NVIDIA Q2 Revenue Reaches US $30 Billion, Outlook Misses Expectations, Stock Price Plunges

Nvidia anticipates a year-on-year increase of approximately 80% for the third quarter of the fiscal year 2025, breaking below triple-digit growth.

This may be the last time Nvidia reports triple-digit growth in its quarterly financials.

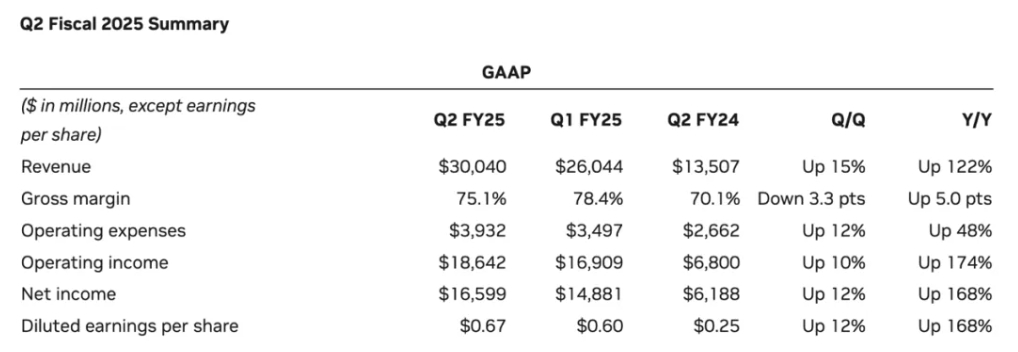

On August 29th, after the U.S. stock market closed, the artificial intelligence giant Nvidia announced its performance report for the second fiscal quarter of 2025, ending on July 28th, 2024. The data shows that during the reporting period, Nvidia's revenue reached 30 billion U.S. dollars, a year-on-year increase of 122%; net profit reached 16.599 billion U.S. dollars, a year-on-year increase of 168%; adjusted gross profit margin reached 75.7%, compared to 71.2% in the same period of the previous year; adjusted EPS was 0.68 U.S. dollars, compared to 0.27 U.S. dollars in the same period of the previous year.

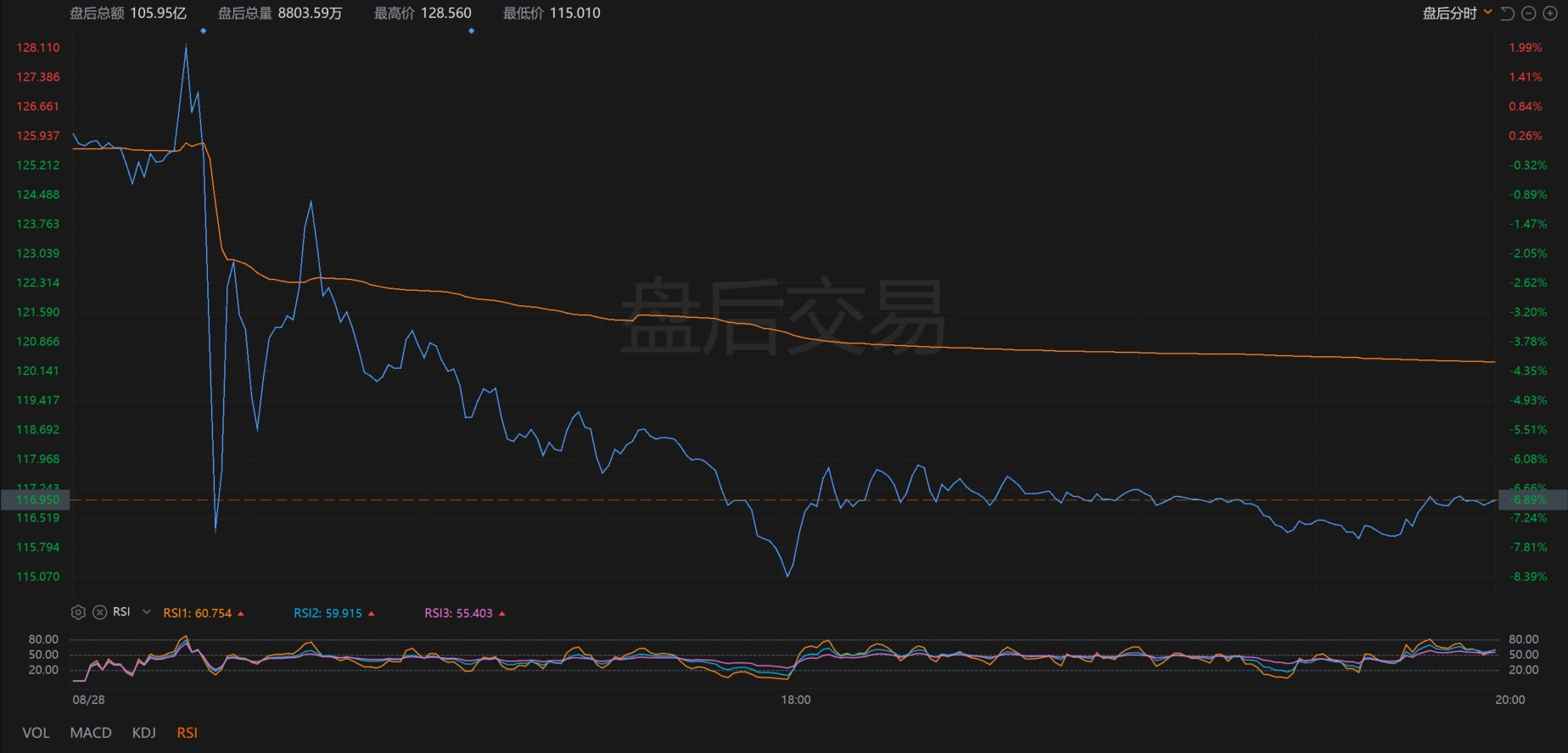

Due to the outstanding performance during the reporting period, Nvidia's stock price once surged by 2% after the market closed. However, due to the management's first announcement of a "merely" double-digit performance forecast for the third quarter, Nvidia's stock price quickly turned down, once plummeting by more than 8%, and finally closed down by 6.89%, at 116.95 U.S. dollars.

Nvidia's plunge also affected a collective correction of AI chip concept stocks: the NASDAQ 100 fell by more than 1.3% after the market closed, and U.S. AI chip stocks fell collectively after the market closed, with AMD falling by more than 3.8%, Arm Holdings falling by more than 3.6%, Advanced Micro Devices falling by more than 6.7%, and Micron Technology falling by more than 3.3%.

Data center revenue sets a record, while employee compensation growth leads to a decline in growth rate.

Looking at the specific data.

Nvidia's outstanding performance in the second quarter was mainly due to the record business income from the data center, which grew by 154% year-on-year, creating 26.3 billion U.S. dollars in revenue for Nvidia, becoming the "brightest spot" in Nvidia's segmented field. This part of the business accounted for as much as 88% of Nvidia's total revenue, including the AI chips most concerned by the market.

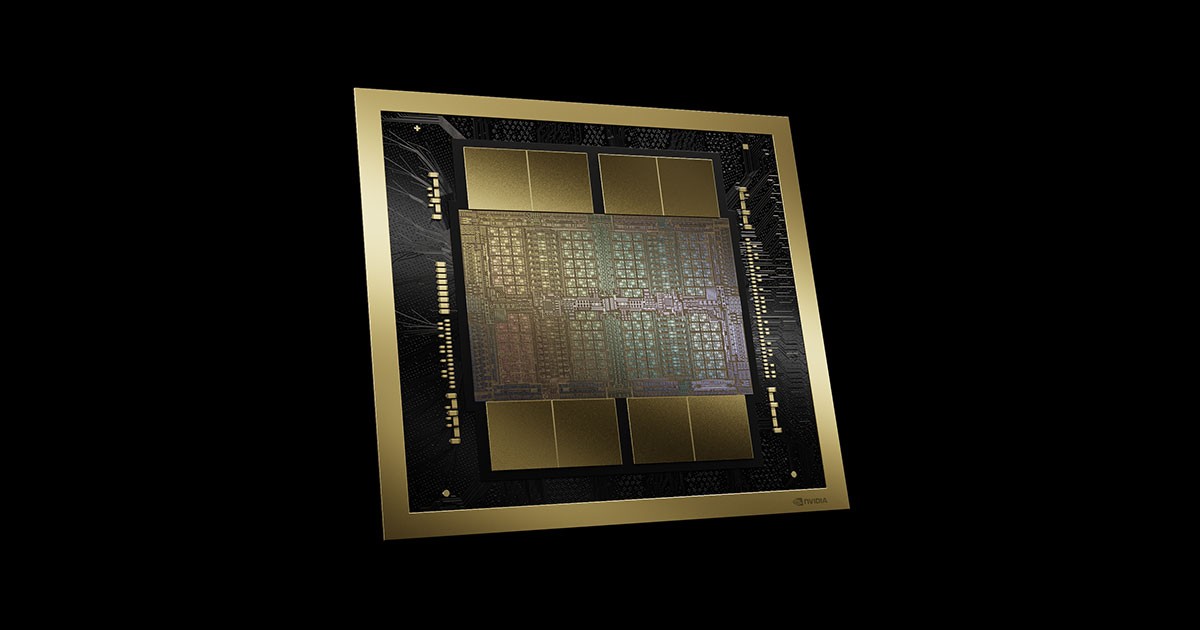

Nvidia stated that its H200 Tensor Core and Blackwell architecture B200 Tensor Core processors performed well in the latest industry standard benchmark tests. In the MLPerf Training where H200 made its debut, its performance was 47% higher than H100 after extending H100. H200 also outperformed H100 by 47% in single-node GNN training.

Not only that, but after the last round of submissions, under the same system scale, Nvidia also improved Stable Diffusion v2 by 80%. Comments said that these improvements all reflect many enhancements in Nvidia's software stack, showing the top-level optimized performance of the chip under official tuning. Because of this, many Nvidia partners, including ASUS, Dell, Fujitsu, Gigabyte, and Oracle, have expressed satisfaction with the quality performance of the supplier's chips.

In addition, Nvidia has also launched a variety of Blackwell systems driven by the NVIDIA Grace™ CPU, and has already shipped samples to partners and merchants. Nvidia CEO Huang Renxun said that Nvidia will mass-produce Blackwell in the fourth quarter and start shipping in the fourth quarter. It is expected that with the help of Blackwell, Nvidia's revenue in the fourth fiscal quarter will reach several billion U.S. dollars, and the demand for Blackwell GPUs is strong, with an estimated overall gross profit margin of Nvidia in the fiscal year 2025 reaching 70%.

In terms of gaming and artificial intelligence personal computers, Nvidia's revenue in the second quarter reached 2.9 billion U.S. dollars, a year-on-year increase of 16%. Nvidia said that this was mainly driven by the sales of Nvidia GeForce RTX 40 series GPUs and game console SoCs. The previous quarter saw a year-on-year increase of 18%.

In terms of professional visualization, Nvidia's revenue in the second quarter reached 454 million U.S. dollars, a year-on-year increase of 20%, and the previous quarter saw a year-on-year increase of 45%; in the field of automotive and robotics, the second quarter revenue reached 346 million U.S. dollars, a year-on-year increase of 37%, and the previous quarter saw a year-on-year increase of 11%.

Overall, except for the automotive and robotics business, the growth rate of all of Nvidia's businesses slowed down compared to the previous quarter. Nvidia said that this was mainly due to the increase in employees and compensation.

Blackwell mass production postponed to the fourth quarter, Nvidia may end triple-digit growth

At the financial report conference call, the focus of analysts was on the mass production of Blackwell. As early as the first quarter conference call on May 23, Huang Renxun had said that the AI chip using the Blackwell architecture had been produced on a small scale, and it was expected to start delivery in the second quarter, achieve mass delivery in the third quarter, and the data center could operate on the new product in the fourth quarter. However, things did not go as planned, and Blackwell encountered "difficulty in childbirth" in this quarter.

In response to this, at this conference call, Huang Renxun said that Nvidia did not make any functional changes to its Blackwell processor during the test production phase. There are about 100 different types of systems based on Blackwell that are about to be developed and sampled, and the company expects to ship and produce Blackwell products in large quantities in the fourth quarter.

Nvidia also said that Blackwell is a leap forward, and Blackwell is not just a GPU, but an AI infrastructure platform. As more sample testing and mass production are carried out, its potential will become clear. The most important thing we do is to improve the performance and efficiency of the next generation of products. Therefore, at the same power level, Blackwell's performance is many times higher than Hopper's. This is energy efficiency, getting higher performance with the same power, or getting the same performance with lower power.

The financial report meeting also revealed that in the first half of the 2025 fiscal year, Nvidia returned 15.4 billion U.S. dollars to shareholders in the form of stock buybacks and cash dividends. At the end of the second quarter, the company had 7.5 billion U.S. dollars left in its stock repurchase authorization. On August 26, 2024, its board of directors approved an additional 50 billion U.S. dollars in stock repurchase authorization, with no expiration date. Nvidia will pay a cash dividend of 0.01 U.S. dollars per share to shareholders on October 3rd for the next quarter.

Looking forward to the third quarter, Nvidia estimates that the revenue for the third quarter of the 2025 fiscal year will be around 32.3 billion to 32.7 billion U.S. dollars, a year-on-year increase of about 80%; the gross profit margin will reach about 70%, and the total operating expenses for the year are expected to increase by 40% - used to develop the next generation of products, thus ending its consecutive five quarters of triple-digit growth. Affected by the news, Nvidia's stock price fell sharply after the market closed.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.