Hawkinsight Hong Kong Market Closing Roundup (1.29) | Hong Kong stocks closed red Evergrande system closed court liquidation order collective suspension

On January 29, the three major indexes of Hong Kong stocks opened higher in early trading, and then narrowed their gains.。Hang Seng closed up 0 at close.78%, reported 16077.24 points。

On January 29, the three major indexes of Hong Kong stocks opened higher in early trading, and then narrowed their gains.。Hang Seng closed up 0 at close.78%, reported 16077.24; Hang Seng SOE Index closes up 0.91%, reported at 5408.93 points; Hang Seng Tech Index closes up 0.54% at 3203.59 points。

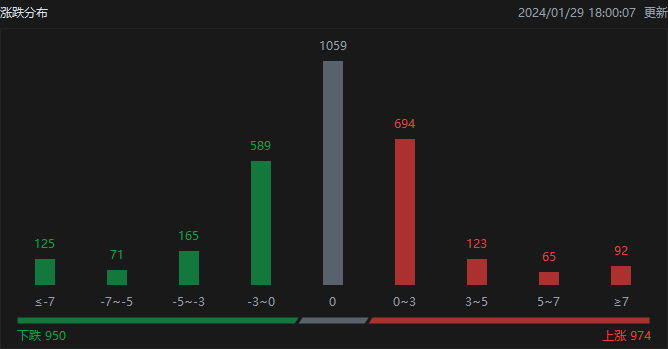

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 974, fell 950, and closed flat at 1004.。

On the day of the Hong Kong stock market, North Water traded a net sell of 25.HK $9.6 billion, of which HK Stock Connect (Shanghai) sold a net 1.3 billion..HK $4.5 billion, Hong Kong Stock Connect (Shenzhen) net sales of 12.HK $5.1 billion。

Sectors and Fundamentals

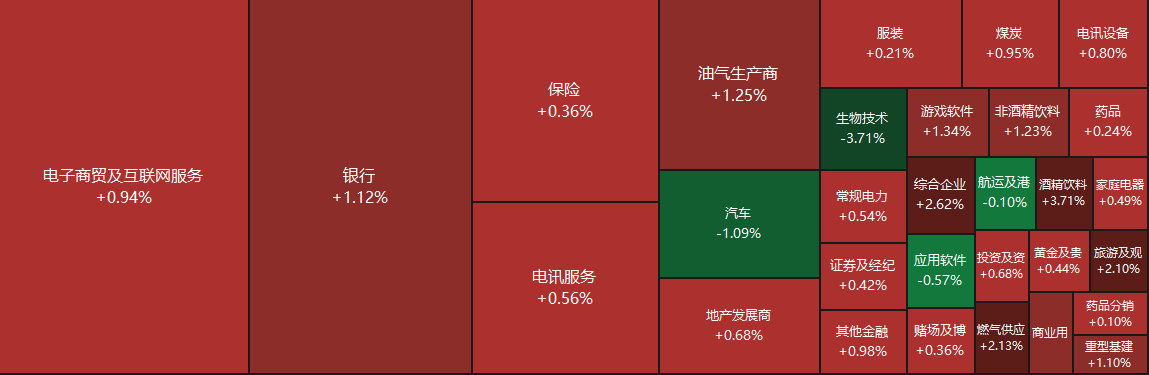

From the disk point of view, the network stocks rose, Alibaba, Jingdong rose more than 2%, Baidu rose nearly 2%, NetEase, Beery Beery rose more than 1%, Meituan, Xiaomi rose nearly 1%;。It is worth noting that Evergrande was suspended from trading today due to a winding-up order received from a Hong Kong court.。On the other hand, oil stocks were active throughout the day, with Sinopec up more than 2%, PetroChina up more than 1%, and CNOOC up nearly 1%; beer stocks rose one after another, with Budweiser Asia Pacific up more than 6%, Tsingtao Brewery up nearly 4%, and China Resources Beer up more than 2%.。

Fundamentally, Guangfa Securities pointed out that the elimination of base disturbance, outlook 24Q1 sales, since 2014 Q1 industry production continued to grow, the efficiency of listed companies repeatedly record high, mainly due to high-end gifts and friends and relatives and friends to drink and other off-season consumption scenarios, considering the February Spring Festival is conducive to Q1 channel stocking, a good start is still expected。The bank said that the current sector valuation continued to fall, reflecting the market's concerns about the future high-end process and the medium and long-term growth potential of enterprises, the bank believes that the apparent demographic structure phase of the formation of support in the case of rapid downward risk of sales is small, while high-end is in the ascendant, benchmarking overseas also has a larger space, the industry trend is expected to continue.。

The General Office of the Guangzhou Municipal People's Government issued the Notice on Further Optimizing the Policies and Measures for the Stable and Healthy Development of the City's Real Estate Market, optimizing and adjusting the purchase restriction policy, and purchasing housing with a construction area of more than 120 square meters (excluding 120 square meters) within the limited purchase area, which is not included in the limited purchase scope.。Founder Securities said, Guangzhou or for the first-tier city policy "test field," the Guangzhou purchase restriction policy of the substantial optimization or will lead a new round of first-tier cities policy unbundling tide.。Open source securities pointed out that the central bank, the General Administration of Financial Supervision for many consecutive days of voice, financial support for real estate responsibility, more measures to improve financing, is expected to follow up will increase the financing support of high-quality real estate enterprises.。

According to the official website of the Judiciary of Hong Kong, China, on the morning of January 29, the High Court of Hong Kong held a winding-up petition hearing against Evergrande.。At the hearing, the court finally formally issued a winding-up order against Evergrande。In the afternoon, the High Court of Hong Kong will sit to deal with the regulatory order and issue written reasons.。After the court officially issued the winding-up order, the three listed companies of Evergrande (China Evergrande, Evergrande Automobile and Evergrande Property) all suspended trading at 10: 18 or 10: 19 a.m. on the 29th.。During the period between the opening and suspension of trading on the 29th, China Evergrande plunged more than 20% to 0.HK $163; Evergrande Auto plunges more than 18% to 0.HK $229; Evergrande Properties down 2.5%, now 0.HK $39。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 22, Xiaomo reduced its holdings of China China Exemption 21.81.26 million shares, price per share 68.HK $8,135, total reduction of approximately HK $15.01 million。The latest number of shares held after the reduction is about 804..690,000 shares, with the shareholding ratio changed to 6.91%。

On January 23, Schroders PLC reduced its stake in Kerry Construction 44.40,000 shares at a price of 12.HK $6,009, with a total reduction of approximately 559.HK $480,000。The latest number of shares held after the reduction is 8669..350,000 shares, with the shareholding ratio changed to 5.97%。

On January 25, Silchester International Investors LLP reduced its stake in COSCO Shipping Port 157.20,000 shares, price per share 5.HK $5,349, total reduction of approximately 870.HK $090,000。The latest number of shares held after the reduction is about 2..1.3 billion shares, shareholding changed to 5.97%。

New Stock News

1, according to the Hong Kong Stock Exchange disclosed on January 26, Xunfei Medical Technology Co., Ltd. (hereinafter referred to as: Xunfei Medical) to the main board of the Hong Kong Stock Exchange, Huatai International, Guangfa Financing (Hong Kong), CCB International for its joint sponsors.。

According to the prospectus, Xunfei Medical is a global leader in the medical artificial intelligence industry and a leader in the large-scale commercial landing of medical artificial intelligence solutions in China.。The company is committed to building a new human-machine collaborative diagnosis and treatment system and helping China's medical reform.。According to Frost Sullivan, Xunfei Healthcare's revenue scale in 2022 ranks first in China's medical artificial intelligence industry。

2, according to the Hong Kong Stock Exchange disclosed on January 26, Zhejiang Tongkang Pharmaceutical Co., Ltd. (hereinafter referred to as: Tongkang Pharmaceutical) to the main board of the Hong Kong Stock Exchange, CITIC as its exclusive sponsor.。

According to the prospectus, Tongyangkang Pharmaceuticals is a clinical-stage biopharmaceutical company dedicated to the discovery, development and commercialization of differentiated targeted therapies to meet the urgent medical needs of cancer treatment.。With the company's strength in the field of medicinal chemistry, in-depth understanding of cancer (especially lung cancer) and efficient clinical development strategy, the company is conducting two key clinical trials of its core product TY-9591 in the treatment of advanced NSCLC in China.。Since its inception in 2017, the company has established a strong pipeline of 11 drug candidates, including two low-risk products - core product TY-9591 and key product TY-302, five innovative clinical products (represented by the company's internally developed key product TY-2136b), and four products in the preclinical stage.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.