HKEx 2023Q1 net profit up 28% YoY! Weak core business still needs to improve

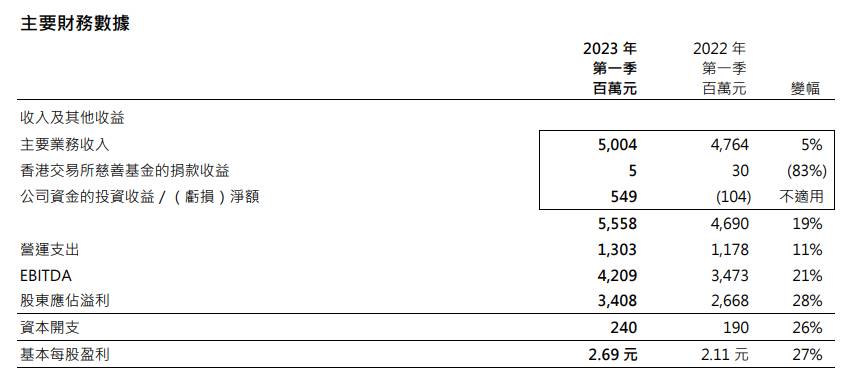

April 26, HKEx Announces First Quarter 2023 Results Report。Total HKEx Q1 revenue up 19% YoY to 55.5.8 billion yuan (HK $, the same below); net profit attributable to the parent company increased by 28% YoY to 34.08 million yuan, exceeding market expectations of 18% growth; basic earnings per share increased 27% year-on-year to 2..69 yuan。

April 26, HKEx Announces First Quarter 2023 Results Report。Total HKEx Q1 revenue up 19% YoY to 55.5.8 billion yuan (HK $, the same below); net profit attributable to the parent company increased by 28% YoY to 34.08 million yuan, exceeding market expectations of 18% growth; basic earnings per share increased 27% year-on-year to 2..69 yuan。

It is worth noting that HKEx's total revenue and net profit performance for the quarter was second only to the first quarter of 2021, the second highest on record.。

The Hong Kong stock market was resilient and robust in the first quarter of 2023, with an average daily turnover of $127.8 billion, unchanged from the fourth quarter of 2022, but down 13% year-on-year, the HKEx said in its report.。In the first quarter of 2023, the Shanghai-Shenzhen-Hong Kong Stock Connect operated smoothly, with the average daily turnover of northbound and southbound transactions reaching RMB97 billion and RMB37.5 billion, respectively.。Revenue and other gains from the Shanghai-Shenzhen-Hong Kong Stock Connect amounted to 5.6.4 billion yuan, down 12% year-on-year。

In terms of bonds, a total of 58 bonds were listed on the HKEx in the first quarter of 2023 (including Hong Kong's first listed insurance-linked securities issued by the World Bank in the form of catastrophe bonds), with a total fund-raising of more than $178 billion.。As of March 31, 2023, there were 1,701 listed bonds on the market, valued at more than 5.7 trillion yuan。

In terms of newly listed companies, a total of 18 new companies were listed on the Hong Kong Stock Exchange in the first quarter of 2023, raising a total of $6.7 billion, down 55% year-on-year.。As of March 31, 2023, a total of 92 listing applications were being processed.。

In response, HKEx Group Chief Executive Officer Ou Guansheng said the group had a good start to the year, with first quarter 2023 results among the best ever quarterly results.。Group derivatives market grew in the first quarter despite weak economy affecting turnover in global markets。In the future, the Group will continue to focus on implementing various strategies, actively promote global dialogue and connectivity, and work with regional and international shareholders to create win-win results and promote sustainable market development.。

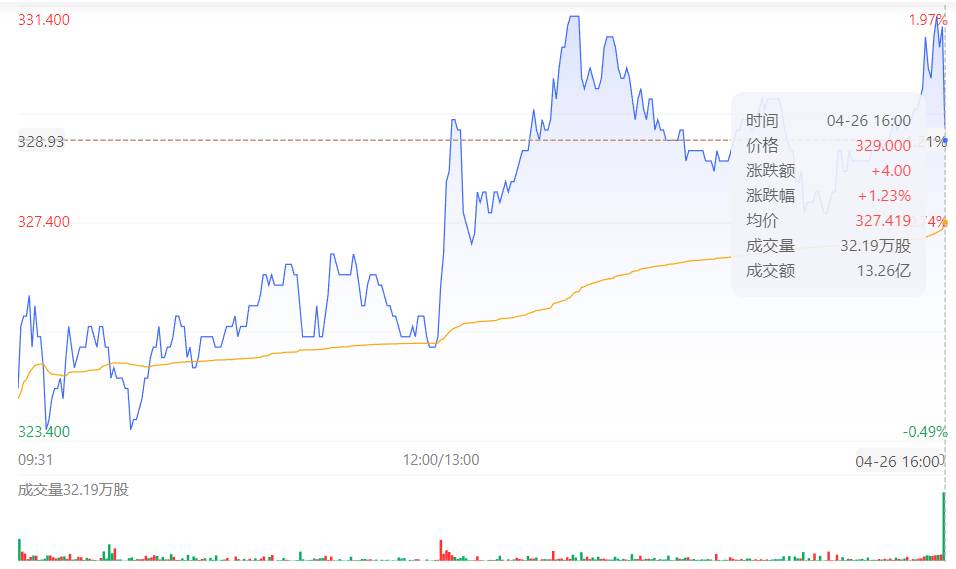

After the news was released, the HKEx rose as high as nearly 2% yesterday before narrowing in late trading to close at HK $329.。

Major banks have mixed reactions to HKEx's Q1 results。

Morgan Stanley released a research report saying that HKEx's first-quarter net profit rose 28% year-on-year to 34% due to strong net interest income, faster expansion of internal funding and lower tax expenditures.HK $08 billion, 7% higher than the bank expected。In addition, HKEx's 19% year-on-year revenue growth in the first quarter was also in line with the bank's expectations due to higher investment income and lower transaction costs in line with average daily market turnover。Net interest income exceeded the bank's expectations by 15 per cent, but core income was weak as expected, with a pre-tax profit of $3.8 billion, 2 per cent higher than expected.。On the other hand, the decline in the Hong Kong Interbank Offered Rate (HIBOR) in the first quarter of this year from its peak in the fourth quarter of last year may result in a slight lag in HKEx rates in the second quarter of this year。As a result, the Bank has given HKEx a target price of HK $253 and a rating of "Underweight."。

Nomura said that because the HKEx's first-quarter revenue and net profit exceeded expectations, it maintained its "buy" rating, but the core business revenue fell short of expectations, or its target price from 415..HK $26 to 400.HK $42。

Bank of America Securities also released a research report saying that HKEx's net profit was strong in the first quarter, but stock market turnover was weak during the quarter, down 13% year-on-year, with poor growth in core business relative to earnings growth and the need for improvement in core revenue。Overall IPO fundraising size down 56% year-over-year, expected to improve or improve in coming quarters, but overall IPO market sentiment is weaker。Bank of America said it lowered its average daily turnover forecast for the HKEx this year from HK $125 billion to HK $120 billion, but raised its 2023-25 earnings forecast to 6% -7%, while reiterating HKEx's "buy" rating and maintaining its target price of HK $360.。

Citi believes that HKEx's net profit in the first quarter of this year increased by 28% year-on-year and 14% month-on-month, outperforming market expectations of 11%, largely driven by a big increase in net investment income.。However, the recovery in core revenues has been slower than expected and operating expenses have been higher than expected.。Citi said that the HKEx market rebounded in the first quarter of this year, so that the fair value of the externally managed portfolio turned a profit, driving investment income exceeded expectations by 57%, the bank believes that this year's investment income forecast still has room for upward adjustment, so the HKEx target price of HK $300, rating "sell."。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.