NVIDIA Stock Soars 8% After Jensen Huang Boosts Market Confidence

On Wednesday, Nvidia's shares surged more than 8% to 116.91, the biggest one-day gain in six weeks, adding nearly $200 billion to the day's market capitalization。

On Wednesday, NVIDIA's shares surged more than 8 percent to $116.91, its biggest one-day gain in six weeks, adding nearly $200 billion to its market capitalization on the day.

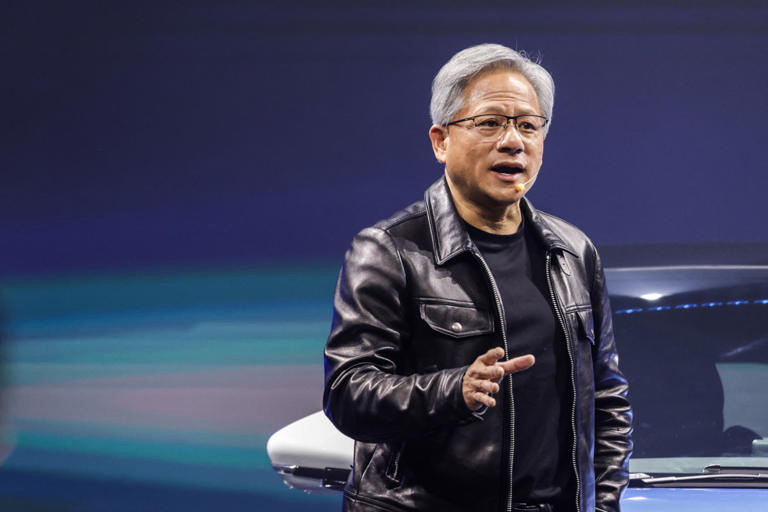

NVIDIA's stock price has soared, largely because its CEO Jensen Huang has “reported good news” in public.

On Wednesday at the Goldman Sachs Communacopia + conference, when Goldman Sachs CEO David Solomon (David Solomon) asked Jensen Huang (Jensen Huang) now Nvidia's biggest concern, Huang replied: “We have a heavy responsibility on our shoulders, everyone is counting on us. ”

Huang said NVIDIA is facing “incredible” demand and that the company is “sold out of all its products.”

“The demand is so great that the delivery of our parts, technology, infrastructure and software is really exciting for people.” Huang added, “because it directly impacts their revenue, it directly impacts their competitiveness.”

Huang also said that while it takes a lot of resources to train AI models, it pays off in the long run. When customers use the company's products to augment CPUs, the cost does increase, but the computation time is reduced by a factor of about 20. Even assuming a doubling of costs upfront, there is a 10x savings after running with NVIDIA's GPUs.According to Huang, “That's the immediate return on investment you get through acceleration.”

Huang's comments were a shot in the arm for the market. The stock was previously sold off because NVIDIA's guidance for the third quarter was lower than expected. Last week NVIDIA plunged 14%, evaporating about $400 billion in market value.

Goldman Sachs semiconductor analyst Toshiya Hari believes that NVIDIA's stock has been oversold in recent times. “Demand for accelerated computing is still very strong.” Hari said, “You're going to see [NVIDIA's] demand portfolio expanding to enterprises and even sovereign nations.”

Due to the lack of options, several tech giants, including Amazon and Meta, are developing their own chips, wanting to reduce their dependence on NVIDIA. And these companies' homegrown chips can be manufactured directly at specialized foundries such as TSMC, bypassing NVIDIA altogether.

Hari acknowledges that the barriers are coming down on the question of whether to develop or buy in-house, but he says the threat is overstated.

First, NVIDIA H100 has a 90% share of the AI chip market compared to competitors such as AMD's MI300 series, so its technology is ahead of the curve.

Second, these tech companies develop their own chips primarily to solve computing tasks specific to their business. While these mean a loss of sales that would otherwise belong to NVIDIA, proprietary chips are not suitable to compete directly with NVIDIA in the open market.

Hari cited Google as an example, saying the company is developing its own AI chips to help improve Google search. But at the same time, the company's Google Cloud Platform shows no signs of waning interest in NVIDIA's AI chips.

They [referring to Google] are still buying NVIDIA GPUs in bulk, as is Amazon,” Hari said. In the field of commercial chips, NVIDIA is the first choice. Even compared to custom chips, they have an advantage in terms of speed of innovation.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.