"Before the ambush, after the pursuit of troops" TSMC performance after the full-year expected company to speed up the car chip layout.

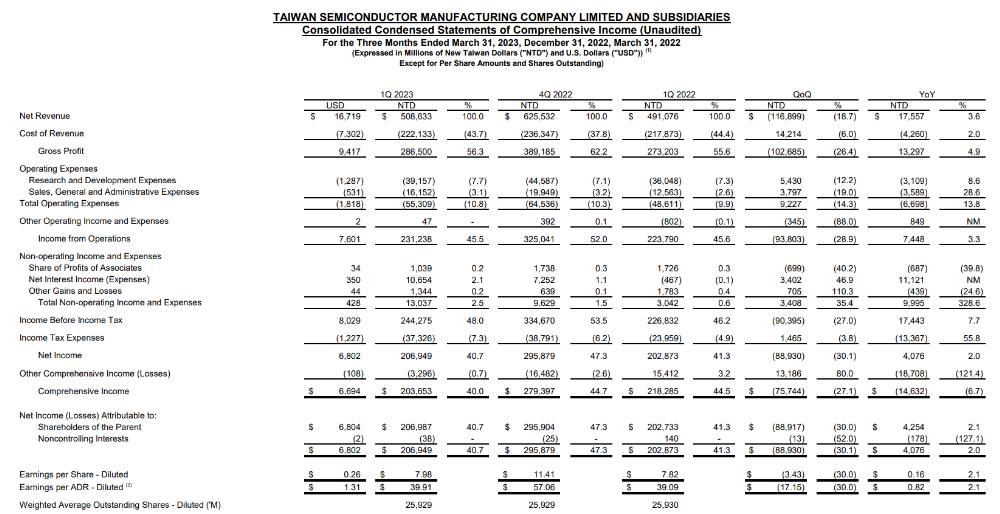

TSMC's first quarter 2023 results show that the company's revenue was 167.$200 million, down 18.7%。At its first-quarter earnings conference, TSMC lowered its full-year forecast for 2023 and considered the company's revenue decline to be in the "low to medium single digits."。

Over time, the downturn in the semiconductor industry has gradually been reflected in the chip giant, TSMC.。

Chip Cold Winter TSMC Lowers Full-Year Expectations After Poor Earnings Data

On April 20, TSMC released its first quarter 2023 results。According to the report, the company's revenue was 167.$200 million, down 18.7%; quarterly gross margin recorded 56.3%, down 9.5%; and its net profit was down 30% month-on-month..1%, recorded 68.$0 billion。

In the middle of last year, due to the impact of the epidemic, the global chip supply and demand inflection point quickly arrived, short-term chip inventory surplus, so that many semiconductor companies feel unprecedented pressure, have begun to cut production or cut orders.。At first, TSMC was not affected too much, even at the end of December last year in the Tainan Science Park held its key technology 3nm process production and plant expansion ceremony, officially announced the start of large-scale production of 3nm.。

However, over time, TSMC has gradually felt the pressure of the industry boom.。Sources pointed out that the original TSMC 3nm large customer Intel nuclear display order delays, resulting in a huge decline in customer demand, but can only slow down the progress of production expansion, in order to control cost pressures.。

At this point, by Intel "pigeon" TSMC, the hands of the big customers only Apple。Sources have pointed out that the chip giant, which has been forced to a dead end, is doing everything possible to produce enough 3nm chips to meet its needs, ensuring that every iPhone 15 Pro and iPhone 15 Pro Max of Apple is equipped with the 3nm A17 bionic chip of SMC as quickly as possible.。

In terms of cost control, TSMC, like most industry giants, had to take advantage of its employees.。It is reported that in the company's April 24 annual routine base salary increase notice to employees, announced that the average salary increase in 2023 is 4% -5%, down from 10% last year, causing dissatisfaction among employees.。Some media said that in TSMC's internal employee discussion area, some employees complained that TSMC did not adjust its capital expenditure this year, but instead reduced its salary increase, saying that "competitors Samsung and Intel are not so stingy."。

Despite the efforts, TSMC seems to be full of doubts about its own prospects, and at its first-quarter earnings conference, TSMC lowered its full-year forecast for 2023 and considered the company's revenue decline to be "low to medium single-digit levels."。

TSMC said that the current global demand for PCs and smartphones is still relatively weak, the relevant customers are still actively carrying out inventory adjustments, while automotive demand is stable, but there are signs of marginal weakness, while benefiting from the current GPT wave, AI-related demand is steadily increasing.。Based on a comprehensive analysis of inventory levels, downstream demand and other factors, the company looks forward to 2023 global semiconductor industry (excluding storage) revenue year-on-year decline of mid-single digits, wafer foundry industry year-on-year decline of high single digits.。

One wave after another, TSMC's cutting-edge technology may be caught up by Intel and Apple's OEM yield rate falls into a bottleneck.

Despite the huge number of Apple orders in hand, TSMC's prospects are still "dangerous."。

On the one hand, the artificial intelligence revolution pioneered by Microsoft's ChatGPT may put forward higher quality requirements for manufacturers in the future, and many technology manufacturing giants are beginning to make efforts in this field to speed up the pace of product iteration and upgrading, and TSMC is facing fierce competition.。

In the middle of this month, according to insiders, Apple's top-level meeting began to discuss Samsung Electronics' chip process yield, saying that Samsung Electronics' yield recovery is faster than expected。Some industry insiders also said that Samsung Electronics is likely to have increased the yield of its 4nm process from about 60% to at least 70%, while TSMC's 4nm process yield is estimated to be around 80%.。

On April 23, another insider broke the news, chip design giant ARM is about to personally off the field to manufacture chips, the standard products for Apple A series of bionic chips and Qualcomm Xiaolong 8 mobile platform.。It is reported that ARM has formed a "solution engineering" team, as a chip technology team, responsible for the development of prototype chips for mobile devices, laptops and other electronic products.。In addition, the media is expected to ARM chip will be unveiled in the near future, but whether the final direct docking mobile phone manufacturers, is not sure。

For now, however, TSMC's main competitor is Intel.。Earlier, Intel said it would mass-produce its 20A and 18A processes in the first and second half of 2024, respectively, to benchmark TSMC's 2nm and 1.8nm chips, and it is estimated that TSMC's 2nm chips will be mass produced as early as 2025, which means that once Intel completes the 18A process as planned, it will be able to reverse the TSMC as early as the second half of 2024.。

If Samsung and ARM are just adding to the chip circuit, Intel is directly trying to overtake the industry leader in 2024.。

In this regard, TSMC co-CEO Wei Zhejia put down harsh words last week, said will not evaluate the development of competitors, but TSMC's N3 process is the first to achieve mass production, is currently the most advanced, N2 process will do so again, and even expand the leadership position.。

On the other hand, TSMC seems to have encountered a bottleneck in the company's art production.。

On April 26, according to Apple's information tracking website MacRumors, TSMC's process yield on OEM 3nm chips was limited to 55%, which did not meet Apple's requirements.。MacRumors further revealed that in addition to the rumored A17 bionic chip, TSMC is also OEM 3nm M3 chips for the MacBook series at the same time。

Process yield bottlenecks limit TSMC's foundry capacity, overlaid with huge Apple foundry orders, and technology industry research firm Arete Research analyst Brett Simpson believes TSMC's delivery time may have been delayed。

In the face of market questions, Wei Zhejia said that although the company has reached "mass production and good yield," customer demand still exceeds supply capacity.。In the second half of this year, TSMC will increase production of A17 and M3 chips for Liguo, while producing chips for Intel, AMD and Nvidia.。

TSMC takes another approach to target on-board chips to express their opinions at home and abroad

Facing the cruel market environment, TSMC has taken a different approach and turned its attention to the automotive chip market.。

Compared with the chip manufacturing process of traditional electronic products, automotive chip manufacturing has a natural disadvantage。Due to different life cycles, automotive chips require stronger robustness and durability than electronic chips。In this regard, TSMC has launched its special automotive chip manufacturing process, which can effectively deal with the differences between the two.。The catch is that due to differences in product processes, the manufacturing process of automotive chips usually lags behind the manufacturing process of electronic chips by several years.。

On April 26, at a press conference in Silicon Valley, TSMC launched a software specifically for the manufacturing process of automotive chips, which can advance the design process of chips by two years.。In other words, as early as 2025, TSMC will be able to carry the most advanced 3nm chip technology available on the automotive side.。

Kevin Zhang, vice president of business development at TSMC, said that historically, automotive chip technology has been lagging behind traditional electronics chip technology, but our software allows chip designers to start designing as early as possible, bringing the time difference closer to two years。He also said that previously automakers typically left important technical decisions in chips to chipmakers, but due to the close cooperation in the early stages, these suppliers and manufacturers now tend to discuss directly with TSMC。

On the same day, Honda Motor Company announced that it has reached a strategic cooperation agreement with TSMC (TSM)。Honda CEO Toshihiro Mibe said that Honda has reached a basic agreement with TSMC on strategic cooperation, which includes sharing information on production and parts supply, with a focus on ensuring the supply of integrated circuits and other parts.。He also said that Honda Motor Company will establish direct cooperative relations with chip manufacturers to achieve long-term stable supply of chips.。

For TSMC's market outlook, the market is also divided.。

In mid-February, Warren Buffett's Berkshire Hathaway (Berkshire Hathaway) announced that it had sold 86% of TSMC's holdings and basically wound up.。It's worth noting that the company just bought 61 million TSMC shares in the third quarter of last year, but already sold 86% of them in the fourth quarter, which is not common in the stock god's career.。You know, Buffett has always emphasized sharing corporate value through long-term holding, and he has said that if you're not going to hold a company for ten years, you shouldn't even hold it for a minute.。

On the other side of the ocean, Zhang Kun, a Chinese public offering headstream deeply influenced by Buffett, bucked the trend in the first quarter and added TSMC.。According to its management fund E Fund Asia Selected Stocks 2023 Q1 Report, Zhang Kun bought TSMC, an invisible heavy stock in the fourth quarter of last year, again in the first quarter of this year.。According to statistics, the fund increased its holdings of TSMC 25 in the first quarter..87% of the shares, the largest increase in the fund's top 10 heavyweight stocks。In addition, TSMC also jumped from 12th place at the end of 2022 to 4th largest position in the quarterly report.。

As of yesterday's U.S. stock close, TSMC edged down 0.05%, reported 82.25美元。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.