layer of risk for investors and reducing the pressure brought by sector rotation.

Moreover, ETFs do not face the risk of suspension or delisting.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.For ordinary investors or novice investors, ETFs are undoubtedly the best choice to participate in the artificial intelligence market.