Why You Should Pay Attention to Broker's Stop Loss Level

In the process of learning Forex trading, you may encounter the term "stop loss level," which is a very important aspect that traders often overlook。There are three important things you should know about stop loss levels。

In the process of learning Forex trading, you may encounter the term "stop loss level," which is a very important aspect that traders often overlook。Some people confuse it with a stop loss, but it's actually very different。A stop loss is a closing order that is automatically applied to a floating position when funds are exhausted, and the stop loss level is more of a limit when a trade order is placed。There are three important things you should know about stop loss levels。

Understanding Broker Stop Loss Levels

So, what is the stop loss level and why pay attention to it?The stop loss level is a limit that determines where you should place stops, take gains, and stop loss orders (buy stops and sell stops) at the current price.。Determinants are usually set in points, and the determinants are different for each broker。

For example, your broker has a stop loss level of 2 points。Therefore, you can only place stop orders up and down at a price level that is at least 2 pips away from the current price。Suppose you are trading EUR / USD and the currency pair is currently at 1.0727 level, since the stop loss level is 2 points, you can only place orders at a position 2 points higher or lower than that level。

Sometimes, the broker's stop and limit levels are set together。However, they differentiate according to the type of pending order。If the stop loss level applies to buy stop loss orders and sell stop loss orders, the limit level will be used for limit pending orders (buy limit and sell limit)。Usually, Forex brokers set the stop and limit levels to the same pip。

How to check a broker's stop loss level?

Finding the broker's stop loss level is very easy。First of all, you can look for it on the official website of the broker, most brokers provide this information。Usually, the stop loss level specified on the broker's website is for the EUR / USD currency pair。It is worth noting that major currency pairs usually have lower stop loss levels than cross-currency pairs or exotic currency pairs。

If you find it difficult to search for information online, there is a more accurate way to check the broker's stop loss level。You can go directly to your trading platform (MetaTrader 4 or MetaTrader 5) and follow the simple steps below。

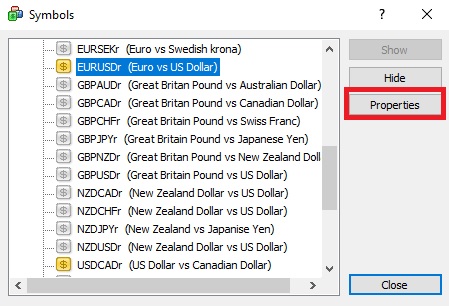

1.First, select the currency pair。Let's say EUR / USD is selected, then right-click EUR / USD in the market observation window and select the trading instrument。

2.In a subsequent window, select the pair and click Properties。

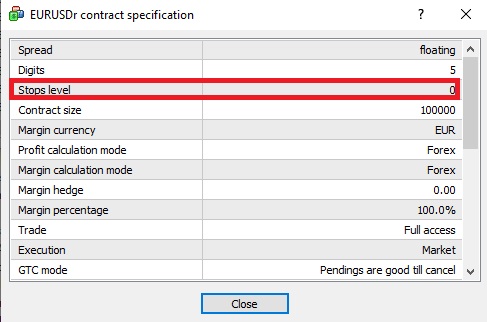

3.Displays some information about the trading status of that particular currency pair in the broker, including stop loss levels。

What you should know about stop loss levels

Although the discussion about stop loss levels is not as mainstream as leverage or spreads, it is still an important feature that brokers need to understand, especially for such short-term traders。A few things you should know about stop loss levels。Why so?

1.Stop loss cannot be less than stop loss level

The stop loss amount you set cannot be less than the broker's stop loss level。If the Forex broker stop loss level is around 1-3 points, this may not be a problem, but if the broker's stop loss level is as high as 14 points, it means you cannot set a stop loss smaller than 14 points。This may not be ideal for day traders and scalpers using low spread or cent accounts。

2.Scalpers can benefit from brokers with low stop loss levels

Scalping requires high precision。Therefore, scalpers need to look for brokers with low stop loss levels so that their execution can be as close to the target as possible。

3. Not suitable for automated trading

Some traders use forex robots for trading, traders using such automated trading tools should be careful with the broker's stop loss level。Usually, Forex robots have their own rules when entering and exiting。Therefore, when the stop loss level set by your broker is too far from the current price, it may affect the performance of the robot。

What is the best stop loss level??

Although the stop-loss level is an important part of trading, it is often overlooked。It is safe to say that the smaller the stop loss level, the better for the trader。Lower stop loss levels will cause less difficulty for traders。Not surprisingly, many traders prefer forex brokers that are able to offer this service。

Having said that, it is not easy to find such a convenient broker, most likely an ECN broker。Of course, you can consider using this broker, but this broker may not be suitable for all types of traders。Before using their services, make sure you understand the risks。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.