The two-counter model is about to open. The first list of securities has been released!

On June 7, the official website of the Hong Kong Stock Exchange disclosed that in order to further support the development of the RMB and Hong Kong securities markets, the Hong Kong Stock Exchange intends to launch the "HKD-RMB dual counter model" and the "dual counter dealer mechanism" in the Hong Kong securities market on June 19.。This means that under the dual-counter trading model, investors can trade in both Hong Kong dollars and RMB.。

On June 7, the official website of the Hong Kong Stock Exchange disclosed that in order to further support the development of the RMB and Hong Kong securities markets, the Hong Kong Stock Exchange intends to launch the "HKD-RMB dual counter model" and the "dual counter dealer mechanism" in the Hong Kong securities market on June 19.。This means that under the dual-counter trading model, investors can trade in both Hong Kong dollars and RMB.。

Among them, eligible dual-counter securities are securities designated by the HKEx with Hong Kong dollar and RMB counters and eligible for the dual-counter dealer scheme.。

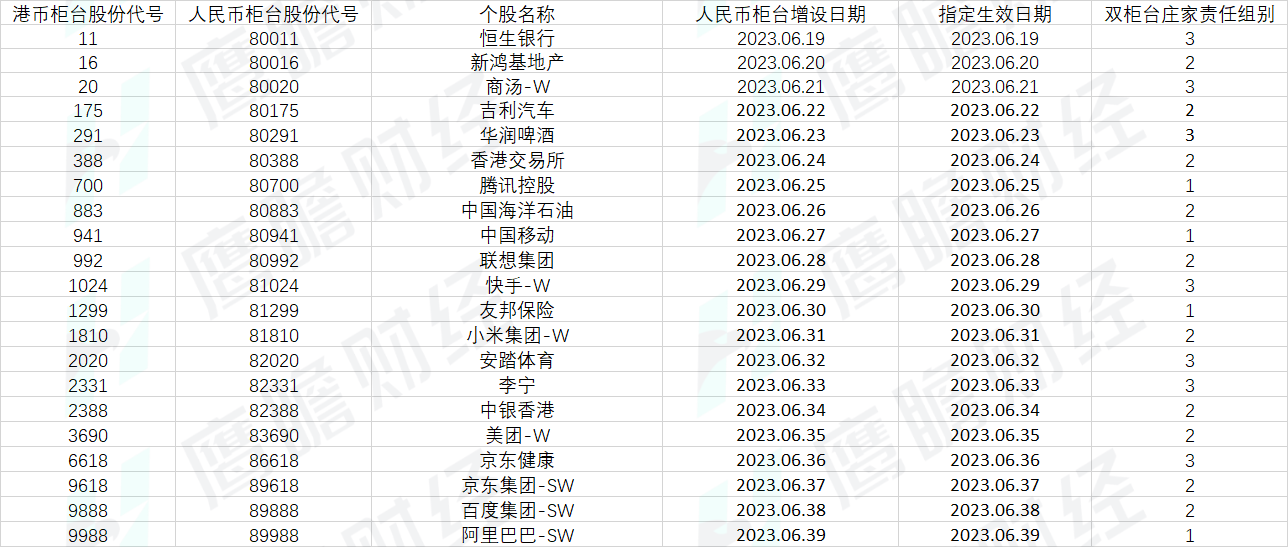

At present, according to the disclosed information, there will be 21 Hong Kong listed companies landing the first batch of open list。A stock in the dual counter model will have two exchange codes and two securities abbreviations.。On the Hong Kong dollar counter, the original code and abbreviation of individual stocks remain unchanged; on the RMB counter, the code of individual stocks is changed to the first 8, the last four unchanged code, and the suffix "-R" is added after the original abbreviation.。

The so-called "dual-counter model" is the general term for the entire HKD-RMB dual-counter trading process, dealer activities and settlement model.。Under the dual-counter model, eligible securities have both Hong Kong dollar and RMB trading desks, and investors can buy, sell and settle in two currencies, Hong Kong dollar and RMB, respectively.。The securities under the two counters belong to the same class of securities, so the securities under the two counters can be converted to each other without changing the beneficial ownership, and there is a two-counter dealer mechanism to solve the problem of liquidity and the spread between the two counters.。

In short, after the implementation of this model, investors can buy the same listed company's shares can be denominated in Hong Kong dollars, can also be denominated in RMB, the whole set of trading process, dealer activities and settlement mode is called the two-counter model, in which the implementation method needs to be approved by the regulatory authorities.。

In this regard, Hong Kong Monetary Authority Chief Executive Yu Weiwen has said, "Hong Kong is committed to the development of diversified offshore RMB assets, so that RMB holders have more investment options, thereby enhancing the willingness of overseas enterprises to use RMB in cross-border trade, the latest initiative is the introduction of Hong Kong stocks' HKD-RMB dual counter dealer mechanism '."。

The Futu Investment Research team also said that the dual-counter model provides investors with more investment options, giving them the flexibility to invest in Hong Kong dollar or RMB-denominated stocks according to their investment needs and risk tolerance; at the same time, investors can choose to invest in stocks denominated in different currencies, thereby diversifying exchange rate risk.。With the interconnection between the Hong Kong stock market and the mainland market, mainland investors will be able to allocate overseas assets more flexibly.。

Regarding the risk of exchange rate fluctuations, Wang Xueheng, chief analyst of overseas strategy research at Guoxin Securities, believes that under the current mechanism of the Hong Kong Stock Connect, mainland investors purchase Hong Kong stocks through southbound trading in Hong Kong dollars, settlement and settlement in RMB, and the implementation of T + 2 clearing and settlement.。During the holding period, investors are required to bear the risk of changes in the RMB / HKD exchange rate, especially when the global financial environment is volatile and exchange rates fluctuate significantly, which may result in large exchange gains and losses.。Under the dual-counter model, mainland investors can directly trade Hong Kong stocks through the RMB counter, realizing seamless conversion of Hong Kong dollar and RMB listed shares, which will significantly reduce the exchange costs and exchange rate risks arising from previous participation in Hong Kong Stock Connect investments.。

However, it is worth noting that although the dual-counter model has been basically determined to land on June 19, Hong Kong stock market participants can then begin to use dual-counter trading.。However, mainland investors are not yet able to immediately participate in the dual-counter model through the Hong Kong Stock Connect, which may focus on local or overseas investors in Hong Kong trying to use the dual-counter model at the initial stage of opening.。According to a briefing released by the HKEx in January, it can be expected that the two-counter model under the Hong Kong Stock Connect will be implemented in the next phase, but the timing of the implementation will still await further arrangements from the HKEx.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.