Nvidia Valuation Falls to Pre-ChatGPT Level—Is It a Buy Now?

Nvidia's valuation has now dropped to its pre-ChatGPT launch level, as a sell-off looms amid Trump's recession threat, despite the company's solid fundamentals.The AI chipmaker tumbled another 5% on M

Nvidia's valuation has now dropped to its pre-ChatGPT launch level, as a sell-off looms amid Trump's recession threat, despite the company's solid fundamentals.

The AI chipmaker tumbled another 5% on Monday, bringing its market cap down to $2.61 trillion—now 31% off its record high in January.

The stock's trailing 12-month P/E ratio has fallen to 36.4x, making it cheaper than when ChatGPT was first released on November 30, 2022. It is also trading at its lowest valuation since August 2019.

Ben Reitzes, managing director at Melius Research, noted that Nvidia's forward P/E ratio has dropped to 24x, making it 41% cheaper than it was at the time of ChatGPT's launch. He believes the risks have been largely priced in and sees a disconnect between Nvidia's valuation and its long-term growth potential.

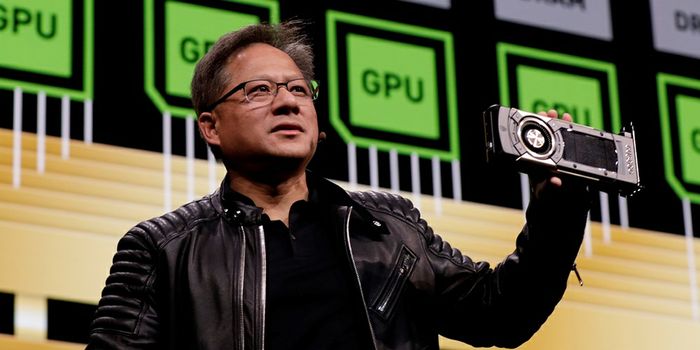

We remain very optimistic, Reitzes wrote in a note Monday, pointing to next week's GPU Technology Conference, where CEO Jensen Huang is expected to reaffirm Nvidia's leadership in AI and unveil its product roadmap through 2027.

Notably, nvidia posted stunning results in 2024, with full-year revenue of $130.5 billion, up 114%, and net income of $72 billion, up 145%. The company also expects another 60%+ sales growth and a 70%+ gross margin for the next quarter, as demand remains robust.

Nvidia will also kick off the GTC 2025 AI conference next Monday. Last year, it announced the GB200 chip during the event, and many anticipate the unveiling of its next-generation product lineup and how CEO Jensen Huang will shape the future of AI and Nvidia's dominance.

Reitzes compared Nvidia's current valuation reset to a historical precedent: Apple. In 2008, Apple's forward multiple fell from 33x on the day it announced the iPhone to just 15x by the end of the year amid the financial crisis. However, the mobile revolution didn't end, and Apple now trades at 31x earnings on significantly larger profits.

If Nvidia mirrors this kind of industry leadership, we could look back at this period of uncertainty and have a good chuckle, he added.

Melius Research maintains a Buy rating on Nvidia with a $170 price target, implying a potential 60% upside from current levels.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.