U.S. manufacturing PMI fell short of expectations in August, and inventory digestibility deteriorated

The most worrying is the ratio of the new orders index to the inventory index.

On September 3rd, the U.S. stock market faced another tumultuous wave.

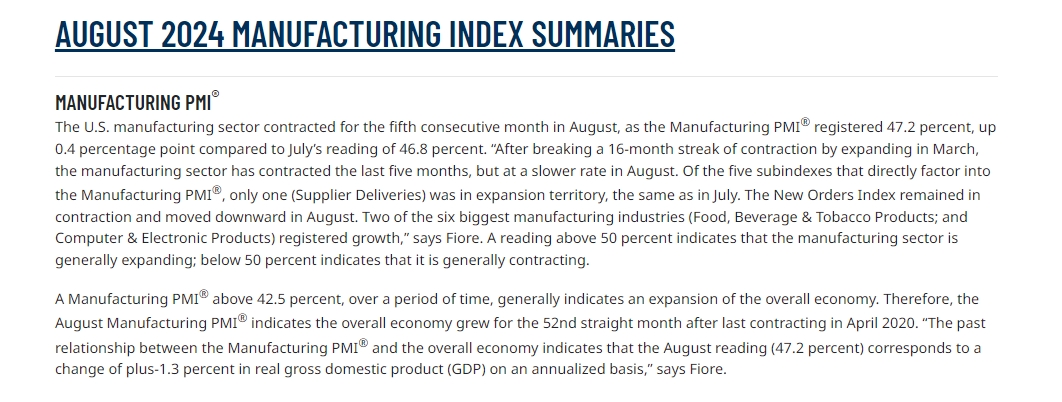

Amid market concerns about U.S. economic growth, data released by the U.S. Institute for Supply Management (ISM) showed that the U.S. manufacturing index for August was only 47.2, below the expected 47.5, and continued to be below the 50-point threshold that separates expansion from contraction. An index above the threshold indicates expansion, while one below indicates contraction.

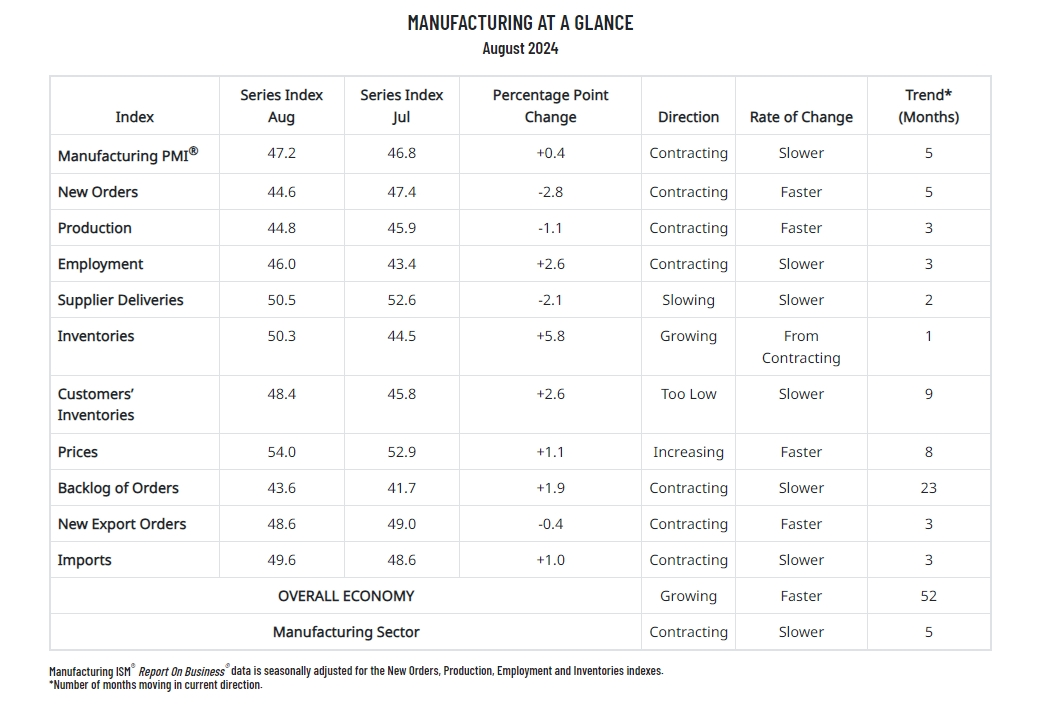

In terms of sub-indexes, the new orders index recorded 44.6, the worst since June 2023; the inventory index recorded 50.3; the production index recorded 44.8, a further decline from July; the employment index recorded 46, indicating that factory employment continued to contract, but at a slower pace, which is one of the few bright spots; the supplier delivery index fell from 52.6 in July to 50.5 in August, indicating slower delivery times.

Among these, the ratio of the new orders index to the inventory index is the most concerning, as it reflects the manufacturers' ability to digest their inventory. Public data shows that under the U.S. ISM index, the new orders index for June, July, and August was 49.3, 47.4, and 44.6, respectively; the inventory index was 45.4, 44.5, and 50.3, respectively; the ratio of the two was 1.0859, 1.0652, and 0.8867, respectively. This ratio has declined for three consecutive months and fell below 1 this month, indicating that the manufacturing industry's distribution channels are severely clogged.

Additionally, the Markit manufacturing PMI data released earlier yesterday also met with a cold response, recording 47.9, below the expected and previous value of 48.

The two underperforming manufacturing data gave the U.S. stock market, which returned from a long holiday, a heavy blow.

The S&P 500 index closed down 2.12% at 5,528.93 points; the Dow Jones Industrial Average closed down 626.15 points or 1.51% at 40,936.93 points; the technology-heavy Nasdaq Composite closed down 3.26% at 17,136.30 points; the Nasdaq 100 closed down 3.15%, marking the largest single-day decline since July; the VIX volatility index surged 33.38%, closing at 20.74.

The U.S. stock market's "Seven Sisters of Technology," which have been leading the charge in this upcycle, have all been defeated. Nvidia closed down 9.53%, falling to a low not seen in over three weeks, with a market value loss of $279 billion, setting a record for the largest single-day market value loss in U.S. stock market history. Tesla rose 2.7% before turning down 1.64%. Amazon closed down 1.26%, Google A closed down 3.68%, Apple closed down 2.72%, Microsoft closed down 1.85%, and "Metaverse" Meta closed down 1.83%.

After the release of the U.S. ISM manufacturing index, the U.S. dollar index fell slightly in the short term, then recovered, rising 0.10% to 101.755 points, with a trading range of 101.561-101.917 points; U.S. Treasuries surged, with the yield on the 10-year benchmark note falling 10 basis points at one point. U.S. interest rate cut expectations have intensified, with the CME FedWatch tool showing the likelihood of a 50 basis point rate cut in September rising from 30% to 39%, while the probability of a 25 basis point cut fell to 61%.

Regarding this data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said, "The further decline in PMI data indicates that the drag on the economy from the manufacturing sector has intensified in the middle of the third quarter. Forward-looking indicators suggest that this drag could intensify in the coming months."

Williamson also said, "Sales below expectations have led to warehouses filled with unsold inventory, and the lack of new orders has prompted factories to reduce production for the first time since January. Producers have also cut their workforce for the first time this year due to concerns about overcapacity and reduced the purchase of inputs. The combination of declining orders and increasing inventory sends the most pessimistic forward-looking signal for production trends in a year and a half, and it is one of the most worrying signals since the global financial crisis."

He continued, "Although the decline in demand for raw materials has eased supply chain pressures, rising wages and freight costs are widely reported as factors driving up input costs, which are currently rising at the fastest pace since April of last year."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.